August Inflation Report: A tale of two food inflations

+Consumer Goods: Nigerian Breweries seek funds

August Inflation Report: A tale of two food inflations

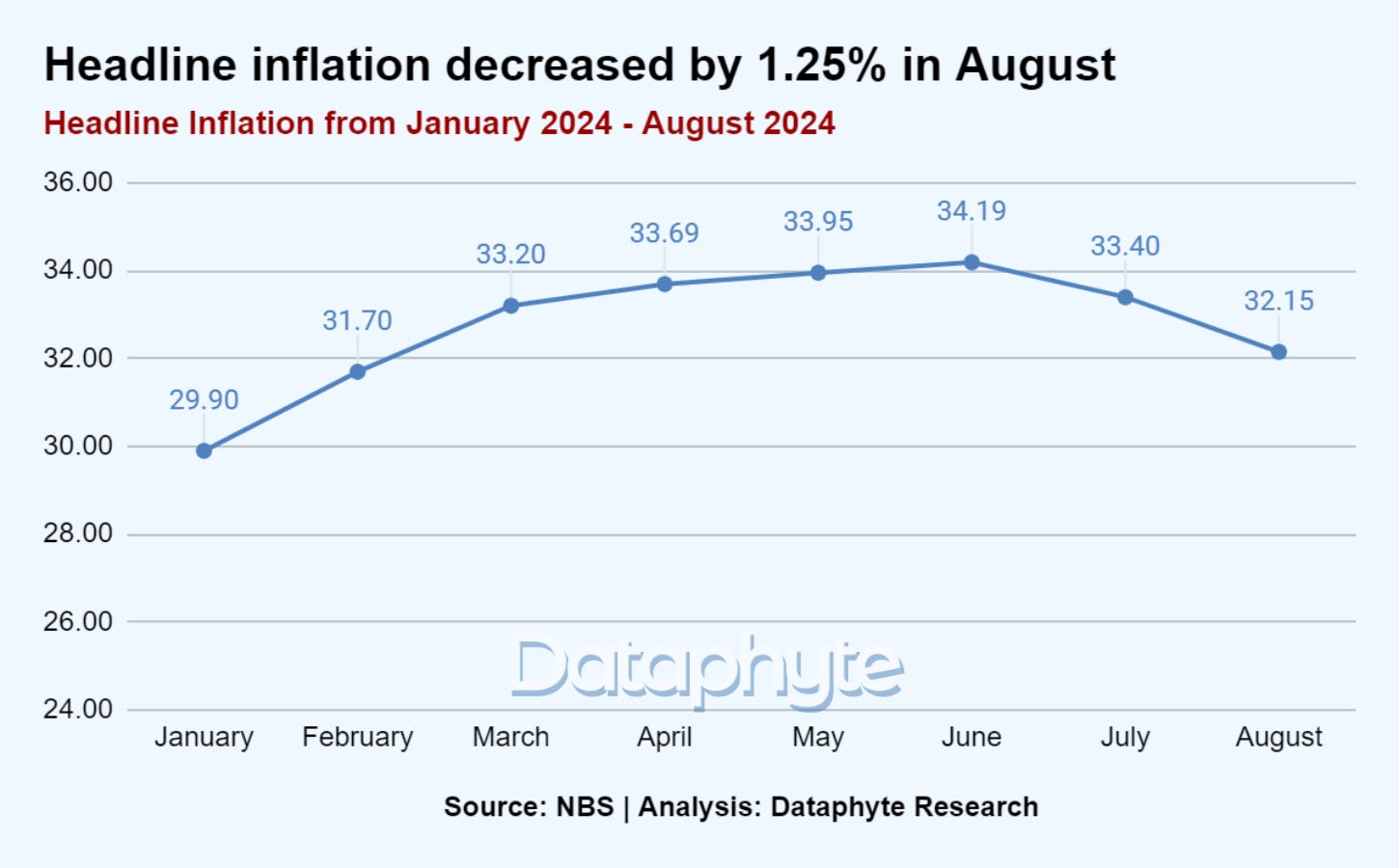

Nigeria’s inflation rate showed that the rate of consumer price increase in the month of August slowed down by 1.25% higher than the 0.79% rate in July, according to the latest NBS Consumer Price Index.

Headline Inflation fell from 33.40% in July to 32.15% in August. This is the second consecutive fall in the last 8 months.

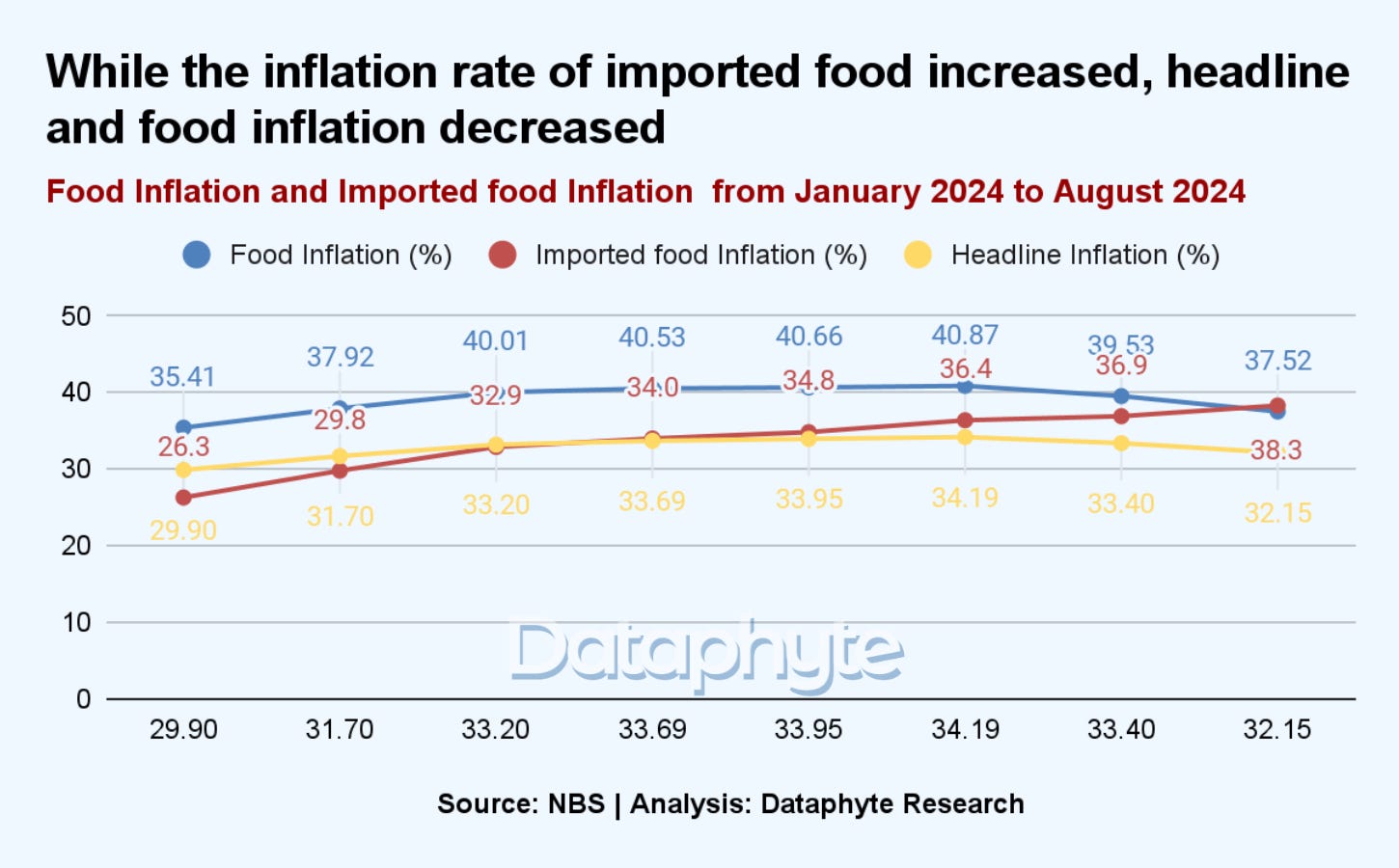

The recent decreases in the inflation rates have been largely linked to the decrease in domestic food prices and less to do with imported food prices.

