Currency Woes: The Naira’s Nadir

+The New Kid on the Block: Aradel Holdings PLC joins the NGX

Currency Woes: The Naira’s Nadir

The Nigerian Naira has been termed as one of the “worst performing” currencies in Sub-Saharan Africa according to the latest edition of the African Pulse, a report by the World Bank.

“By end-August 2024, the Ethiopian birr, Nigerian naira, and South Sudanese pound were among the worst performers in the region,” the report stated.

This statement highlights the extent of the currency's devaluation relative to other currencies in Sub-Saharan Africa.

Within the last 10 months, the Nigerian Naira has devalued by over 82%. It moved from ₦896 in January to ₦1635 in mid-October.

The devaluation of the naira is an outcome of the floating exchange rate policy implemented by President Tinubu after taking office in May 2023. This policy allows the value of the naira to be determined by market forces.

The devaluation of the Naira might have a mixed effect on the broader economy. In the short term, the devalued Naira has led to increased inflation, but a proper management of the policy might lead to economic stability and growth in the long term.

According to the World Bank, the weakening of the Naira is a result of the surge in demand for U.S. dollars in the parallel market, driven by financial institutions, money managers, and nonfinancial users. This, combined with limited dollar inflows and slow foreign exchange disbursements to currency exchange bureaus by the central bank, has contributed to the currency's decline.

In Sub-Saharan Africa, the Naira is the third most devalued currency in 2024. The most devalued currency is the Zimbabwean Dollar, followed by the Ethiopian Birr.

During this period, only 10 African countries experienced no fluctuations in the value of their currencies relative to the U.S. dollar. These countries include Somalia, Cabo Verde, Djibouti, Eritrea, Libya, Mauritania, Morocco, Mozambique, São Tomé and Príncipe, and Sierra Leone.

In contrast, Kenya's shilling recorded the highest appreciation among the different currencies in African countries in 2024, outperforming other currencies on the continent.

The depreciating naira makes imports more expensive, further driving up inflation in a country that relies heavily on imported goods.

In the last 9 months, Nigeria has experienced one of its highest inflation rates in the last 15 years. Inflation increased by 9.4% during this period, rising from 29.9% in January 2024 to 32.7% by September 2024.

Research carried out by Dataphyte showed that a fluctuation in the exchange rate has a noticeable effect on the inflation rate, especially imported food and food inflation.

Food inflation plays a major role in driving overall inflation in Nigeria. Given the country's reliance on imported food products, fluctuations in food prices have a direct and significant impact on the national inflation rate.

Despite the short-term challenges of the naira devaluation, it has started to produce some positive long-term benefits. The total trade surplus grew by 6.5% quarter-on-quarter, rising from ₦6,527 billion in Q1 to ₦6,945 billion in Q2 2024. This expansion reflects improved trade balances, as the devaluation has made Nigerian exports more competitive in global markets.

While the Naira devaluation might help address structural imbalances, the Nigerian government must balance these measures with strong social and economic policies to mitigate the negative effects on its vulnerable masses.

The New Kid On the Block: Aradel Holdings PLC joins the NGX

Aradel Holdings Plc, an integrated energy company, announced the listing of its ordinary shares on the Main Board of Nigerian Exchange Limited (“NGX” or “the Exchange”) by way of a ‘’Listing by Introduction’’ on October 14, 2024.

This is the second company to be listed on the NGX in 2024, following the listing of Transcorp Power Plc in March.

According to the company’s press release, the listing of its shares on NGX aligns with its strategic vision to be positioned as a major publicly listed entity in Nigeria’s stock market and expands its opportunities for both the company and its shareholders.

For the broader economy, this will enhance investment opportunities in Nigeria's oil and gas sector by expanding the pool of potential investors and strengthening the country's capital markets.

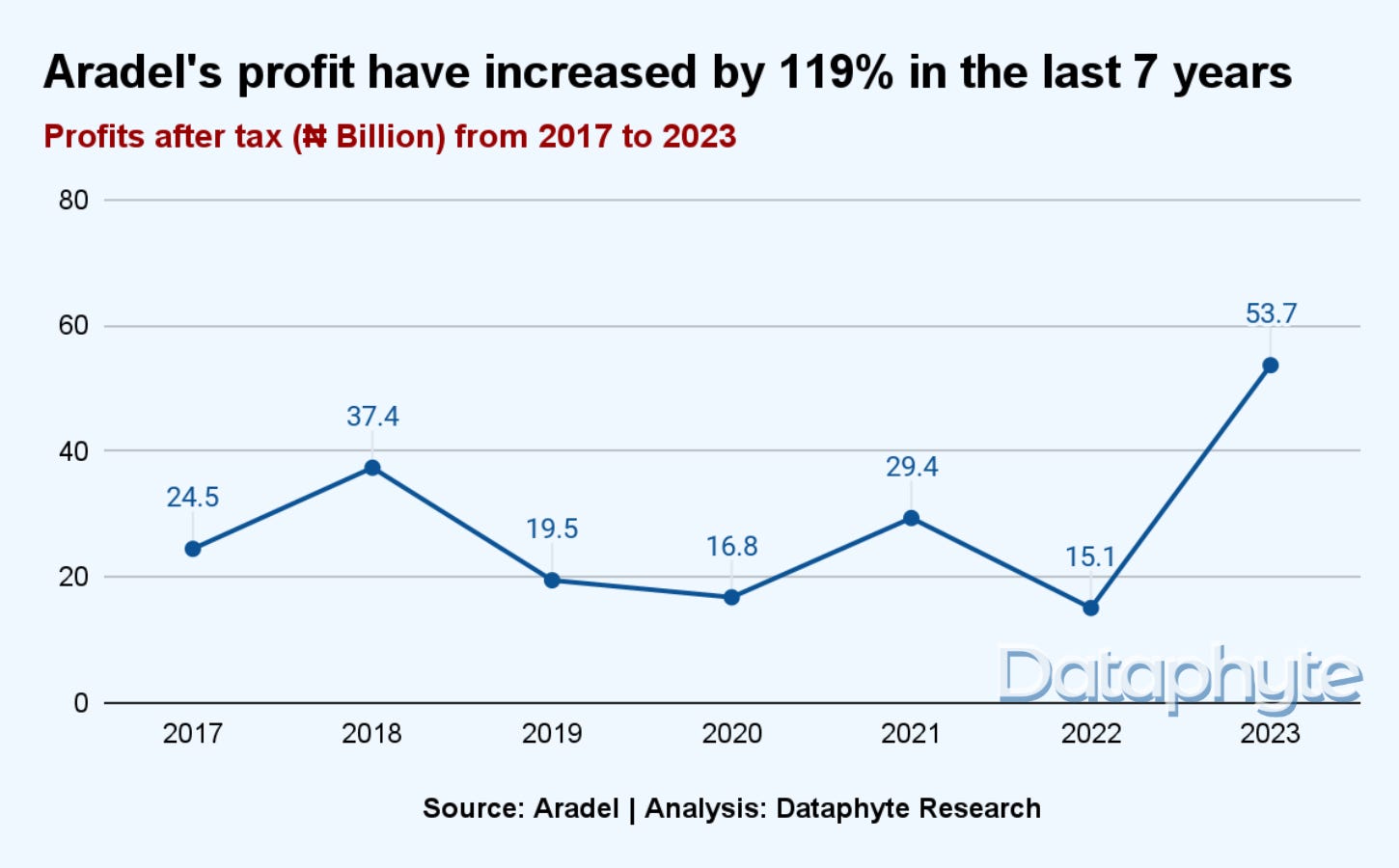

Aradel's income statement reveals that in the last 7 years, the company’s profit after tax has grown by 119%, rising from ₦19.5 billion in 2019 to ₦53.7 billion in 2023. This significant increase reflects strong financial performance and growth during this period.

Aradel’s listing on the NGX comes at a critical moment when capital investment in Nigeria's oil and gas sector has significantly decreased.

Over the past 8 years, capital investment in Nigeria's oil and gas sector has dropped by over 99%, falling from US$720.15 million in 2016 to just US$5 million in Q2 2024. This marks the lowest level of investment in the sector during this period.

There are only 9 oil and gas companies listed on the NGX, which limits the access of investors to capital investment within the sector.

Upon listing, Aradel Holdings will offer a total of 4.34 billion shares, boosting the NGX equities market capitalization by ₦3.35 trillion. This will make Aradel the highest-valued oil and gas company on the exchange, according to NGX data.

The listing will strengthen the representation of the oil and gas sector in Nigeria's stock market, attracting new investors and capital. This might provide the much-needed boost to an industry experiencing declining investment.

Aradel Holdings Plc opened with a share price of ₦772 on the first day of trading and peaked to ₦820 on the second day of trading, but is currently recording a 5.9% drop as at 16th October.

The Chairman, Aradel Holdings Plc, stated, “the listing of Aradel Holdings on NGX represents a pivotal moment for us. We are committed to driving sustainable growth in Nigeria’s energy industry, particularly in the renewables space, while continuing to excel in petroleum product exploration and refining. This listing provides us with the platform to unlock further value for our shareholders.”

The Group Managing Director/CEO of NGX Group, Temi Popoola, said “the benefits of an equity market listing for the upstream sub-sector of the oil and gas industry is especially crucial in light of its dire capital requirements and chronic underinvestment.

“Aradel has come to the market at a critical time as this and we are confident that our infrastructure here at NGX, both market and technology, can unlock the capital flows needed to ensure the sector thrives.”