Got Work? Nigeria’s Unemployment Keeps Rising

+The Flour Mills shareholders buyout

Got work? Nigeria’s Unemployment Keeps Rising

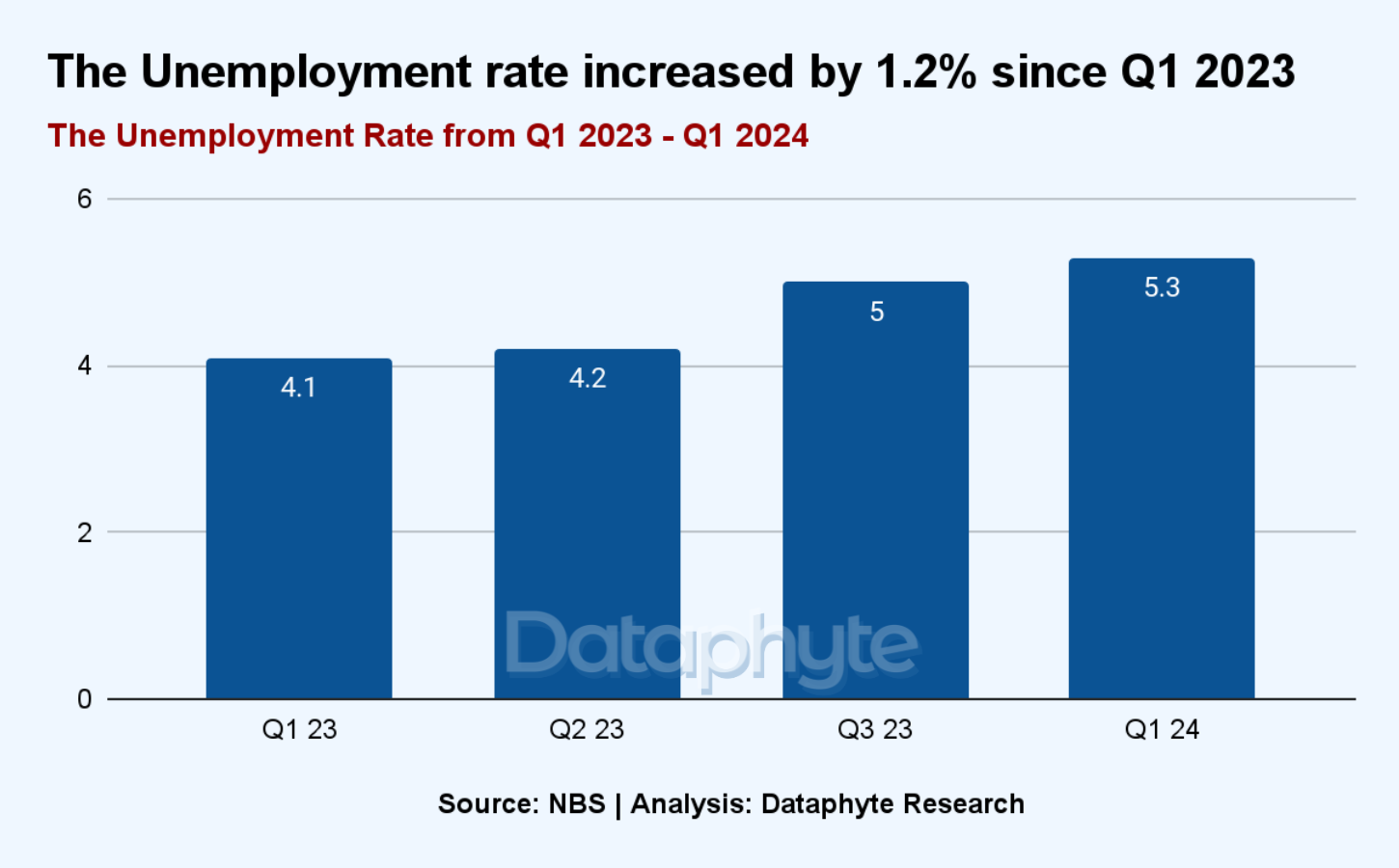

Nigeria’s unemployment rate increased from 5% in Q3 2023 to 5.3% in Q1 2024, according to the Nigeria Labour Force Survey (NLFS) released by NBS.

The increasing unemployment rate might indicate an expanding labour force, with more individuals entering the job market. However, the rate of economic activity is insufficient to absorb this growing supply of labour, resulting in stagnant or declining employment opportunities.

This may also suggest that the expanding labour force consists largely of individuals with lower skill levels, limited capacity, inadequate training, and insufficient educational qualifications, making them less competitive in the job market.

