Dear Esteemed Reader,

What more can we say? You’ve been a great inspiration to us in the past year!

We are thrilled each time Paul rolls out figures from the backend of growing numbers of avid readers of each edition of our newsletter, Data Dives. He says the same of our news stories on the Dataphyte Website.

The occasional feedback we get, the healthy criticism, and the friendly praise also encourage us to move on.

So, this is 2024! And we are presenting new offerings from Dataphyte’s Insight Team. One of them is the Marina and Maitama Newsletter on Thursdays.

This weekly brief showcases our analysis of salient and recent developments in the corporate sector (Marina) and our musings on matters of public policy (Maitama).

Here’s to new beginnings!

From the Dataphyte Insight Team

Half of a Yello Glo

By January 18, 2024, Glo subscribers will no longer be able to make calls to MTN, but they can still receive calls from MTN lines. This partial disconnection is a regulatory measure to address the outstanding debt and ensure financial compliance within the telecom industry.

The Nigerian Communications Commission (NCC) gave a nod to MTN to bar incoming calls from Glo subscribers over interconnection debts owed by Glo, speculated to run into billions of Naira.

This half-way communication between MTN’s Yello! customers and Glo’s may harm Globacom Limited more than MTN Nigeria Communications.

Glo has the second largest GSM subscribers in Nigeria, but it has not grown its customer base as fast as MTN and Airtel between September 2022 and March 2023, an analysis of NCC data shows. 9 Mobile subscribers are the least in number and in growth in the same period.

If MTN makes good the NCC’s directive, it stands to lose nothing more financially from the standoff, unlike Globacom.

The standoff could make Globacom lose some of its customers to MTN and Airtel, and its second place to Airtel. Airtel has been effective in growing its subscriber base lately with a 3.3% within the referenced 6 months, while Glo only grew its customers by 2.4%.

Globacom would do well to avoid these complications by settling its debts owed to MTN before the NCC’s deadline.

Beyond the Yello Glo: The Socioeconomic Risks

The NCC’s notice could have severe socioeconomic ramifications for the country beyond Globacom and its customers.

Social Risks: In areas, especially remote rural towns and villages, where the Glo network is the only functional network, the inability of Glo customers to call emergency numbers that are MTN lines may lead to untold hardship, risks, and even fatalities.

In these areas with Globacom network coverage alone, the option to port to other networks or purchase their new sims may not work since the other networks are not fully available there.

This may lead to health and security incidents in these places.

Further Risks of Oligopoly: Granted, Glo customers would be directly affected by the loss of service and may choose to switch to another network as a result.

However, this may force 61 million Glo customers to port to other networks, such as MTN, AIRTEL and 9MOBILE, even if those networks do not offer better tariff plans, better network services, or customer care services.

By narrowing people’s telephony options as this, the NCC directive may be encouraging a reversal to oligopoly in the telecoms sector.

Economic theory holds that when GSM Operators, like other firms, do not earn customers by superior service, they are not likely to work for the benefit of the customers.

Under oligopolistic conditions, even old customers of the other phone networks may be shown the shorter end in tariff and network services as market competition declines. The companies then become strong enough to dictate selfish terms of services to their customers.

Impact on Businesses: The barring of the GLO network by MTN would significantly affect businesses that rely on GLO for their communication needs. Companies that have GLO lines for their employees or use GLO as their primary network for business operations would experience disruptions. This could lead to decreased productivity, communication breakdowns, and potential financial losses.

However, in cities with options, Glo subscribers have the unlimited choice to port to other networks, regardless of the quality of service they receive in the new networks.

Businesses and individuals using MTN may also be forced to spend more on calls to glo customers, especially in situations where the glo customer should have been the one calling or calling back.

ASI’s new Altitude

On January 8, 2024, the Nigerian equities market crossed the 80,000 basis point historic mark with gains from 54 firms, signalling a promising start to the second week of January 2024.

The Nigerian Exchange Limited (NGX) All-Share Index (ASI) finished at 80,328.58 basis points on January 8, 2023, the first trading day of the second week of January, up from 79,664.66 basis points recorded on the last trading day of the first week of January.

The day the NGX’s All Share Index soared to its new altitude, 1.19 billion units were traded, totalling 15.26 billion naira. The top five gainers were JBERGER, CUTIX, JAIZBANK, LASACO, and CORNEST, and the top losers were DAARCOMM, ETERNA, CWG, PZ, and FIDELITYBANK.

Nigeria's All Share Index (ASI) serves as a crucial barometer for measuring the health and performance of the country's stock market.

The ASI aggregates the market values of all listed equities, providing investors and analysts with insights into the overall direction and sentiment of the market.

As of January 9, 2024, the ASI stood at 83,191.84 points, reflecting recent positive momentum and a head start towards approaching another milestone of 85,000 basis points.

Nigeria’s stock market depends on prevailing sentiments, much like any other stock market globally. Based on forecasts and suggestions, investors' financial decisions have changed, resulting in these modifications and milestone breaks.

