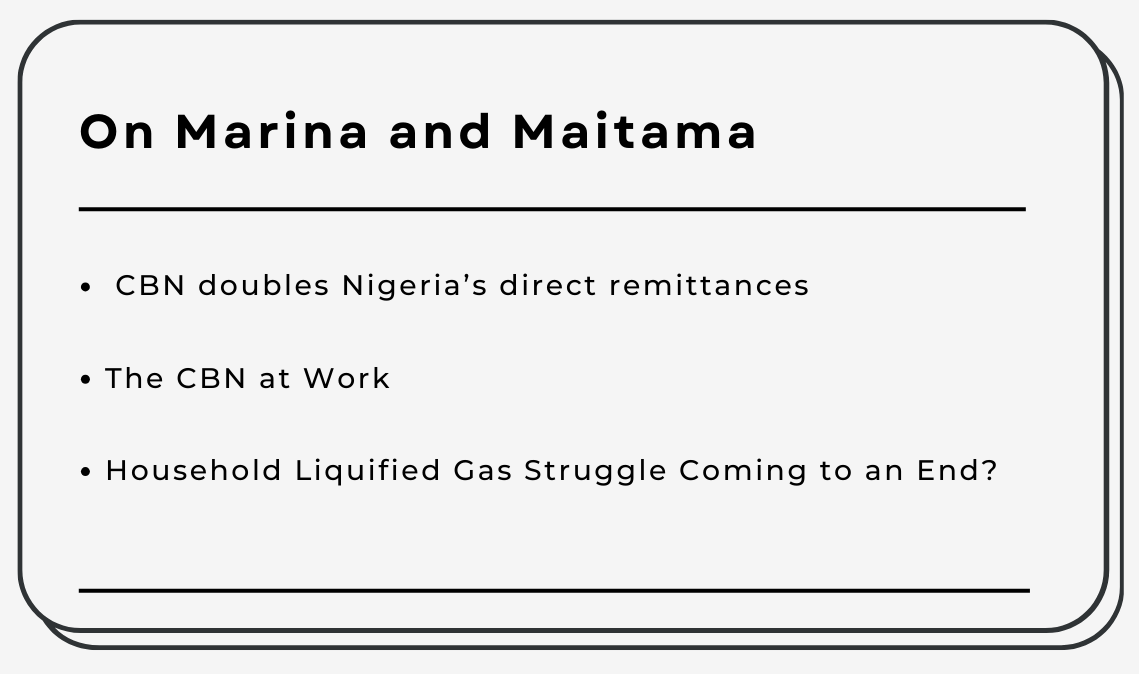

Nigeria’s total direct remittance has increased by 164% between January 2024 and May 2024.

According to data from the Central Bank of Nigeria (CBN), Nigeria’s total direct remittances increased from $139 million in January 2024 to $365 million in May 2024.

This increase has been attributed to the measures put in place by CBN to enhance the transparency and efficiency of remittance channels.

This increase suggests Nigerian migrants have been sending more money “back home to the folks,” as direct remittances are also known as “funds for the folks back home” according to the International Monetary Fund (IMF).

The rise in remittances has the potential to boost household income, promote economic growth, reduce poverty, and lead to overall economic stability.