In 2023, Nigeria’s total working-age population was 116,604,860. This represents 53.8% of the total population. Out of the total working-age population, 84,148,566 were employed.

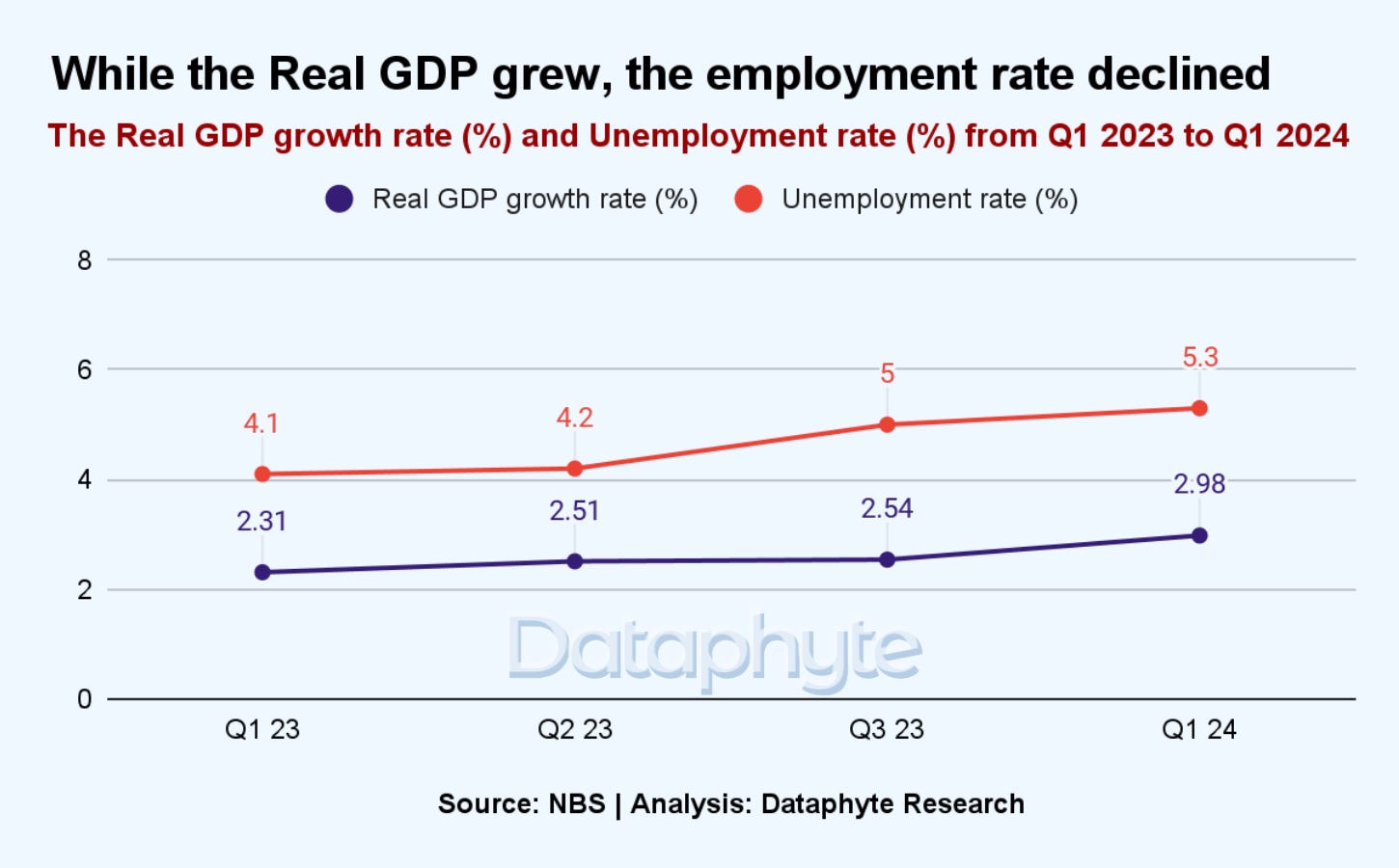

In contrast, Nigeria's economy recorded a modest growth of 0.44% in its real GDP growth rate between Q3 2023 and Q1 2024. It increased from 2.54% to 2.98% within the same time period.

Real GDP growth rate reflects the overall productivity of a nation's labour force, serving as a measure of the efficiency and output generated by the workforce within the economy.

However, this economic expansion was accompanied by a rise in the unemployment rate.

This suggests that the economic growth might be driven by sectors which are less dependent on human labour or using fewer labour to produce more output.

