2024 First Quarter: Data, Daughter, and a Dot of Laughter

Hooray! January is done and dusted!

The only month everyone stays awake to see - its first second, its first minute, its earliest hour, and more.

Yet, January’s anticipated joys can be an anticlimax.

Looking forward to the last January, we wrote a few hours to 2023:

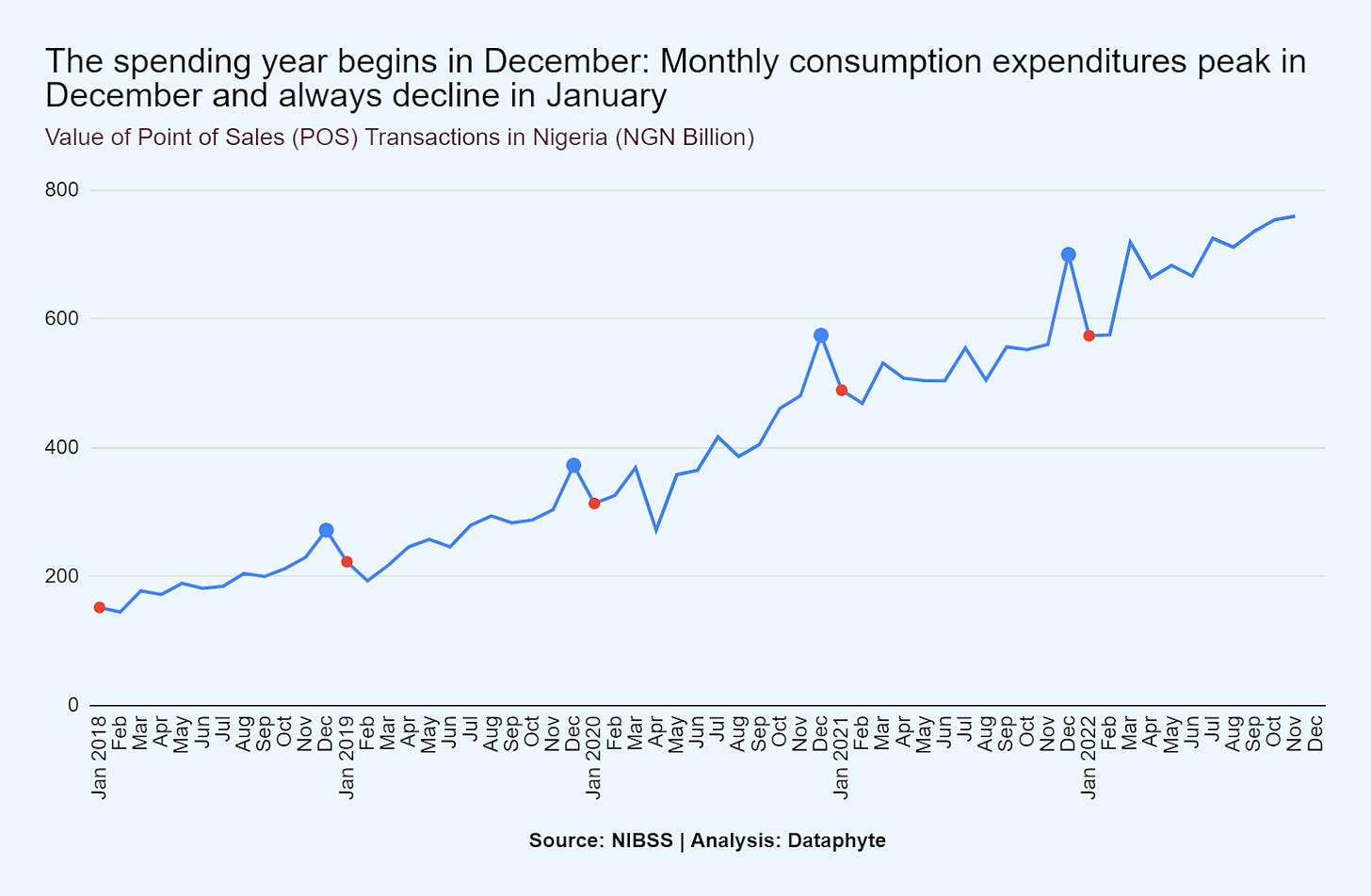

“For people of all religious faiths and pets of all racial fractions, New Year’s Eve marks the culmination of a Happy December, in which they’d sought respite from work and purchased wholesale fancies, food, and fun to share with friends and family.

“Indeed, December’s pricey happiness peaks this midnight, plateaus into the early hours of New Year’s Day, and progresses into an anticlimax before the sunset of the first day of a Humbling January, as the trend shows.”

Data shows that January is always a sobering month. Old certainties disappear.

New realities appear.

Naira realities. Naija realities.

Last year, we had the benefit of foresight into the first quarter of the new year 2023.

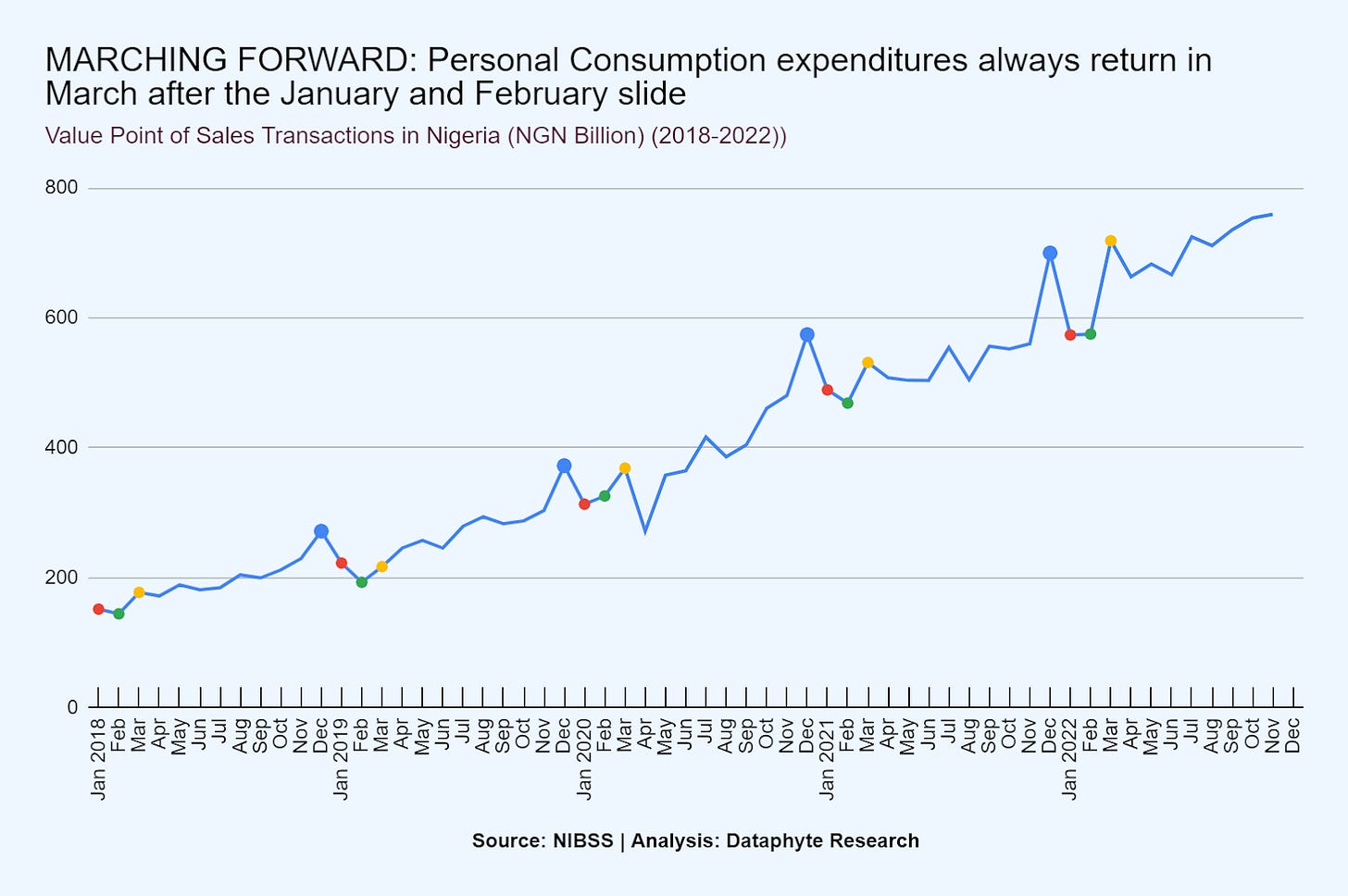

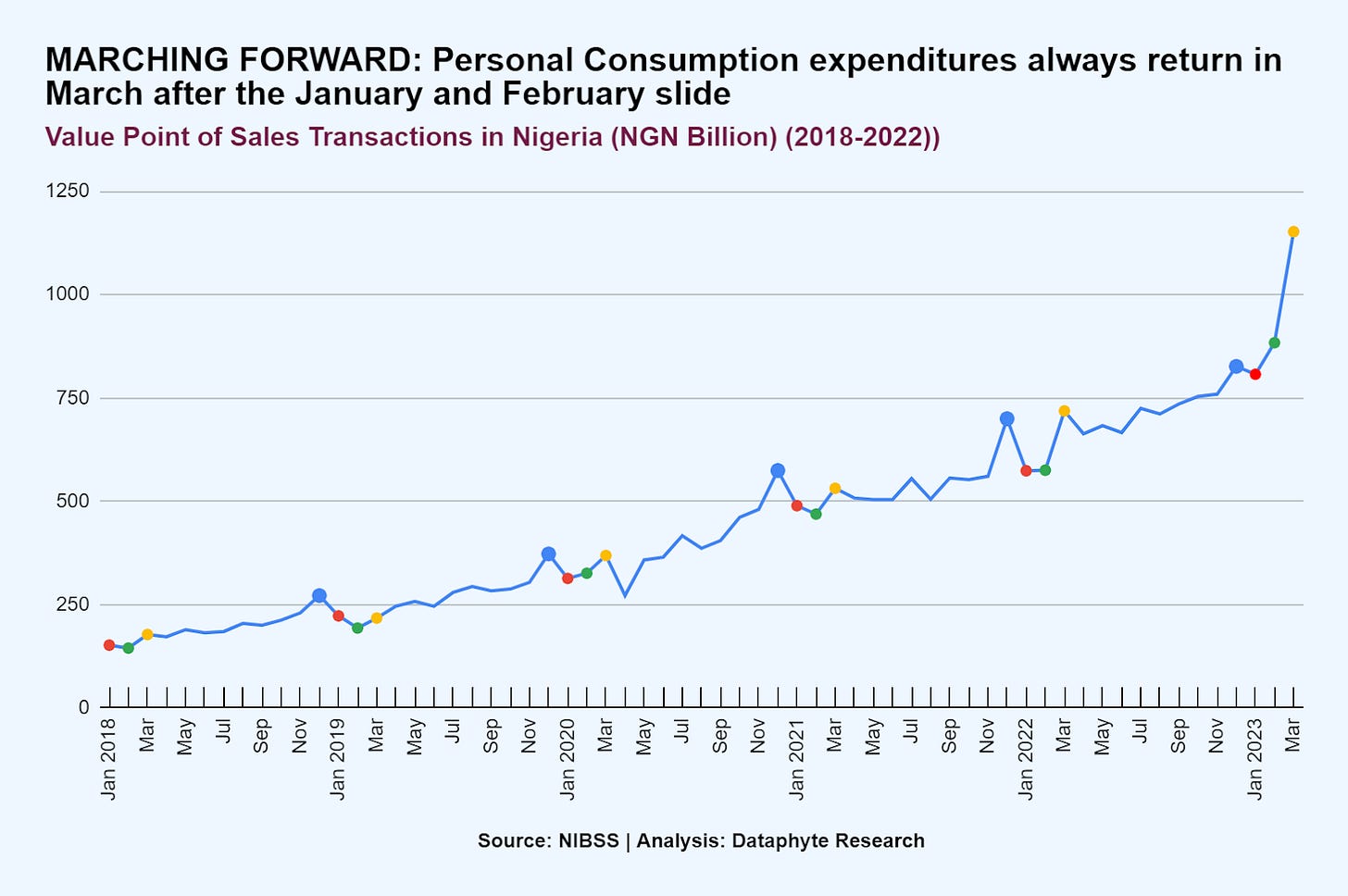

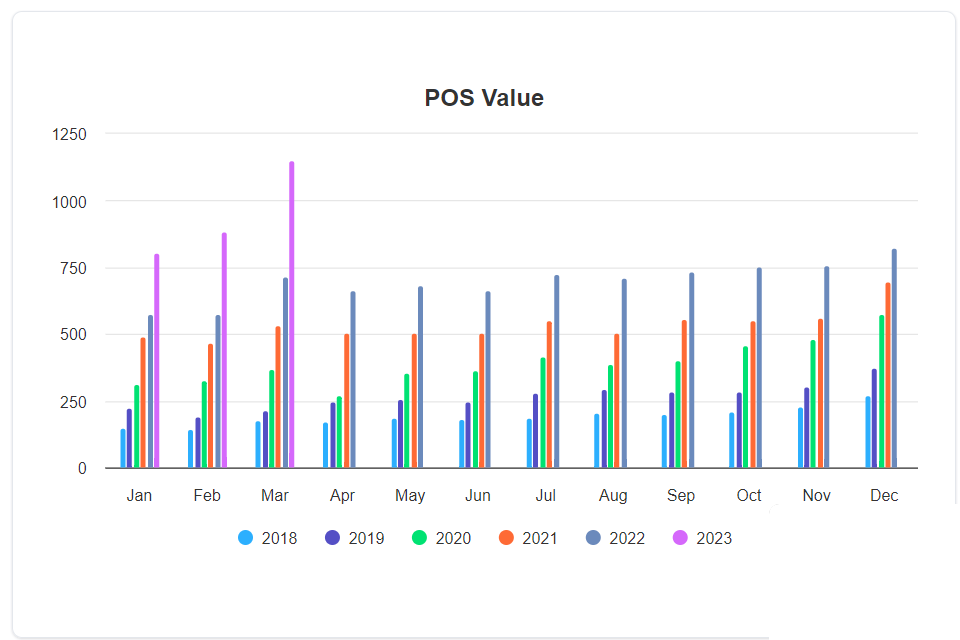

We predicted A Humbling January, Harsh February, and a Hopeful March Ahead.”

The first quarter of 2023 turned out the way we predicted.

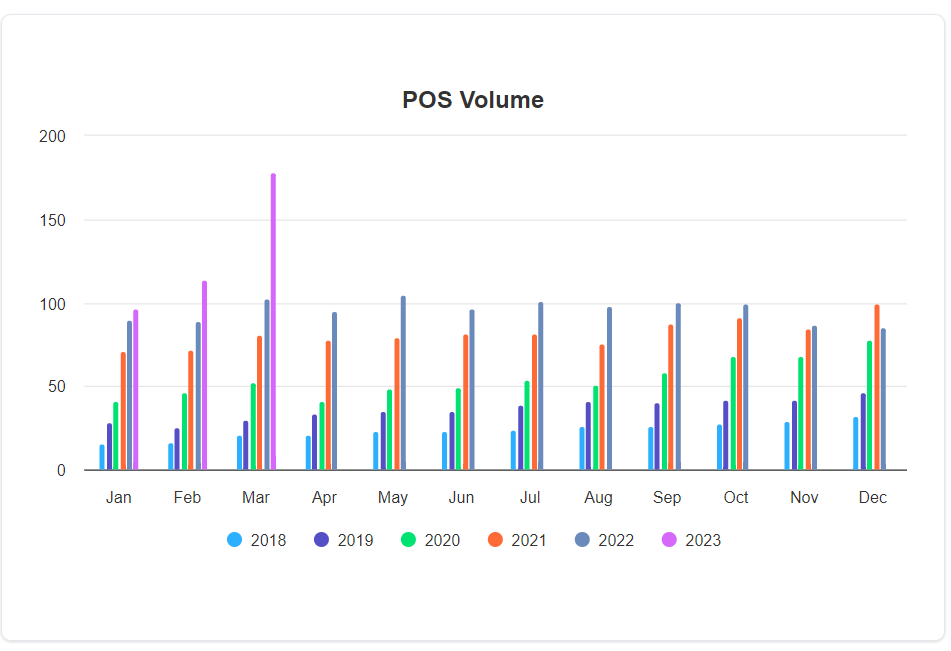

Consumer spending, proxied by the value of POS transactions, bounced back in an unprecedented way in March 2023.

Will the first quarter of 2024 see the same humbling January and hopeful March?

Let’s see.

A Dearth of Data

Since December 2022, when we made the earlier prediction, the Nigeria Inter-Bank Settlement System Plc (NIBSS) posted only 4 additional months of e-payment banking industry data for December 2022-March 2023.

