Global Market Sellouts: Nigerian Reasons

+Granted Merger: Providus and Unity Bank

Global Market Sellouts: Nigerian Reasons

Global stock markets experienced one of its heaviest shocks on the 5th of August, 2024, with Asia leading the downturn.

The Japanese stock suffered its biggest losses in 37 years, with the Nikkei 225 Index plunging by 12.4%. The Nasdaq composite fell over 6%, S&P fell by 4.25%, the Dow fell by more than 1000 points, while the London FTSE 100 fell by more than 1.5%.

Analysts blamed the losses on the fears of a US recession, caution over the AI hype, and geopolitical tensions in the Middle East.

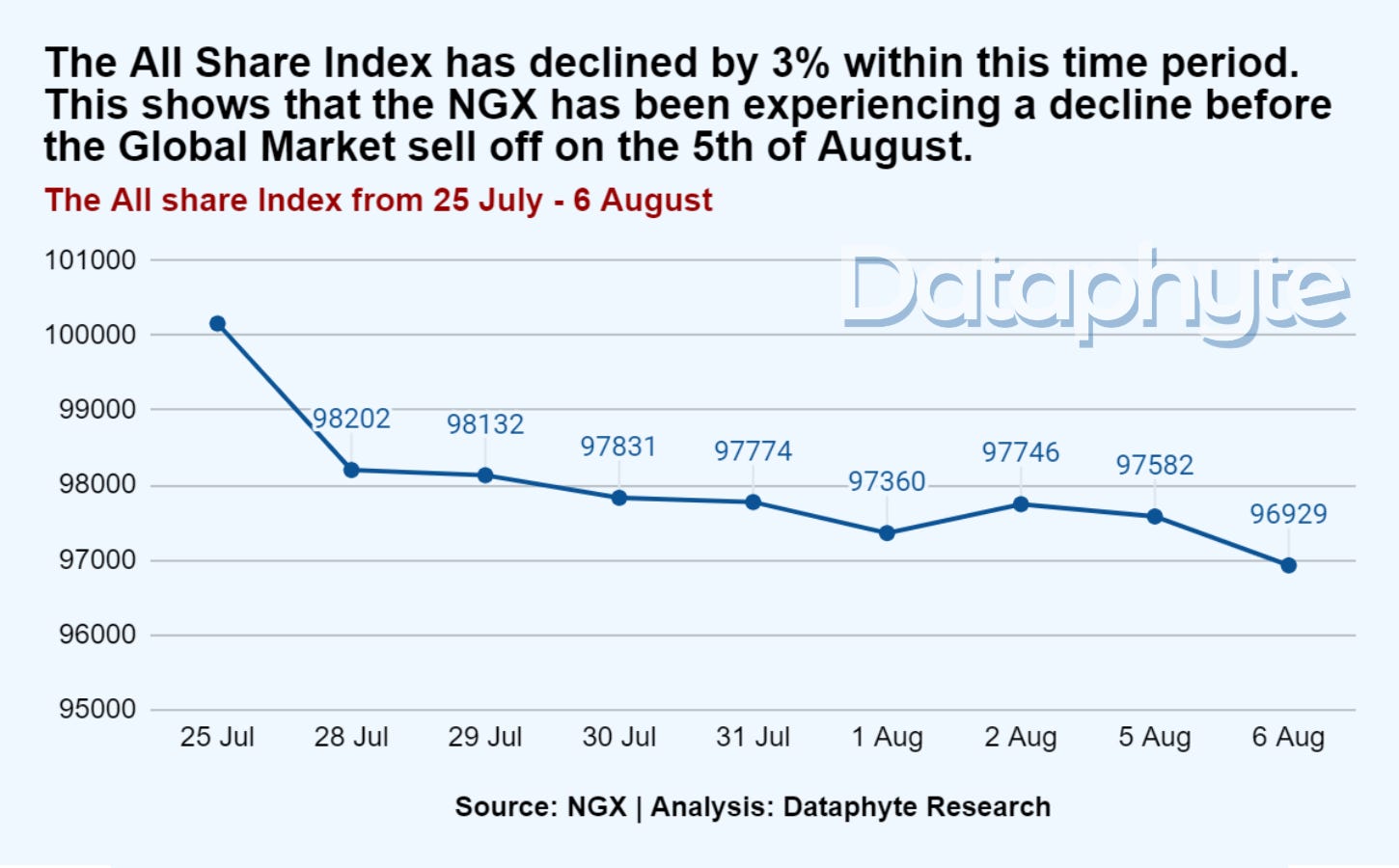

Although the Nigeria Stock Exchange experienced a loss within that time period, trend data shows that this may be unrelated to the losses in the Global market.

