A Mega-Merger in Nigeria’s Pension Space

+Tax Incentives in the Oil and Gas Sector

A Mega-Merger in Nigeria’s Pension Space

The National Pension Commission (PENCOM) has approved the merger between ARM Pension Managers (PFA) Limited and Access Pensions Limited to form a new entity named Access ARM Pensions Limited.

This merger reflects the recent broader trend in the financial services industry where firms are consolidating to remain competitive, optimize operations, and better serve customers.

According to the management of PENCOM, “the merger is expected to result in the achievement of economies of scale, improved operational efficiency of the new entity as well as improved service delivery to Retirement Savings Account (RSA) Holders.”

Also, this might lead to more robust portfolio management to ensure that pension fund administrators remain capable of meeting their obligations to retirees.

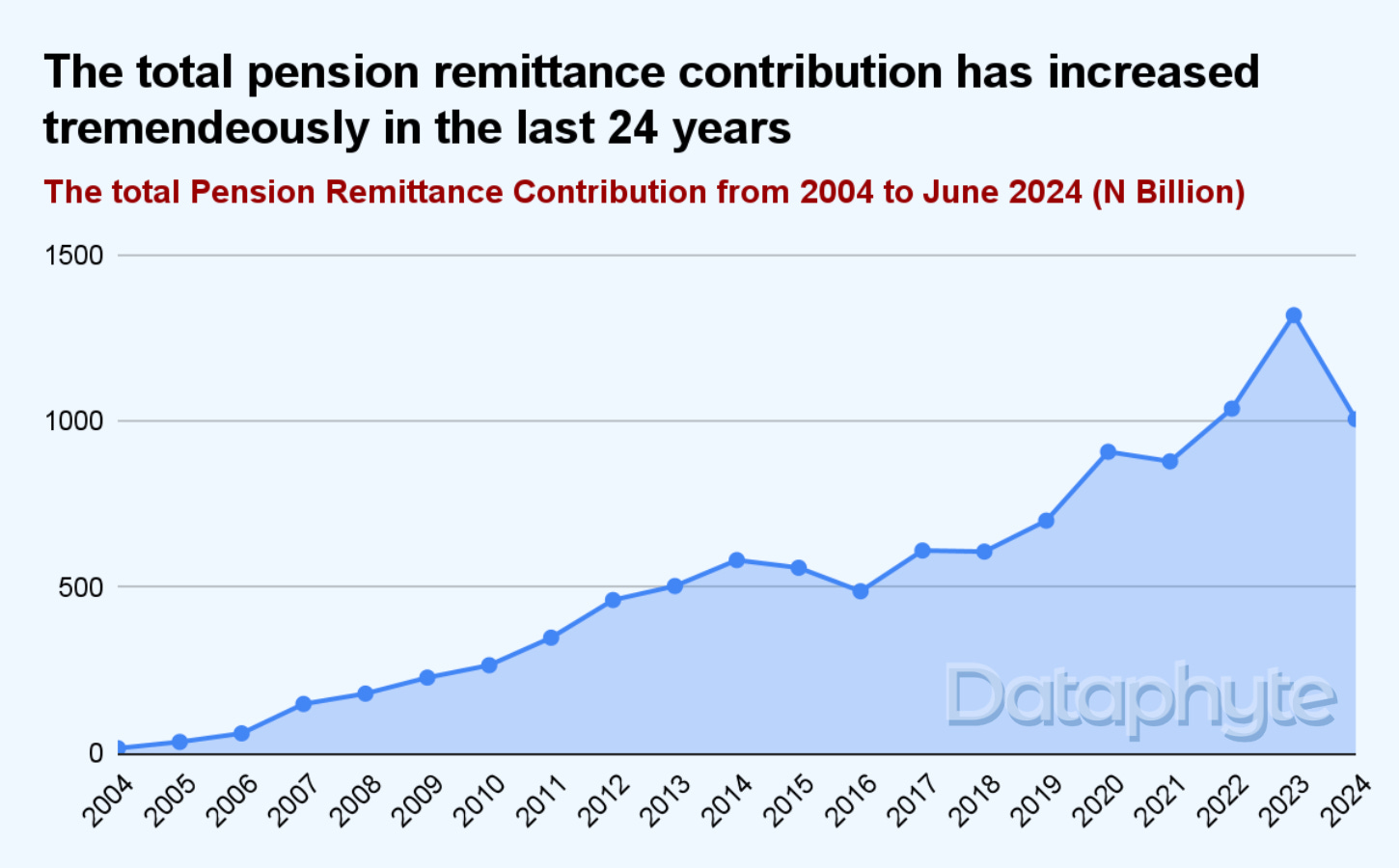

At the end of the first half of 2024, the total number of Retirement Savings Account (RSA) registrations stood at 10.4 million while the total remittance of pension contribution stood at ₦10.9 trillion.

The total remittance of pension contribution increased by 120% between Q1 2024 and Q2 2024. It increased from ₦314.17 billion in Q1 2024 to ₦692 billion in Q2 2024.

The public sector remains the highest pension contributor to total pension remittance. It contributed a total of ₦543.56 billion, while the private sector contributed ₦462.61 billion in the first half of 2024.

