CBEX: Is Nigeria's Financial System Vulnerable?

+Nigeria’s AfCFTA Strategy to Transform Its Intra-African Trade Presence

CBEX: Is Nigeria's Financial System Vulnerable?

On April 16, 2025, the Crypto Bridge Exchange (CBEX), a digital asset trading platform, suspended its operations without prior notice. The platform is alleged to hold approximately $847 million in investor funds, resulting in significant financial losses.

This incident is not isolated. Over the past five years, Nigeria has experienced a surge in similar investments, raising urgent concerns about the country’s growing vulnerability to financial crime.

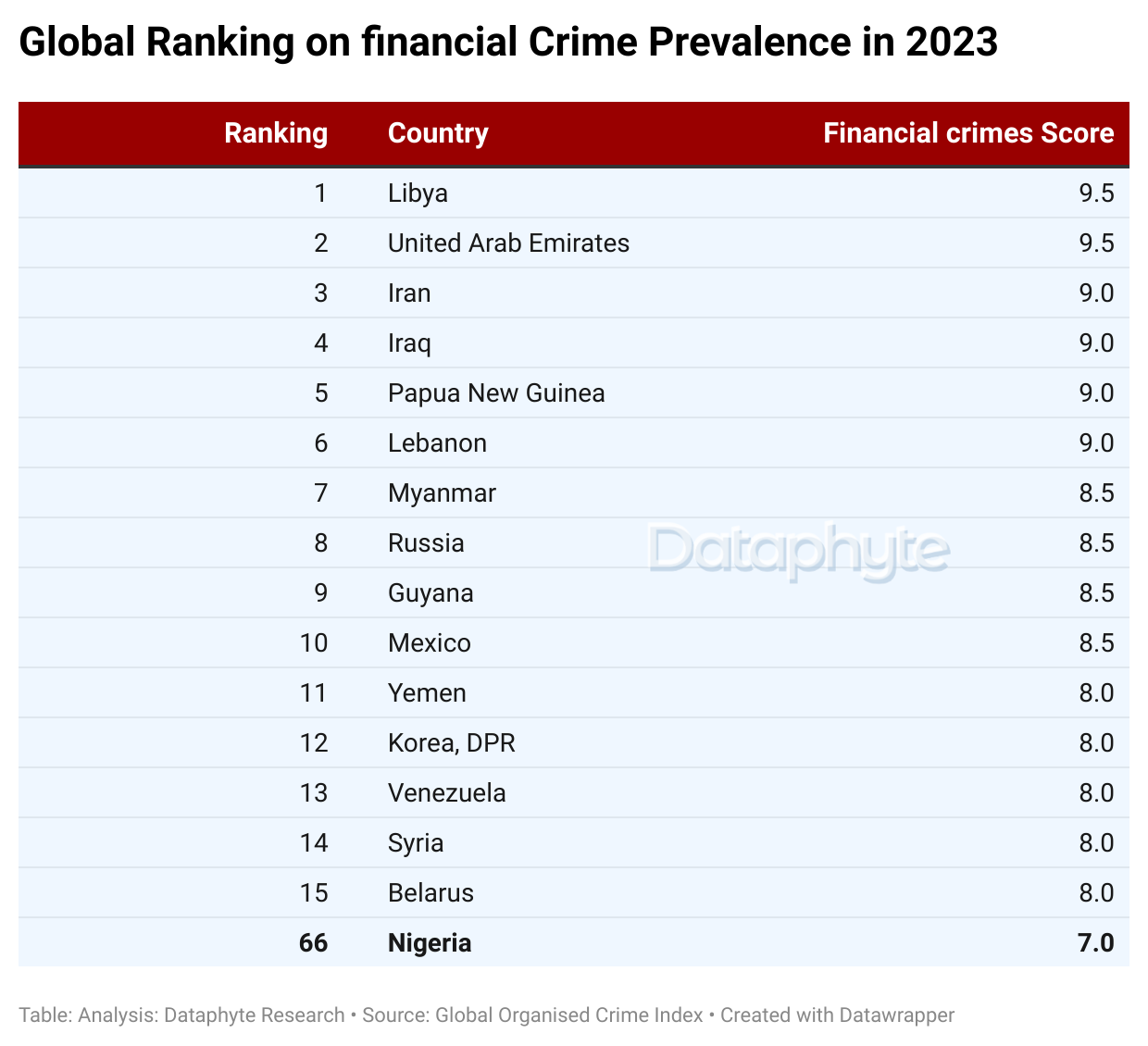

According to the Global Organized Crime Index (2023), Nigeria scored 7 out of 10 for financial crime prevalence, indicating a significant exposure to illicit financial activities. Similarly, the 2022 National Inherent Risk Assessment (NIRA) classified Nigeria as having a "high threat risk" level for money laundering, a strong indicator of systemic financial crime threats.

