A Shop on Buka Street

Beyond the sibling rivalry on Buka Street, there is a lucrative market for those catering to the food needs of Nigerians.

People now spend a larger proportion of their total expenses on food at restaurants than in the past 10 years.

This comes at a time when the proportion of total expenses spent on eating inside the home declined by 19%. It declined from 64% of total expenses in 2010 to 45% of same in 2020.

On the other hand, cooked food purchased outside the home increased by 11% in the same period.

As of 2010, Nigerians actually spent less than 1% of their total expenses eating outside their homes. By 2020, they spent 11% extra eating on Buka Street.

So, if you’re considering a side hustle or a new enterprise, think of setting up a local restaurant on Buka Street.

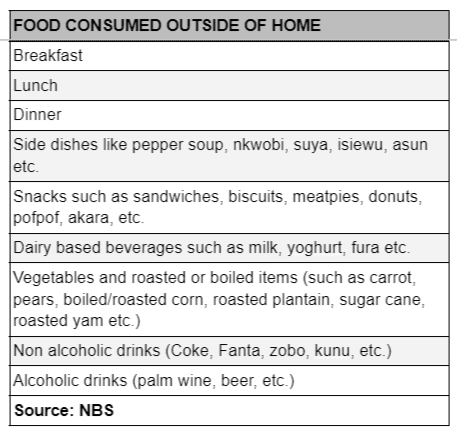

Relying on the NBS list, here are areas you could think of catering to:

Shifting Priorities?

It’s often said: A person’s personal budget reveals their values.

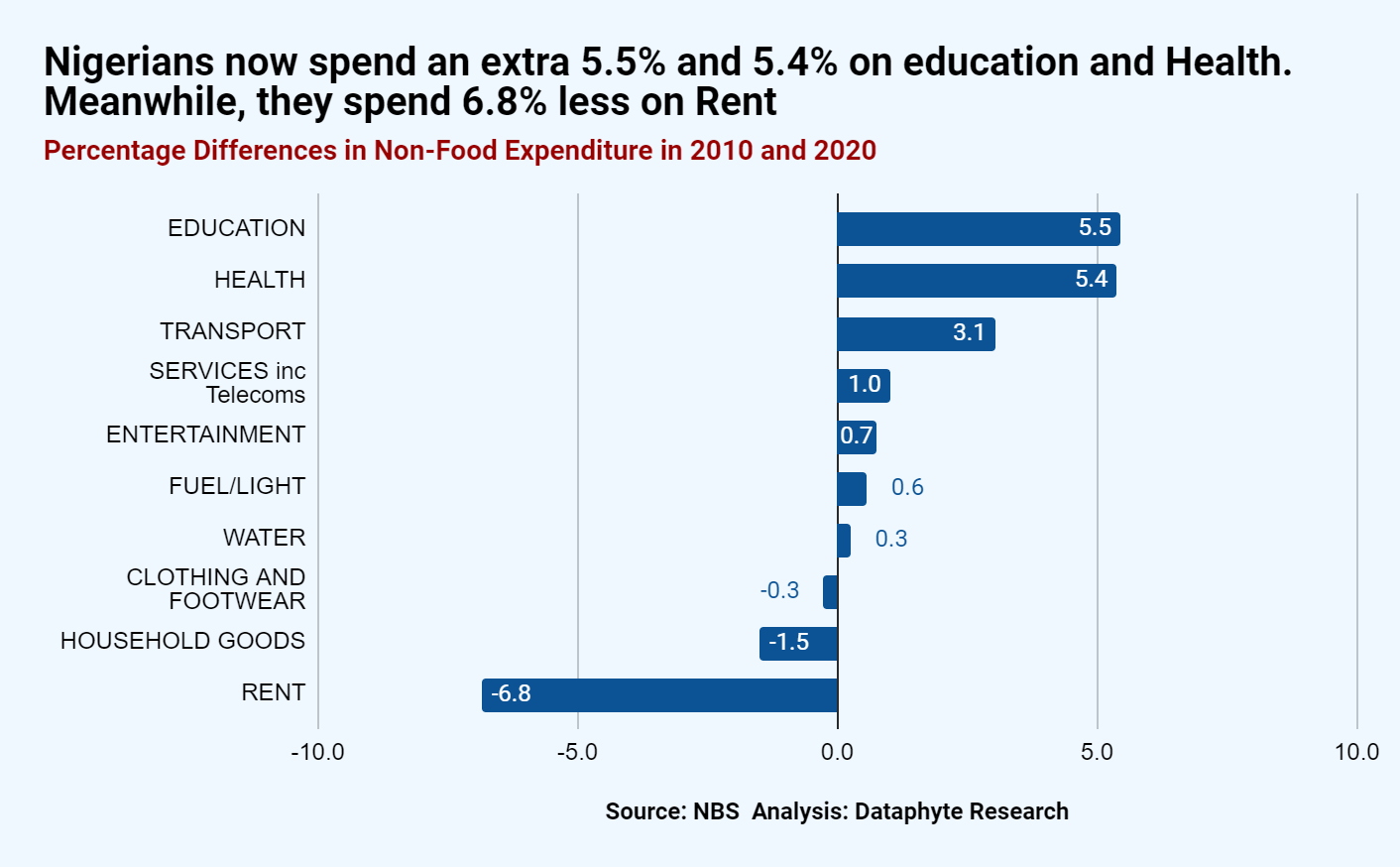

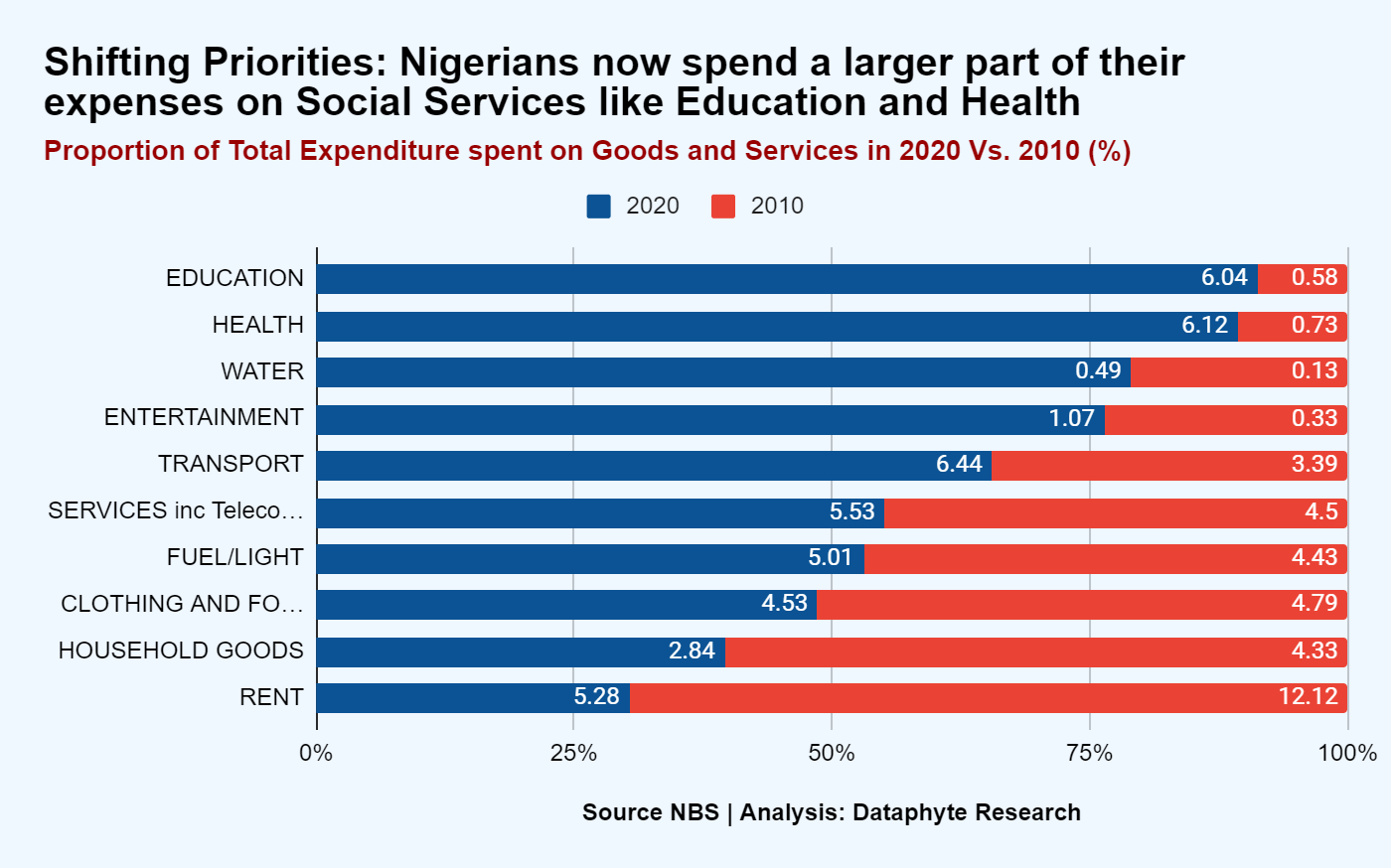

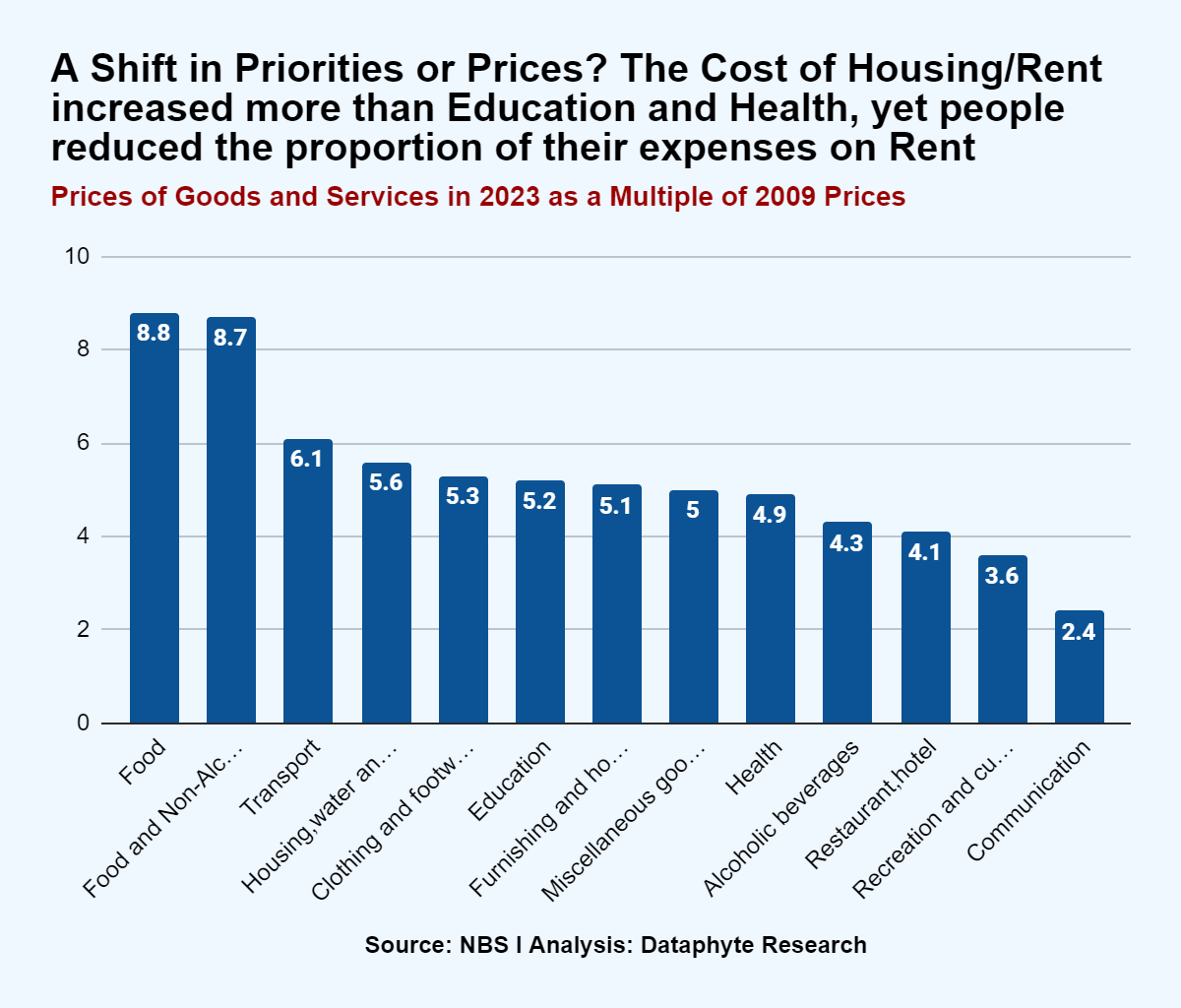

The NBS’ Consumption Pattern in Nigeria Report for 2010 and 2020 reveals that Nigerians’ spending priorities have shifted towards social services such as Education and Health more than other infrastructural services like Transport and Telecommunications.

They now spend 6% of their total expenditure on Education, a 5.5% increase over 0.6% in 2010.

Same goes for Health at 6.1% of their total expenditure, a 5.4% increase over the 0.7% 10 years ago.

These two are followed by Transport with an increase of 3.1% and Telecoms services increasing by 1%.

On the other hand, the proportion of spendings on rent declined most from 12.1% in 2010 to 5.3% in 2020.

This is followed by the proportion of spendings on Household Goods, declining by 1.5% from 4.3% to 2.8%. Clothing and footwear marginally declined by 0.3%, from 4.8% to 4.5%.

This shifts could be due to shifting priorities but they could also be due to the increased cost of quality education and healthcare services in the country.

However, data shows that the cost of transport, housing and clothing and footwear actually increased more than education and health.

It appears that individuals and households have just chosen to cut costs on things like transport, housing and rent, and clothing and footwear in order to keep up with their life’s priorities.

Keeping up with the Prices

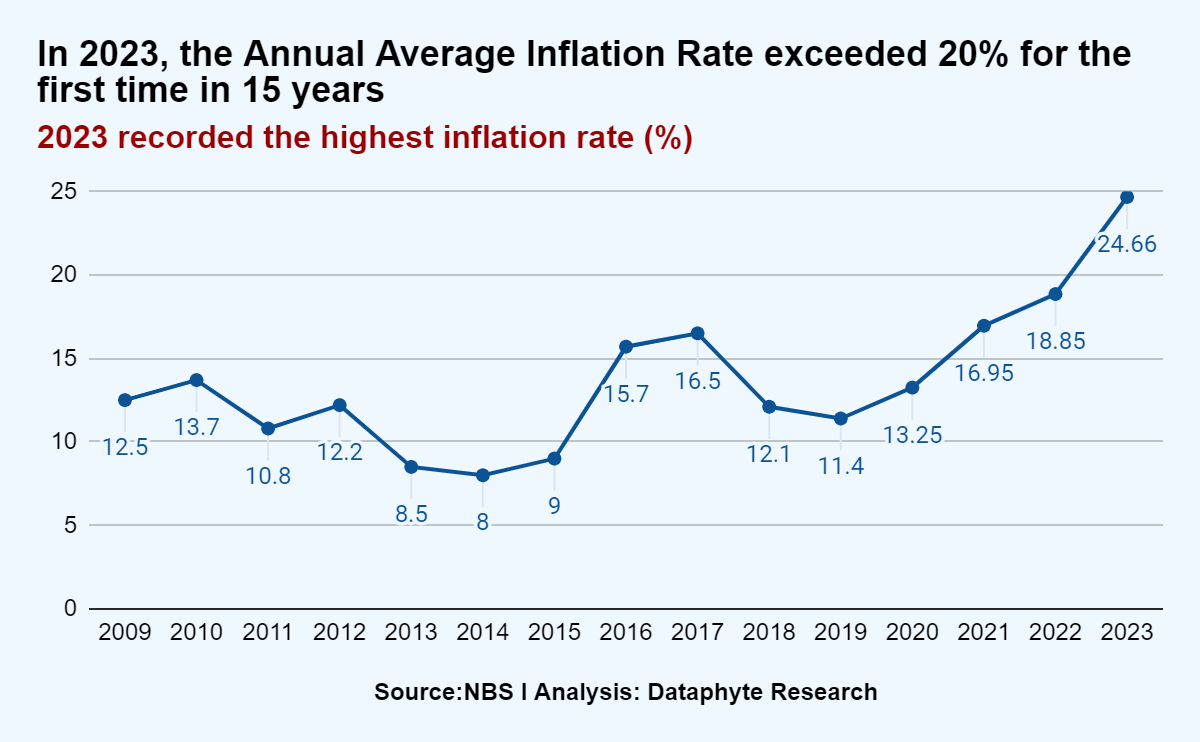

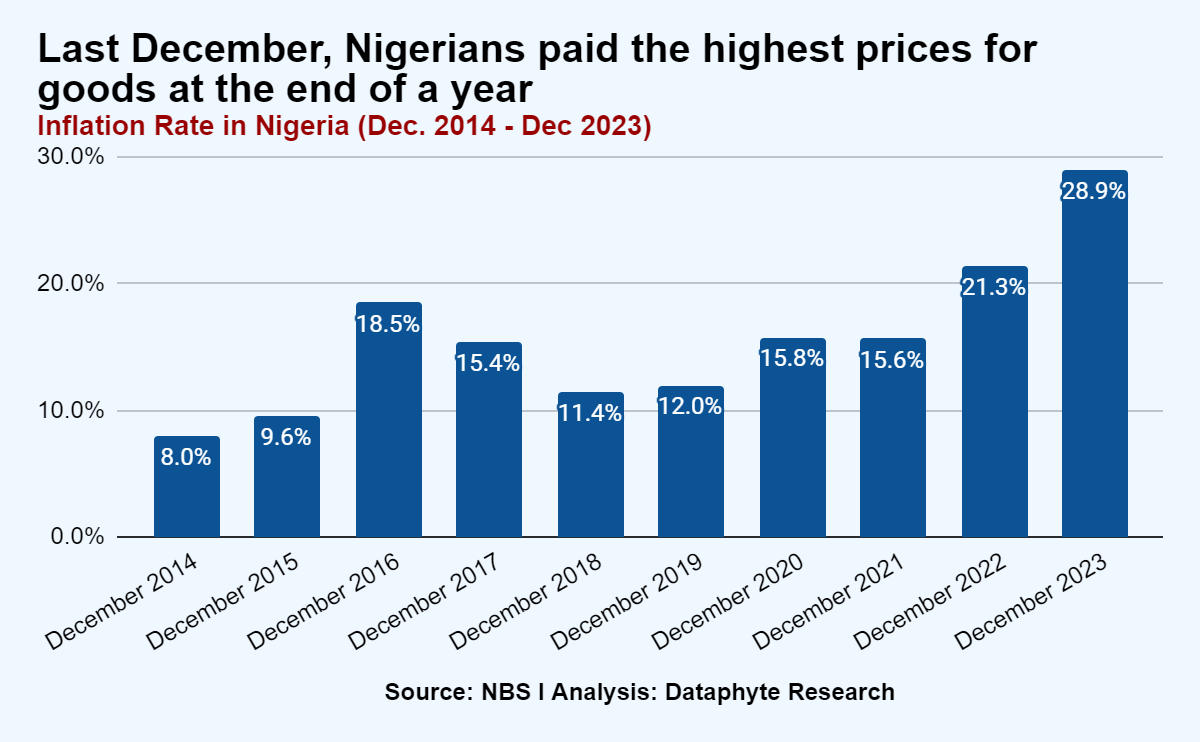

Nigeria’s annual average inflation has exceeded 24% over 15 years, with the prices of goods and services increasing faster in the last 4 years, an analysis of data from the National Bureau of Statistics (NBS) reveals.

Owing to this, Nigerians parted with so much more money in buying goods last December than in any other year in the last 10 years.

Inflation is the measure of the rate of change in the price of commodities in the market. It signifies the strain on the people’s pockets as they pay more to purchase the same basket of goods month after month or year after year.

It also applies to the rate of increase in the fee charged for the same set of services such as education, health, telecommunications, electricity, etc., within different periods.

If you reside in Nigeria, this is no longer news. It’s a lived reality.

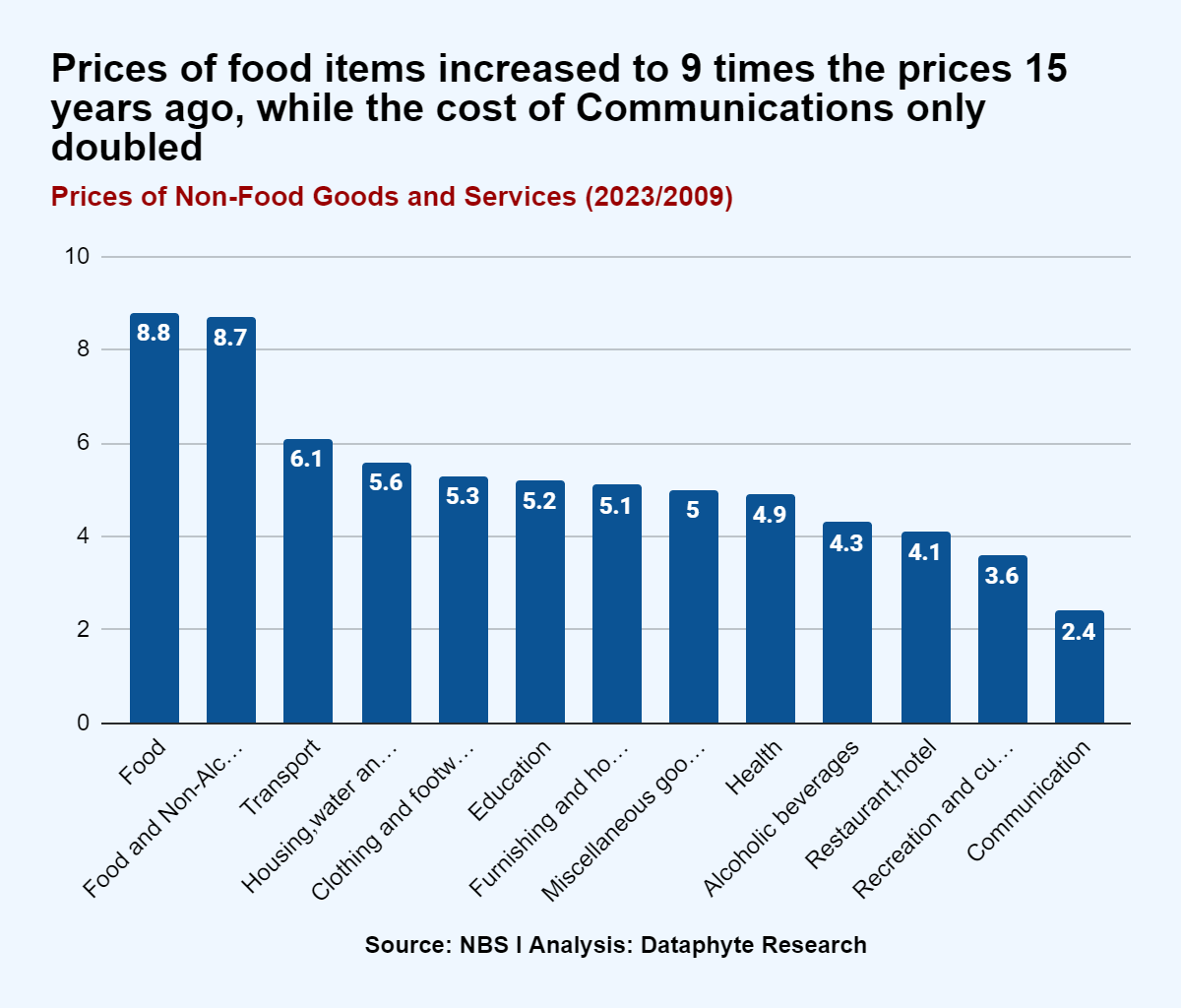

What is news is that the prices of some goods and services have not increased as fast as others. Arming yourself with knowledge of this would help in allocating your personal income judiciously and making smart buying decisions.

For instance, while the price of subscriptions for phone calls and internet services (communications) has only doubled in the past 15 years, the price of food is now 9 times what it used to be.

Again, while food and telecoms are not substitutes, the awareness of the changes in food prices helps one to allocate adequately for food without a feeling of over budgeting for it.

Next to food prices comes transport fares, with 6 times the prices in 2009.

Transport, housing, water and energy, and education are the only services that their costs have increased to 5 times the 2009 prices, as of December 2023.

Different Places, Different Prices

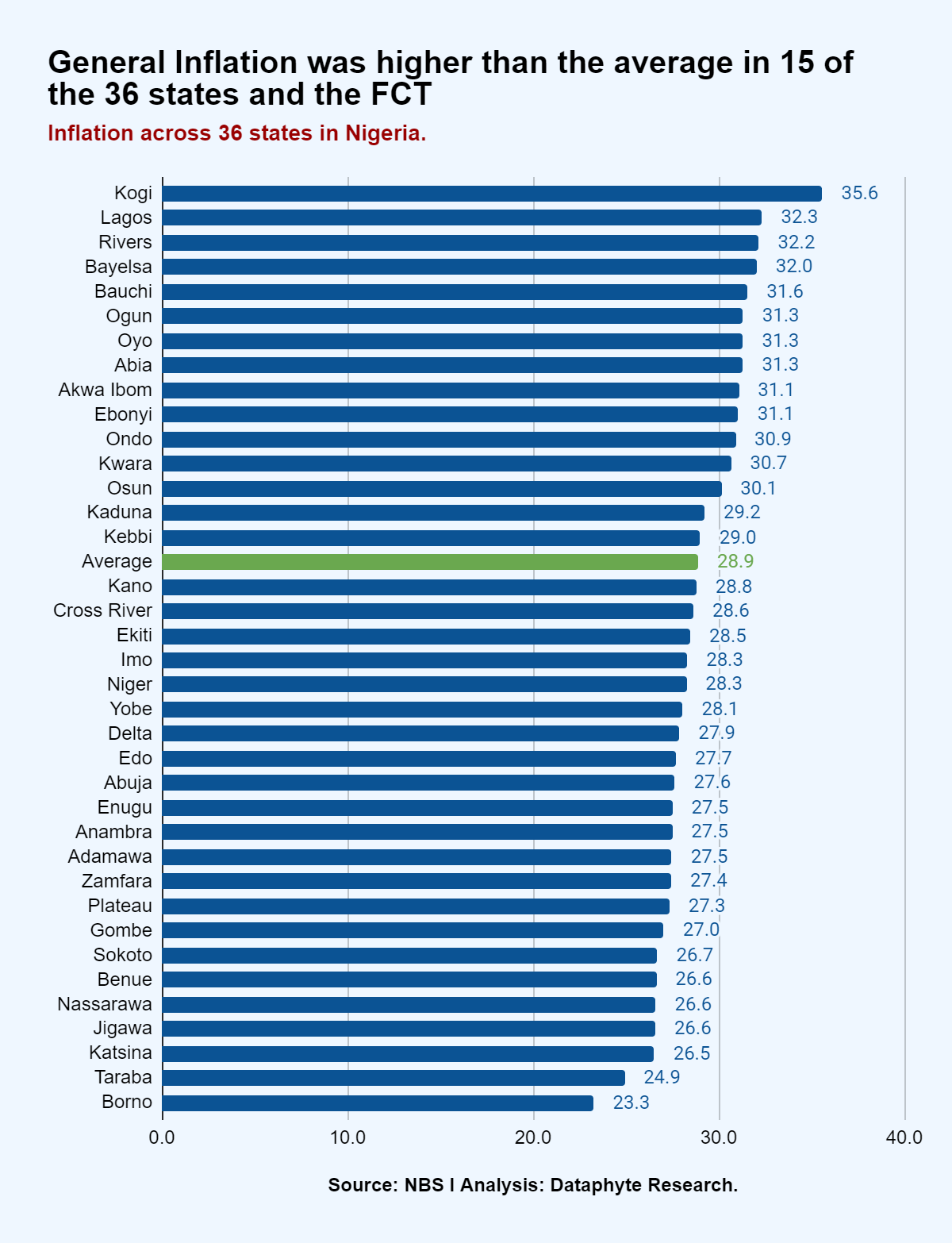

However, the inflationary pressure varies across states in Nigeria.

While all regions witness an increase in the prices of goods and services, the inflation pressure is higher than the national average in 15 states and lesser in the other 21 states and the FCT.

The states with the highest general inflation rates are Kogi, Lagos, Rivers, Bayelsa and Bauchi states. States like Nassarawa, Jigawa, Katsina, Taraba and Bauchi have the lowest inflation rates.

North-South Food Gap: Any Opportunities?