Domestic food inflation, in particular, has been a significant contributor to the nation's overall inflation. Recent data shows that while there was a gradual decline in domestic food inflation, the prices of imported foods continued to rise.

While the headline inflation decreased by 1.25% in August, the domestic food inflation rate decreased by 2.01%, and the inflation rate on imported food increased by 1.39%.

Specifically, domestic food inflation decreased from 39.53% in July to 37.52% in August, whereas inflation on imported food rose from 36.9% to 38.3% over the same period.

In both instances of headline inflation reduction, a corresponding decline in domestic food inflation and increase in imported food inflation was observed, indicating that the decrease in domestic food prices played a critical role in driving down aggregate inflationary pressures within the economy.

Experts have attributed the increase in the prices of imported food to the depreciation of the Naira and global supply chain disruptions. The volatility of the exchange rate has further exacerbated the situation, making imported goods significantly more expensive.

The increase in imported food inflation also suggests that the suspension of tariffs on imported food, announced by President Tinubu in the middle of July and confirmed by the Comptroller-General of Customs at the end of July, have yet to take effect. Inflation reports for September and October may contain evidence, if any, of the impact of this suspension.

In contrast, the Director of the Institute of Capital Market Studies at Nassarawa State University, Prof. Uche Uwaleke, has attributed the recent decline in domestic food inflation to the onset of the harvest season, which has led to an increase in the supply of agricultural products, particularly staple foods, thereby exerting downward pressure on prices.

This divergence in inflationary trends—declining domestic food prices but rising costs for imported foods—creates a complex scenario for Nigeria. While the relief in domestic food prices is a positive development, the growing cost of imported food continues to strain household budgets.

As Nigeria is a major importer of food, the upward trend in these prices risks reversing the gains made from declining domestic food inflation, particularly for urban households dependent on imports.

This mixed outlook requires continued government attention, particularly in improving local food production and managing external economic pressures.

Consumer Goods: Nigerian Breweries seeks funds

Nigerian Breweries announced its N599.1 billion Rights Issue to stakeholders at the Nigerian Exchange Group (NGX) as stated in the company’s X (formerly Twitter) account.

According to the Managing Director and Chief Operating Officer, Has Essaadi, this strategic shift in its financial strategy aims to address the mounting challenges posed by foreign exchange (FX) losses, fortify their financial position and reduce forex related debts.