Both assessments reflect the deepening vulnerabilities within Nigeria’s financial system, including increasing risks of money laundering, fraud, embezzlement, and corruption.

The widespread nature of financial crimes in Nigeria highlights systemic weaknesses, ineffective enforcement mechanisms, and the exploitation of regulatory loopholes. Among the sectors most exposed are banking and real estate, identified by NIRA as critical channels for money laundering, illicit fund transfers, and asset concealment.

Further illustrating the scale of the challenge, data from the Economic and Financial Crimes Commission (EFCC) shows that convictions for financial crimes increased by 148% over the past five years. However, there was a notable decline in convictions in 2023.

Furthermore, the Economic and Financial Crimes Commission (EFCC) reported recovering ₦156 trillion between May 2023 and May 2024 from financial crimes, an alarming figure that highlights the extent of financial crimes impacting Nigeria’s economy.

In global rankings, Nigeria stands 66th out of 193 countries in financial crime prevalence, and 16th among Sub-Saharan African nations, according to the Global Organized Crime Index (2023).

This position places Nigeria in the top third of countries struggling with significant organised financial crimes. While Nigeria is not the worst-affected country in the world, it remains among the higher-risk nations where financial crimes such as fraud, money laundering, embezzlement, and cybercrimes are widespread concerns.

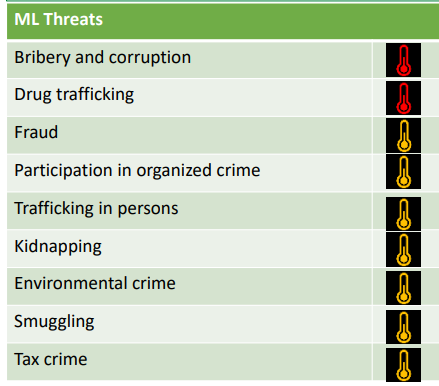

The National Risk Assessment (NRA) Report further paints a concerning picture. Bribery and corruption are identified as the most prevalent financial crimes in Nigeria, categorized under a "very high threat" level (coded in red). Fraud and tax evasion also carry high threat levels (orange),

(categorized using a color code: Red – Very High Threat, Orange – High Threat, Yellow – Medium Threat)

Source: 2022 National AML/CFT/CPF Inherent Risk Assessment.

In terms of money laundering threats (ML threats), the banking and real estate sectors are flagged as particularly vulnerable. This vulnerability stems from regulatory gaps, opaque transactional processes, and limited due diligence, making these sectors prime targets for criminal exploitation.

(categorized using a color code: Red – Very High Threat, Orange – High Threat, Yellow – Medium Threat)

Source: 2022 National AML/CFT/CPF Inherent Risk Assessment.

Regarding the CBEX incident, the Securities and Exchange Commission (SEC), a government agency created to regulate and develop the Nigerian Capital Market clarified, “The Commission hereby states that neither CBEX nor its affiliates were granted registration by the Commission at any time to operate as a Digital Assets Exchange, solicit investments from the public, or perform any other function within the Nigerian capital market.”

Despite lacking registration and regulatory approval, CBEX operated freely and was widely promoted. This exposes the significant regulatory gaps in Nigeria’s financial environment, where unverified entities can exploit unsuspecting investors.

The SEC also issued a public advisory: “Refrain from investing in or dealing with any entity offering unrealistic returns or employing recruitment-based investment models. Prospective investors are advised to verify the registration status of investment platforms via the Commission’s dedicated portal: www.sec.gov.ng/cmos before transacting with them.”

Amid these concerns, a recent regulatory development offers a glimmer of hope. On March 29th, 2025, President Bola Tinubu signed the Investments and Securities Act 2025 into law. This progressive legislation seeks to strengthen Nigeria’s capital market, enhance investor protection, and align regulatory practices with global standards.

If effectively implemented, it could foster a more transparent, resilient, and competitive financial environment, restoring investor confidence and curbing systemic abuses.

Nigeria’s AfCFTA Strategy to Transform Its Intra-African Trade Presence

The global trade landscape is undergoing a significant transformation. Barely three weeks after the United States announced a new wave of reciprocal trade tariffs, Nigeria has moved to strengthen its economic ties within Africa by building deeper trade partnerships under the African Continental Free Trade Area (AfCFTA) framework.

In this vein, Nigeria announced the gazetting of its AFCFTA Provisional Schedule of Tariff Concessions (PSTCs) on the 15th of April, 2025. This move establishes zero-duty (duty-free) access for 90% of tariff lines on trade in goods, aimed at enhancing Nigeria’s competitiveness across African markets.

The AfCFTA, launched in January 2021, was created to reduce trade barriers and foster greater economic cooperation among African nations. However, despite Nigeria’s membership, the country’s trade engagement with the rest of the continent has remained relatively low and has even declined in recent years.

Gazetting ensures that the trade commitments are formally incorporated into Nigeria's legal framework, providing clarity and certainty for all stakeholders, including businesses, organizations, and citizens.

According to Dataphyte analysis, trade with other African countries accounted for approximately 8% of Nigeria’s total trade in 2024, down from 11% in 2020.

This downward trend is even more pronounced on the export side: Nigeria’s exports to other African countries have fallen by 7.7 percentage points over the past five years, dropping from 19% in 2020 to 11.3% in 2024. Although, there has been a slight increase in exports between 2023 and 2024.

On the other hand, Nigeria’s imports from the African continent have remained relatively stagnant and low, consistently accounting for around 3% of its total imports.

Nigeria’s Position in Intra-African Trade

The decline in imports and exports between Nigeria and Africa signals a diminishing presence of Nigerian goods across Africa and may reflect waning demand for Nigerian products in regional markets presently, compared to 2020. The trend raises broader concerns about Nigeria’s competitiveness and economic relevance within intra-African trade.

Nigeria’s recent decision to eliminate tariffs on the majority of African imports under the AfCFTA could be a significant step towards reversing this trajectory. By making trade easier and more affordable, the country is positioning itself to stimulate business activity with its African counterparts, regain market share, and boost its regional competitiveness.

Notably, between 2020 and 2024, Nigeria’s trade volumes with other continents, especially Europe, Asia, and the Americas, have remained significantly higher than its trade within Africa. Despite belonging to the same continental bloc, intra-African trade represents only a small fraction of Nigeria’s global trade portfolio, reflecting an underutilization of regional economic opportunities.

Yet, the broader African context tells a different, more optimistic story. According to the IMF Direction of Trade Statistics, intra-African trade in goods has surged by 69% over the last five years, rising from $94 billion in 2020 to $159.7 billion in 2024.

Despite Nigeria’s trade reducing over the years, in 2024, Nigeria emerged as the second-largest player in intra-African trade, recording a total goods trade volume of $18 billion. This is attributed to Nigeria being the most populous country in Africa and highlights Nigeria’s strategic importance and influence within the African trade landscape, reaffirming its position as a key economic driver on the continent.

Today, Nigeria stands at a pivotal crossroads in redefining its role within Africa’s evolving trade architecture. As global trade dynamics shift and regional blocs become increasingly vital, Nigeria’s bold move to implement its AfCFTA tariff concessions signals a renewed commitment to deepening African economic integration.

However, fully realizing this potential will require sustained policy commitment, strategic investment in trade infrastructure, and the promotion of competitive Nigerian goods and services across African markets.

With intra-African trade rising by 69% between 2020 and 2024, Nigeria faces not only a compelling opportunity but also a strategic responsibility to harness this momentum. By capitalizing on AfCFTA benefits and eliminating trade barriers, Nigeria can significantly boost its economic performance while playing a defining role in shaping a more interconnected and self-reliant African economy.

Thanks for reading this edition of Marina and Maitama. It was written by Lucy Okonkwo and edited by Adijat Kareem.

If you've read this far, now take 2 seconds to share:

Register now for our upcoming webinar on Data, AI, and Elections in West Africa: