Ease of Doing Business: Perception vs Reality

The newly released Nigeria Ease of Doing Business Survey Report (EODB) has shown that States in the northern parts of the country are the most suitable for business.

However, this ranking needs to be handled with care because they are at best, perceptions of proprietors and managers of MSMEs across the states.

Besides, on several indicators, their reported views did not reflect the tangible and measurable realities on the ground.

For instance, MSME respondents from States with lower crime incidences sometimes felt their state was more unstable and insecure than those from states with higher crime prevalence, and vice versa.

Typically, respondents to the survey from the southern parts of the country perceived their states to be less suited for business due to safety and security concerns than their northern counterparts thought of their states.

This corroborates the caveat contained in the report that “subnationals’ satisfaction with security as it affects doing business is not necessarily linked to external perceptions of the security situation on the ground.”

However, beyond this caveat on the contrasts between internal and external perceptions of the ease of doing business in a state, there is a more urgent caveat: the contradictions between the (internal/external) perception and the reality on the ground.

Perception

The Ease of Doing Business Survey relied on “a minimum of 50 respondents for small and medium enterprises and a minimum of 250 for micro-enterprises.

“The respondents occupied senior positions in the MSMEs surveyed, being either business owners, partners, or CEOs; finance heads, CFOs, VP in charge of Finance, or Directors of Finance; or senior managers or senior executives.”

Their views were quantified with questions as this: On a scale of 0-10, “How satisfied are you with the availability of state, industry, and sector information for your business on the state website?” the EODB 2023 Report indicated.

The report determined the ease of doing business based on indicators like Infrastructure, Stable and secure environment, Transparency and accountability of information, Skills and Labour, Regulatory Environment, and Economic opportunity.

For instance, the Stable and Secure Environment indicator measured the survey respondents' perception of how physically safe and secure their state was for business.