The All Share Index (ASI) in the Nigerian Stock Market has been on the decline since the announcement of the new interest rate on the 25th of July, well before the 5th of August when the global stock turbulence began.

The ASI had fallen by 2,574.55 between the 25th of July and 5th of August. It was 100,156.96 on the 25th of July and fell to 97,582.41 on the 5th of August.

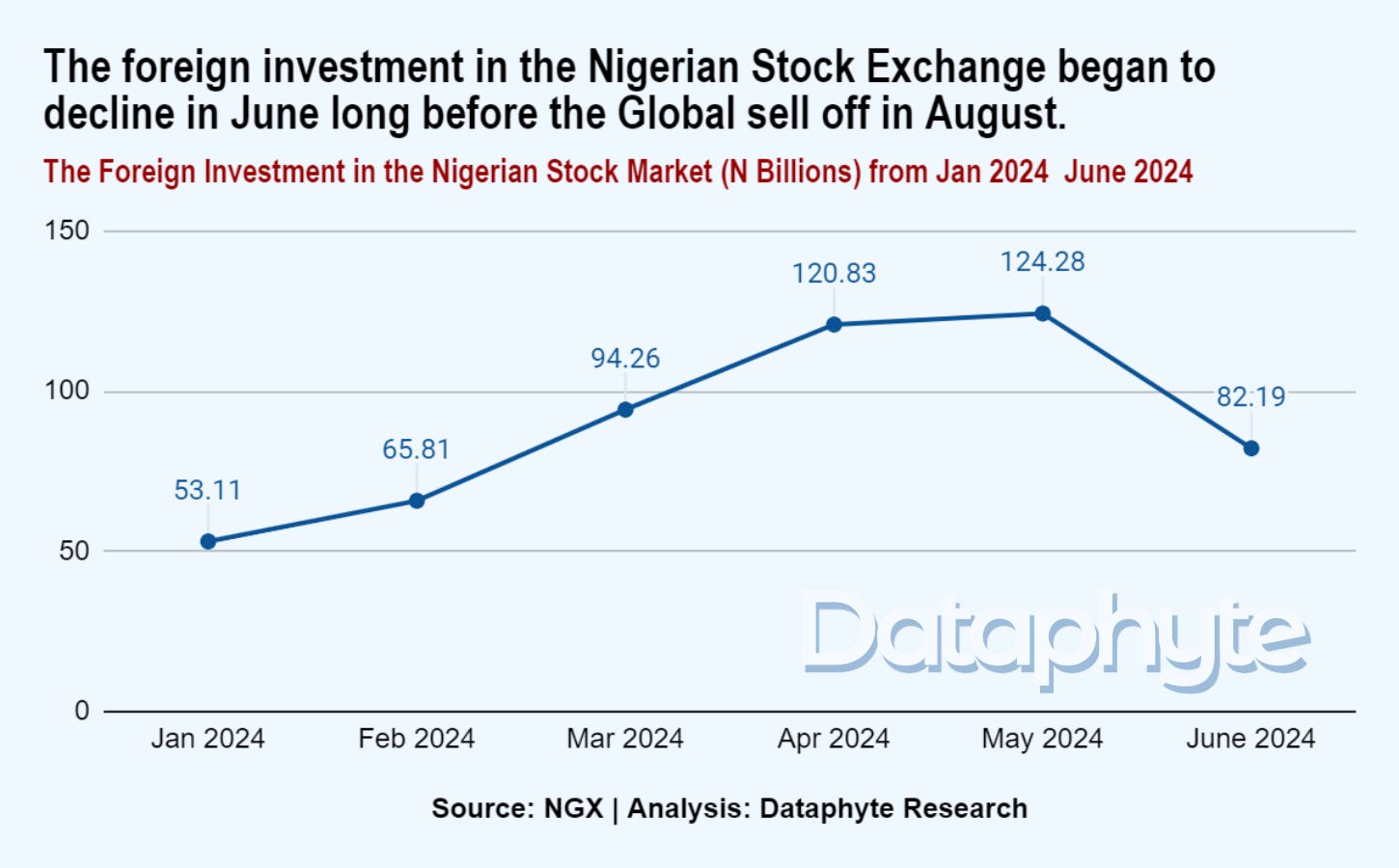

The global influence on the decline in Nigeria’s stock index may be minimal also because foreign participation in the NGX is 23% compared to 77% of domestic participation in the Nigerian Stock Market as of June, 2024.

Also, foreign investment in the Nigerian Market declined in June, though it is still higher than the foreign investment in January 2024.

Foreign investment in the Nigerian market peaked in May, but declined by 33.87% in June. It rose to N124.28 billion in May and declined to N82.19 billion in June.

