In Nigeria, like in many parts of the world, women led startups are underfunded, making it difficult for these startups to thrive.

This means that the funding discrepancy in the start up business will lead to lack of equal opportunities for women to innovate and build successful businesses that can contribute to the country and global economy at large.

In January, PUNCH quoted a report which stated that female owned startups received 2.3 per cent funding while the male owned startups received 85 per cent total funding in 2023.

According to the report from Africa: The Big Deal, all-male founding teams received $1 for every $1 raised, while all-female founding teams only received 2.7 cents (37x less).

Such discrepancies in funding affect a startup’s likelihood of success and its potential for future growth.

Startups are founded by one or more entrepreneurs who want to develop a product or service for which they believe there is demand. These companies generally start with high costs and limited revenue, which is why they look for capital from a variety of sources such as angel investors and venture capitalists.

Drivers of growth

These startups are important because they are the engine of economic growth. They are the source of new jobs, new products, and new services. They drive innovation and create wealth. Startups are riskier than established businesses, but they also have the potential to generate higher returns.

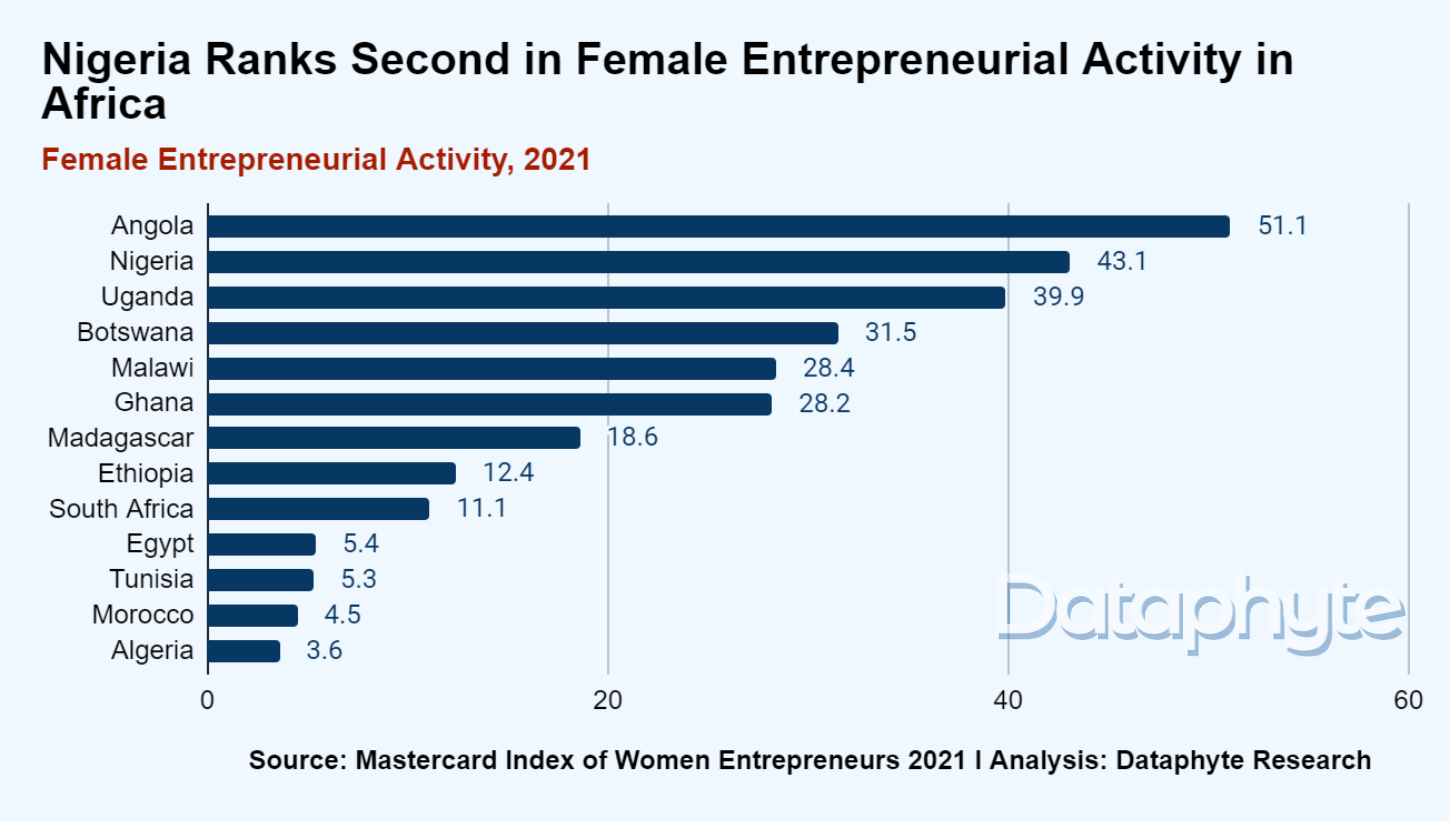

Data shows that 43.1% of women are entrepreneurially active in Nigeria as at 2021. The Mastercard Index of Women Entrepreneurs defines ‘entrepreneurial activity’ as “working age females about to start a business or have been operating one for a maximum of 3.5 years”.

According to this measure, Nigeria ranks second among 13 African countries surveyed in the report. Angola tops the chart with 51.1% of its women being entrepreneurially active.

Advancing Gender Equality In Startups

One of the factors responsible for the inequality among startups is the widespread gender gap in STEM (Science, Technologies, Engineering and Mathematics) as it is within these fields that individuals best acquire the skills needed for success in the innovative entrepreneurship world (OECD, 2018).

Also, the funding gap is considered as the most prominent problem in female owned start-ups and entrepreneurship. They are often faced with challenges in raising capitals for their businesses.

However, funding helps companies to take shape and become operational. It enables the founder of the company to fine-tune their business plans, hire talent, build a sales force and fund working capital. Funding is needed at different stages of a start-up in order to meet varying liquidity and investment needs during a business’s development.

Meanwhile, the UBS financial management advised that,‘‘While individual women can try their best to manoeuvre the funding process in their favour, it would be more powerful and impactful if the entrepreneurial ecosystem played its part in narrowing the gap.

‘‘Also, there is an abundance of evidence to suggest that women entrepreneurs, who receive funding, develop businesses that perform as well, or even better, than their male counterparts, which suggests investors are missing out on attractive investment opportunities.’’

Fixing the problem

There have been some initiatives set up by financial institutions to specifically address the gender funding gap in entrepreneurship. Access Bank’s W Initiative which began in July 2014 is one such example.

The stated goal of the initiative is to “accelerate a new and stronger wave of hitherto scanty female entrepreneurs in Nigeria”. In addition to financial inclusion, the initiative includes capacity building programs, mentoring programmes, and maternal health services.

On the tech startup side, FirstCheck Africa is an early-stage, women-led venture capital firm which also seeks to close this gap. It aims to support “Africa's most exceptional female-led startups” and help female founders get the “financial, social and belief capital to build category-defining companies”.

The costs of not addressing the gender funding gap are significant. Apart from the urgency of gender equality, UBS estimates that allowing men and women to contribute equally as entrepreneurs could increase global GDP by 3-6%, boosting the world economy by USD $2.5-5 trillion.

That’s a lot of opportunity - and growth - to leave on the table.

Thanks for reading this edition of SenorRita. It was written by Kafilat Taiwo and edited by Joachim MacEbong.