For Glo and Country

“See you next Thursday for another fresh serving. And hopefully, phone users get back the second half of a Yello Glo by then.”

These were the closing words of this newsletter last week.

We are delighted to announce that this wish was granted.

The partial disconnection of Glo subscribers from reaching MTN subscribers has been put on hold.

Today was the deadline.

The Presidency was reported to have waded into the matter, sighting national concerns, should MTN carry out the orders of the National Communications Communications.

We are happy that the government saw that this was beyond Glo.

In “Half of a Yello Glo,” the lead story in our maiden edition of this newsletter last Thursday, we outlined the socioeconomic risks of blocking telecommunications.

Here is an excerpt from last week showing the risk that was averted today:

Beyond the Yello Glo: The Socioeconomic Risks

The NCC’s notice could have severe socioeconomic ramifications for the country beyond Globacom and its customers.

Social Risks: In areas, especially remote rural towns and villages, where the Glo network is the only functional network, the inability of Glo customers to call emergency numbers that are MTN lines may lead to untold hardship, risks, and even fatalities.

In these areas with Globacom network coverage alone, the option to port to other networks or purchase their new sims may not work since the other networks are not fully available there.

This may lead to health and security incidents in these places.

Further Risks of Oligopoly: Granted, Glo customers would be directly affected by the loss of service and may choose to switch to another network as a result.

However, this may force 61 million Glo customers to port to other networks, such as MTN, AIRTEL and 9MOBILE, even if those networks do not offer better tariff plans, better network services, or customer care services.

By narrowing people’s telephony options as this, the NCC directive may be encouraging a reversal to oligopoly in the telecoms sector.

Economic theory holds that when GSM Operators, like other firms, do not earn customers by superior service, they are not likely to work for the benefit of the customers.

Under oligopolistic conditions, even old customers of the other phone networks may be shown the shorter end in tariff and network services as market competition declines. The companies then become strong enough to dictate selfish terms of services to their customers.

Impact on Businesses: The barring of the GLO network by MTN would significantly affect businesses that rely on GLO for their communication needs. Companies that have GLO lines for their employees or use GLO as their primary network for business operations would experience disruptions. This could lead to decreased productivity, communication breakdowns, and potential financial losses.

However, in cities with options, Glo subscribers have the unlimited choice to port to other networks, regardless of the quality of service they receive in the new networks.

Businesses and individuals using MTN may also be forced to spend more on calls to glo customers, especially in situations where the glo customer should have been the one calling or calling back.

Before the New Deadline

The government’s intervention is not meant to spare Globacom from fulfilling its debt obligation to MTN.

It was actually meant to make it pay. The government has now given Globacom a 21-day window to pay up.

According to a report by The Guardian, the Nigerian Communications Commission (NCC) has stated that the disconnection will be paused for a period of 21 days, starting January 17th, 2024. The announcement was made in a statement signed by the Director of Public Affairs, Reuben Mouka:

“The Commission is pleased to announce that the parties have now reached an agreement to resolve all outstanding issues between them. For this reason, and in the exercise of its regulatory powers in that regard, the Commission has put the phased disconnection on hold for a period of 21 days from today, January 17, 2024.

“Whilst the Commission expects MTN and Glo to resolve all outstanding issues within the 21-day period, the Commission insists that interconnect debts must be settled by all operating companies as a necessary component towards compliance with regulatory obligations of all licensees. It is OBLIGATORY that Mobile Network Operators (MNOs) and other licensees in the telecom industry keep to the terms and conditions of their licenses, especially as contained in their interconnection agreements.”