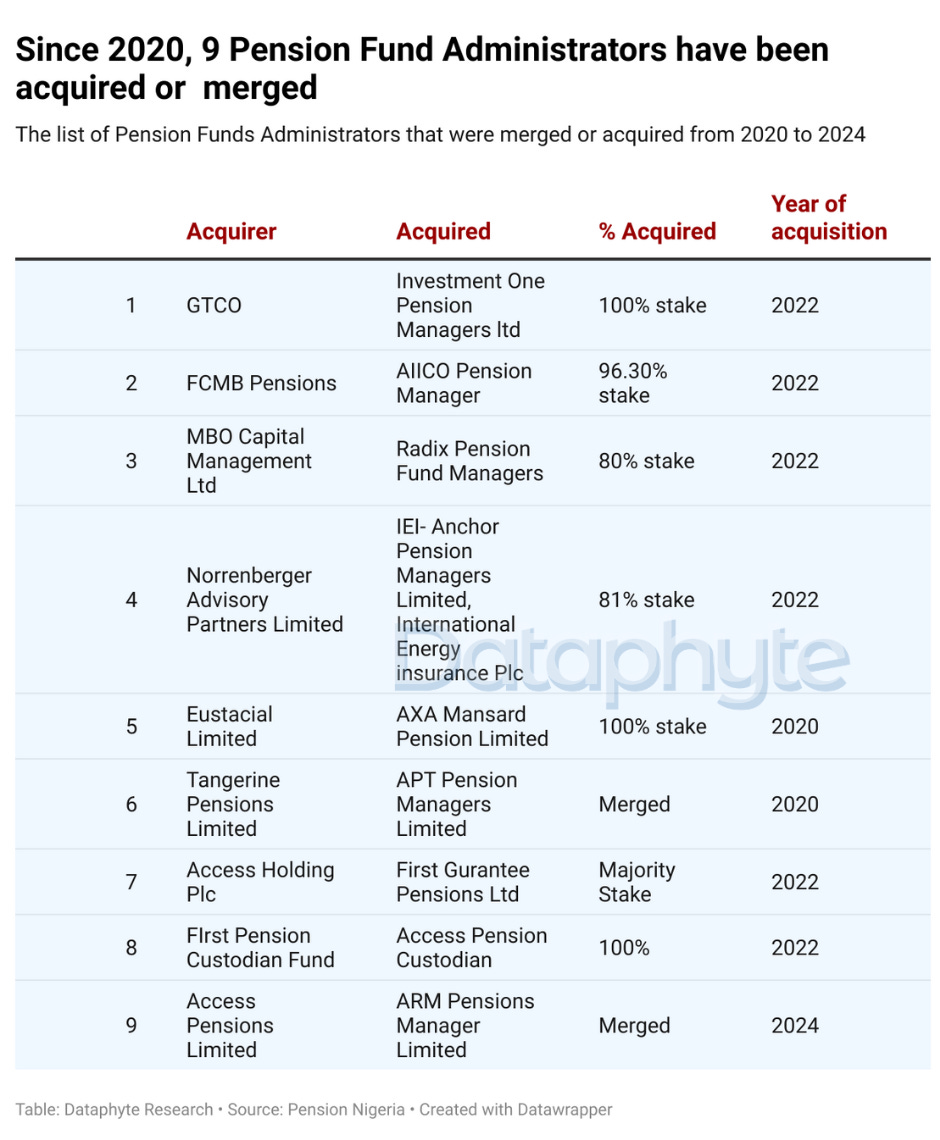

In 2020, and particularly after the consolidation of the Nigerian pension sector in 2021, the regulatory framework underwent a significant change. The National Pension Commission (PENCOM) increased the Minimum Regulatory Capital Requirement (shareholders’ fund) for Pension Fund Administrators (PFAs) from ₦1 billion to ₦5 billion.

As a result, the industry has seen 9 major mergers and acquisitions. These consolidations were primarily driven by the need to meet the new capital requirements and enhance operational efficiency across the industry.

