Does the Decline in Dollar Rate Reduce Prices?

In the realm of financial advice, where Pocket Science typically steers readers towards optimising income for shifting market dynamics, a different tone prevails in this edition, that of an explanation of why prices of goods remain high despite the decline in the dollar rate.

The sentiment on social media is, “Who decline in dollar rate epp?”

It’s always been said that Nigeria is an import-dependent economy. So people attributed the growing cost of food and commodities in the country to the higher cost of import as a result of the increasing price of the dollar against the Naira.

However, in contrast to public expectations, the prices of commodities remain high even though the value of the dollar against the Naira is declining.

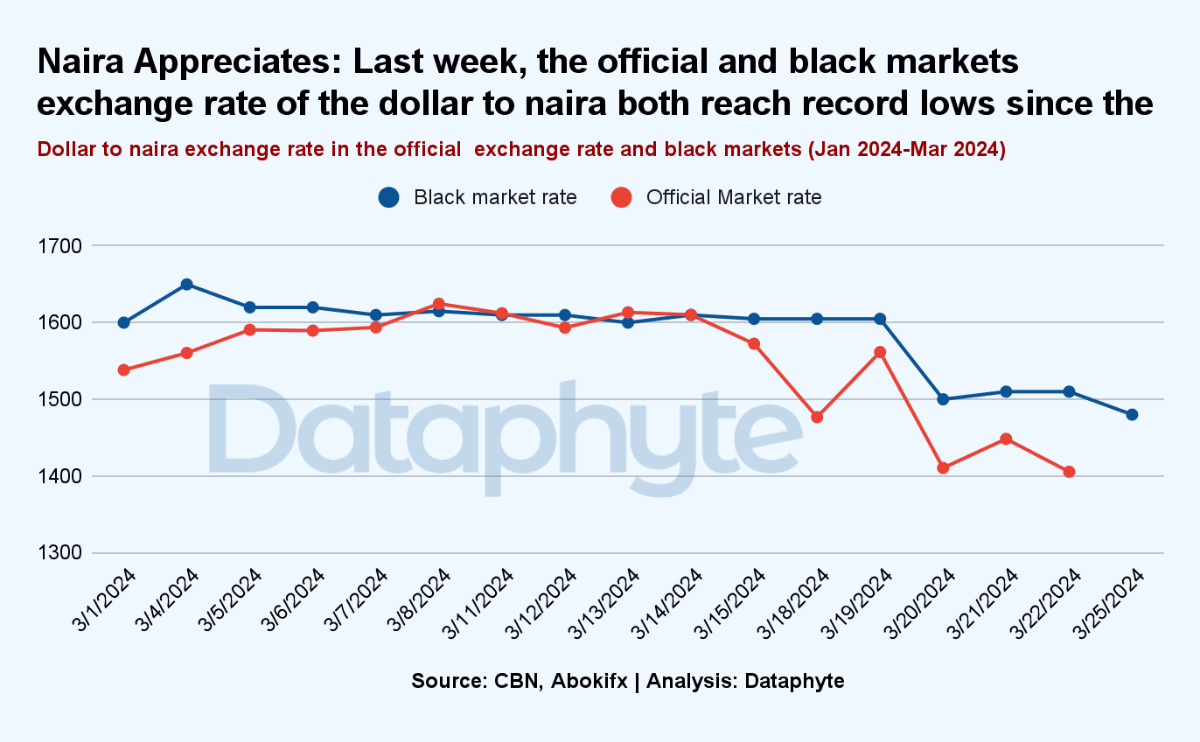

This decrease in the market and the official rate of the dollar against the Naira actually signifies a stronger value of the Naira.

There are several reasons for changes in exchange rates over time, such as shrinking foreign reserves, the state of the world economy, and national policy.

While the official and parallel market dollar rates have not yet converged, both have declined. They reached a record low since the beginning of March, something that seemed impossible for months.

4 Reasons for Sticky Prices?

"Sticky" is a term from economics that describes a reluctance to change. Applied to prices, it signifies its resistance to adjustments despite shifts in input costs, demand or other economic conditions.

And that's precisely what's happening with commodity prices in Nigeria.

Prices of commodities remain high or even soar higher, despite the decrease in the price of the Dollar against the Naira.

The Naira is currently N1,405 against a Dollar in the official market, according to the latest CBN data while in the black market, the Naira currently trades at N1,480, according to AbokiFX.

People across Nigeria are scratching their heads about this. They're asking, "Why is the Naira getting better, the dollar getting cheaper, but our shopping bills aren't getting any smaller?"

Well, one or two factors may be responsible.

Inflation expectations

One reason prices stay high is because people expect them to keep going up, so businesses are less likely to lower them even when other factors change.

According to an article by the Hutchings Center, high inflation expectations among businesses and consumers often also lead to hesitancy in adjusting prices promptly.

Even when the cost of commodities changes, influenced by shifts in foreign exchange rates, businesses may postpone adjusting prices.

Imported Food Inflation

On the other hand, while imported food prices matter, most of the price increases come from locally made items, like food, which face challenges in production and distribution.

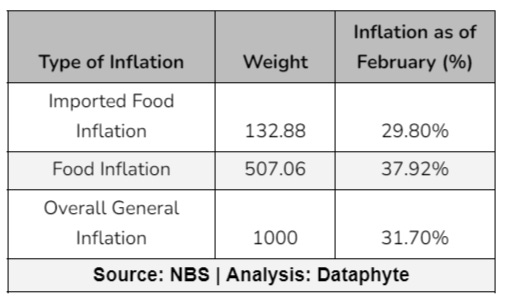

Imported food inflation accounts for 26% of food inflation, representing only 13% of the general inflation rate across all items, according to the NBS CPI report.

This disparity suggests other dynamics in the local food production chain account for the bulk (74%) of food inflation.

Again, while food inflation carries the heaviest weight (51%) in the overall inflation, the weight of imported food inflation is minimal at 13.3%. So a fall in the price of imported food, for instance, may not change the food price level and, in essence, the general price levels significantly.

It implies that other domestic supply-side issues, such as production limitations, inefficient distribution, and agriculture policies, also contribute to the economy's inflationary pressures.

It depends on what you’re buying

Also, the effect of lower (or higher) dollar rate on the local price of commodities depend on what you are buying.

Where the majority of the population are not buying goods made from imported raw materials or imported machinery, e.g. imported wines, computers, electronics, etc., they may not feel the effect of a change in the dollar rate.

For services too, people who feel the brunt most when the price of foreign exchange rises are those who pay for international services like overseas education, medicare, and travel.

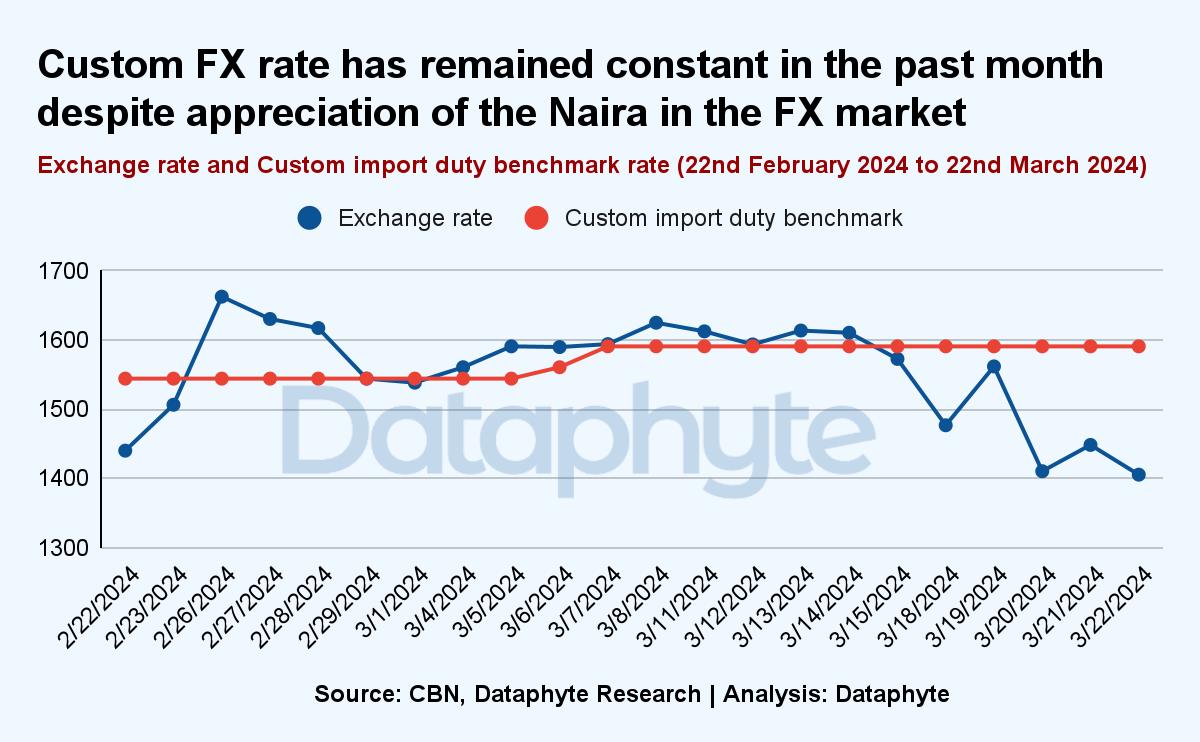

Customs’ FOREX Benchmark for Import Tariff Not Adjusted

Another thing that may keep prices of imported goods high is that the Nigerian Customs continue to charge importers tariffs based on the same Dollar rate as it was before the Dollar rate reduced. This contributes to the price stickiness.

All through the period where the exchange rate has decreased, the benchmark for custom import duties stayed at N1,544.08 per Dollar, showing that the tariff rates applied to imported goods have not changed.

Overall, a fixed tariff for imported goods may delay price changes in imported goods.

So, now you know why the recent decreases in the dollar rate may not have reduced the wads of naira that leave your pockets.

In essence, we understand why it takes time for prices to respond to shifting market conditions and how governments’ policy interventions may reduce price stickiness and strengthen market dynamics.

This edition of Pocket Science was written by Khadijat Kareem who paid for her Microsoft certification this March at the prevailing exchange rate and edited by Oluseyi Olufemi who quickly exchanged his few wads of dollars for Naira as the dollar rate began to decline.

Thanks for reading. See you next week.