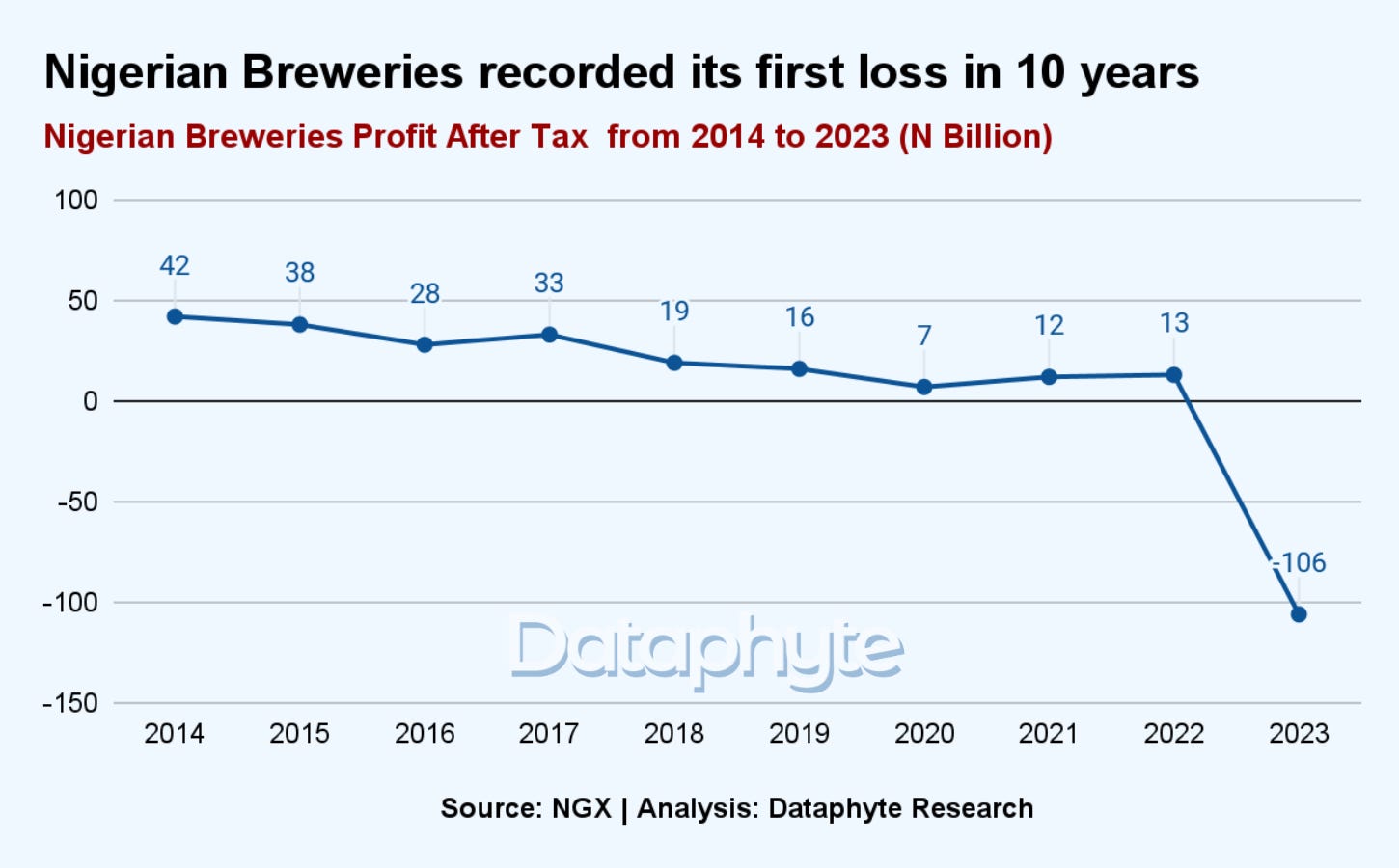

An analysis of the company’s Financial Statement showed that the company made its first loss in 2023 after its 10-year streak of profits.

The company made a loss of N106 billion in 2023, which almost wiped out its profits of the last few years.

This loss was associated with ”heightened operational costs, continued pressure on consumer disposable income, escalating inflation rates and FX volatility in the country.”

The volatile exchange rate, which has significantly increased the cost of importing raw materials, has hit Nigerian Breweries, like many companies in the Fast Moving Consumer Goods (FMCG) sector hard.

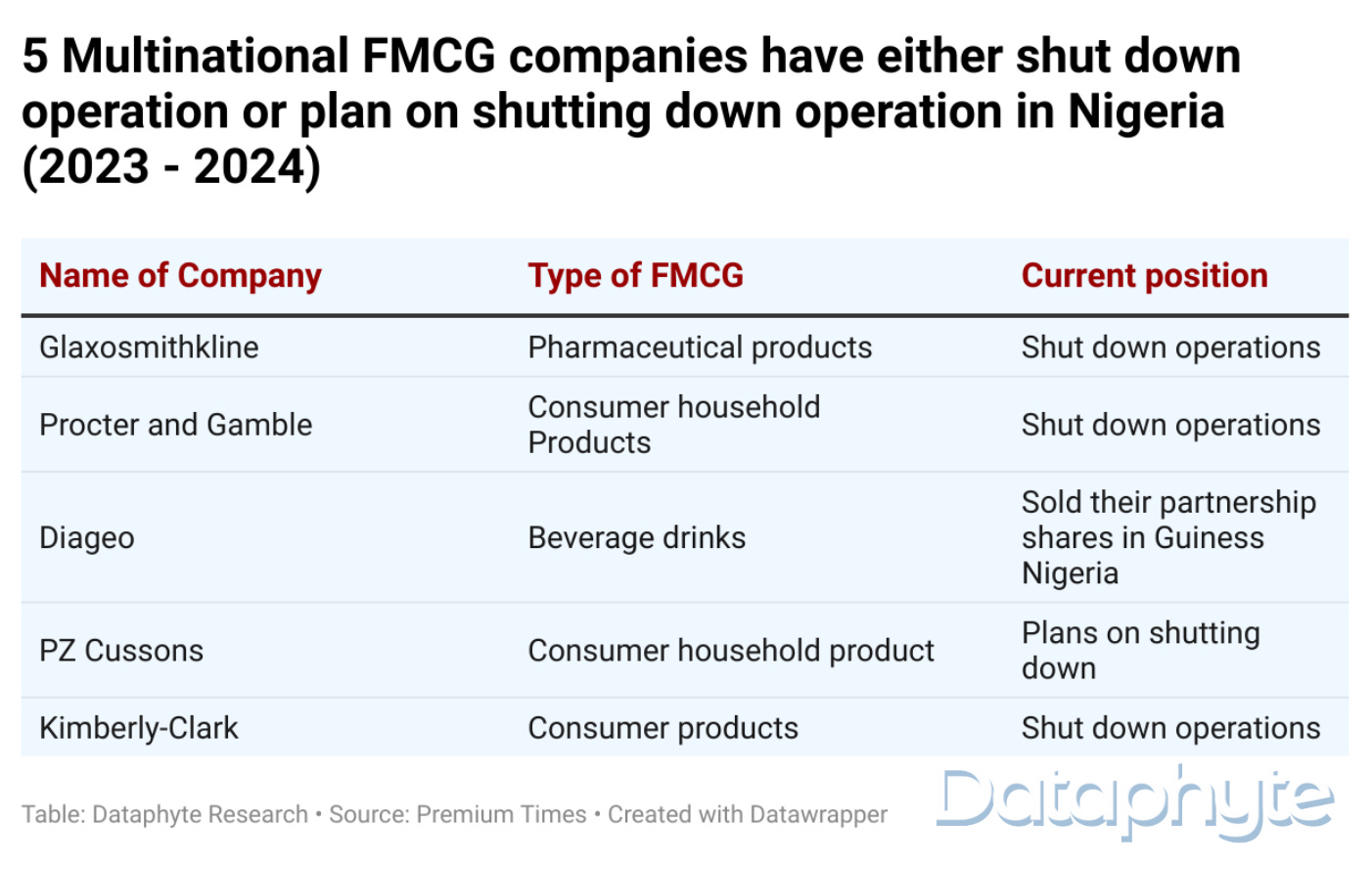

Unlike Nigerian Breweries, at least 5 multinational companies in the FMCG sector have shut down operations or are in the process of shutting down operations because of losses made as a result of the country’s foreign exchange volatility and Naira devaluation.

The FMCG sector consists of products that sell quickly at relatively low cost. It comprises packaged foods, beverages, toiletries, cosmetics, cleaning supplies and other low-cost household items.

Nigeria's foreign exchange crisis has been a major challenge for businesses, particularly those reliant on imports.

The Rights issue offer will enable the company to shore up its balance sheet by reducing its FX exposure and strengthening its cash reserves.

By lowering debt obligations tied to foreign currency, Nigerian Breweries might pass on fewer price hikes to consumers, which is critical in a market where disposable income is already shrinking due to economic challenges.

“This initiative, which is part of our strategic Business Recovery plan, will improve our financial stability and profitability to ensure a resilient and sustainable future for our stakeholders,” states Has Essaadi.

Thank you for reading this edition of Marina and Maitama. It was written by Lucy Okonkwo and edited by Joachim MacEbong.