E-payment data for April 2023 to December 2023 could not beted on the NIBSS website as of the time of writing.

This is unusual.

The November 2022 banking sector’s e-payment data was available for public use a month later in December 2022.

The usual prompt release of these data enabled the trend analysis and useful advisory we provided for the public on December 31, 2022, relating to matters of the economy and personal finance going into the new year 2023.

It states on its website though that: “The Nigeria Inter-Bank Settlement System Plc (NIBSS) was incorporated in 1993 and is owned by all licensed banks including the Central Bank of Nigeria (CBN). It commenced operations in June 1994.

“Nigeria Inter-Bank Settlement System Plc (NIBSS) operation is supported with the best Information, Communication and Technology infrastructure for Automated On-line operations as well as effective information and data transmission security practices to deliver world-class payment/settlement services. Operational and Credit Risks in funds transfer across financial institutions are adequately mitigated by NIBSS operations.”

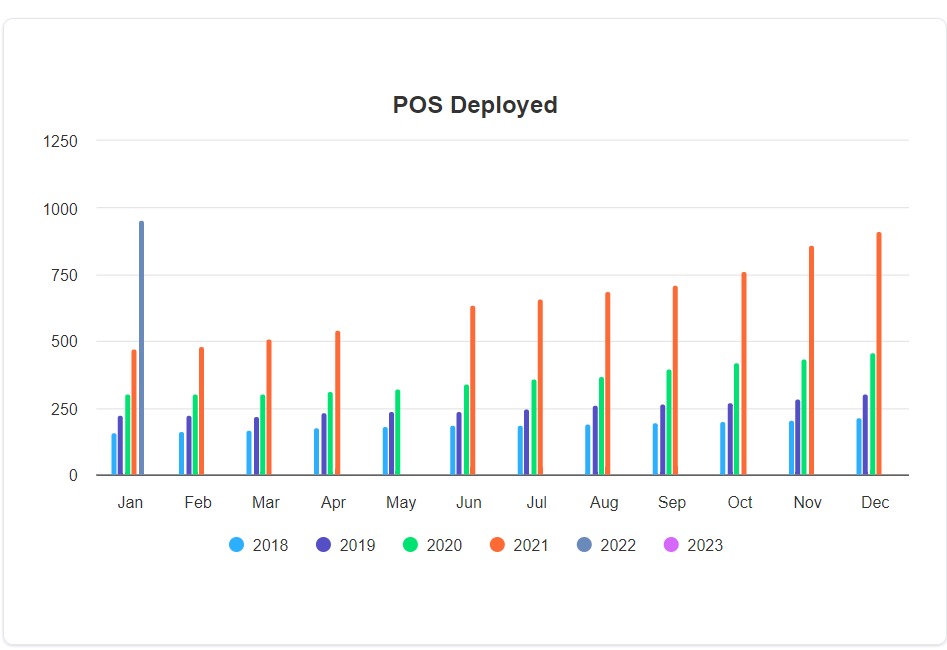

Yet, the NIBSS did not display the number of POS deployed since February 2022 till date.