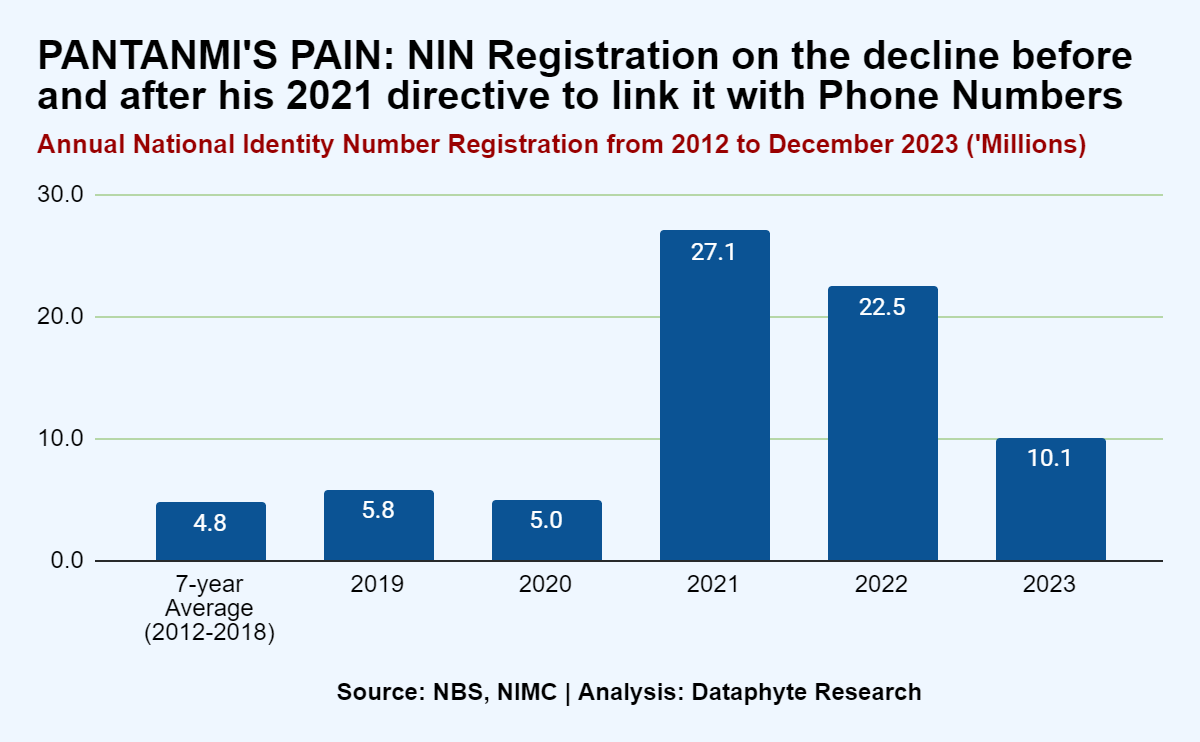

Pantanmi’s Pain

The former Minister of Communications and Digital Economy, Prof. Isa Ali Ibrahim (Pantami) has decried once again the failure of Nigeria’s security agencies to track the identity of the owners of phone line used for communicating payment of ransoms and other financial crimes. He regretted that this information is readily available on the National Identity Numbers database.

He said this at the instance of the abduction of five sisters together with their father in the Bwari Area Council of the Federal Capital Territory.

Mr Pantanmi had conveyed the Federal Government’s directive that all phone lines be linked with the National Identity Number, which had all the biometric and bank verification numbers (BVN) of each registered person.

After this directive, more people registered for their NIN, but the number of people has reduced since then.

The National Identification Number (NIN) was deployed in 2012 as the cornerstone of a comprehensive National Identity Database that allows for the unique identification of individuals within the country.

Mr Pantanmi wants to know why the security agents have not utilised the robust NIN database he built during his tenure to track criminals and tackle festering insecurity in the country.

What we need to know

Mr Pantanmi’s security concerns can only be realised if we find answers to these questions:

Is it confirmed that all telecommunication companies have complied with the directive to disable every line that has not been linked to NIN, such that there is no active line in Nigeria that is not linked to NIN?

Can we confirm that the Nigerian security services consisting of the Nigerian Police Force (NPF), Nigerian Military, The Department of State Service and other security operatives have the technical capacity to track the location and the location and the identity of everyone, especially criminals that are using a particular line for criminal activities?

Can we confirm that the security operatives have the manpower capacity to track criminals to the gate of hell to apprehend them?

Can we confirm that elected representatives at the local/state/federal level have the political capacity to punish security officers who have the technical and manpower capacities to track and apprehend criminals but fail to do so?

Can we confirm that elected/appointed/employed government officials can audit all telecommunication companies in real time to ascertain whether each fully complies with the government's directive to disable every line that has not been linked to NIN?

This is what we know:

Not all lines have been linked to the NIN due to the delay in deadlines given by the NCC for Telecoms company to effect the barring of lines that have not complied with the directive.

The Nigerian Communications Commission (NCC) directed telcos, including MTN, Airtel, Globacom, and 9mobile, to fully disable all phone lines for which subscribers had not submitted their NINs and those without verified NINs by February 28, 2024.

Furthermore, NINs that had been submitted but not verified were to be disabled on or before March 29, 2024, while five or more lines linked to an unverified NIN were to be disabled on the same date.

Similarly, lines linked to an unverified NIN, but fewer than five, were to be disabled on or before April 15, 2024.

It is also common for criminals to use the phone lines of their victims of robberies and abductions to do phone communications. Tracking the owner of a phone sim linked with their NIN may be easy. Tracking the user of the line may be another thing.

Tasked to Tax

Nigeria’s President, Bola Ahmed Tinubu set up a tax reform committee led by former PWC scribe, Taiwo Oyedele with the mandate to bring up policies that can help Nigeria raise its tax revenue.

There have been debates on whether the government should increase tax rates in a bid to make more money from taxation.

However, the government has promised to increase tax without increasing the tax rate.

A former Chairman of the Federal Inland Revenue Service (FIRS) stated that compared to the population of over 200 million people, many Nigerians are evading tax. He said this at the public presentation and breakdown of the 2022 appropriation bill.

The FIRS scribe, while acknowledging that Nigeria has 41 million taxpayers as of 2021, expressed concerns over the tax to population ratio of the country.

Micro Earnings from Micro Enterprises

Personal Income Tax (PIT) is charged either on Pay as you earn or Self-assessment. It is collected at the state level.

Data from the World Bank revealed that self-employed persons in Nigeria make up 79.8% of the total employed population of the country (as of 2019). Many of these run micro-businesses, and others run small and medium enterprises (MSMES).

Yet, earning tax revenue from this bloc of employees and entrepreneurs remains a big challenge.

The CAC reported that over 40 million MSMEs were unregistered as of 2018. The federal government tried to mobilize MSMEs to register in 2020 when the government announced free registration for 250,000 MSMEs in the country.

By January 2021, 100,000 MSMEs had benefited from the free registration.

To raise tax revenue without overburdening the current taxpayers among the MSMEs, the Tinubu administration needs to have more MSMES in the tax net.

Already, tax-compliant MSMEs complain that multiple taxation, mostly various business levies, weigh down their businesses. Although the business premises levy is being enforced at the local government level, income tax remains is still hardly collected by the state and federal agencies from self-employed persons.

Also, a survey by the Nigerian Economic Support Group said the challenge of the tax system in Nigeria was related to administrative issues of how to pay, when to pay and where to pay taxes.

Many MSMEs are ignorant of the processes of paying tax, by implication, there is no actual tax provision for their staff to fulfil the P.A.Y.E obligation, according to the report.

Fleeing Companies and Fluctuating Company Tax

For Corporate businesses, the problem moves from identifying them to issues of tax evasion.

Nigeria's corporate income tax has been noticeably rising and falling during the past ten years.

These fluctuations may result from tax evasion, business closures and the exit of several multinational companies from Nigeria.

In 2023, at least seven multinational companies were noted to have left the country; UNILEVER, PSG, and P&G are among those that have left the country.

They blamed the power crisis, constant devaluation of the Naira, and forex availability, coupled with other stringent policies of the government as reasons for their exit.

Multinationals leaving the country may affect corporate income tax revenue mobilization in the country.

Aside from these issues, some commentators had earlier stated that Nigeria’s tax rate may discourage investors and payment of taxes. Nigeria has one of the highest company income tax rates in the world.