According to the National Bureau of Statistics (NBS) GDP data, economic growth within this period was largely driven by the oil and gas sector, which grew by 5.70%, and service-based industries such as telecommunications, trade, financial institutions, real estate, and professional services, which expanded by 4.32%.

These sectors, however, tend to rely more on capital investment and advanced technology, requiring fewer workers to achieve the same or greater levels of productivity. This shift toward automation and capital-intensive processes reduces the demand for labour, even as these industries grow.

Conversely, labour-intensive sectors that traditionally employ large portions of the workforce, such as agriculture and manufacturing, have shown much weaker growth. Agriculture grew by a mere 0.18% and manufacturing by 1.74% over the same period.

These sectors, which typically absorb less-skilled workers and are more reliant on manual labour, are underperforming. The sluggish growth in these sectors contributes significantly to the stagnation in job creation, as they are unable to generate sufficient employment to keep pace with the expanding labour force.

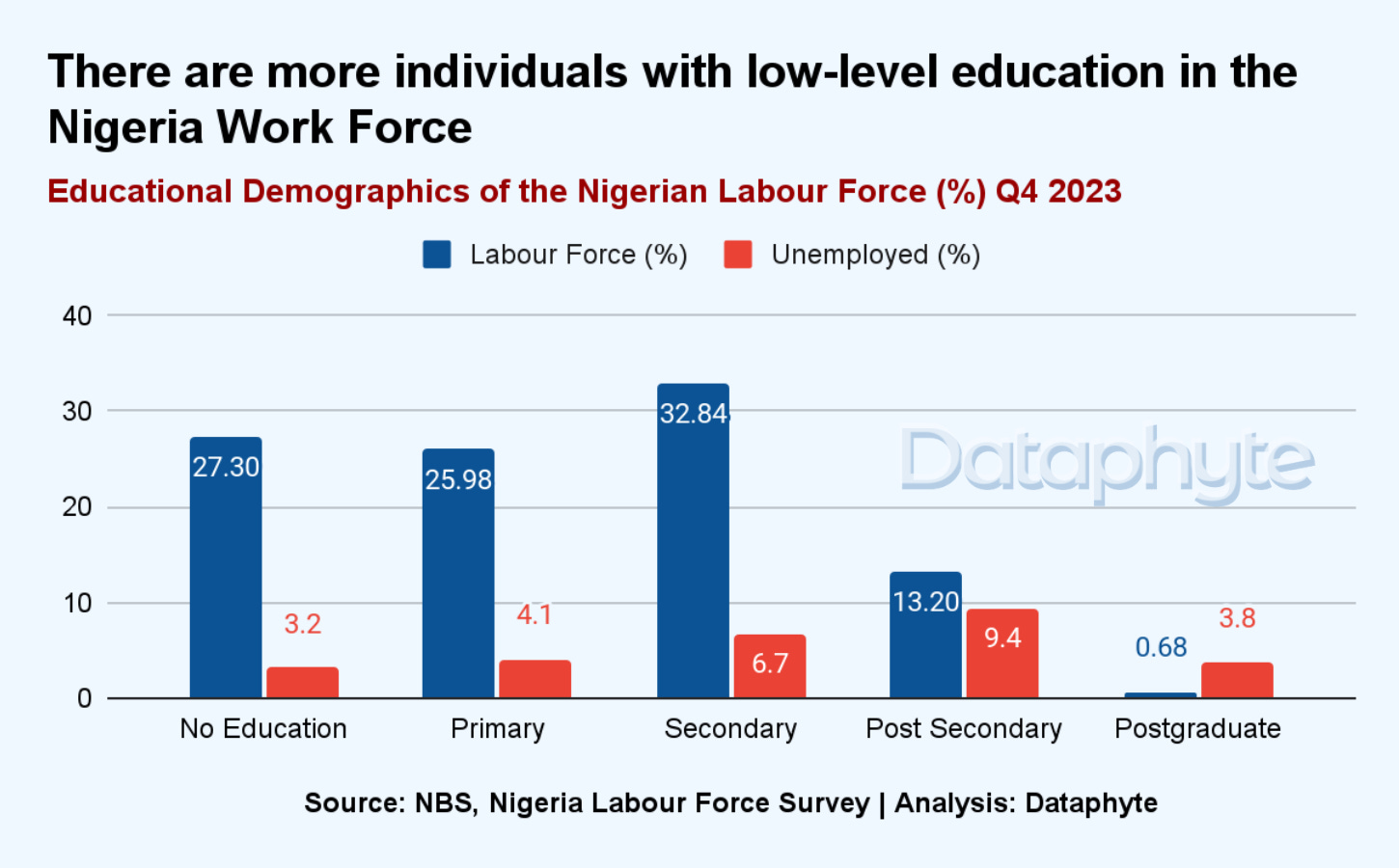

Another key issue is the mismatch between the skills required by the rapidly expanding sectors and the qualifications of the available workforce. A large proportion of Nigeria's working-age population lacks the high-level skills, education, and training necessary to compete for jobs in the growing sectors.

