The Federal Mortgage Bank of Nigeria (FMBN) has raised the mortgage ceiling for its National Housing Fund (NHF) from ₦15 million to ₦50 million to help bridge Nigeria’s housing deficit. The announcement was made at the 46th Kaduna International Trade Fair, held from February 14 to 23, 2025.

According to the FMBN, “The NHF scheme is for Nigerians in all sectors of the economy, particularly those within the low and medium-income levels who cannot afford commercial housing loans, such as civil servants, traders, artisans, and commercial drivers,” among others.

However, in order to tap into NHF benefits, any Nigerian in employment, whether self-employed or in paid employment, would be required to register on the platform and contribute 2.5% of their basic salary for at least six months. “The pool of funds created by the contributors nationwide becomes available to any contributor to borrow from, after contributing for a minimum of six months,” said the bank.

The increase in the NHF ceiling has been attributed to the rising demand from high-income earners in the private sector while still accommodating low and medium-income contributors.

Housing Deficit in Nigeria

Between 1991 and 2023, Nigeria’s housing deficit has increased from 7 million to 28 million. This 300% increase in the deficit has been attributed to a growing population without adequate supply of affordable housing. A research analyst, Elijah Okpara in his article on “The Current State of Housing Deficit in Nigeria”, noted that the housing deficit challenge has been further “exacerbated by (an) inefficient mortgage industry, diminishing income, and poverty,” among several factors across the country.

To tackle some of these challenges, the scheme broadened its solutions across four different levels: NHF Mortgage Loan, Individual NHF Construction Loan, Home Renovation Loan, Rent-to-Own Scheme, and Rental Assistance Scheme. These solutions are framed to cater to the diverse needs of Nigerians across all income brackets.

The ‘Rent-to-Own Scheme’, for example, allows Nigerians to own a residential property through rentals, albeit within the price range of the mortgage ceiling. Through the ‘Individual NHF Construction Loan’, individuals are able to apply for the loan either to develop a land or buy directly from government or private estate developers.