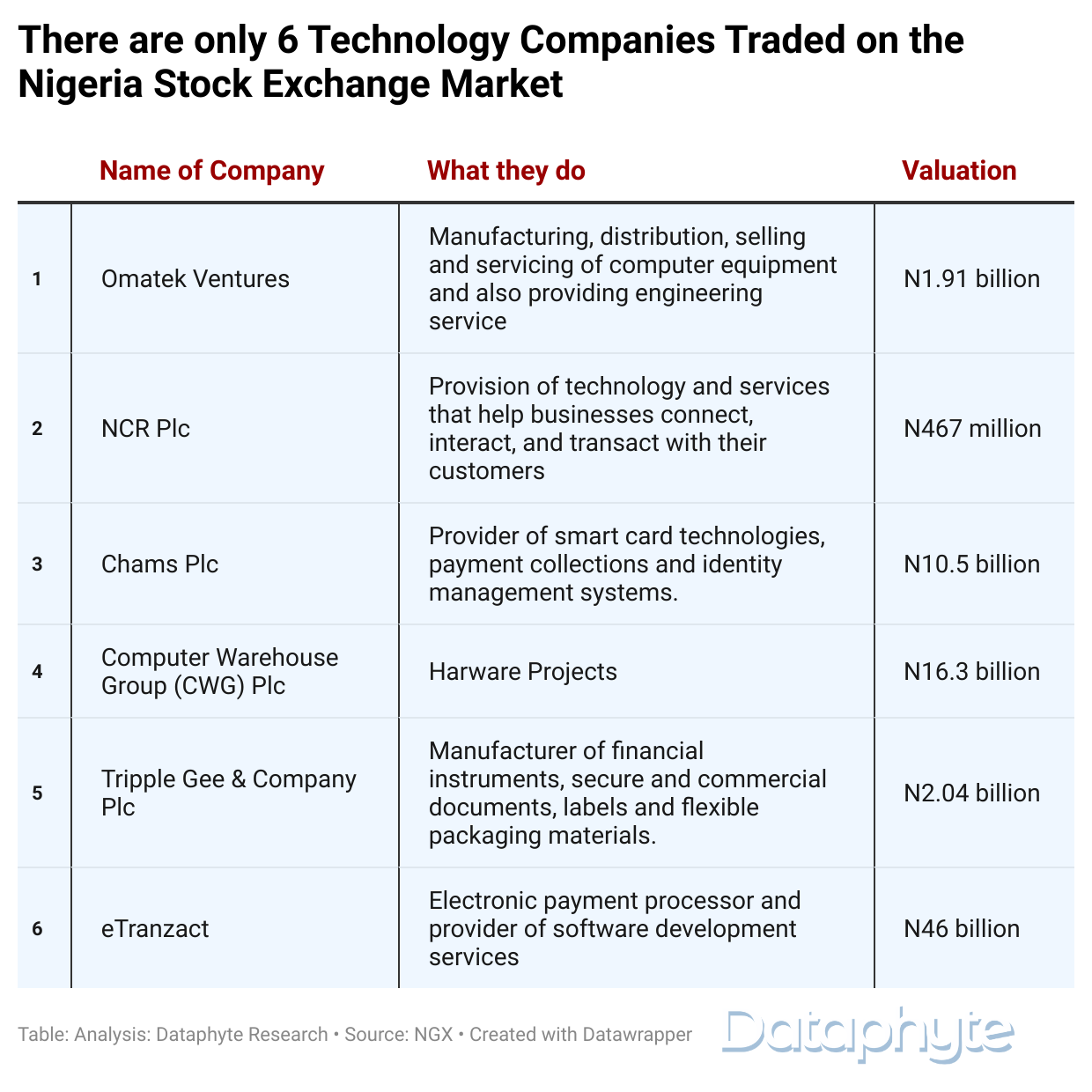

One fear that triggered the massive sell out was that investors believed major technology companies, especially those investing in artificial intelligence (AI), had