The Central Bank of Nigeria recently released its Household Expectation Survey for January 2025. The survey, which is conducted monthly, samples around 1,600 households to investigate their financial priorities and find out their expectations for the economy in the coming months.

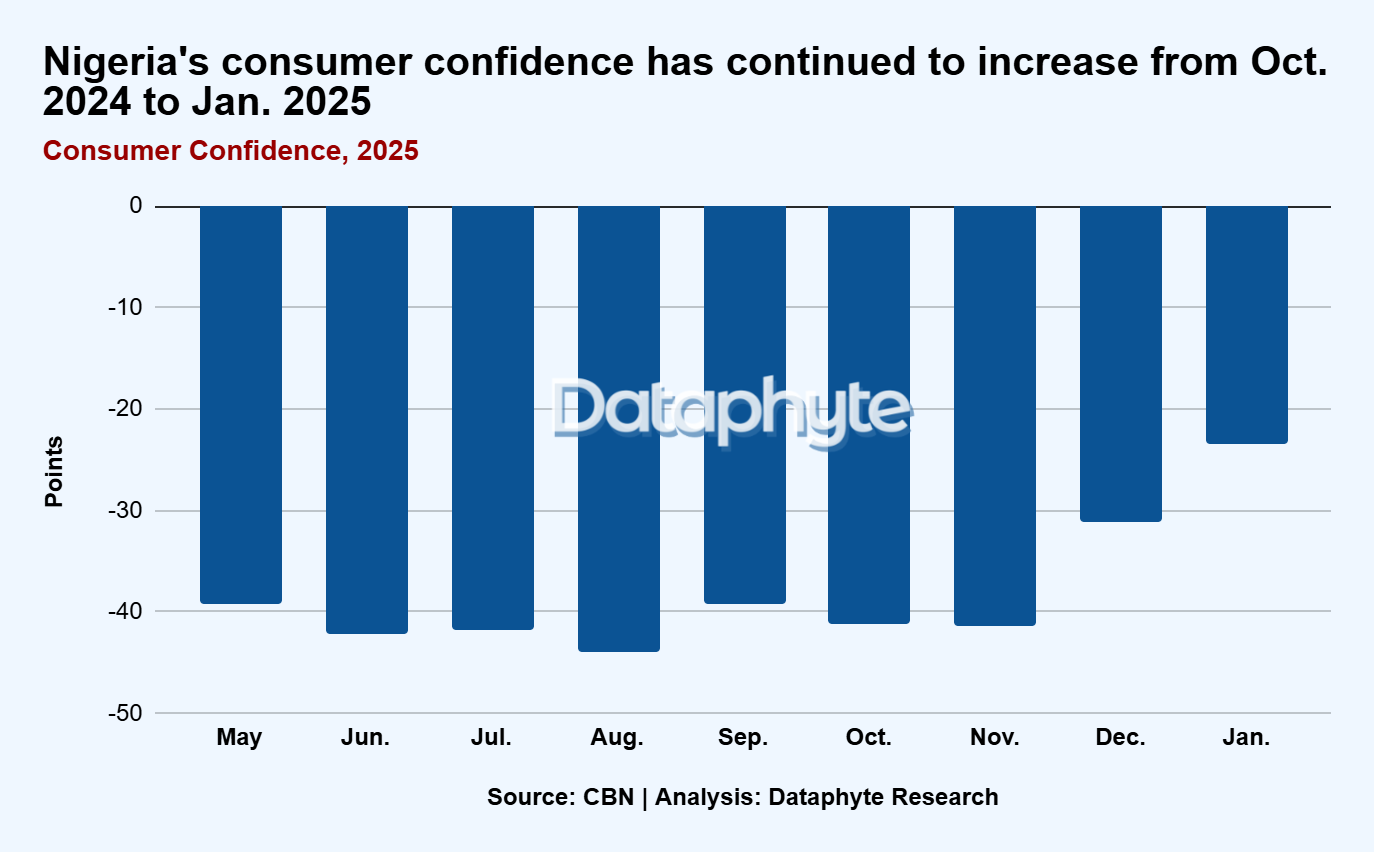

The first thing to note about the report is the improvement of sentiment. Though it is still negative overall at -23.5, it has shown a strong improvement from a low point of -44 points in August 2024. That is a positive swing of 20.5 points. It may be the first sign of a gradual shift in consumer sentiment as prices of food and fuel begin to be relatively more stable compared to recent months.