Many of the working-age population have no formal education or only secondary-level qualifications, limiting their employability in capital and technology-driven industries such as telecommunications, finance, and professional services, which require specialised skills and higher education.

This mismatch in skills is further exacerbated by the fact that the informal sector remains the largest employer of labour, accounting for 92.7% of the working-age population, with 77,561,393 individuals engaged in informal employment.

While the informal sector provides livelihoods for a vast majority of Nigerians, it is often characterised by low productivity, limited access to capital, and poor working conditions, contributing to the overall inefficiency of labour allocation in the economy.

The slow growth in agriculture and manufacturing, combined with a workforce that is inadequately trained for high-skill industries, might be one of the reasons why unemployment remains high despite modest economic growth.

To address this, targeted policy interventions are needed to boost labour productivity in agriculture and manufacturing while investing in education and skills training to bridge the gap between the labour force and the demands of the evolving economy.

Buyout: Flour Mills of Nigeria to Buyout Minority Shareholders

Flour Mills of Nigeria Plc (FMN) has formally notified the Nigerian Exchange and its stakeholders of a major move by its majority stakeholder, Excelsior Shipping Company Limited, to buy out its minority shareholders through a Scheme Arrangement.

Excelsior Shipping Company Limited, currently holds a 63.34% stake in Flour Mills of Nigeria Plc (FMN), will acquire the remaining 36.66% of shares held by minority shareholders upon completion of this strategic buyout.

Excelsior Shipping Company Limited is an international logistics company. It is a “significant player in Non-Vessel Operating Common Carrier (NVOCC), Freight Forwarding, Full Container Load (FCL) and Less than Container Load (LCL).”

According to Boye Olusanya, FMN’s Group Managing Director, “In line with FMN’s ambition to become the leading Pan-African food business that feeds and enriches lives of its consumers every day with quality brands, this move aligns with our strategy aimed at positioning the company to achieve its ten-year vision of building a company that is sustainable, resilient, dynamic, and adaptable in its people, systems, and structures.”

Also, this strategic buyout will make Excelsior gain full ownership and control of FMN and this could lead to possible delisting of FMN from the Nigerian stock exchange - as it will no longer be a publicly traded company.

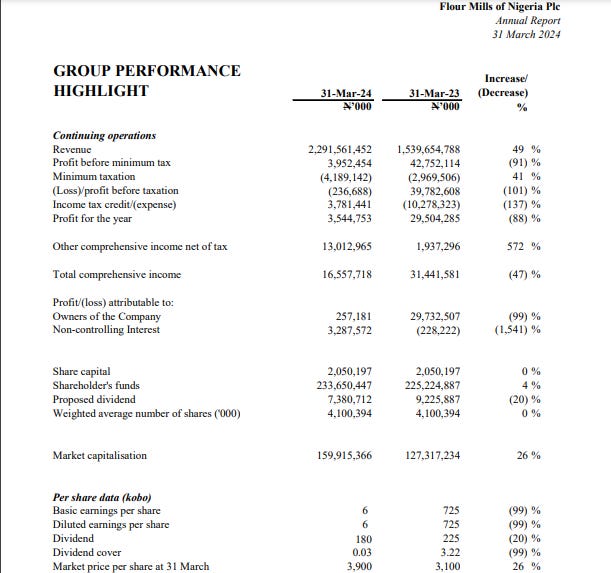

The company’s Financial Statement as at 31st March 2024 showed that its profit declined by 88% compared to the previous year, 31st March 2023.

Specifically, it recorded a profit of ₦29.5 Million in March 2023 and ₦3.5 million in March 2024.

Flour Mills of Nigeria, Last audited Financial Statement, 31st March 2024

Source: Nigeria Exchange Group (NXG)

Within the last one year, some companies in Nigeria have either had to shut down operations or adopt alternative strategies to remain viable to deal with the increasing operational costs and losses acquired from the volatile exchange rate.