overvalued their shares and were now undergoing a correction.

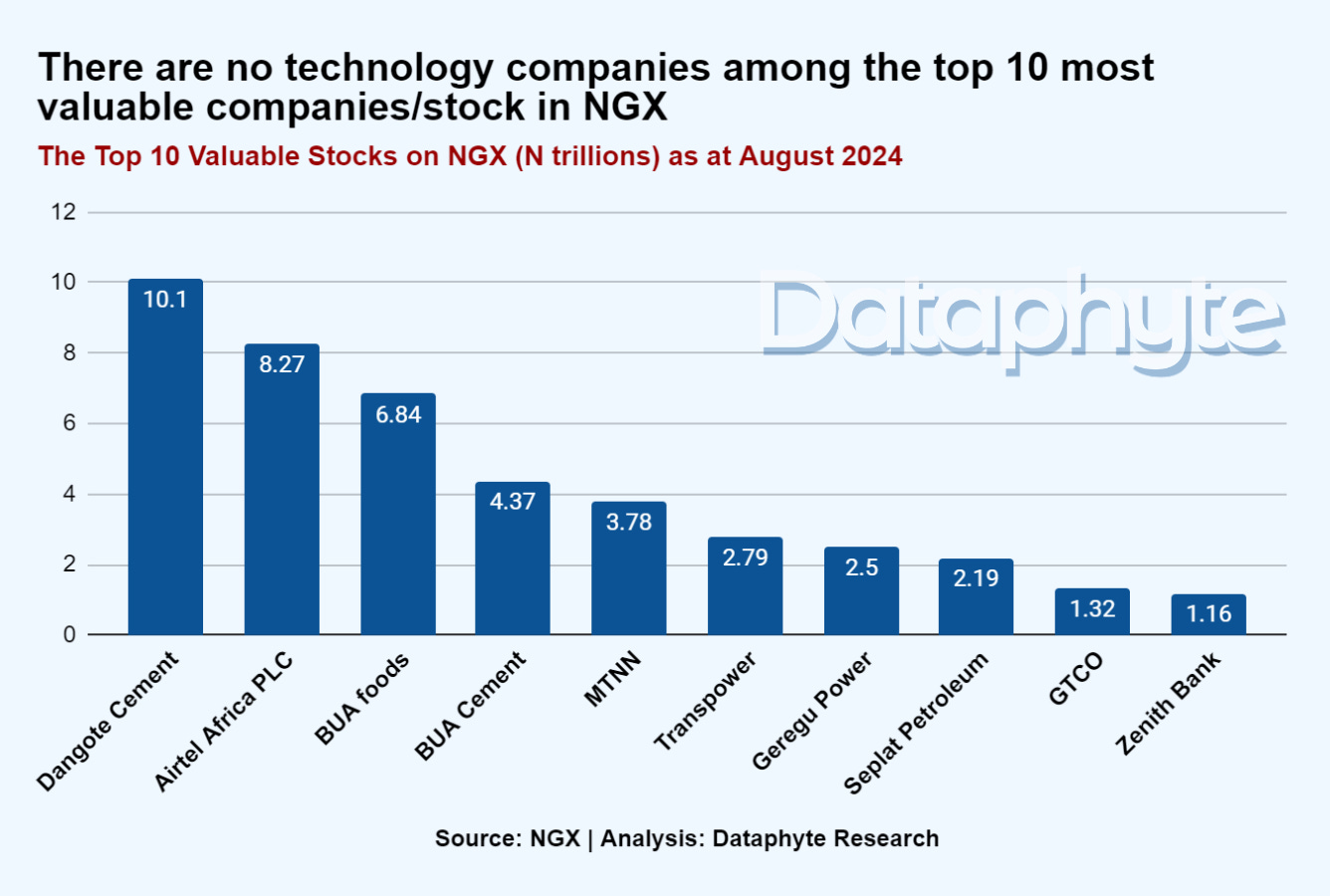

Out of the 119 listed equities taking part in trading on the NGX, there are only 6 technology companies.