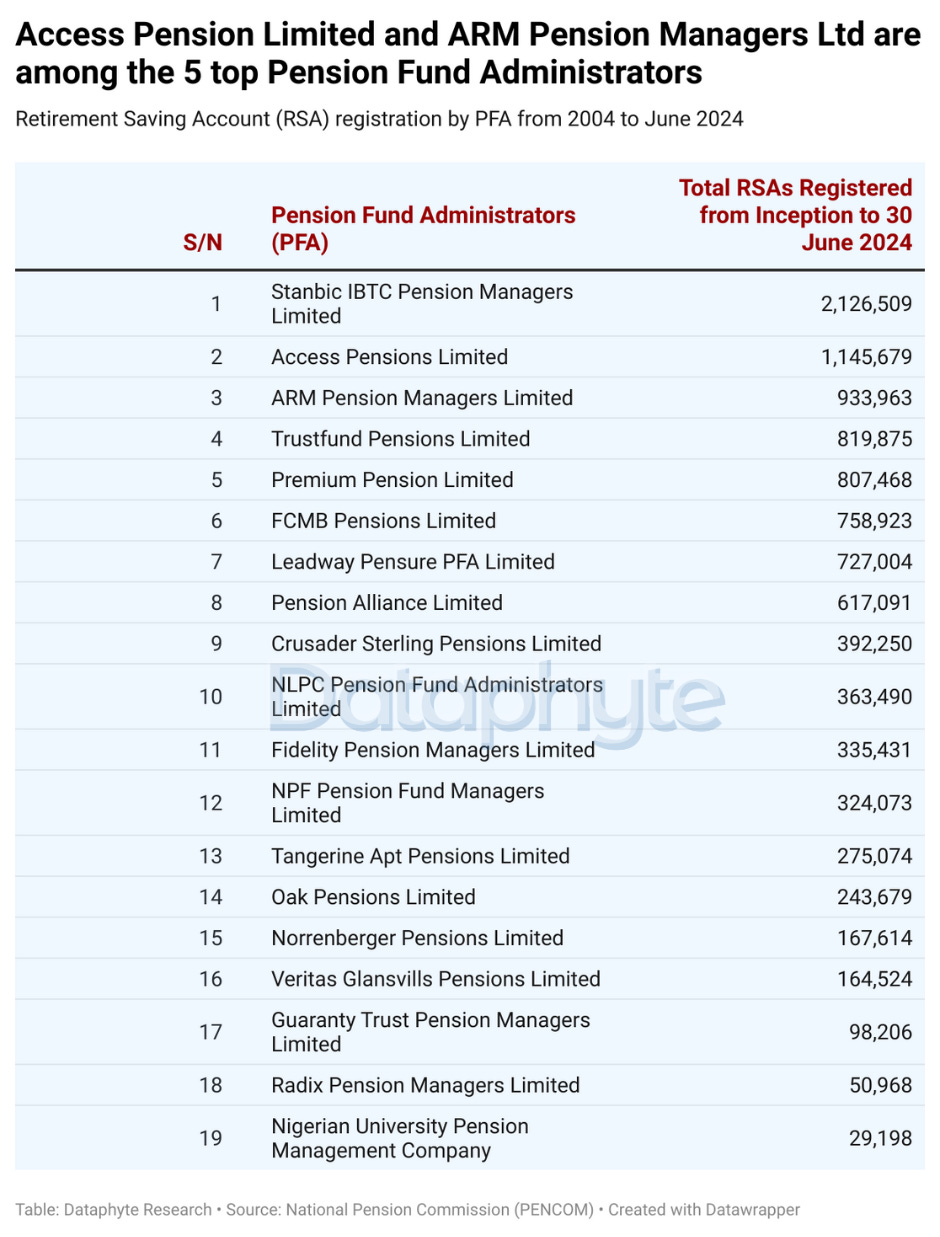

An analysis of the Retirement Saving Account registrations across the Pension Fund Administrators (PFA) revealed that Access Pensions Limited and ARM Pension Managers (PFA) Limited were among the top 5 PFA in Nigeria before the merger.

The merger will enable the new entity, Access ARM Pensions Limited, to be the second largest Pension Fund Administrator in Nigeria.

According to the Former Chief Executive of Access Holdings Plc, Late Dr Herbert Wigwe, “‘We are pleased to have reached this transformative milestone in our pension fund administration journey. The proposed combination of ARM Pension with Access Pensions will not only create sustainable stakeholder value but will also contribute positively to the growth and development of the pension industry. We anticipate an exciting future for the combined entity.”

The Group CEO of ARM Holding Company Ltd, Jumoke Ogundare, said: “the proposed combination will create a formidable pension funds administration business leveraging Access Group’s extensive distribution network and innovation culture to deliver sustainable value to stakeholders.”

With a combined asset of over ₦2 trillion, the new entity, Access ARM Pensions Limited will be positioned as a key player and solidify their influence in Nigeria’s pension industry.

Tax Incentives in the Oil and Gas Sector

The Honourable Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun has unveiled two major fiscal incentives aimed at driving investment in Nigeria's oil and gas sector, the Value Added Tax (VAT) Modification Order 2024 and Notice of tax incentives for Deep Offshore Oil & Gas Production, in accordance with the Oil & Gas Companies (Tax Incentives, Exemption, Remission, etc.) Order 2024.

The VAT Modification Order 2024 will exempt a range of key energy products and infrastructure, including Diesel, Feed Gas, Liquefied Petroleum Gas (LPG), Compressed Natural Gas (CNG), Electric Vehicles, Liquefied Natural Gas (LNG) infrastructure, and Clean Cooking Equipment.

Also, the Notice of Tax Incentives for Deep Offshore Oil & Gas Production provides new tax relief for deep offshore projects.

Mr Edun stated that the new fiscal incentives are “aimed to lower the cost of living, bolster energy security, and accelerate Nigeria's transition to cleaner energy sources. Also, it will position the country’s deep offshore basin as a premier destination for global oil and gas investments.”