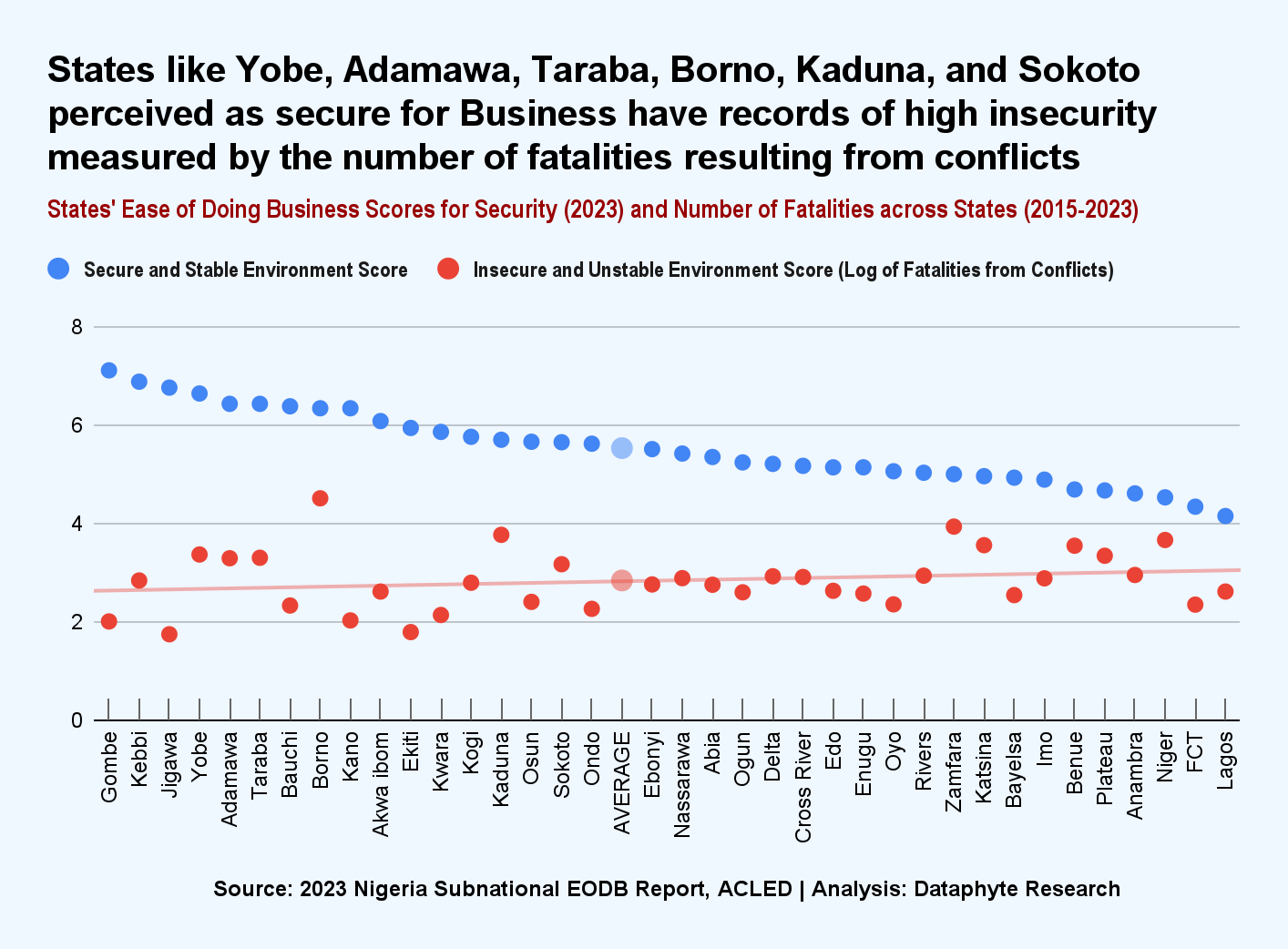

These perceptions generally contradict the facts on the ground.

The actual figures of fatalities from battles, violence against civilians, explosions/remote violence, and so on across the states between 2015 and 2023 suggest a different reality.

The state perceived to be most stable and secure for business is Gombe with a perceived satisfaction score of 7.11.

In contrast, the MSMEs in Lagos perceive it as the most unstable and insecure State for business, with a score of 4.15 out of 10.

As per infrastructure, the EODB Index measured people’s opinions about electricity supply, ease of transport, and telecommunications and internet connectivity in their respective states.

The respondents from the southern parts of the country rated their states lower than their peers did in the north.

According to the results from the survey from the EODB report, in Infrastructure, Kebbi ranked 1st with a perceived satisfaction score of 6.56.

For the electricity infrastructure, the State has the highest electricity supply score of 6.36.

Also going by the feelings of the MSMEs in Kebbi, the State has the highest ease of transportation with a satisfaction score of 6.54, and equally the best access to telecommunication and Internet connectivity with a score of 7.11.

The state ranked the lowest in infrastructure is Delta with a perceived score of 3.79.

How reliable are these perceptions?

Let’s compare them with the tangible realities on the ground.

Reality

Stable and Secure Environment

The EODB score showed that MSMEs in the Northern parts of the country perceive their states to be the most stable and secure for doing business. The reverse is the case for the MSMEs in the Southern parts of the country.

Yet, the crime statistics gathered from ACLED show that the 11 states with the highest number of fatalities from violence against civilians between 2015 and 2023 are in the northern parts of the country.

The total number of fatalities in those 11 states is 84% of the total fatalities recorded in Nigeria between 2015 and 2023.

The Ease of Doing Business Scores for security contradicted the number of fatalities in the respective states.

For Instance, Borno, ranked 8th best safe and secure on the EODB report, has the highest fatalities from situations threatening the stability and security needed for doing business in the state.

Conversely, the state perceived to be the least stable and secure for doing business is Lagos. Yet, the State recorded one of the lowest fatalities resulting from the usual causes of instability and insecurity.

The EODB security scores give a weak reflection of the actual security situation on the ground, showing a weak relationship of 19%.