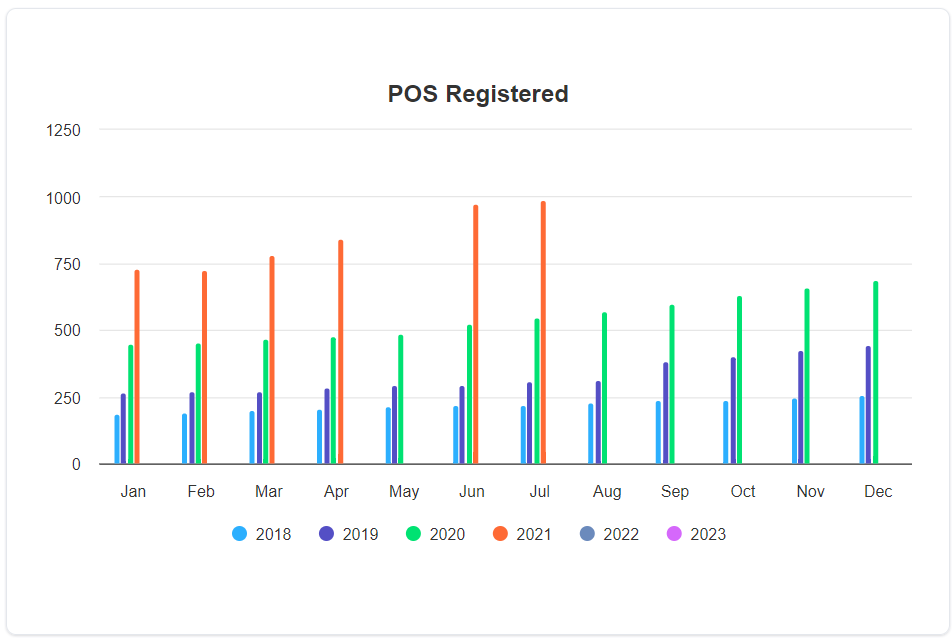

For registered POS, the last entry was for July 2021.

Sighted 27/01/2023

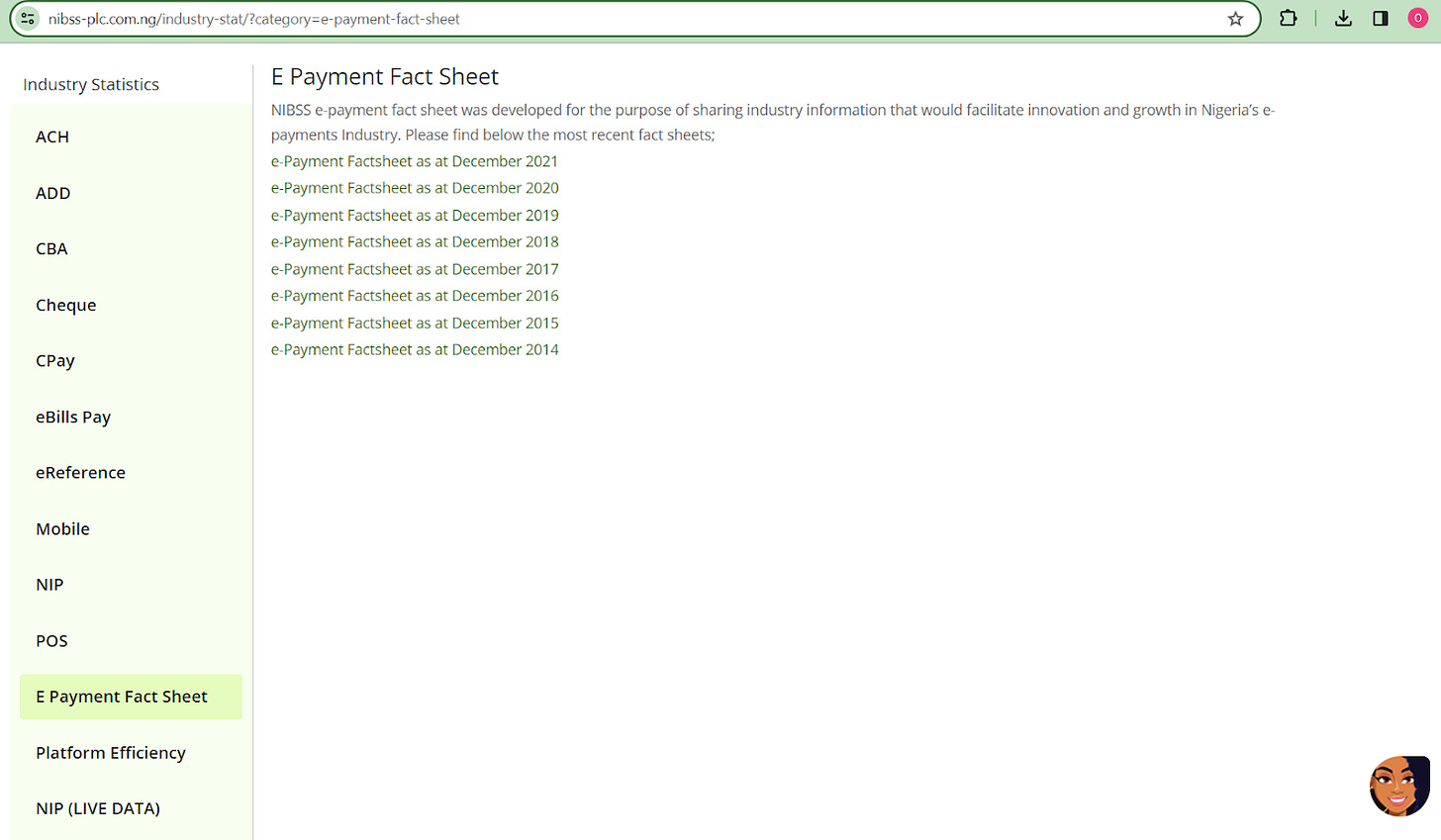

The once available e-payment factsheets were no longer there.

The company’s statement read “NIBSS e-payment fact sheet was developed for the purpose of sharing industry information that would facilitate innovation and growth in Nigeria’s e-payments Industry. Please find below the most recent fact sheets:

e-Payment Factsheet as at December 2021

e-Payment Factsheet as at December 2020

e-Payment Factsheet as at December 2019

e-Payment Factsheet as at December 2018

e-Payment Factsheet as at December 2017

e-Payment Factsheet as at December 2016

e-Payment Factsheet as at December 2015

e-Payment Factsheet as at December 2014”

Interestingly, the NIBSS views its December 2021 e-payment factsheet as “the most recent”.

Dearth, delay, or distortion of business and socioeconomic data may open the field for speculations and misinformation across the board.

Making data-driven inferences and fact-based decisions may get harder in Nigeria as the days pass.

Does the CBN or the NBS have it, then?

We could not find banking industry data beyond December 2022 from the two official Data Houses in Nigeria.

As of the time of writing, the latest record of e-payments in the banking industry that we could find with the NBS was contained in its Selected Banking Sector Data (Q1-Q4 2021).

For the Central Bank of Nigeria, only the Industry E-Payment Figures for January to December 2022 were available on the CBN Website on E-Payment Statistics.

The Central Bank has become renowned for illegally shrouding its records in secrecy, and the NIBSS is closely knit with the Central Bank of Nigeria:

“The Board of Nigeria Inter-Bank Settlement System Plc (NIBSS) is composed of the Deputy Governor, Financial System Stability of the Central Bank of Nigeria as the Chairman, representatives of Banks as Directors, Executive Directors and the Managing Director/CEO, who heads Executive Management group of the organisation,” the NIBSS website informed.

Last August, the Central Bank reluctantly released a backlog of annual financial statements during a probe of the former CBN Governor, Godwin Emefiele and his suspected enablers.

“The financials of the CBN has been shrouded in secrecy for years, the last time it issued its annual report being 2015, until Thursday when it published a seven-year backlog of earnings reports.

“To bring its activities to light, President Tinubu hired a one-time CEO of the Financial Reporting Council of Nigeria (FRCN) Jim Obazee as the special investigator to undertake a forensic audit of its books” Premium Times reported last year.”

The Investigative Journalism outfit earlier reported that “amid massive funding of govt’s deficits, CBN refuses to publish annual reports,” highlighting the CBN’s disregard for the law mandating it to make public its books:

“In gross contravention of its own laws, the Central Bank of Nigeria (CBN) has repeatedly failed to release its annual reports showing details of its operations and financial obligations.

“Since 2005 when it started publishing details of its annual report on its website, the CBN never failed to publish the report until 2018 when it stopped the publication of the crucial documents.”

According to the CBN Act 2007, the apex bank is expected to publish its report within two months after the end of each financial year.”

Little can be learned from a life without history.

The Death of A Daughter

It was Daniel Yo who comically captured the love of a father for his daughter differently from that which he has for his son:

When I had my son, I said, “I will die for you.” But when I had my daughter, I said, “I will kill for you.”

This January, Mr Al Kadriyar would have killed to preserve any of his captured daughters. Instead, his first daughter was killed in cold blood by kidnappers, and he had to stoop still to secure the release of the other 5 daughters.

Family members of the Al-Kadriyar girls disclosed paying a ransom to secure the release of 5 out of the 6 kidnapped girls, part of a group of 23 abducted individuals on January 2, 2023, in Bwari, Federal Capital Territory.

Tragically, four individuals were killed by the bandits recently, including one of the sisters, while the remaining 19 hostages were liberated on Saturday night.

One of the six sisters was killed over a delay in payment of the ransom. The abductors then increased the ransom to 100 million. This unfortunate incident generated horror and disgust from people all over the country as they called on the government and security operatives to rescue the family.

While the recent waves of kidnapping and insecurity in the Federal Capital Territory are disturbing, the situation only mirrors the untamed insecurity in its neighbouring states and the country as a whole.

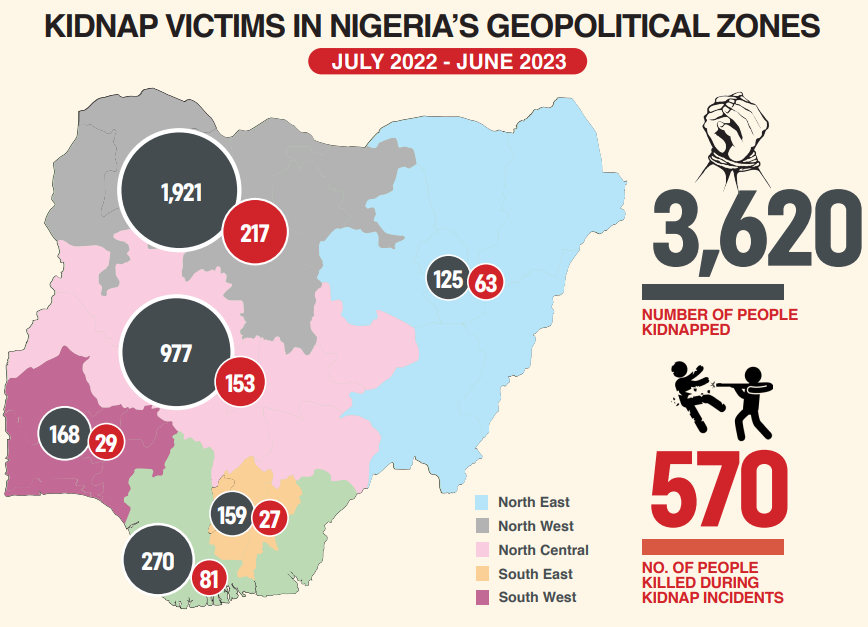

About 3,620 people were kidnapped in Nigeria between June 2022 and June 2023. The North Central, which consists of states like Abuja, Kogi, Nasarawa, and others, recorded the second-highest number of kidnapped people.

Source: SBM

Additionally, States like Kaduna, Niger, Kogi and Nasarawa that share borders with the capital territory recorded significant numbers of people kidnapped.

The FCT Police Public Relations Officer, SP Josephine Adeh, said the FCT police has “rescued the victims and reunited them with their families,” Punch reported.

However, the family of the Al-Kadriyar victims regarded the claim by the Nigerian Police Force as a true version of a lie. The true version that the people already know.

“We paid a ransom for the release of our girls. A ransom was paid, and the police were not involved. The children called me, and I went to pick them up. On my way, I saw soldiers at the junction, and the bush is a very thick bush along the Gurara Dam, so I had to call the attention of the soldiers to follow me to the spot where we could locate our children,” an Uncle of the girls said, according to the Punch.

In the FCT and other parts of the country, people don’t bother to report kidnaps anymore. They think that to really survive unrelenting kidnaps, Naira-denominated ransoms.

In the first 2024-centric edition of Data Dives, “When Pleasure Peaks and Pain Plateaus”, we admonished:

“What works is to expect pleasure to decrease and for pain to increase - that food crops will decrease naturally unless they are cultivated again, against all the odds of an infertile and insecure land. And to be assured that thorns will increase naturally unless they are hindered.

“The resolve to work against these natural negative expectations forms the background to every vocation of man.”

One is not sure if this is the vocation of our civil servants, security forces, or the political class.

A Dot of Laughter

For 2 hours, some Nigerians forgot their economic adversities and political parties.

They rallied to support the Super Eagles to a redemption win over the Indomie Lions of Cameroon, sorry indomi table lions of Cameroon.

This reminds us that when all is lost, hope can reenact a new order.

Yes, we know the fiscal disaster that lurks in the shadows with the dearth of transparency about our banking sector data.

We all know about the guesswork policy-making that will follow, and how it will harm the vulnerable more.

We see the damage the death of a daughter brings to the father’s psyche, the dread that overwhelms the family.

Yet the Naija spirit somehow shows up in the end.

That hope made an aching country to recover its glory that’s oft been trampled on by Cameroon.

And after all that we deal with everyday, we need some dot of laughter on our faces.

Naija no go carry last!

Thanks for reading this Data Dive. Cheers to more wins!