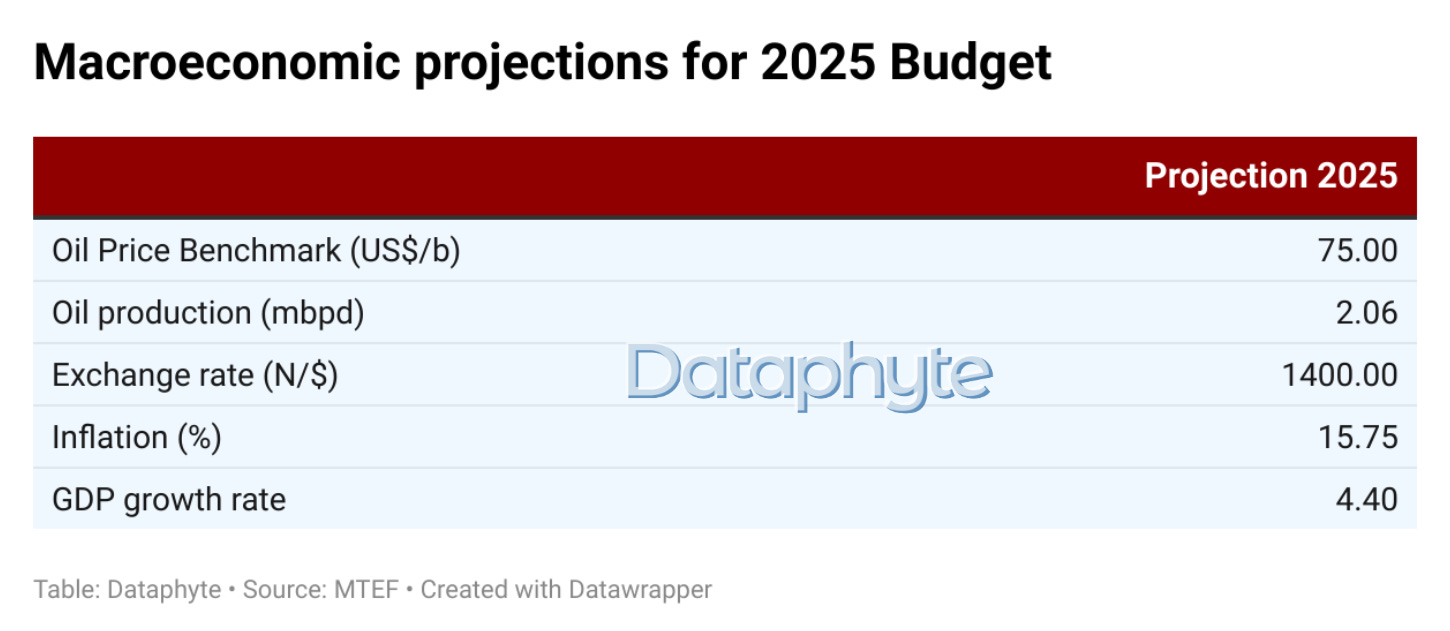

The recently released 2025-2027 Medium Term Expenditure Framework and Fiscal Strategy (MTEF) projects that the Nigerian economy will grow by 4.4% and inflation will be down to 15.75% in 2025.

According to the report, “the growth in real GDP during the period will be driven by the anticipated increase in domestic oil refining capacity, telecommunications, crop production and employment, with the bulk of projected growth coming from the non-oil sector.”

The current macroeconomic indicators show that the MTEF projection has fallen short in meeting its macroeconomic growth projections in 2024 and might not meet its 2025 macroeconomic projections if the current fiscal and monetary trajectory remains the same.