Unlike the Global Market where AI/technology companies are among the top valuable companies, the technology companies listed on the Nigeria Stock Market are not among the top valuable companies.

The fears agitating the global sell off may have little or no effect on the Nigerian market as the market is isolated from the events influencing the sell off of stocks.

The Nigerian Market dynamics centre on recent monetary policies coupled with public unrest and protests, which may discount investor confidence, both foreign and domestic, in the NGX.

For instance, MTN Nigeria, one of the companies with the highest market capitalisation in the NGX, experienced huge losses on the 5th of August.

“About 5.95 per cent or N11.30 per share drop in MTN Nigeria Communication Plc to N178.70 per share dragged the domestic stock market lower by N92 billion in market capitalisation,” reports Arise News

Some believe that the challenges with service delivery since the beginning of the Hunger protest on the 1st of August worsened the MTN stock value losses.

Granted Merger: Providus and Unity Bank

The Central Bank of Nigeria (CBN) has approved a N700 billion bailout to support the proposed merger between Unity Bank and Providus Bank Limited.

This move is aimed to prevent systemic risks, protect depositors and maintain the confidence in the country’s banking system.

In the press release by the Acting General Director, Corporate Communications of CBN, Sidi Hakama, “This strategic move is designed to bolster the stability of Nigeria’s financial system and avert potential system risks.”

In July, the Nigeria Stock Exchange (NGX) suspended the trading of the shares of Unity Bank alongside 7 other companies because they defaulted in filing their audited financial statement for 31st December, 2023.

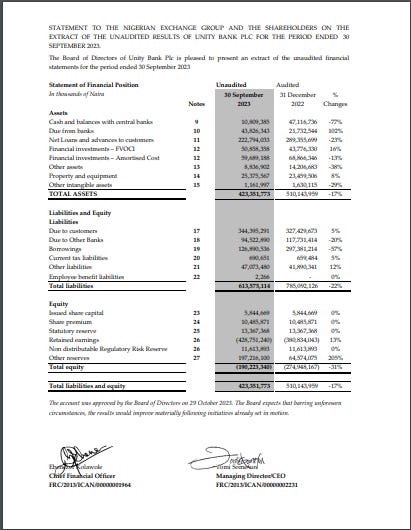

As of the last unaudited Financial Statement released by the Bank’s Board of Directors for the period ended 30 September 2023, the total liabilities and equity decreased by 17% between 31st December 2022 and 30th September 2023.

Unity Bank, Last Unaudited Financial Statement, 30 September, 2023

Source: Unity Bank

Despite Unity Bank’s unexciting results, the CBN asserts that the bank did not face a precarious situation comparable to that of Heritage Bank which it recently liquidated.

