Access Bank: 3 Fast Steps Forward

+Niger-ish Neighbours: A Time to Close a Time to Open

Access Bank: 3 Fast Steps Forward

Taking three fast steps forward

That is exactly what Access Holdings did at the moment.

Dataphyte earlier predicted that the Bank had chances to thrive after the sudden departure of its trailblazer CEO, Herbert Wigwe, like it was with Apple Inc. after the passing of its maverick co-founder, Steve Jobs.

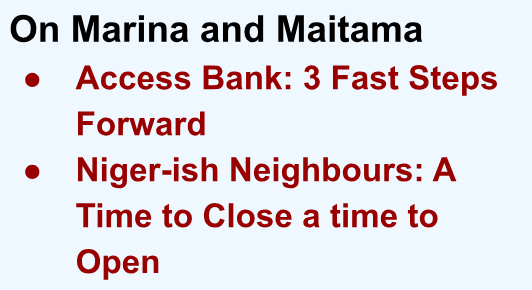

Then we reported that: “After this tragic event, the company's share price fell by 6.3% from N24.75 on Friday, February 9, to N23.20 on Monday, February 12.

“Thankfully, the bank’s market performance began recovery as soon as the announcement of the new Acting CEO, Ms Bolaji Agbede that same day.

“By Tuesday, Access's share price rose by 0.43% increasing to N23.30. The next day, Wednesday, the share price rose further by 1.55% to N23.60.”

After that fast first move came the second step forward.

A new chairman, Mr Aigboje Aig-Imoukhuede CFR. He previously served as the pioneer CEO till his retirement in 2013. He replaces the erstwhile chairman, Mr. Abubakar Jimoh. This appointment is coming four weeks after the passing of the bank's CEO, Herbert Wigwe.

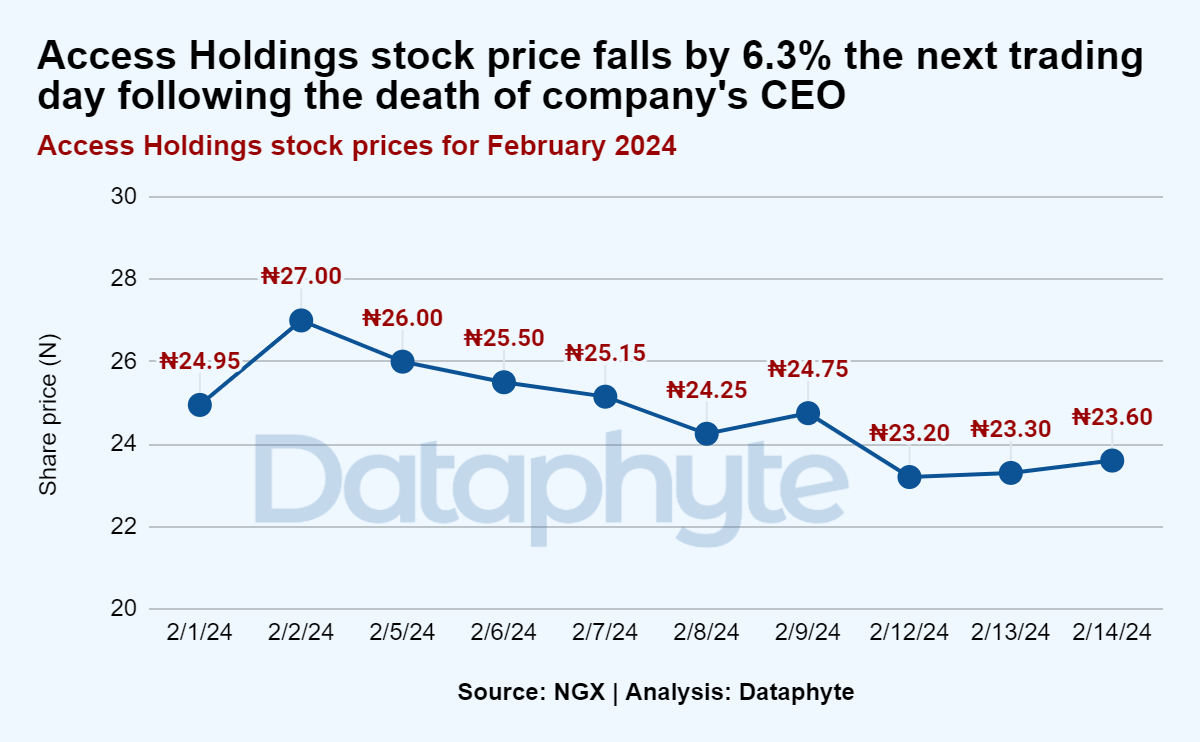

Access Bank’s stock price appreciated the day after Mr Aig-Imoukhede’s comeback.

On March 14, the next trading day after the appointment of its new chairman, Access Holdings’ stock price per unit increased by 1.52% from N23.00 to N23.35.

Afterwards, the stock price per unit remained stable at N23 until a slight drop at the close of trade on March 20, 2024.

Under Aig-Imoukhuede's stewardship between 2002-2013, Access Bank became one of Nigeria's top 5 banks with a presence in 9 other African countries and the United Kingdom, a press release from Access Holdings informs.

During his time at the helm of affairs, the bank grew its customer base from 10,000 to over 6 million, with over 5,000 employees and an assets base of $12 billion.

As of March 20, 2024, Access Holdings is one of the most traded stocks on the Nigerian Stock Exchange. As of the close of trade yesterday, the company exchanged 413 million shares in 410 trades.

Choosing new leadership for an organisation like Access Holdings comes with courage and tactfulness, particularly because it comes with maintaining the trust of investors.

Commenting on his appointment, Mr Aig-Imoukhuede said, “I am thrilled to be back in active service to the Access Group ecosystem. I am confident that working with our directors, our exceptional team of executives and our best-in-class banking and finance professionals, we will deliver outstanding value to our esteemed stakeholders. I am determined that our shared vision, which Mr Wigwe gave everything for, will be realised.”

While at it, the bank made its third ambitious move.

The Group announced that it has entered into a binding agreement with the Kenyan-based KCB Group Plc for the acquisition of all the share capital of National Bank of Kenya Limited from KCB.

This furtherance of its African expansion strategy to make Access Bank “Africa's Gateway to the World.”

We wish the new chairman and the whole bank staff a seamless and successful transition!

Niger-ish Neighbours: A Time to Close a time to Open

The federal government has directed that Nigeria’s land and air borders with Niger be opened.

Niger's borders were closed in August 2023 when ECOWAS imposed sanctions on Niger, Mali, Guinea and Burkina Faso, where the military recently seized power from democratic governments.

The sanctions were part of ECOWAS’s measure to restore constitutional order in these countries.

While the sanctions lasted, all land and air borders between Nigeria and Niger Republic were closed, as well as suspension of all commercial and financial transactions between Nigeria and Niger.

Additionally, all service transactions, including electricity to the Niger Republic, were disconnected. This affected all trade activities between both countries.

Nigeria had sacrificed the trade benefits with Niger to seek the entrenchment of democracy across its northern border.

Previous trade records show that Nigeria and Niger are traditional trade partners. They trade in major products like electricity, cement, petroleum products, tropical fruits, livestock products and other food items.

Over the past 27 years, Nigeria's exports to Niger grew at an average annual rate of 7.62%, rising from $39.5 million in 1995 to $287 million in 2022.

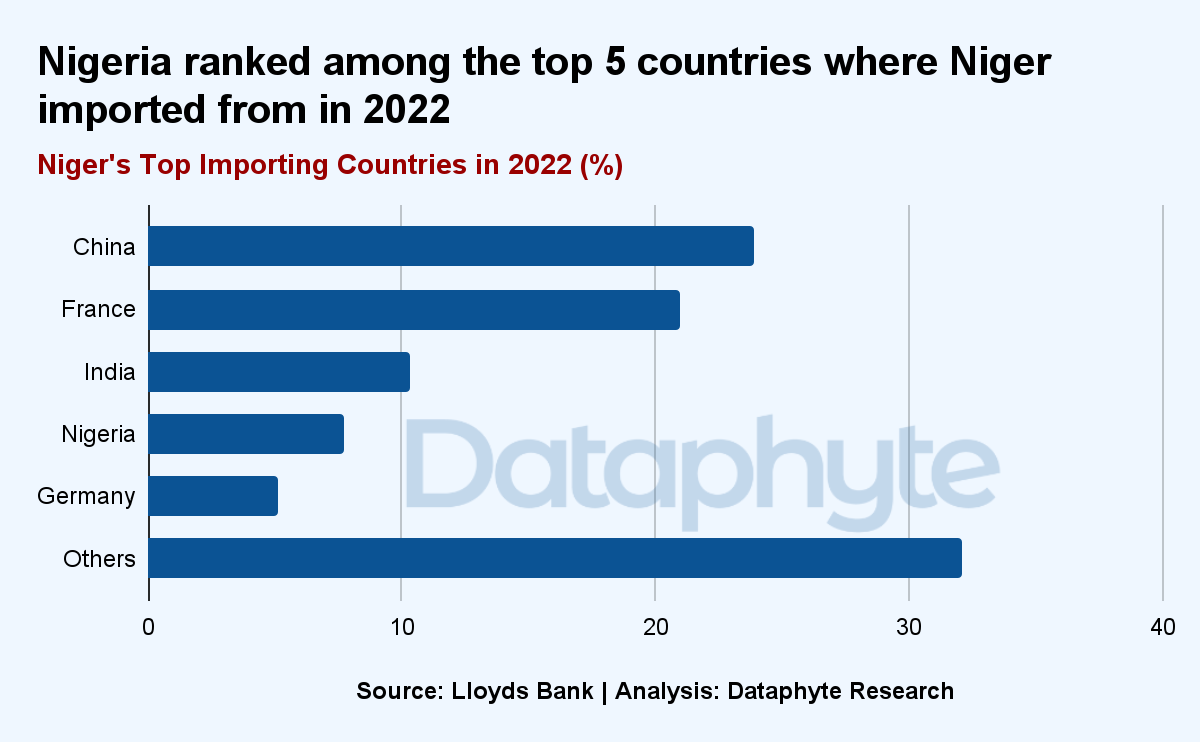

In 2022, Nigeria ranked among the top 5 countries where Niger imported from.

Thanks for reading this edition of Marina and Maitama. It was written by Funmilayo Babatunde, who just decided to open an Access Bank Account because her friend works there, and edited by Oluseyi Olufemi, who has travelled north of Nigeria across the River Niger but has never made it to the border with the Niger Republic.