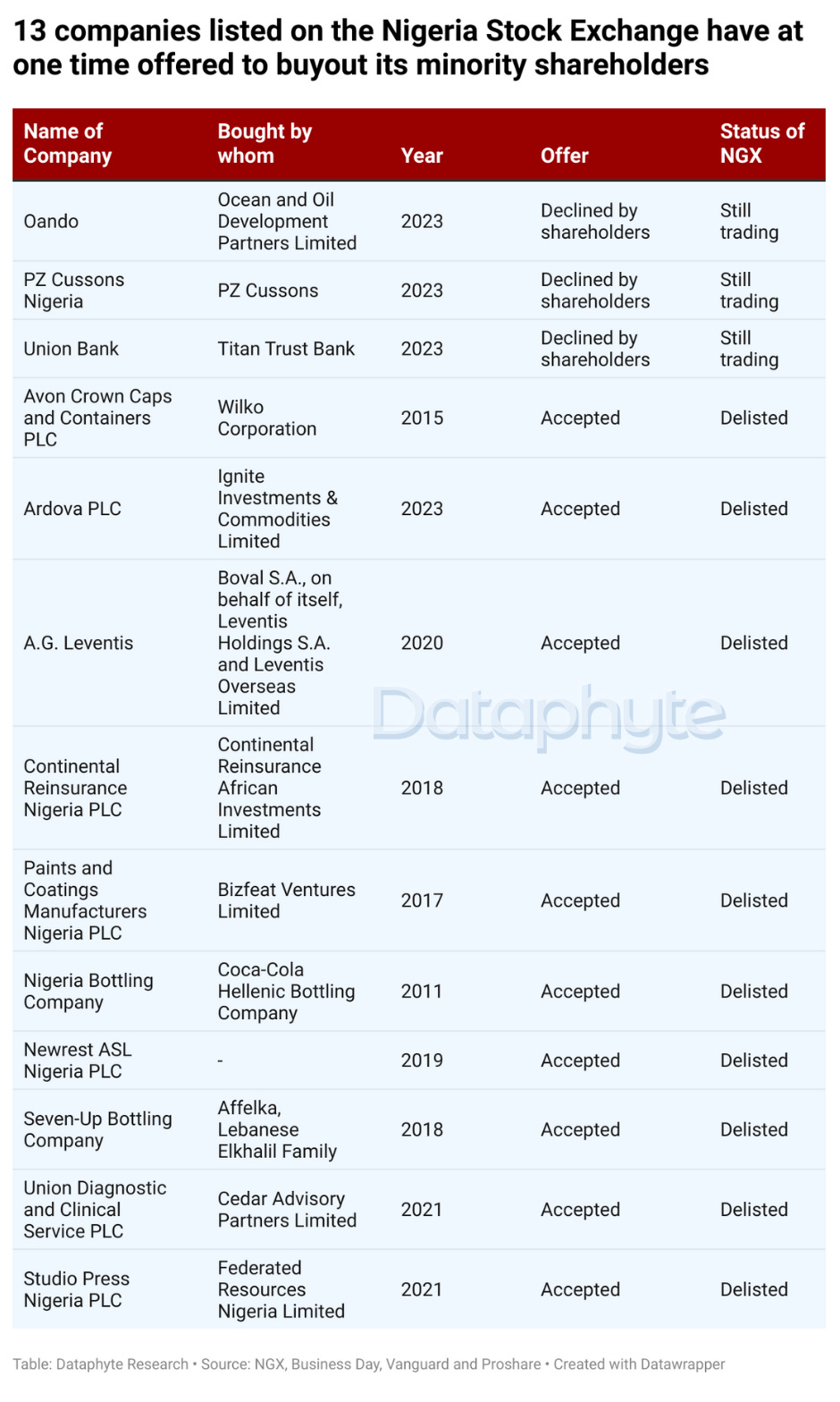

In the last 22 years, 13 companies have filed to buy out minority shareholders through the Scheme of Agreement. While some offers were rejected by their shareholders, others accepted.

Most of the companies who have had a minority shareholder buyout through the Scheme of Agreement have eventually delisted from the Nigeria Exchange Group (NGX).

A Scheme of Agreement is a court-approved process between a company and its shareholders or creditors, by which the rights or liabilities of the shareholders or creditors may be altered. It requires the approval of the shareholders and other regulators.

The scheme of Agreement is in line with Petition Sections 353, 354 and 355 of Companies and Allied Matters Act No.3 of 2020 (as amended) (“CAMA 2020”).

FMN has received approval from the NGX and the Securities and Exchange Commission (SEC) to proceed with its buyout of minority shareholders. The next step involves filing for a Court-Ordered Meeting (COM) with the Federal High Court, where shareholders will vote on the proposal.

To pass, the resolution requires at least 75% approval from voting shareholders. FMN’s board has endorsed the move, citing the benefits of better alignment of its subsidiaries and resources, which will enhance the company’s growth and competitiveness in the food and agro-allied sector.