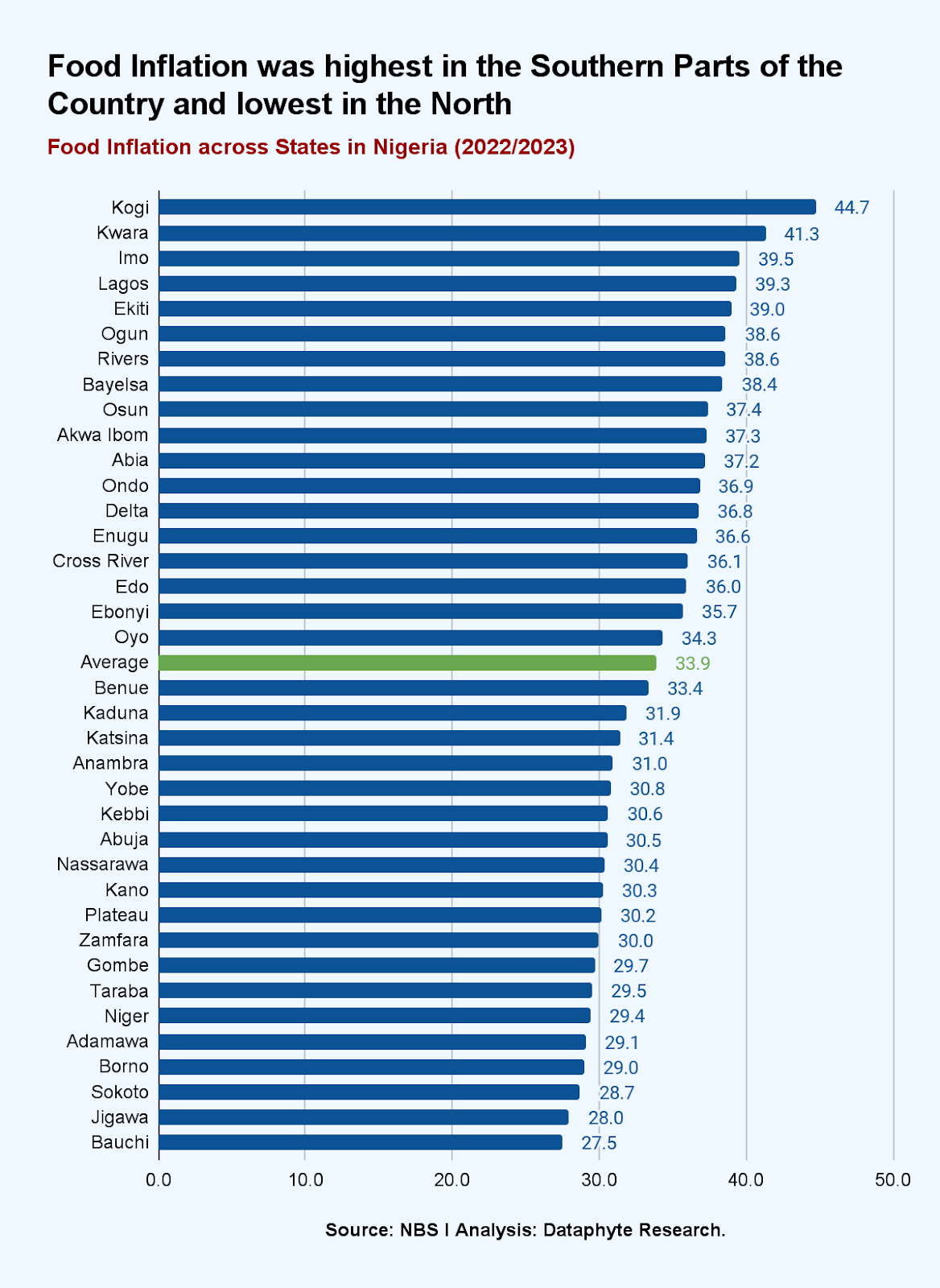

When it comes to food inflation, there’s a North-South divide.

Food inflation figures for the 36 states and the FCT show that food prices increased faster in the southern part of Nigeria than in the northern parts.

All the states which recorded a food inflation rate above the national average of 33.9% were Southern states, with the exception of the North-Central States of Kogi and Kwara.

Also, all the states which recorded a food inflation rate below the national average were Northern states, with the single exception of Anambra, a Southeastern State.

This North-South gap in food inflation indicates a consistent demand-supply gap in food production.

It shows there is a higher demand for food products in the southern states without commensurate food production and supply.

Business intelligence suggests that more subsistence farming in the southern parts of the country can help individuals and households mitigate the cut-throat food inflation there.

Other business strategy questions are: What are the factors limiting subsistence and commercial agriculture in the South? What are the factors encouraging farming in the North?

What are the options available for adequate investment in agriculture to narrow down the gap between food production and food demand?

Could it be the North simply has a comparative or absolute advantage in agriculture than the South of the country?

These too are some food for thought 🤔.

Thanks for reading this edition of Pocket Science. See you next time!

This edition was composed by Kafilat Taiwo and Funmilayo Babatunde. It was edited by Oluseyi Olufemi.