2023 First Quarter: A Humbling January, Harsh February, and a Hopeful March ahead

Hooray! It’s December 31st, 2022!

A mix of excitement and expectation fills the air as the world counts down to the last seconds of the year after sunset.

Celebrations and fireworks around the globe this midnight, as time unveils a new year, will veil the disappointment of many at their unfulfilled dreams in the lost year or the disillusionment of others about a new year in which they know things will not really be new.

For people of all religious faiths and pets of all racial fractions, New Year’s eve marks the culmination of a Happy December, in which they’d sought respite from work and purchased wholesale fancies, food, and fun to share with friends and family.

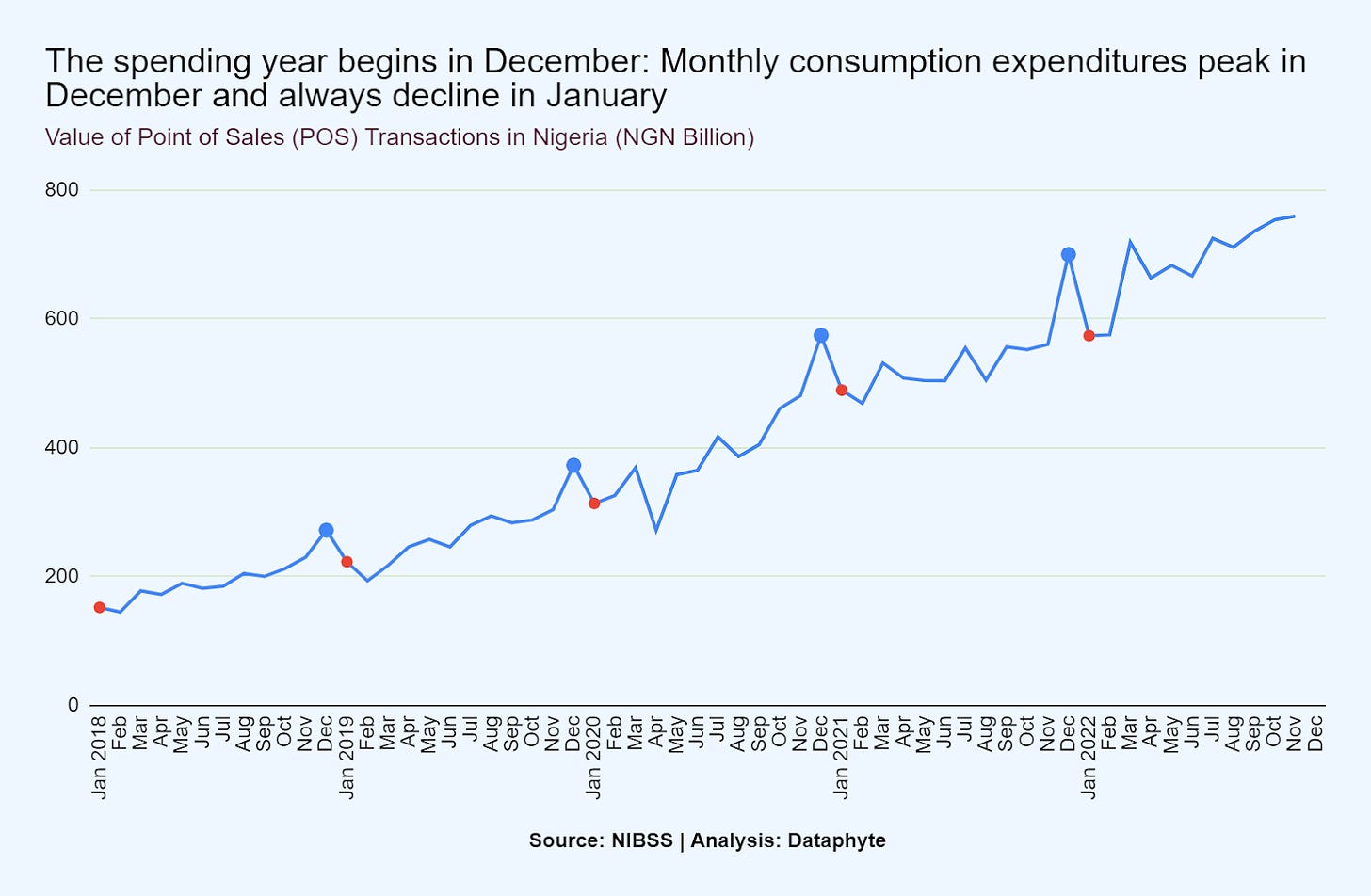

Indeed, December’s pricey happiness peaks this midnight, plateaus into the early hours of New Year’s Day, and progresses into an anticlimax before the sunset of the first day of a Humbling January, as the trend shows.