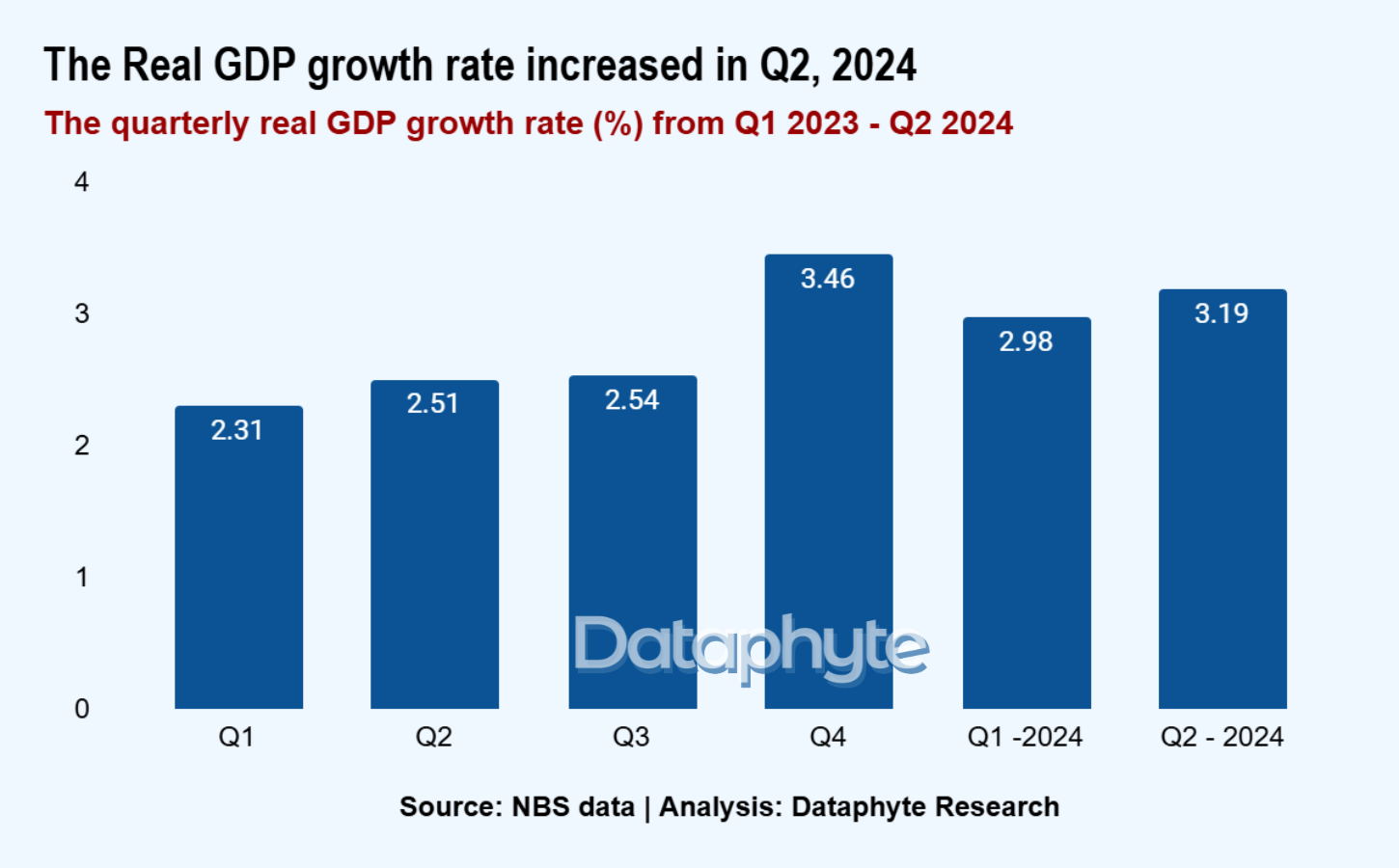

NBS data on the country’s real GDP growth showed that it grew by 0.21% between Q1 2024 and Q2 2024. Real GDP stood at 2.98% in Q1 2024 and 3.19% in Q2 2024.

Although there was an increase in the Q2 2024 real GDP growth rate, it is 0.61% less than the projected growth rate of 3.8% by the MTEF for 2024.

The projected economic growth for 2024 was hinged upon critical macroeconomic assumptions, several of which did not materialise as expected, undermining the expected outcomes.