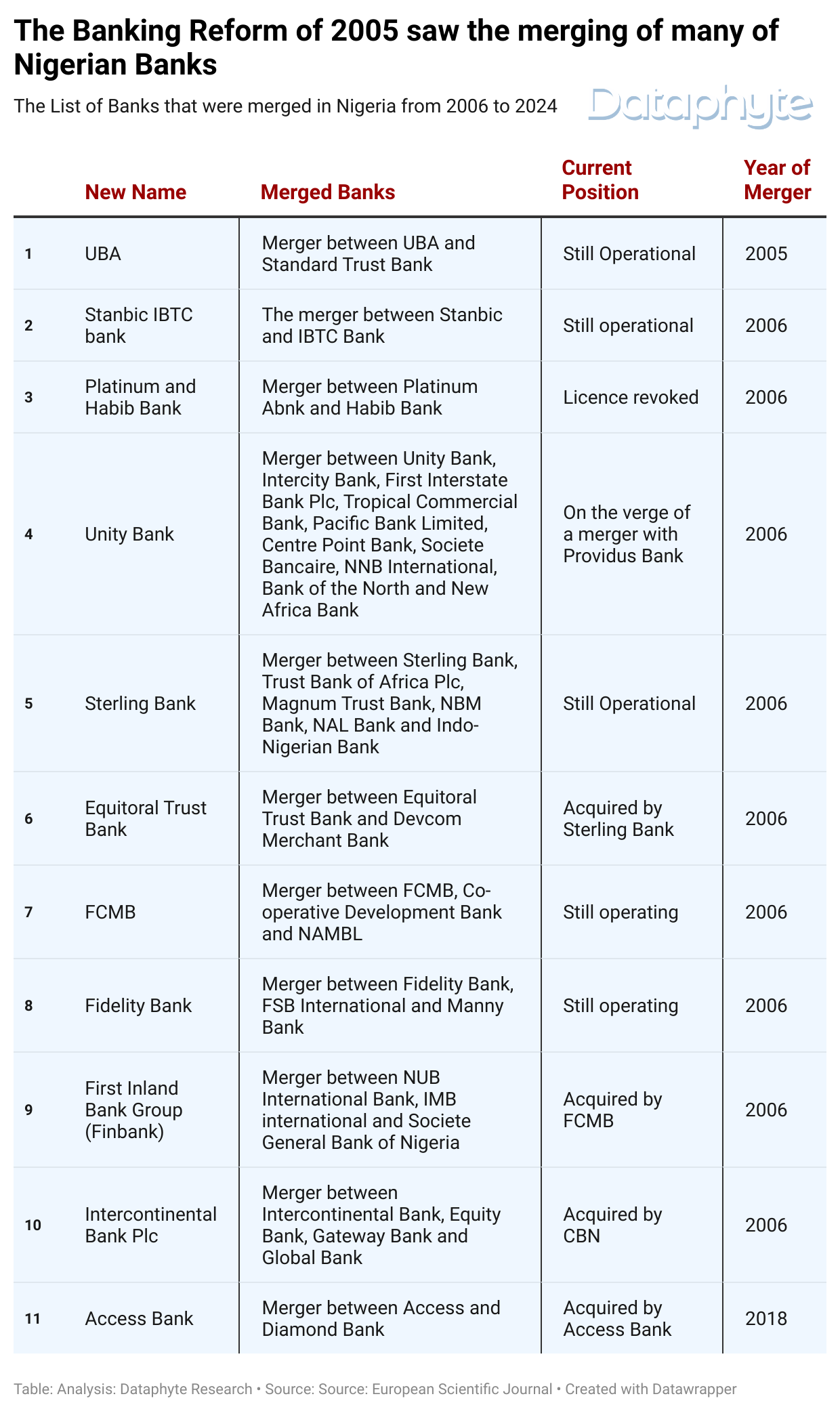

In the 19 years since the last banking sector reform in 2005, the number of Nigerian Commercial Banks reduced from 89 to 25, according to data from the Nigeria Deposit Insurance Company (NDIC).

Within this period, the CBN revoked the licence of 24 banks while the remaining 65 banks either merged or acquired another bank, got liquidated or closed down.

A merger is the voluntary combination of two companies on generally equal terms to form a single new legal entity. Companies mostly undertake a merger to gain market share, reduce operational costs, expand to new territories, unite common products, grow revenues, and increase profits—all of which should benefit the firms' shareholders.

The merger of both banks is expected to make them more financially stable and increase their banking capital.

Since the beginning of the year, the CBN has been on a bid to strengthen banks and promote confidence in the banking system with the announcement of the bank recapitalisation policy.

The CBN reviewed the new capital requirement for commercial banks with international licence, increasing it from N50 billion to N500 billion.

For banks with national licences, the CBN adjusted their minimum capital requirement from N25 billion to N200 billion, while that of regional banks increased from N10 billion to N50 billion.

The funding provision by the CBN is to enable Unity Bank to meet up with its obligations to CBN and other stakeholders.

“The arrangement is crucial for the financial health and operational stability of the post-merger organisation,” the CBN submitted.

Thank you for reading this edition of Marina and Maitama. It was written by Lucy Okonkwo and edited by Oluseyi Olufemi.