After the happiness of December peaks tonight, a month of modest spending follows. Besides personal financial trends, the central government’s financial policies and political programmes present the likelihood of an even more sober first quarter of 2023 for the country.

January holds out usual cuts in consumption expenditures and then the promised cash withdrawals limits on January 9th, together with the expiry of the old N1000, N500, and N200 currency by January 31st.

February holds out harsh electoral and economic realities - the crashed election hopes for half the Nigerian electorate whose candidates would certainly lose, together with the usual low consumption expenditures.

March promises the resolution of these nerving economic and electoral conflicts - a comeback of private income and consumption and a countdown to the blessings the second quarter holds for sworn political officeholders in May.

Happy December?

December 2022 is definitely a very happy month - for high-income and middle-income earners in Nigeria.

However, data on consumption expenditure, measured by the number of POS transactions in the last quarter of 2022, shows it was a hungry and hollow December for low-income earners in Nigeria.

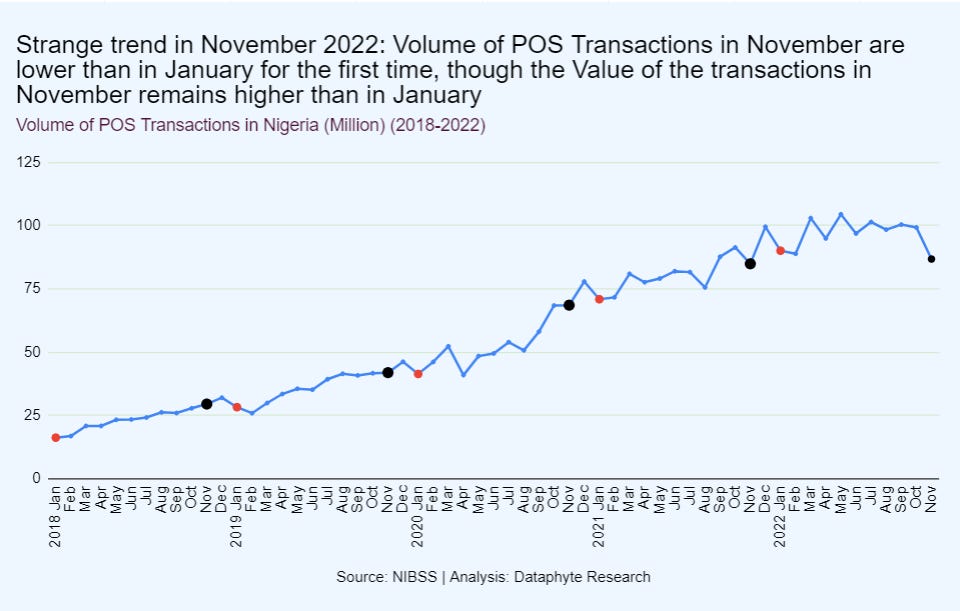

For the first time in 5 years, the volume of POS transactions in Nigeria in November fell below that in January.

Where the value of POS transactions in November still exceeds that in January, it means the value per transaction is higher. This is an indication that the poor are making fewer personal expenditures while the rich are making the bulk of the transactions.

Due to fixed low wages or no wages, in the face of the rising cost of food and non-food commodities, many survive on the gifts and groceries they chance to receive from their richer neighbours during the December festivities.