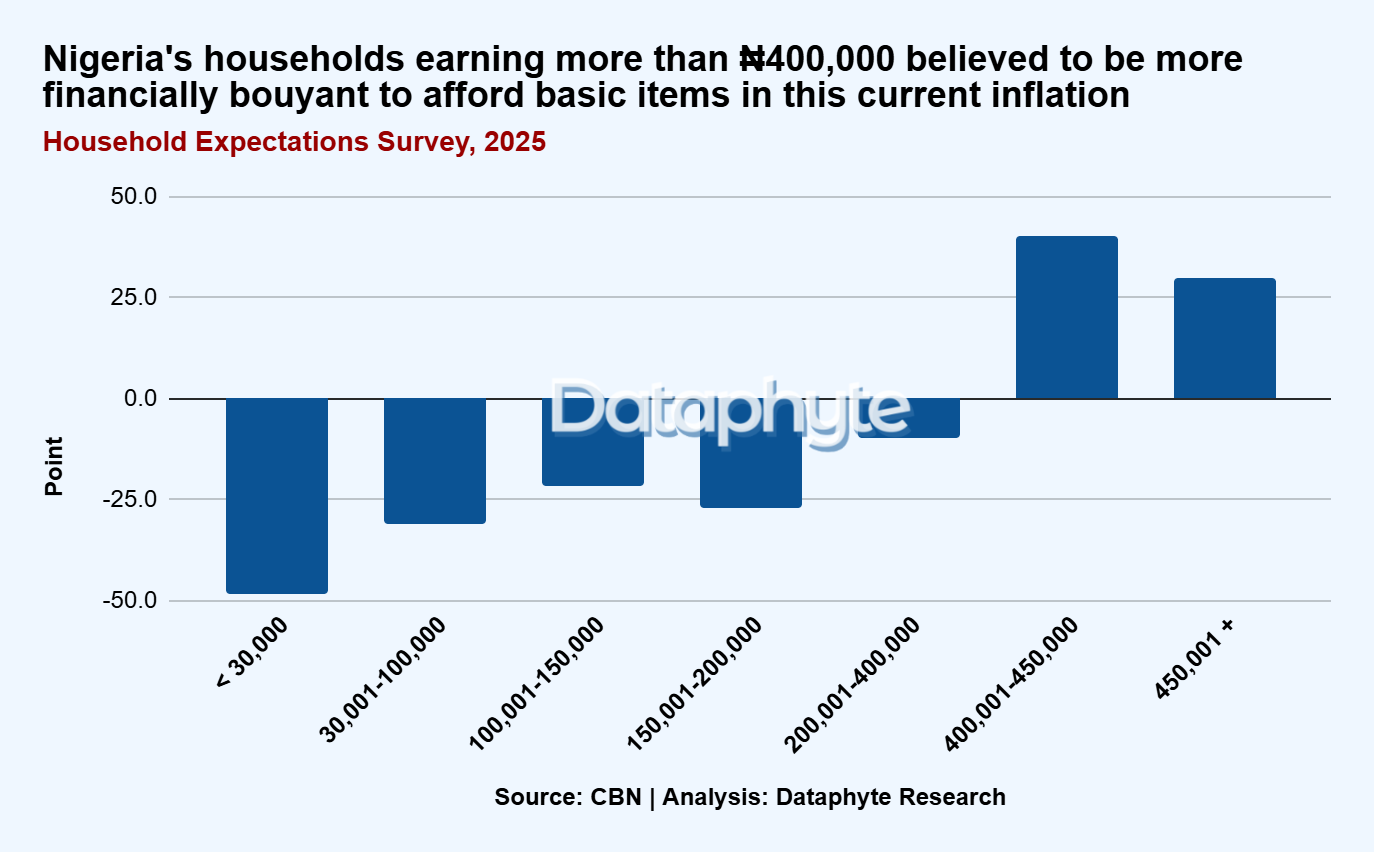

Looking closer at the data and disaggregating by income, it is observed that the improvement in sentiment for January is largely driven by the respondents in the two highest income groups, that is, households that earn between ₦400,000 - ₦450,000 per month and those that earn more than ₦450,000 per month. Both groups had strongly positive consumer confidence in the month under review, though the ₦450,000 per month income group saw a reduction in confidence compared to December 2024.

At the same time, the improvement in sentiment is shared by all income groups, even though the overall sentiment remained negative. The month-on-month improvement ranged from 9.1 points for the lowest income group, to 40 points for the ₦400,000 - ₦450,000 income group.

Economic Conditions

The improvement in overall sentiment is mirrored in the various categories measured by the survey, which are ‘economic condition’ which is the perception of the country’s economic condition; ‘family financial situation’, which refers to the level of savings, investments and other assets, when compared to outstanding debts; and last but not least, ‘family income’, which is primary income and receipts from other sources received by all family members as participants in any economic activity or as recipients of transfers, pensions, grants, and so on.

All three categories have seen an improvement in sentiment over the last 6 months by an average of 20 points.

The future

Respondents also seem fairly upbeat about the future. They are asked what they think of economic conditions in the next month, three months and six months. Here too, we see significant increases in optimism. For example, from a low point of -26.9 in November 2024, there has been an improvement of 17 points to -10.8 when respondents are asked what they think economic conditions will look like in the next month.

When broken down by ‘economic condition’, ‘family financial situation’ and ‘family income’, respondents are also much less pessimistic overall. Sentiment is positive overall for ‘economic condition’ and ‘family income’ in the next three months, with ‘family financial situation’ being only mildly negative in the same time frame.

Another aspect of the report is worth mentioning. In the next month, respondents’ household spending is projected to go up 9 points, 13 points in the next 3 months and 14 points in the next 6 months. Once again, this suggests growing optimism about future economic conditions.

Key drivers of inflation

According to the CBN, the major drivers of inflation perception in January include energy, transportation, and exchange rate. The same month, there was a report which shows how energy poverty keeps Nigerians poor. More than half of the population self-generates electricity for their household and industrial use, buying fuel at high prices.

In Nigeria, where the average household size is 5 people per household, the impact of a dysfunctional economy will be felt if there's no substantial income to keep up with the economic conditions. More essential is the reality of what the survey has shown. Even though the rebased CPI shows a decrease in the inflation rate, it does not mean that prices have reduced. It only means that prices are rising slower than before.

Renewed hope?

The CBN’s data makes it quite clear that respondents to the Household Expectations Survey think that the worst has passed economically. Since full deregulation of the downstream petroleum sector took effect in September, prices have moderated after the initial spike. This would go some way to explaining the improvement in consumer sentiment, as energy costs are a key driver of inflation perception among respondents.

What is required at this point is a continued focus on price stability, so that incomes can catch up with inflation. It is important that economic policies support this optimism.

Thanks for reading this edition of Pocket Science. It was written by Salako Emmanuel and edited by Joachim MacEbong.

Do you work at a Civil Society Organisation? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey:

Do you work for any government agency? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey: