Big Bills, Small Thrills, and Taxpayer Chills

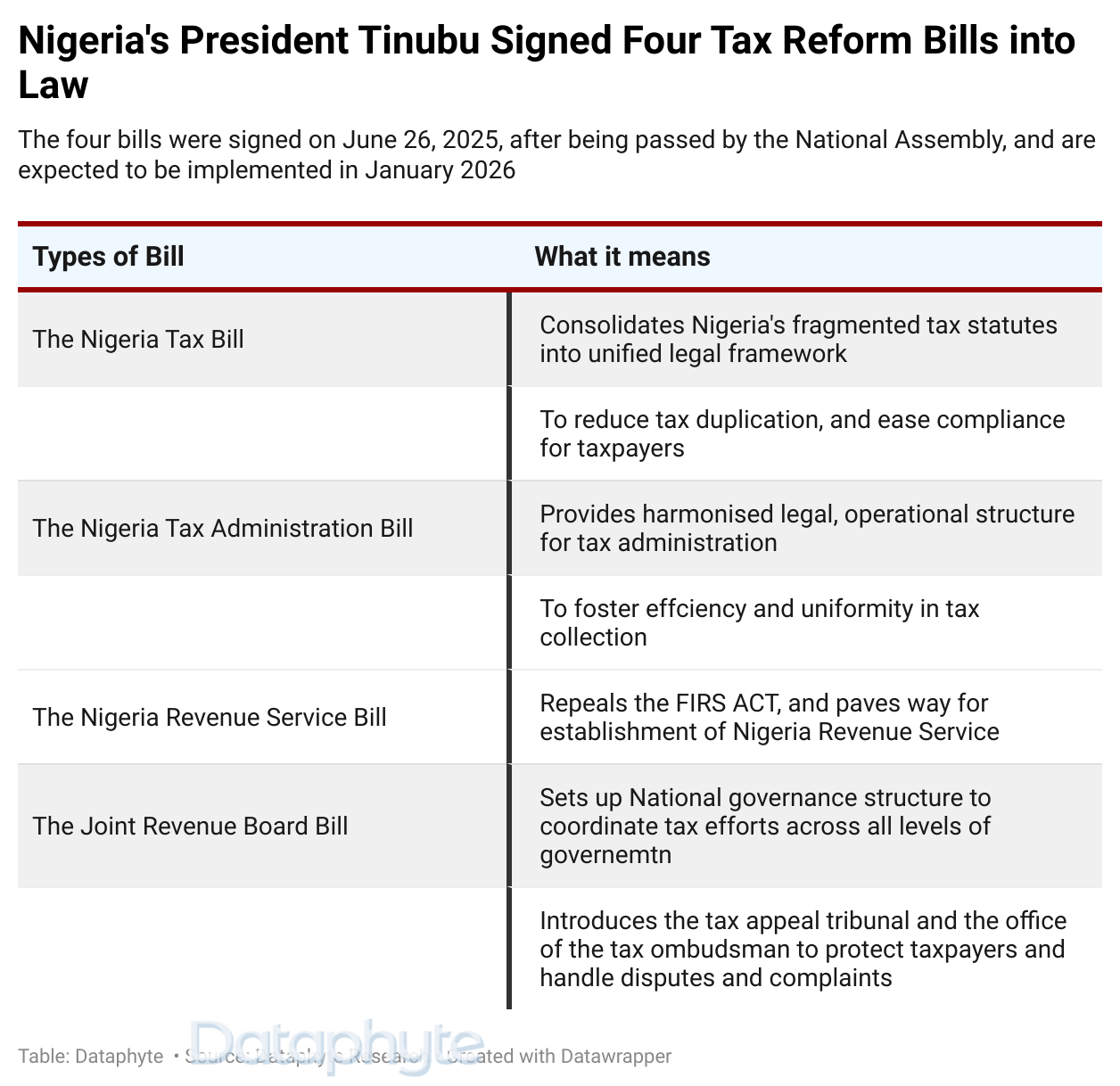

President Bola Tinubu signed four major tax reform bills into law at the Presidential Villa on June 27, 2025. These bills, Nigeria’s Tax Bill, Tax Administration Bill, Nigeria Revenue Service Bill, and the Joint Revenue Board Bill, introduce sweeping changes that will take effect in January 2026.

The aim is to create a unified national tax system, reduce the tax burden on low-income earners, and shift more responsibility to wealthy individuals and corporations. One notable policy change is raising the personal income tax-free threshold from ₦300,000 to ₦800,000 annually.

The reforms also marks a fundamental restructuring of Nigeria’s tax administration. By consolidating tax collection under a single body, the newly established Nigeria Revenue Service (NRS), and replacing the fragmented roles of over 60 agencies, the government seeks to eliminate leakages, boost revenue, and improve equity. For the first time, Nigeria will operate a centralised tax collection mechanism across all levels of government, with a sharper focus on progressive taxation.

But the relatively public concern about the tax reforms is the demand for transparency and accountability in how tax revenues are collected, managed, and allocated to ensure effective implementation.

Explore Our Publications

We release in-depth research publications and publish compelling data-driven reports on a wide range of topics.