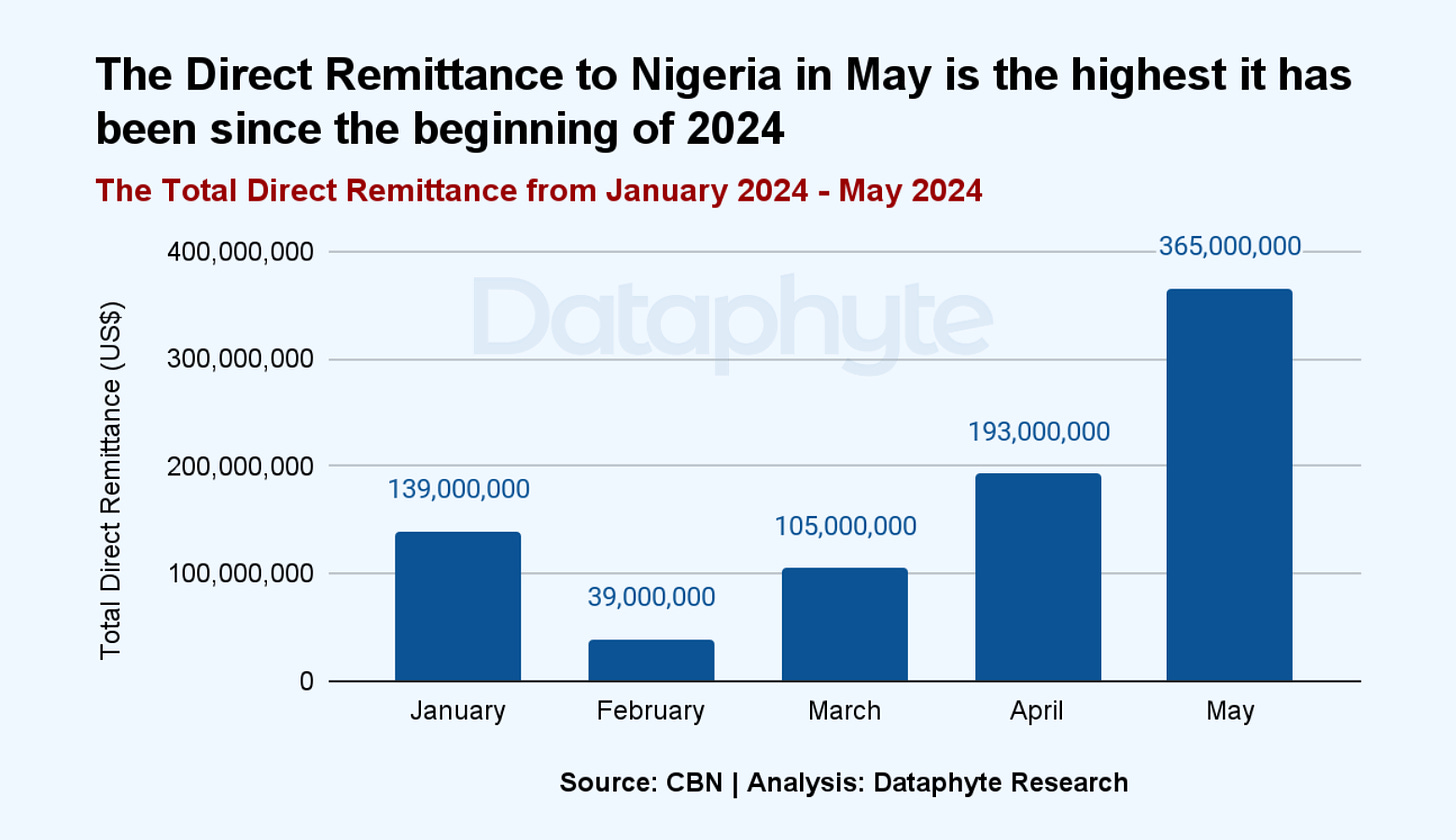

For many countries, international remittances are a crucial source of support for development.

According to the Asian Development Bank (ADB), a 1% increase in international remittances can decrease poverty intensity by 16%.

This emphasises the importance of remittances in supporting household incomes, reducing poverty, and enhancing economic stability.

Thus, international remittances play a critical role in the development of many countries.

According to World Bank data on international remittances, Nigeria has consistently ranked among the top 10 countries in the world receiving international remittances.

Nigeria ranked 6th globally between 2010 and 2015 but dropped to the 10th position in 2020.

In 2023, Nigeria has improved its standing, moving up to become the 8th country with the highest international remittance globally.

The CBN at Work

The increase in Nigeria's direct remittances has been attributed to policies implemented by the Central Bank of Nigeria (CBN), which may be encouraging more transfers back home.

Over the past five months, the CBN has introduced measures to facilitate the transfer of funds from individuals or entities residing abroad to their recipients in Nigeria.

In January, the CBN removed the exchange rate cap previously imposed on International Money Transfer Operators (IMTOs), allowing for more flexible currency quoting.

Additionally, on June 24th, the CBN implemented new measures to enable eligible IMTOs to access Naira liquidity promptly. These measures include:

Same-day settlement for transactions executed before noon on a trading date.

Pricing of transactions with the CBN based on NAFEM rates, referenced by an observable and acceptable market benchmark.

Operation of this market segment in line with existing arrangements for authorized dealers with Foreign Portfolio Investments participating in primary market securities auctions.

Mandatory daily submission of regulatory returns to the CBN by all participants, containing relevant information on the sources of funds.

The Acting Director of the Trade and Exchange Department at the CBN, Dr. W.J. Kanya, emphasised that these developments reflect the regulator’s commitment to ensuring the smooth functioning of foreign exchange markets and enhancing remittance flows through formal channels.

According to Acting Director of Corporate Communications at the CBN, Sidi Ali, the rise in remittance inflows aligns with broader economic strategies focused on diversifying revenue streams and reducing dependence on oil-based income.

Household Liquified Gas Struggle Coming to an End?

Less than 20% of Nigerians can afford and access Liquified Petroleum Gas (LPG), with only 14.8% having access to it, according to the International Energy Agency.

To address this issue, NNPC Retail Limited (NRL) has partnered with PayGas and the Oil Sustainability Programme (OSP) of Saudi Arabia to establish microfilling plant (MFP) solutions using modern technology in rural areas.