Infrastructure

Going by the opinions of the MSME proprietors and managers in the northern parts of the country, the northern part certainly has the set of infrastructure most suited for business.

The EODB Infrastructure indicator assesses levels of electricity supply, ease of transport, telecommunications, and Internet connectivity.

However, further analysis of the Infrastructure sub-indicators using the National Bureau of Statistics data on electricity, transportation, telecommunication, and Internet connectivity provided contrary evidence.

Electricity

Electricity is one of the significant factors business owners consider before setting up their businesses in a state or region.

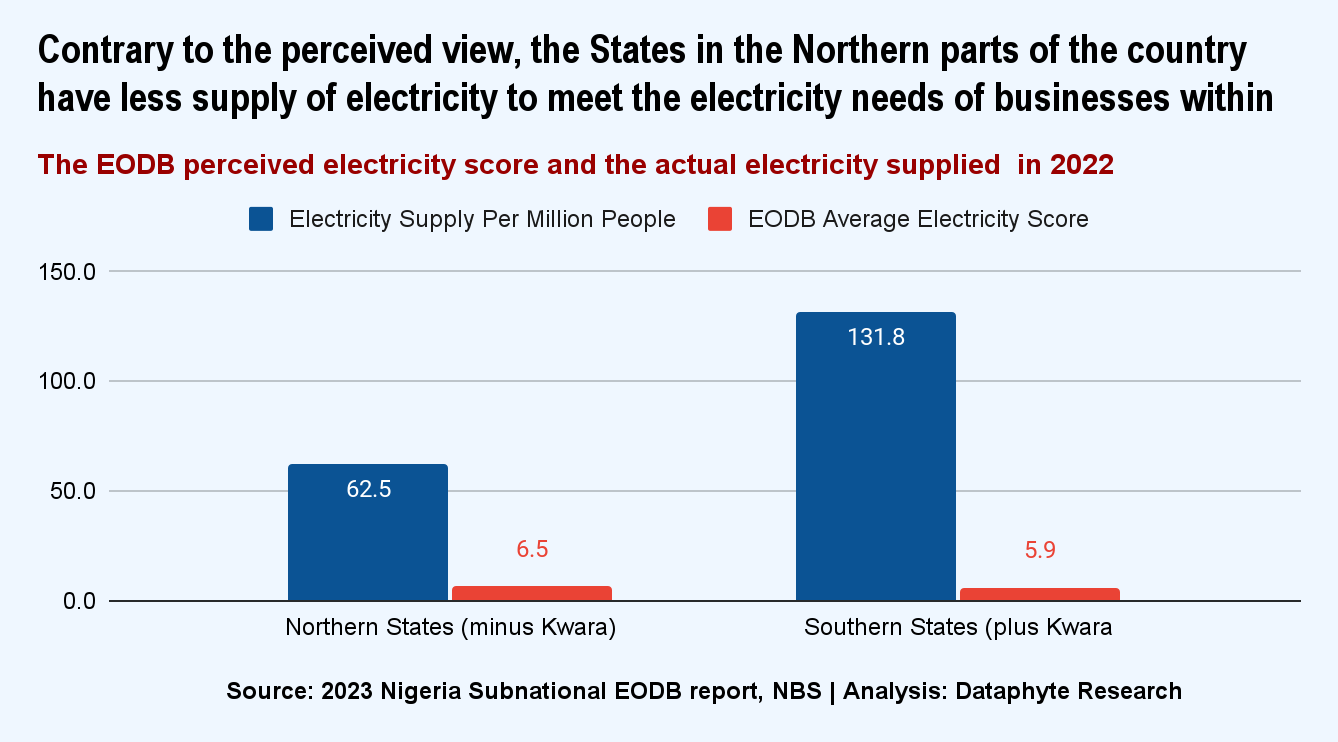

The EODB report shows that all 19 states in the northern parts of the country are perceived to have the highest electricity supply needed for ease of doing business, except Borno, Nassarawa, Kogi, and the FCT.

However, electricity supply data from the 11 Electricity Distribution Companies (DISCOS) contradict these perception scores.

Five of the 11 DISCOS service the northern parts of the country. These are the Kaduna, Kano, Yola, Jos, and Abuja DISCOS.

The rest service the southern parts of the country. These are the Ibadan, Enugu, Eko, Ikeja, Benin, and Port Harcourt DISCOS.

The only exception is Kwara State, which is in the Northern part of the country, but is serviced by the Ibadan DISCO.

Analysis of the electricity supply for the year 2022 shows that the DISCOS supplied the southern states with double the electricity that those in the North had. This is despite the fact that the Northern parts are more populated than the southern parts of the country.

Here is the contradiction:

The Ease of Doing Business Average Electricity score of 6.5 for the States in the north is higher than the 5.9 average for the south.

Yet the states in the north are supplied 62.5 (GWh) electricity per million persons, barely half of the 131.8 (GWh) electricity per million persons supplied to States in the country's South.

In fact, Dataphyte's analysis showed a 100% contradiction between the EODB Electricity Supply scores and the actual level of electricity supplied to the states.

Telecommunications and Internet Connectivity

The current realities of doing business in Nigeria, especially service-based businesses, demand a high use of telecommunication. Active voice and internet connectivity aid the fast delivery of goods and services.

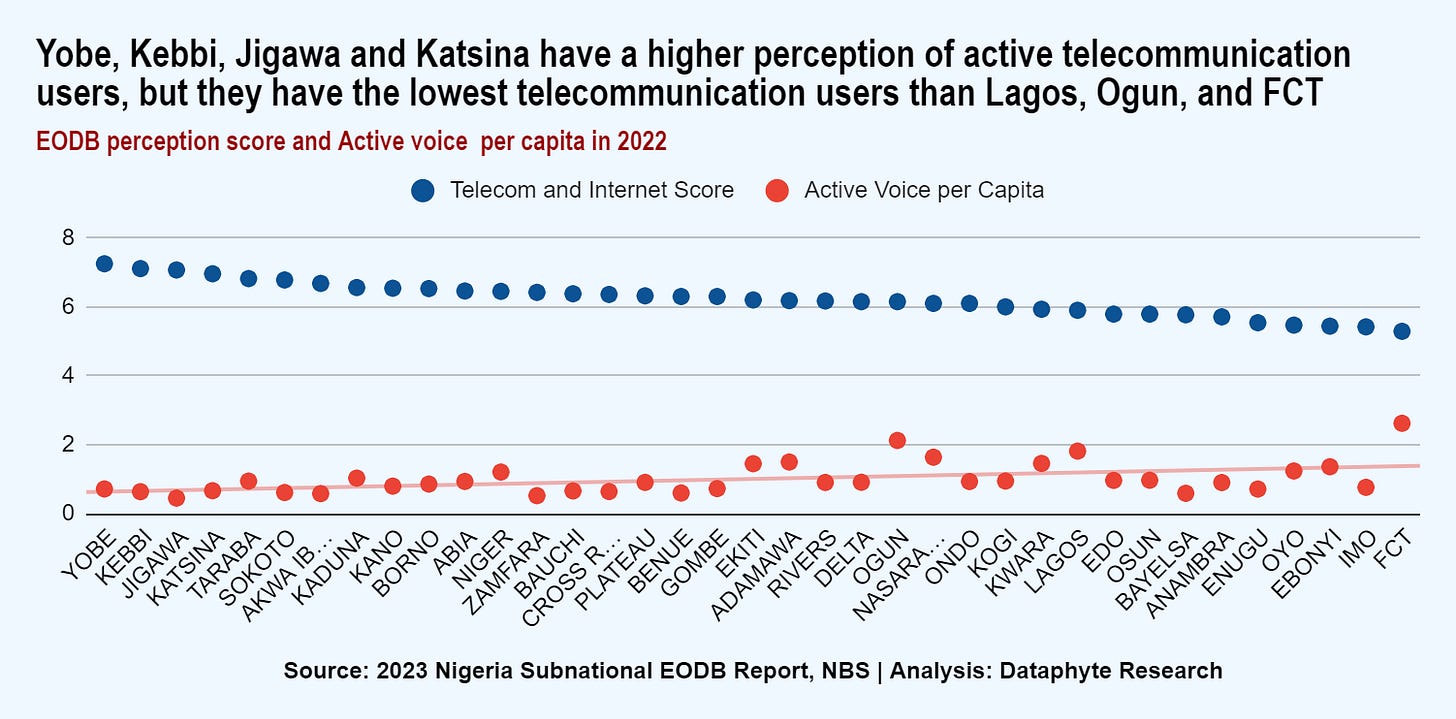

The EODB respondents’ perception of their telecommunication and internet connectivity for the ease of business also contradicts reality on the ground, an analysis of the accessibility to telecoms, which is basic for connectivity, shows.

This alternative analysis measures telecommunication and Internet connectivity by the number of active voice subscriptions per capita and the active Internet subscriptions per capita across the states, instead of relying only on the opinion of some MSME proprietors and managers interviewed for the EODB survey.

Going by the EODB's perception scores for Yobe (7.25), Kebbi (7.11), and Jigawa (7.07), people their believe they have the best phone and internet connectivity to ease doing business.

The realities on the ground contradict this.

The alternative analysis shows that only 64 out of 100 people in Kebbi have an active phone line (0.64 active voice per capita).

In Jigawa, the situation is worse as only 45 out of 100 people have an active phone line (0.45 active voice per capita).

In Yobe, only 7 in 10 people can make a phone call or receive calls (0.72 active voice per capita).

As expected, these comparisons across states showed a 50% contradiction between the EODB perception scores and the active voice subscriptions.