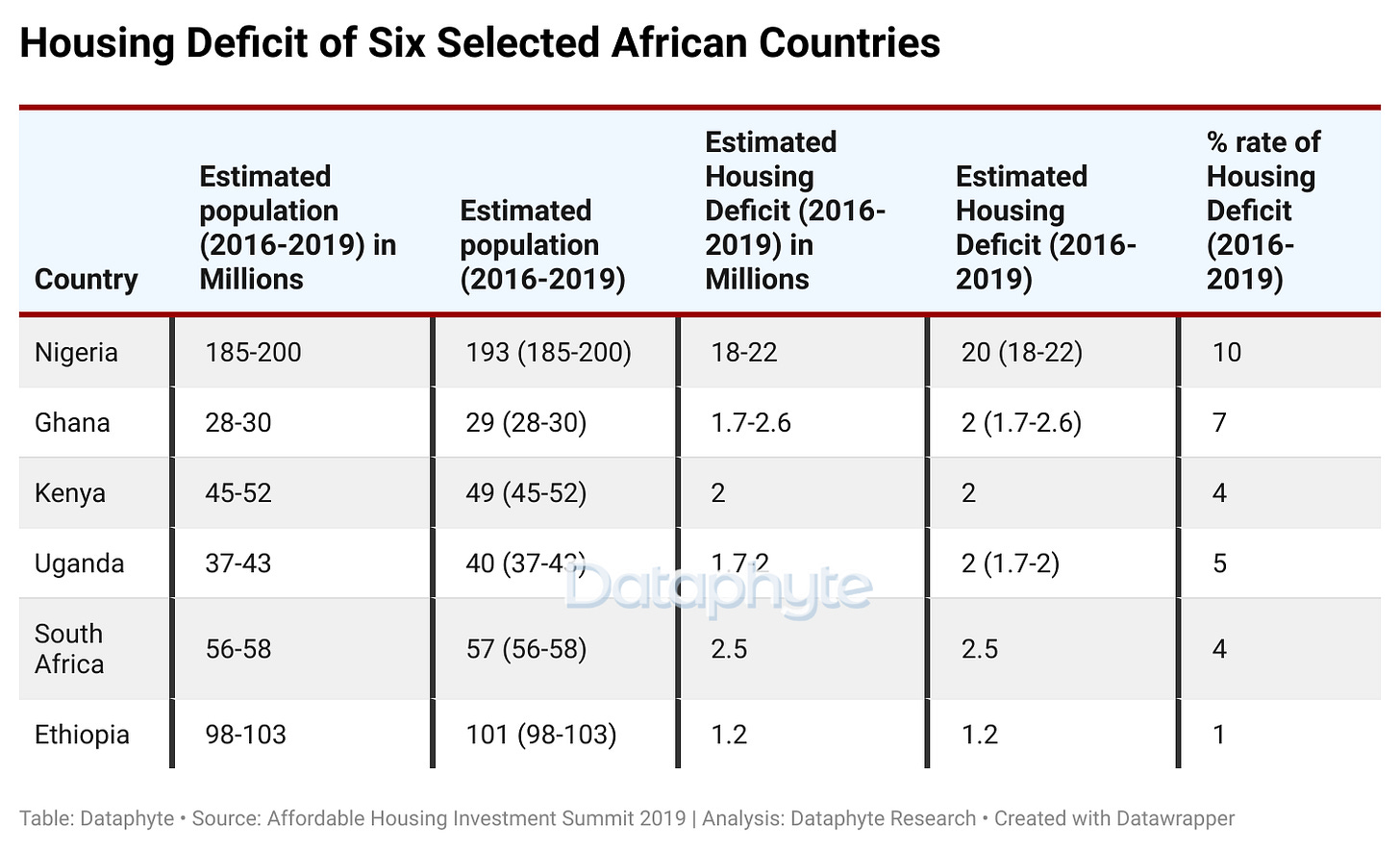

As of 2019, Nigeria had the highest estimated housing deficit among its closest African counterparts, including Ghana, South Africa, and Kenya. While each country's economic conditions and population dynamics are unique, the sheer percentage rate of housing deficit in Nigeria remains significant.