The collaboration aims to enhance the accessibility and affordability of LPG in these locations.

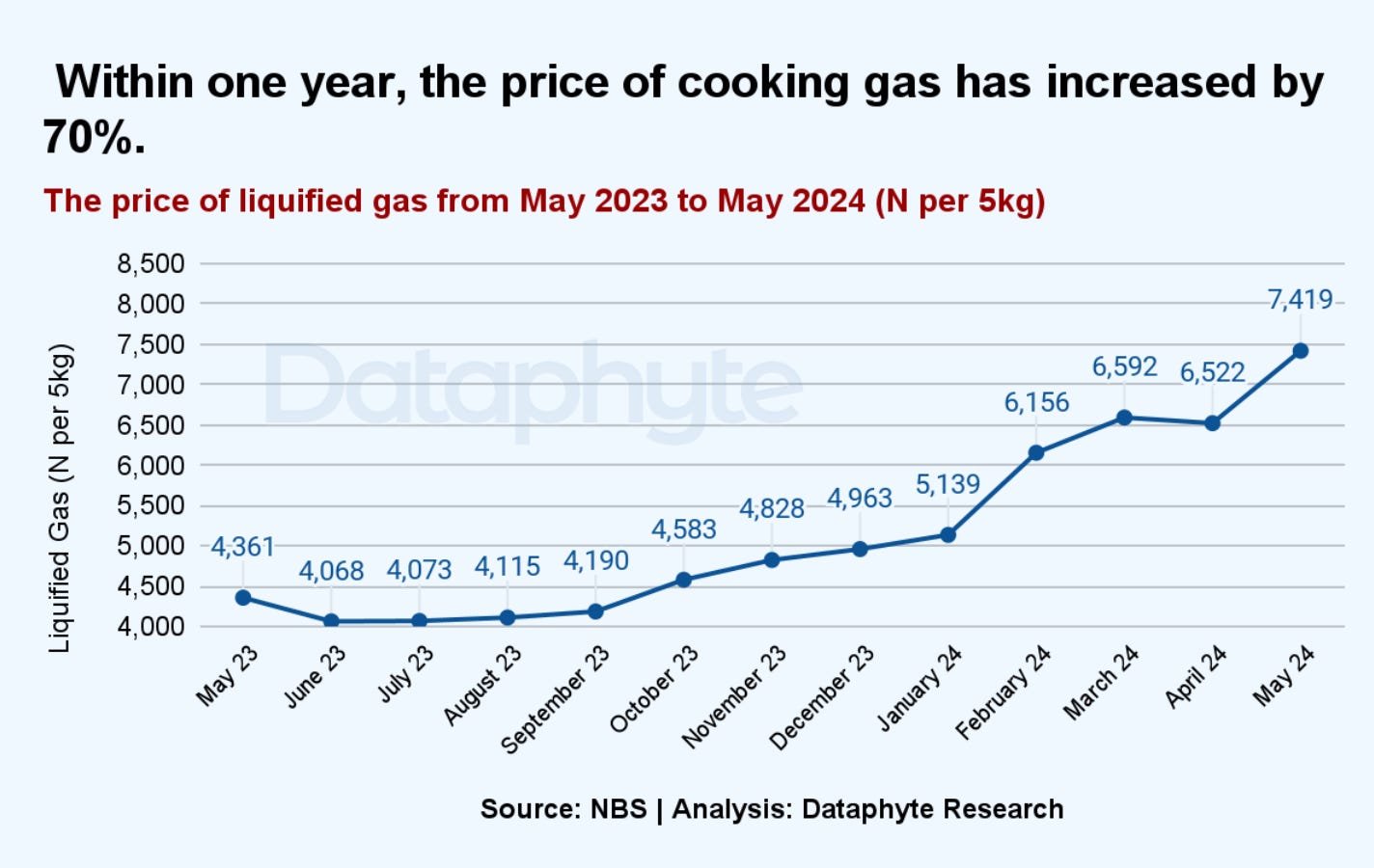

At N7,419, the price of LPG, or cooking gas, has increased by 70% year-on-year between May 2023 and May 2024.

This increase has made gas unaffordable for some urban households, aggravating the situation for those in rural areas.

According to the National Bureau of Statistics (NBS), 72% of people living in rural areas are multidimensionally poor, meaning they live on less than $2.15 (N3,225) per day.

The high price of gas, combined with the scarcity of gas stations in rural areas, makes accessibility to gas particularly challenging for these households.

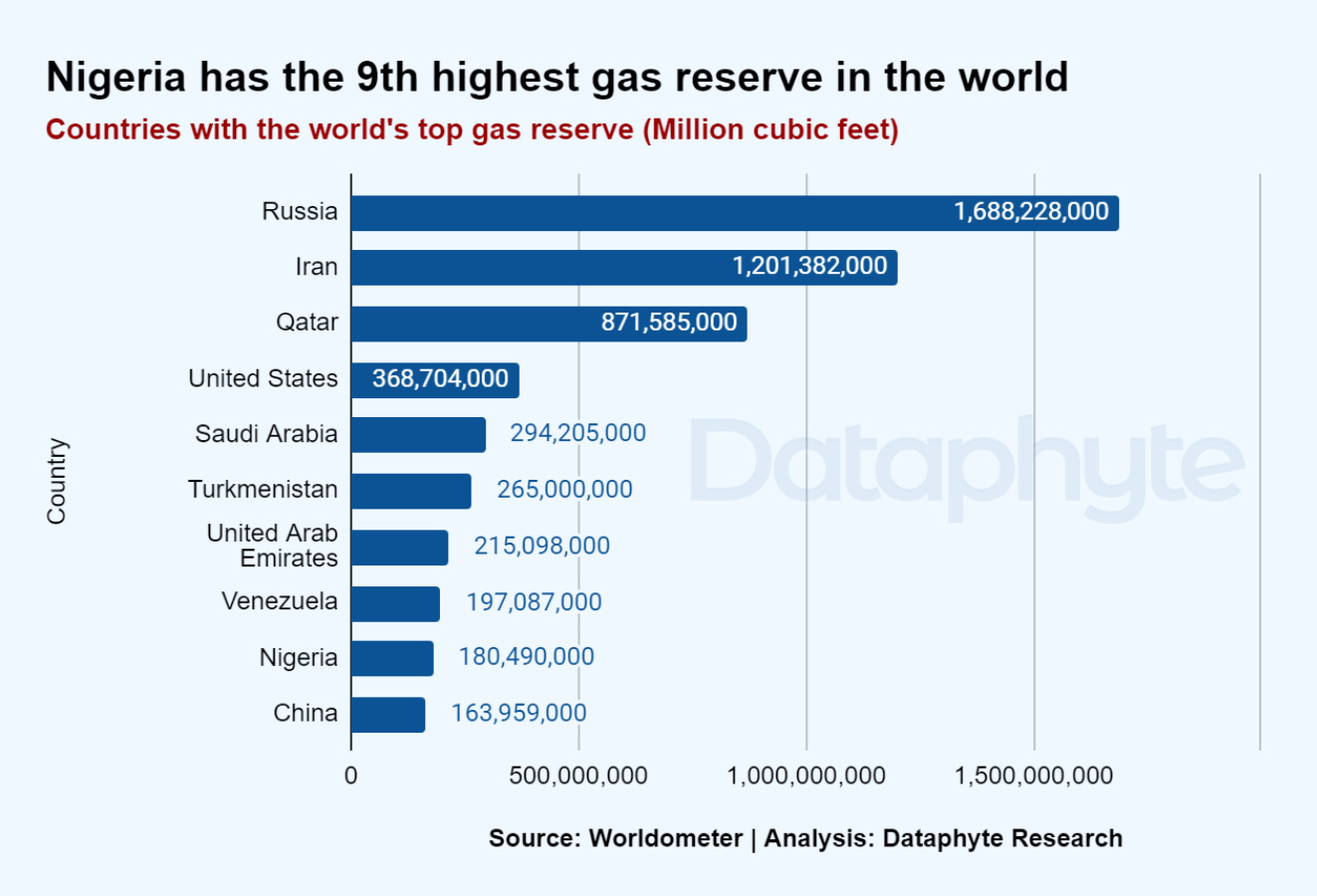

Ironically, Nigeria ranks 9th globally in terms of gas reserves, yet gas remains inaccessible to many Nigerians.

The Minister of State for Petroleum Resources (Gas), Ekperipe Ekpo, noted that despite Nigeria's rich gas reserves, some multinational firms prioritize gas exports over supplying the domestic market, a practice that should be discouraged.

This collaboration by the Oil Sustainability Program of the Saudi Ministry of Energy with NPR is one of the initiatives under the “Empowering Africa” initiative.

The Empowering Africa initiative builds on the clean fuel solution for cooking to improve the lives of millions of people.

“The initiative offers solutions to vulnerable populations globally, many facing dire consequences due to traditional and hazardous cooking practices such as coal and wood usage.”

According to the objectives highlighted by the initiative, this partnership will facilitate the deployment of micro-filling plants, bringing gas closer to rural communities.

Easier access to cooking gas will reduce cooking time, decrease health problems caused by polluting fuels, and lower Nigeria’s carbon footprint.

However, given the current gas prices, affordability remains a concern for rural households.

Thanks for reading this edition of Marina and Maitama. It was written by Lucy Okonkwo and edited by Oluseyi Olufemi.