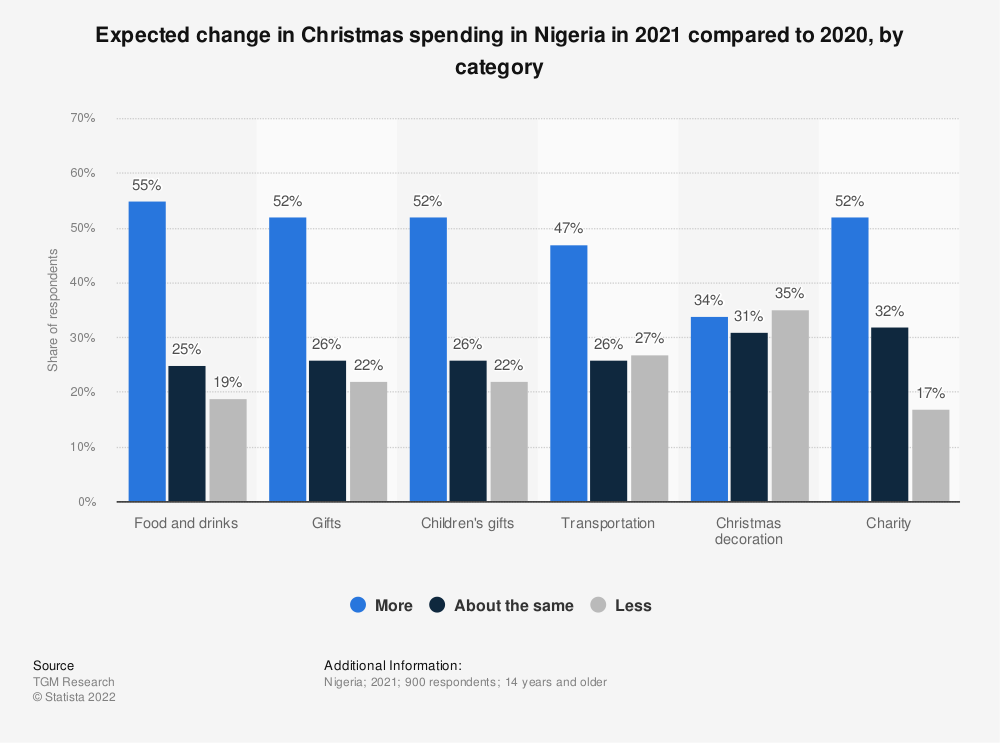

Sending Christmas presents and sharing Christmas purchases by the haves with the have-nots may actually compensate for many's inabilities to afford costly purchases in December, a TGM survey indicates.

“In 2021, over half of the Nigerian participants in a Christmas survey said they would spend more money during the holidays on all aspects related to the occasion, including food and drinks, gifts, transport, and charity. Christmas decoration was the only exception, as 35 per cent claimed they would spend less, compared to 34 per cent who reported they would spend more”, Statista remarked.

Humbling January

The NIBSS noted last December that Christmas spending pushed POS transactions in Nigeria to an all-time high of N6.4 Trillion in 2021. “Nigeria’s acceptance for digital means of payment has improved in recent time, however, the Christmas festivity contributed significantly to the surge in the review year.” the company remarked.

Albeit, by tomorrow, January 1st, 2023, the realities of a long month and year ahead would moderate the emotional spending of many in Nigeria, especially wage earners who would have spent much more than their monthly earnings in December.

As a result of shrunk wallets, monthly consumption expenditures would drop, as signified by the decline in volume and value of POS transactions in January in the past 4 years.

Consumption expenditures may be checked further despite the Central Bank of Nigeria’s (CBN’s) upward review of the upper limit for weekly cash withdrawals, now pegged at ₦500,000 for individuals and ₦5,000,000 for businesses.

Earlier, as of December 6, 2022, the bank stated that from Monday, January 9, 2023, weekly cash withdrawal limits would be reduced to ₦100,000 for individuals and ₦500,000 for businesses.

There are concerns that, come January, many legitimate cashless transactions may be impeded due to a lack of the technological know-how of the payee and payers to effect these electronic transfers and due to poor internet services that often deny the conclusion of transactions in many instances.

Overall, many who hold on to the outgoing N1,000, N500, and N200 currencies would be forced to humbly surrender them to Bank vaults or forever lose their worth.

The CBN Governor, Godwin Emefiele, lamented the “significant hoarding of banknotes by members of the public, with statistics showing that over 80 per cent of the currency in circulation are outside the vaults of commercial banks.

“He said as at the end of September 2022, available data at the CBN indicate that N2.73 trillion out of the N3.23 trillion currency in circulation was outside the vaults of commercial banks across the country”, Vanguard reported.

The phasing out of the old currencies, the pegging of cash withdrawals by individuals and corporates, and the paltry balance in people’s wallets may together humble more people this January than in previous years.