The stock market plays a significant role in a nation’s economy and is closely related to that nation’s stability on the international and domestic levels.

The performance of the ASI has significant implications for the Nigerian economy.

A rising ASI often indicates confidence in the market, attracting domestic and foreign investors. This influx of investment capital can stimulate economic growth, foster job creation, and contribute to overall financial stability.

Could Betta Edu Do Better?

The Minister of Humanitarian Affairs and Poverty Alleviation, Betta Edu, has been suspended amid allegations of a N585 million scandal related to her office.

The funds (N585 million), intended for the Federal Government's Grant for Vulnerable Groups' programs and activities, were allegedly directed into a private account, contravening Nigeria's Financial Regulations.

Specifically, the payments were meant to be disbursed to vulnerable groups in Akwa-Ibom, Lagos, Cross-River and Ogun.

The allegation has triggered public outrage and condemnation, raising questions about its legality. In response to the allegation, Dr Betta Edu described the act as legal and common practice in the Nigerian Civil Service.

The transfer of public funds into a private account contradicted Nigeria's Financial Regulations law, which clearly states that public funds be separated from personal accounts.

Source: Financial Regulations (2009)

Transferring public funds to private accounts, according to the section of the law, is deemed to have been undertaken with fraudulent intention and has the potential to jeopardize public assets.

Interestingly, this is happening at the time the minister's predecessor, Sadiya Umar-Farouq is also facing questioning from the EFCC over a N37.1 billion fraud allegation during her tenure as a minister. This may be seen as a mere coincidence but raises concerns about the integrity of the ministry.

This can result in a loss of trust, hindering aid delivery and exacerbating the suffering of those in need. Consequently, a program designed to safeguard people may inadvertently have the opposite effect.

Betta Edu Could Do Better

Betta Edu had a high-flying career as a scholar and politician but does not have that much impressive history either with honest public conduct or as a humanitarian, which is what her primary medical discipline is all about.

On paper, her humanitarian scholarship, at least in medicine, should have fitted her for such a role as the Minister for Humanitarian Affairs and Poverty Alleviation. Yet, her past performance in that role raises doubts.

As to her scholarship, it is believed she completed her secondary education in 2001 at the Federal Government Girls College, Calabar and obtained her first degree in medicine and surgery from the University of Calabar in 2009.

It is also believed she has a Post Graduate Diploma in Public Health for Developing Countries from the London School of Hygiene & Tropical Medicine, a master's degree in Public Health in Developing Countries from the London School of Hygiene & Tropical Medicine, and a Doctor of Public Health from Texila American University, her profile on WIkipedia read.

Betta Edu’s profile on Wikipedia further revealed that:

Edu is a Fellow of the Royal School of Public Health and the African Institute of Public Health Professionals.

As to her political career, Betta Edu was either the first or youngest to achieve a political feat.

Edu became the youngest person to be appointed Special Adviser to the Executive Governor of Cross River State Benedict Ayade on Community and Primary Healthcare in 2015.

In 2020, she became chairman of the Cross River State COVID-19 Taskforce. In August of that year, she was appointed National Chairman of the Nigeria Health Commissioners Forum.

Betta Edu became the youngest national woman leader of the All Progressives Congress (APC) in March 2022.

With her appointment In August 2023 as the Minister of Humanitarian Affairs and Poverty Alleviation, she became the first female minister from Cross River State and the youngest minister at the Federal Executive Council of Nigeria in the Fourth Nigerian Republic.

Not with a Tainted Humanitarian Career

As a medic, her time as the Cross Rivers State Commissioner for Health was controversial, especially in the state’s handling of the COVID-19 crisis.

The Nigerian Medical Association in Cross River State had to down tools and passed a vote of no confidence on the state Commissioner for Health, Betta Edu, over the “alleged unethical handling of COVID-19 crisis.”

Betta Edu was also accused of posting ventilators that were not available at the State’s COVID-19 treatment centre.

She denied all the allegations and classified them as purely political.

CBN and “Creepy Cryptos”

The Central Bank of Nigeria(CBN) announced its approval of the launch of cNGN Stablecoin on February 27, 2024.

The cNGN (compliant Nigerian Naira Stablecoin) is a digital currency developed by a group of financial institutions, fintech and blockchain experts known as the Africa Stablecoin Consortium.

This initiative is a direct response to the CBN's recent shift in regulatory policies on virtual assets, signifying a strategic move in the evolving landscape of digital financial instruments.

Interestingly, the CBN once regarded cryptocurrencies as creepy and unsafe for the country's financial system.

In 2021, it declared cryptos such as Bitcoin, Ethereum, and other digital currencies illegal. It banned banks and other financial institutions from facilitating accounts for cryptocurrency service providers.

The rationale behind this decision was primarily rooted in concerns related to the potential risks associated with unregulated digital assets, including issues related to fraud, money laundering, and consumer protection.

