Heritage Bank Loses License Again

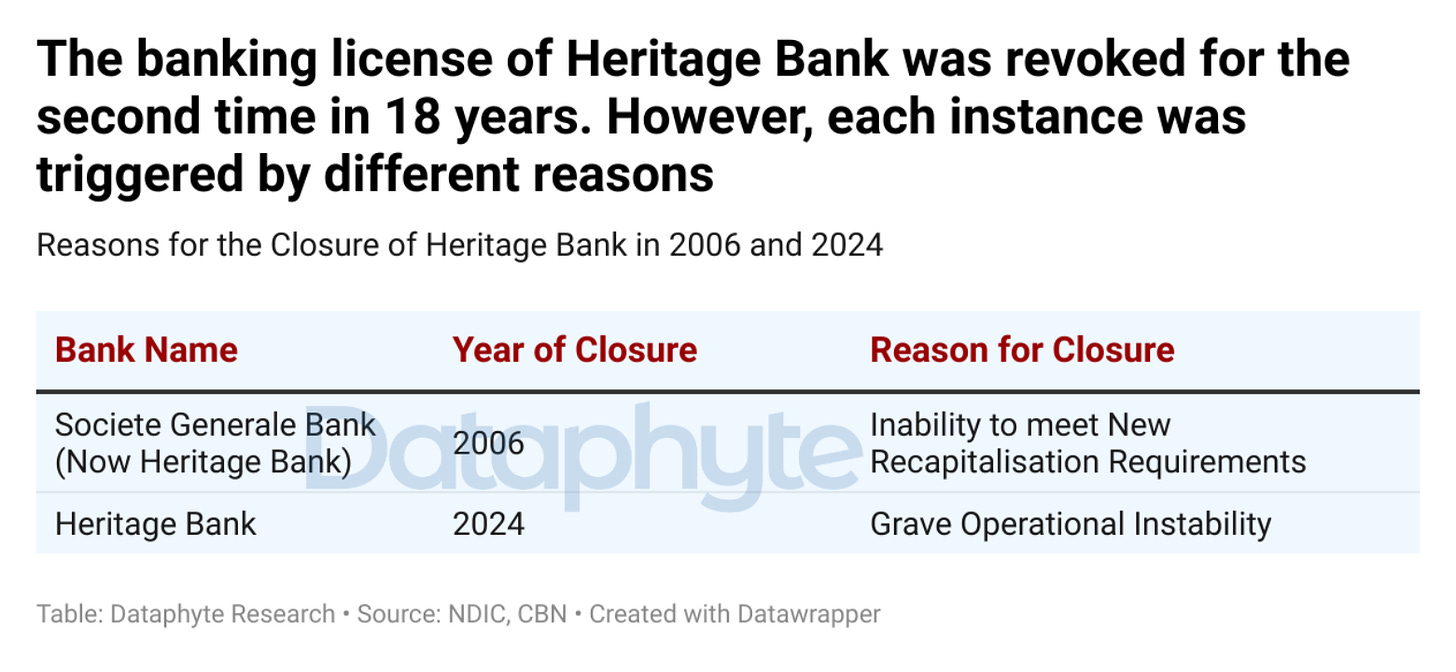

The Central Bank of Nigeria (CBN) revoked the banking license of Heritage Bank for the second time in 18 years.

First as Societe Generale Bank in 2006 and now in 2024 as Heritage Bank Plc.

Twice, both scenarios paint a stark picture of the bank’s turbulent journey with regulatory compliance in relation to financial adequacy and operational stability.

In 2006, the Central Bank of Nigeria (CBN) revoked the banking license of Societe Generale Bank and 13 other banks that failed to meet the new capital requirements of N25 billion during the banks' recapitalization program.

The story took a positive turn in 2012 when International Energy Insurance Investments Ltd (IEI) acquired the defunct Societe Generale Bank of Nigeria’s license from the CBN.

Afterwards, Heritage Bank Plc emerged and began its operations in Nigeria as a regional bank on March 14, 2013.

According to the CBN, “A Commercial Bank with regional banking authorisation shall be entitled to carry on its banking business operations within a minimum of six (6) and a maximum of twelve (12) contiguous States of the Federation, lying within not more than two (2) Geo-Political Zones of the Federation, as well as within the Federal Capital Territory.”

However, on June 3, 2024, the apex bank again revoked Heritage Bank’s banking license due to its inability to improve financial performance, constituting a breach of Section 12(1) of the Banks and Other Financial Institutions Act (BOFIA) 2020.

Both scenarios suggest the bank struggles with business readiness and resilience.

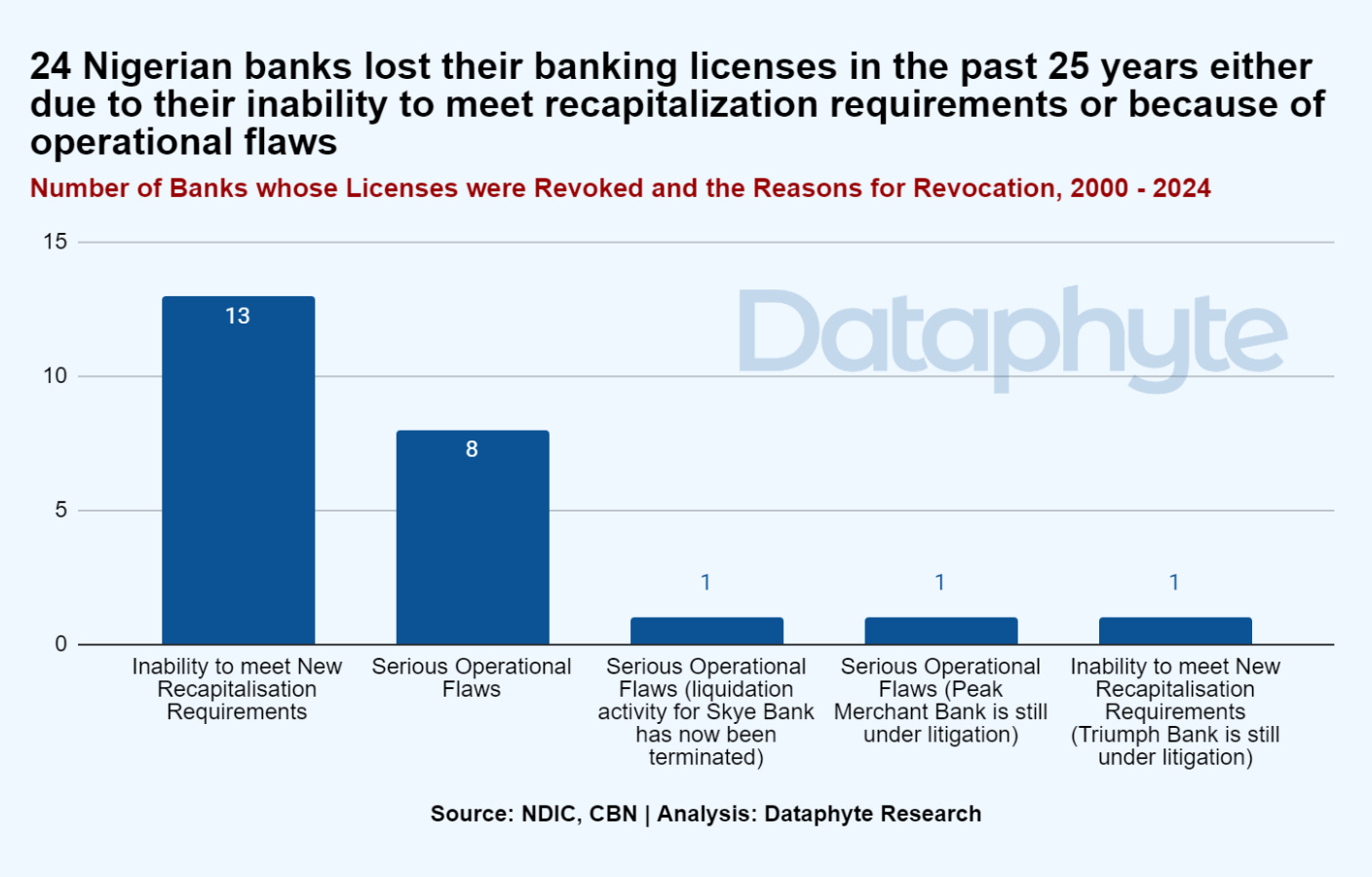

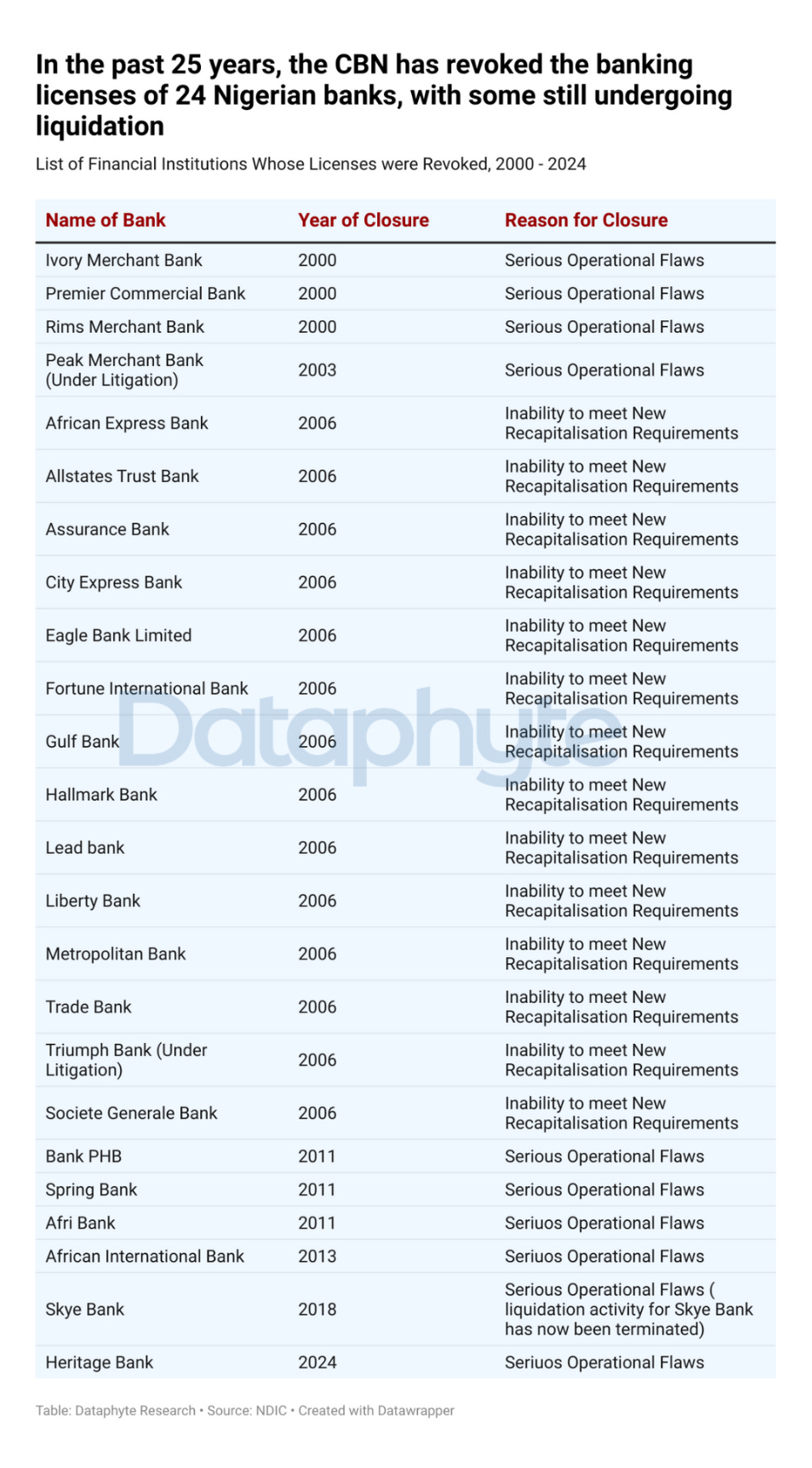

According to the Nigeria Deposit Insurance Corporation (NDIC), the CBN revoked the licenses of 24 banks between 2000 and 2024. Some of them are still under liquidation.