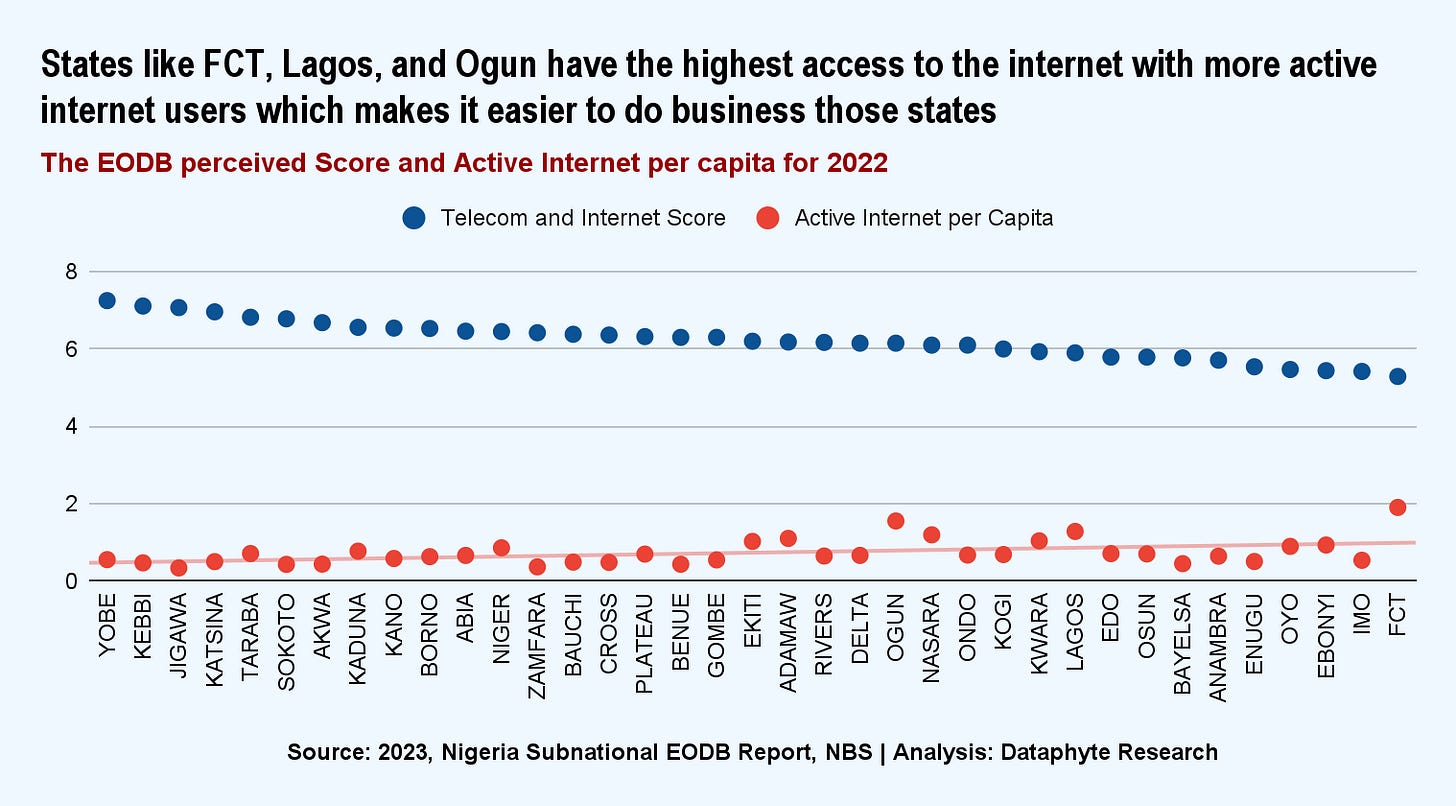

As per the Active Internet subscription, the FCT was ranked lowest regarding telecommunication and internet connectivity with a score of 5.29.

Contrary to this, the NBS data shows FCT to be the state with the highest internet connectivity.

On average, each person has more than one Internet subscription on their phones and WiFis in the FCT (1.91 active Internet subscriptions per person).

This means that, among every 100 people in the FCT, all have 1 Internet subscription each while 91 of them have 2 subscriptions.

Surprisingly, the states that were perceived to have the highest internet connectivity, such as Yobe, Kebbi and Jigawa in the EODB reports showed to be the states with the least internet access.

On the other hand, in Yobe State, which is ranked highest, only 1 in 2 persons have an active phone line.

It’s hard to connect to the internet when one has not subscribed for internet data.

This suggests that if your business heavily deals with people who are active phone lines and have an internet connection, you may begin to move to the FCT or Lagos or like States for smoother and greater ease in doing your service business.

There is a 45% contradiction between the EODB perception scores and the levels of internet subscription per person across the states.

Transportation

One of the main factors contributing to a high or low cost of production is the cost and ease of transporting goods and services from one location to another within or outside the state.

The parameter used in testing the ease of transportation is the cost of transportation within the state.

The cost of transportation within a city ranges between a minimum of N500 to N1,350 in different states. Many will think that with the cost of transportation in places like Lagos, FCT, and Ogun state, they should have the highest cost of transportation, but the reports proved to be contradictory.

States with high costs of transportation include Taraba with an average of N1,350 per drop, Jigawa - N 1200, and Plateau, Katsina and Gombe at N 1100 per drop each.

The EODB’s perception score and the bus journey within the city show a minimal contradiction of 7%.

States such as Sokoto, Ebonyi, Adamawa, and Abia have the lowest cost of transporting goods and services from one place to the other within the state.

Overall, The Ease of Doing Business (EODB) rankings are not entirely irrelevant or inadequate for knowing where to set up your business operations or where it is the easiest to carry out specific operations of your business, but user discretion is strongly advised.

Some states have been overlooked for the ease of doing business, but you might need to look again into them, or seek a second opinion, as they might have the perfect environment for the business you want to set up.

On the other hand, some states have been over-hyped regarding the ease of doing business, you might need to check with realities on the ground before you take a business leap.

Wish you much ease of doing business wherever you are. But in the meantime, enjoy the ease off doing business this weekend.

Hope you enjoyed reading this edition of Data Dives. It was composed by Lucy Okonkwo.