The average oil price over the past 10 months exceeded the projected benchmark by $5.32 per barrel. While this surplus had the potential to bolster oil revenue, the shortfall in production—averaging 0.38 million barrels per day (mbpd) below projections—offset the anticipated fiscal benefits, thereby constraining overall revenue performance.

The exchange rate, initially projected at ₦800/$, experienced a substantial depreciation of over 100% within the year, reaching ₦1,687/$ by November 2024. This pronounced devaluation has exerted significant pressure on macroeconomic indicators, most notably the inflation rate.

Within the last 10 months, the inflation rate rose to 33.88% which is 12.48 percentage points above the projected inflation rate for 2024.

Despite not fully realising the projections for 2024, the 2025 budget framework is optimistic, aiming to increase the GDP growth rate and reduce the inflation rate.

Analysts have projected that the inflation rate might increase further before the end of 2024 and the Naira might devalue further into 2025.

The devalued exchange rate and increasing inflation pose sustained risks to price stability and household purchasing power, with potential spillover effects on critical sectors such as crop production, telecommunications, financial services and manufacturing. These industries are likely to face higher input costs, reduced consumer demand, and supply chain disruptions, thereby undermining productivity.

In 2024, key sectors critical to Nigeria's economic diversification—such as telecommunications, crop production, manufacturing, and financial services—experienced notable declines. These sectors are central to both economic resilience and diversification away from oil dependence.

In general, the non-oil sector experienced a slowdown in its real GDP growth rate between Q1 and Q2 of 2024. Although it maintained a constant growth rate of 2.80% across both quarters, this was a noticeable decline from the 3.07% growth recorded in Q4 of 2023.

On the other hand, the oil sector noticed an increase in real GDP growth of 4.45 percentage points. It increased from 5.70% in Q1 2024 to 10.15% in Q2 2024.

This trend indicates that the country remains heavily reliant on oil revenues, a dependency that poses significant risks to achieving long-term sustainable economic growth. Diversifying into non-oil sectors is essential to mitigate these risks and build economic resilience against fluctuating oil prices and global energy transitions.

America’s oil production is projected to reach 14 million barrels per day by 2025 which will increase crude oil supply and drive down prices. Therefore, some analysts are forecasting a potential decline in oil prices to as low as $40 per barrel in 2025.

For a country whose major revenue source is oil, this might make it harder for the country to reach its economic growth goals and revenue projections for 2025.

The rising cost of hospitality

Restaurants and hotels were the hardest hit by inflation on a month-on-month basis, according to the NBS inflation report for October. The month-on-month inflation in restaurants and hotels increased by 3.47%.

Restaurants and hotels are heavily reliant on food, beverages and utilities — categories directly affected by inflation. This suggests that as food inflation increases, the inflation of restaurants and hotels increase by near the same amount.

The rising inflation rate in this sector could lead to the closure of establishments unable to sustain escalating costs and declining revenues. Additionally, businesses may resort to unethical practices, such as compromising on food and service quality, in efforts to reduce operational costs and protect profit margins.

The month-on-month inflation rate for restaurants and hotels has risen sharply, surpassing the month-on-month inflation rate for food, which remains one of the primary drivers of inflation in Nigeria.

On a year-on-year basis, the inflation rate of restaurants and hotels grew to 33.01%, following closely behind imported food, food, and food and non-alcoholic beverages.

The restaurant and hotel industry relies heavily on key inputs such as food, beverages, and utilities, particularly electricity. An increase in the prices of these inputs inevitably raises the cost of operations and, subsequently, the prices charged to customers for services.

Food (domestic and imported) prices in the country have surged by over 40%, the highest in the last 25 years. Similarly, electricity and other operational costs have risen significantly, further exacerbating operational expenses in this sector.

The sharp rise in the cost of operation is likely to erode profit margins, reduce affordability for consumers, and potentially lead to a contraction in demand. In the long run, sustained input cost inflation could hinder the growth and competitiveness of the restaurant and hotel industry unless mitigated by efficiency improvements or policy interventions.

Thank you for reading this edition of Marina and Maitama. It was written by Lucy Okonkwo and edited by Joachim MacEbong.