Harsh February

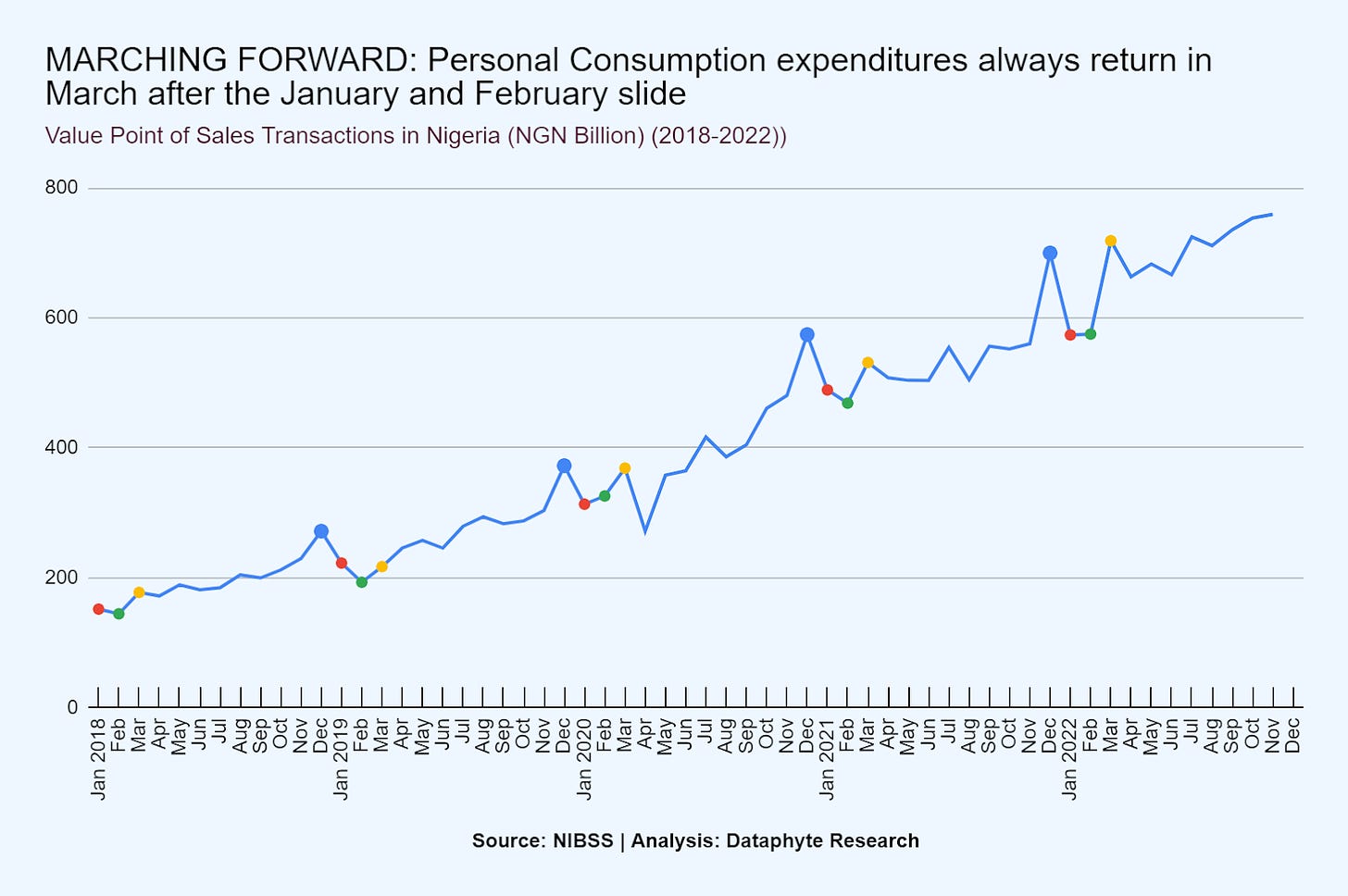

The humbling conditions of January often progress into February. In 3 out of the past 5 years, consumption expenditures dropped further in February than in January, when measured by a further decline in the value of POS transactions in February 2018, 2019, and 2021.

This February, things may fall further apart for many, seeing their electoral hopes dashed by the harsh realities of the presidential election outcomes.

Yet, February may mark a turning point for low economic and lost electoral hopes. While things may be on the low in February, they may not go lower than that in March.

Hopeful March

With the anticipation of another major festivity beginning in March comes the notable annual rise in consumption expenditures in that month. “Easter is a movable feast that is always held on a Sunday between March 22 and April 25.”

Just as people begin to recover financially in March from the humbling season that begins in January, the celebration of electoral victories at the subnational levels would also begin.

“The 2023 Nigerian gubernatorial elections will be held for state governors in 31 out of 36 Nigerian states. All but three elections will be held on 11 March - concurrent with elections to every state house of assembly, two weeks after the presidential election and National Assembly elections—while the Imo State, Kogi State, and Bayelsa State elections will be held on 11 November.”

The first quarter of 2023 would round up on this happy note with a countdown to the inauguration of elected officials and a wider transfer of power to newly appointed political officials in May, the second month of the second quarter.

Beyond March, life would go on with its usual ups and downs till the unprecedented spending next December.

Though the main December celebrant was famed to have had a humble beginning, he comes with a history of people always celebrating his birth in an expensive manner - with gifts including gold, frankincense, and myrrh.

Next December, we’ll see a repeat of like gifts - gifts wrapped in golden colours, Christmas cards with fancy wishes, and costly cologne.

Yet, as another expensive December ends today, many would likely sit to count the cost in January, stand to carry their cross in February, but take off on a high note in the third month.

Thanks for reading through our Data Dive weekly newsletter up to this last edition for 2022. We welcome your comments and suggestions on anything and on topics or themes you’d like us to dive into in 2023.

We wish you fun-filled days, fact-based decisions, and fulfilled dreams in the new year, 2023!