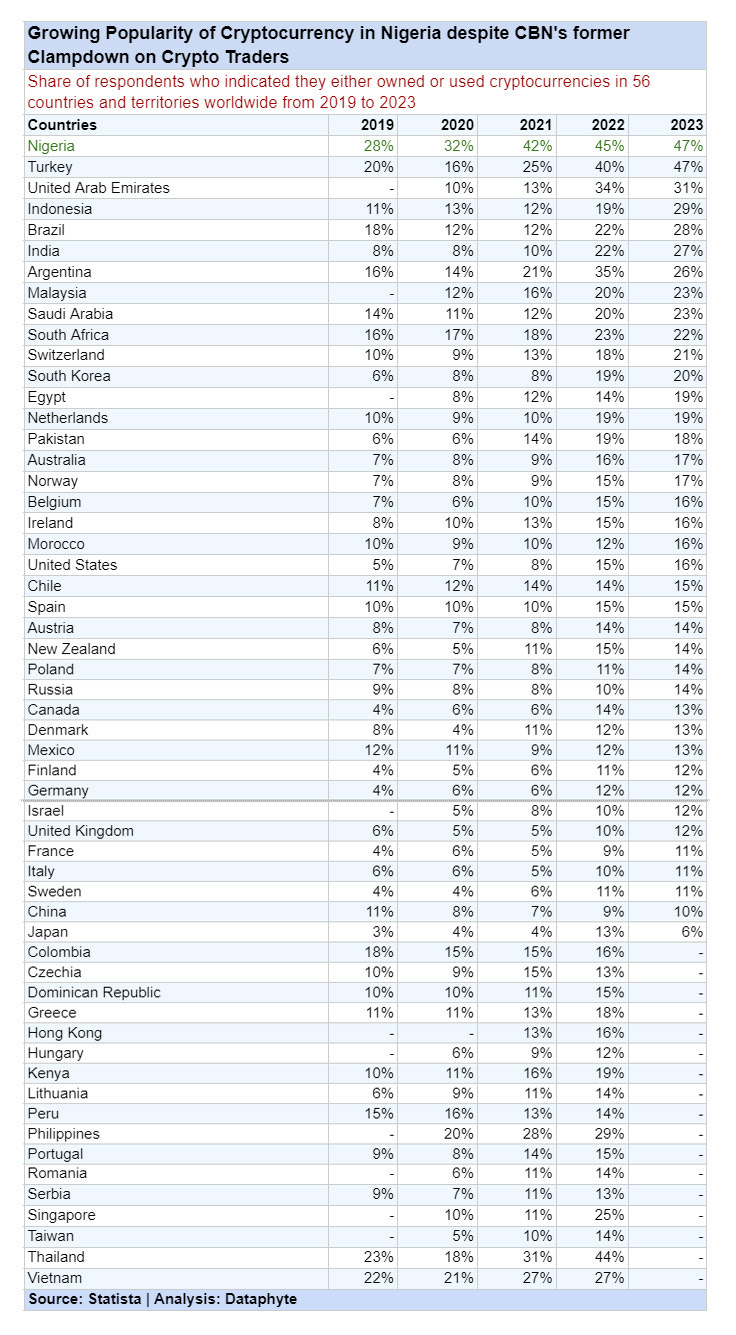

Despite the clampdown, Nigeria still maintains one of the highest Crypto adoption rates globally, with a 47% popularity, according to a survey published by Statista.

The African Stablecoin Consortium plans for the cNGN to work alongside the eNaira, bridging the gap between traditional money and digital assets. Its purpose is to facilitate fast and secure cross-border trades in Naira, offering a more efficient way for Nigerians to send remittances.

Pegged at 1:1, the cNGN Stablecoin has the capacity to turn the Naira into a global currency for worldwide remittances, trade, and investment. This will increase international acceptance of the currency, facilitate cross-border transactions, and potentially attract foreign investment.

Debt Budget Gets Burdensome

Nigeria's debt servicing budget has witnessed a substantial increase from 2015 to the present, reflecting the country's growing debt burden.

In 2015, the budget stood at ₦950 billion, escalating to an awful ₦8.25 trillion in 2024. This “massive” rise raises concerns about the sustainability and implications for the Nigerian economy.

Nigeria’s 2024 budget for debt servicing is 30 per cent higher than the budget for 2023 and 768 per cent higher than the budget for debt servicing in 2015.

The surge in debt servicing may limit the fiscal space for crucial developmental projects, hindering economic growth. It also highlights the challenge of managing the debt-to-revenue ratio, potentially exposing the country to debt-related vulnerabilities.

A substantial portion of the budget is allocated to service debts, diverting resources from essential sectors such as healthcare, education, and infrastructure.

The implications of this trend include a heightened risk of debt distress, increased dependency on external financing, and potential negative impacts on credit ratings.

Such challenges can hinder the government's ability to respond to economic shocks effectively.

Nigeria must implement prudent debt management strategies to address these issues, enhance revenue generation, and prioritise projects stimulating economic growth.

It is crucial to build institutions, adopt cost-effective policies, and diversify revenue streams in order to improve fiscal discipline.

This can promote sustainable economic development and lessen the negative effects of the growing debt servicing budget.