Of these banks, the winding-up orders for the defunct Triumph Bank and Peak Merchant Bank remain unresolved, as they are still under litigation being challenged and are still pending in court.

Similarly, liquidation activity has been terminated for Skye Bank.

In the case of Heritage Bank, NDIC has commenced the liquidation process and has started the payment of insured deposits to the bank depositors.

When a bank shuts down, it signifies a critical and often irreversible situation.

Bank closures could undermine public confidence in the banking system and create a negative impression among depositors and the public.

To allay the fears of depositors, the CBN usually appoints the Nigeria Deposit Insurance Corporation (NDIC) for the liquidation of closed banks’ assets.

As highlighted in the BOFIA Act 2020, the banking license of a bank can be revoked for different reasons. First, when a bank ceases to operate the type of banking business for which the license was issued for 6 months or when a bank goes into liquidation or has insufficient assets to meet its liabilities.

To ensure banks don’t fail easily, the CBN, as the apex regulatory authority for banks and other financial institutions, ensures the safety and soundness of the financial system.

Bank Recapitalisation: Fidelity Bank Launches Right Issue and Public Offer

Fidelity Bank launched a Rights Issue and Public Offer as part of its strategy to meet the new recapitalization requirements.

The bank is raising capital of N127.1 billion through a combination of a rights issue of 3.2 billion ordinary shares of 50 kobo each at N9.25 per share and a public offer of 10 billion ordinary shares of 50 kobo each at N9.75 per share.

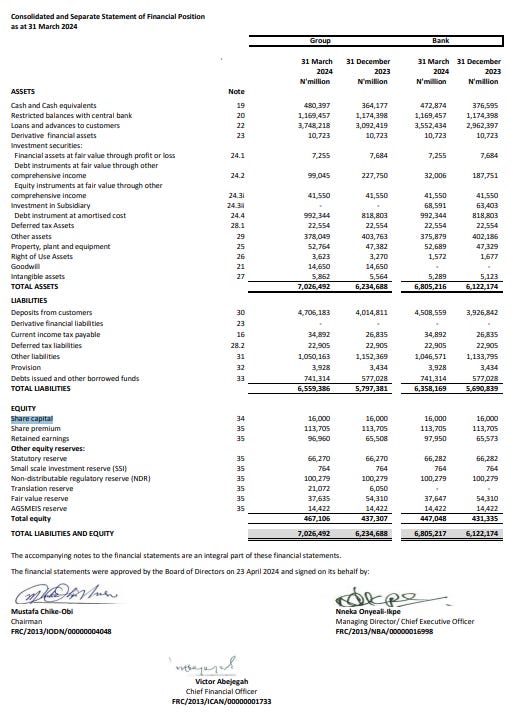

As of the first quarter of 2024, the Bank had a Share Premium of 113.71 billion and a Share Capital of N16 billion.

The Rights Issue and Public Offer brings Fidelity Bank closer to meet the CBN capital requirement and to strengthen its financial assets.

Fidelity Bank Finacial Statement, Q1, 2024

Source: Fidelity Bank Financial Statement, Nigerian Exchange Group

In March 2024, the Central Bank of Nigeria introduced new capital requirements for all Nigerian banks both at the regional, national, and international levels.

The recapitalization exercise aims to ensure that banks maintain sufficient capital to withstand external and domestic economic shocks.

The CBN revised the new capital requirement for commercial banks with international licenses, increasing it from N50 billion to N500 billion.

The CBN also adjusted the minimum capital that national banks can hold from N25 billion to N200 billion, while they now require regional banks to hold a minimum of N50 billion, up from N10 billion.

A rights issue can be a strategy for a company to finance growth initiatives, such as acquiring other businesses or expanding operations. Although this may dilute existing shares due to the issuance of additional shares, the company's expansion has the potential to enhance capital gains in the long run.

Thanks for reading this edition of Marina and Maitama. It was written by Funmilayo Babatunde and edited by Oluseyi Olufemi.