In 2021, the Federal Inland Revenue Service (FIRS) stated that 45,281 companies defaulted on full tax payments.

Nigeria only met its Corporate Income Tax Target in 2021, for the first time in 4 years (2019-2022).

Broader economic issues such as changes in company earnings, rates of inflation, and the rate of economic growth can all affect the total amount of taxes that businesses pay, and the government collect.

Oil Imports: Pay More, Buy Less

Dataphyte’s analysis has shown that as of the third quarter (July - September) of 2023, Nigeria spent the highest-ever amount on importation of refined petroleum between 2021 and 2023.

Conversely, the consumption of petroleum products reduced within the period, especially petrol (PMS), coinciding with the removal of the oil subsidy.

This higher value of imported refined fuels was also in spite of the set-up of local refineries like the Dangote Refinery and the refurbished Port Harcourt Refinery.

On May 22nd, 2023, it was reported that Dangote Refinery was launched with the hope of solving the problem of chronic fuel shortages in the country. The refinery, estimated at a sum of $19 billion, has a production capacity of 650,000 barrels per day.

A data review shows that Nigeria spent N2.859 trillion on petroleum imports in the third quarter of 2023, the highest in all quarters since 2021.

The trade flow shows that in Q3 2021, a sum of N2.091 trillion was spent on petroleum imports, with the figure falling to N1.652 trillion in 2022, before rising to N2.850 trillion in 2023.

The period of the increase in petroleum importation expenditure fell within the period of the Dangote refinery launch, and at a dire time when the country’s currency became further devalued.

With Local Refineries: Pay Less, Buy More?

One of the chief causes of the increase in the expenditure of Nigeria for petroleum importation is the exchange rate between the Naira and the Dollar. Given that the country’s refineries have been so far obsolete, foreign exchange and other shipping costs became the key determinants of how much is spent on refined petroleum.

While the Dangote refinery is not fully operational, if it commences operation, expectations are that it would help reduce the extent to which Nigeria imports refined petroleum.

However, key questions are: Will the Refinery sell refined petroleum to Nigeria’s oil marketers at the international market rate (using a Naira converted figure), or does it plan a special selling price for them?

However, the Petroleum Products Retail Outlets Association of Nigeria believe Nigerians should expect a fall in the price of petroleum if Dangote refinery commences operations.

Currently, the price of petroleum stands between N640-N660 litre in Abuja and sells as high as N750 in the South Eastern part of the country, if the permutations and expectations of the country work regarding the refinery, it means that the price of petroleum will fall below these figures.

With Local Refineries: Import Less, Export More?

Crude oil remains Nigeria’s biggest export. After it is refined abroad, it turns into a significant import.

The question then is: Can the current private and public refineries serve the energy needs of the country? Will Nigeria become a net exporter of refined products?

Data puts Nigeria’s daily fuel consumption at 430,000 barrels per day. Dangote refinery production capacity is put at 650,000 barrels per day, it is expected to start production with 350,000 barrels per day, meaning that even if all the crude oil produced by Dangote is supplied to the local market (a tall order), it won't solve absolutely the problem of petroleum importation into Nigeria. But it can drastically reduce fuel importation.

Nigeria may also want to bank on its “working Port Harcourt Refinery”. According to reports, the 210,000 capacity refinery has reached a stage of mechanical completion.

The government stated that the refinery started production in December last year. If the word of the government scribe is anything to go by, it may show a positive development in respect to local refining or petroleum.

However, concerns are that on many occasions, Nigeria has spent billions to rehabilitate and maintain refineries, just for them to record zero petroleum refining and cost the country just more waste of money.

However, after all these years, the announcement of locally refined petroleum from state-owned refineries may revive the people’s hope that these are not lost obsolete assets.

Thanks for reading this edition of Marina and Maitama. We hope we’ll find answers to our people’s many pains and pay less to buy more fuel. That’s if taxes begin to work for taxpayers

This edition was composed by Tope Moses, Olanrewaju Oyedeji, Funmilayo Babatunde, and Khadijah Kareem. It was edited by Oluseyi Olufemi.