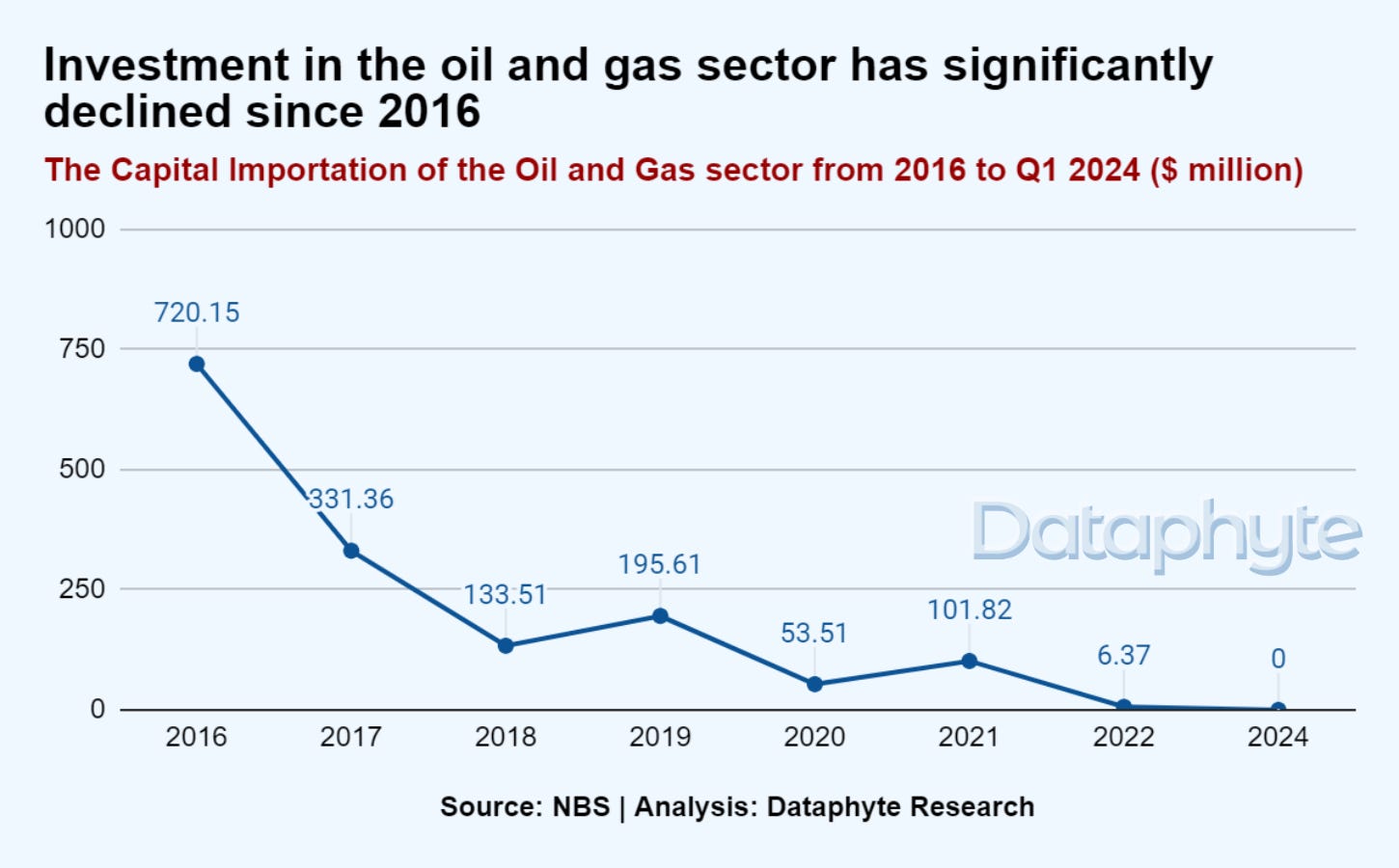

The NBS Capital Importation data shows that the capital imported/investment into the oil and gas sector has significantly declined in the last 8 years.

The Capital Importation data shows that there was no investment in the oil and gas sector in Q1 2024.

Over the past three years, 6 multinational oil and gas companies have divested from their operations, particularly onshore assets in shallow waters. Shell, Total Energies, ExxonMobil, ENI (Agip), Chevron, and Equinor have sold these assets to Nigerian-owned oil and gas companies.

This wave of divestment is not only driven by the global energy transition and pressure to reduce fossil fuel reliance, but also by significant challenges in Nigeria's upstream petroleum sector.

These challenges include widespread crude oil theft which significantly reduces profitability and severe insecurity, especially threats to workers' safety. These issues make operations increasingly difficult, expensive and unsustainable for many companies.

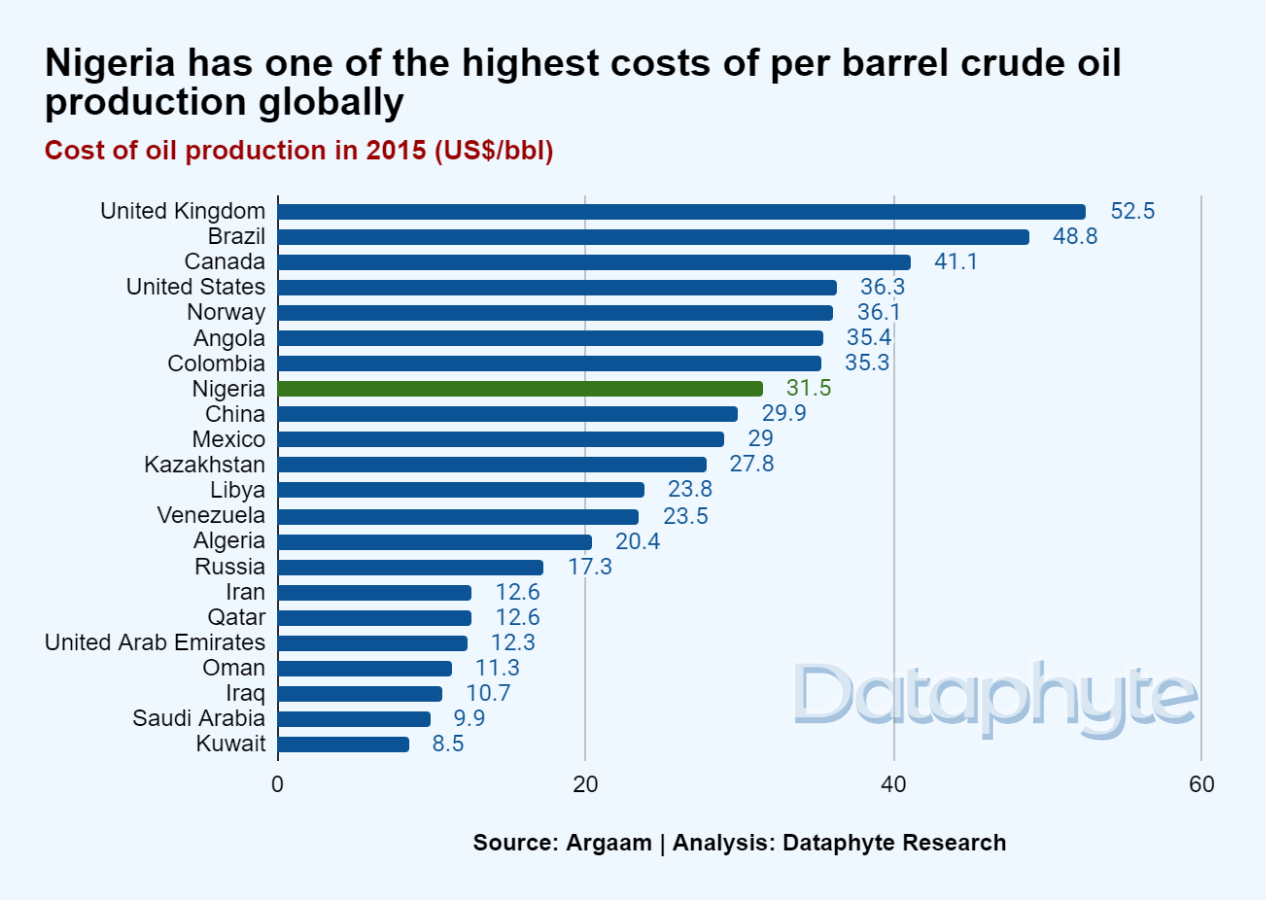

Nigeria has one of the highest oil production costs compared to other oil-producing nations.

Within the last 9 years, the cost of oil production in Nigeria has risen to $48.71 per barrel with personnel costs taking a huge chunk of the operational cost.

The Group Managing Director, Nigerian National Petroleum Corporation (NNPC), Mele Kyari stated that, “many operators in the country spend 50 per cent of their cash flow on personnel costs, thus accounting for why some operators still produce at a high rate.”

In 2019, Seplat CEO, Roger Brown highlighted that Nigeria's oil production costs are significantly high, with direct production costs and gross taxes making up 37% and 33% of expenses, respectively.

Also, Nigerian projects are about 69% more expensive than the global average due to factors such as project delays, rig rates, and drilling costs.

Operating costs in Nigeria are also elevated, with premiums ranging from 15% to 65%. Handling costs for crude can rise to $25 per barrel when including transportation.

Security challenges like sabotage, crude theft, and kidnapping further drive up costs, and the country's contracting cycle, at 36 months, is much longer than the global norm of six to eight months, Brown stated.

Nigeria's oil industry faces declining long-term competitiveness as elevated production costs erode profit margins, reducing the sector's attractiveness to investors and constraining future growth potential.

While the new fiscal policies may enhance the appeal of investing in the oil and gas sector, the underlying cost drivers of high production expenses remain unaddressed, limiting potential efficiency gains and profitability improvements.