The illusion of affordable housing

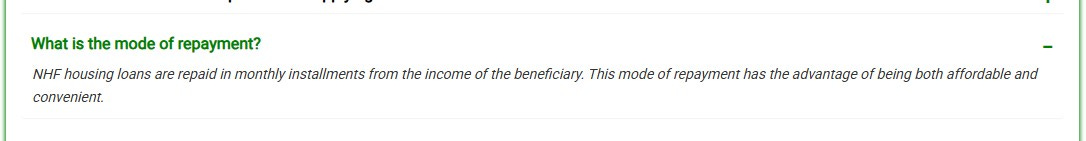

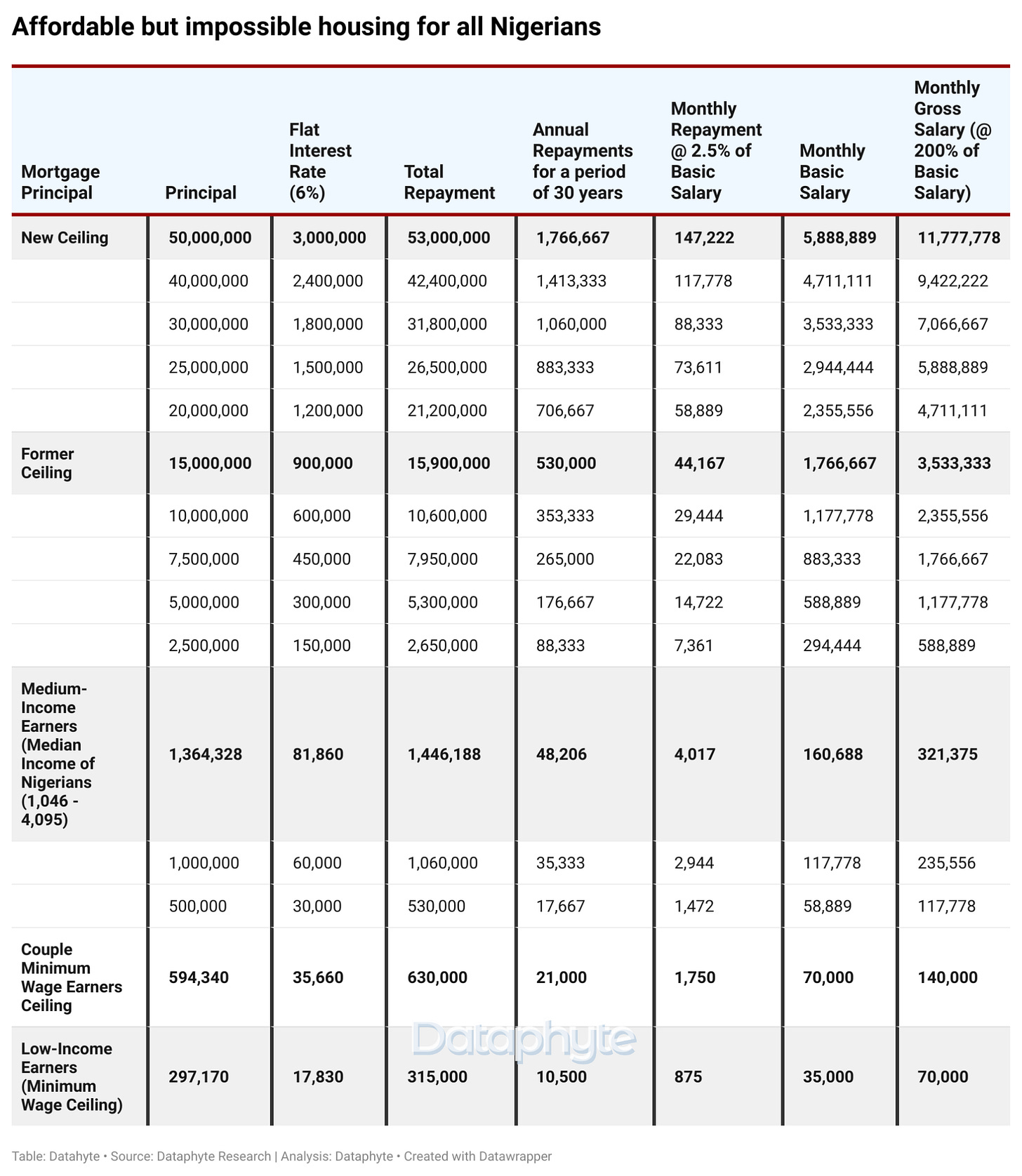

Since FMBN claims it is working towards “affordability and convenience” to tackle the housing deficit in Nigeria, an analysis by Dataphyte considered the possibility of an average income-earner in Nigeria securing FMBN’s mortgage loans, factoring the new ceiling, former ceiling, FMBN’s mortgage interest rate, and Nigerians' average basic salary, including minimum wage and the median income of Nigerians.

Source: NHF Web page

First of all, it is important to note that the loan repayment is up to 30 years, and the analysis assumed that the interest rate would be flat to reduce the financial burden on beneficiaries. The findings were equally able to show how much Nigerians with a certain basic salary can lend conveniently to buy land or build on it.

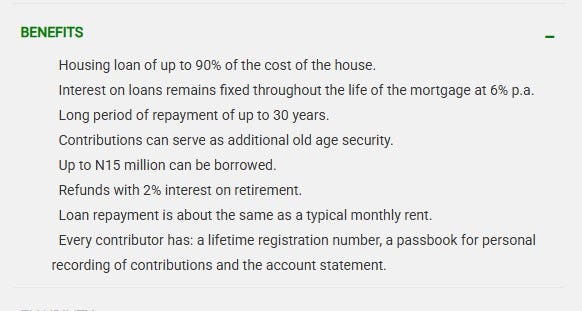

Benefits of Federal Mortgage Bank of Nigeria Loans

Source: NHF Web page

However, part of the results showed that high income earners are really the ones enjoying this benefit, rather than the low and middle income earners, contrary to the aim of this scheme.

According to the World Bank’s classification of Nigeria as a lower middle income country, the average income of a Nigerian ranges between $1,046 and $4,095 per annum, with a midpoint of $2,571 per annum. This is equivalent to an average of $214.25 or ₦321,375 per month gross salary or a basic salary of ₦160,688 (estimated at 50% of gross).

With this basic income, a middle-income Nigerian can seek a mortgage loan of ₦1,364,328 from FMBN to purchase land or build a house. However, given the rising cost of land and construction in Nigeria today, this loan amount may not be sufficient enough to cover all the expenses in view.

Similarly, for low-income earners who earn about the new minimum wage of ₦70,000. Even though they are open to about ₦297,170 of FMBN’s mortgage loan, it remains uncertain what kind of decent house this amount can build – for the average Nigerian family of five – needing a 2 or 3-bedroom flat.

This breakdown further highlights the loan's affordability due to its low interest rate and flexible repayment terms. However, while it may appeal to high-income earners, its true success will be determined by how many low and medium-income earners can benefit from it fully.

Based on this analysis, it is unlikely that the increased NHF ceiling will fix the housing deficit in Nigeria. Other fixes might suffice, but the latest raise in the loan ceiling from ₦15 million to ₦50 million may not have any significant impact in closing the gap.

However, Dataphyte proposes that low and medium-income earners can work towards increasing their income to be open to higher loan amounts before applying for it. This is due to the fact FMBN’s mortgage loan can only be accessed once in a lifetime.

Also, couples can agree to put their monthly basic salary together to attract more sufficient loans towards achieving their dream home. The bank states that “a prospective applicant who wishes to obtain a loan to build a house is expected to have his land as well as an acceptable title to the land.”

Couples, especially newlyweds who wish to take advantage of this scheme, may register their land in both couples’ names if they intend to combine their basic salaries to qualify for higher loan amounts.

Thanks for reading this edition of Pocket Science. It was written by Salako Emmanuel and edited by Joachim MacEbong.

Do you work at a Civil Society Organisation? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey:

Do you work for any government agency? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey: