How Trump’s tariffs might affect Nigeria’s consumer market

Donald Trump’s tariff announcements sent shockwaves through the rest of the world, beginning in the U.S. where the Dow Jones Index lost 500 points. A 25% tariff was placed on imports from Canada and Mexico, while a 10% tariff targeted Chinese goods, including textiles and electronics. Within hours of the announcement, these three countries responded with retaliatory tariffs, leading to trade war and raising concerns about inflation.

In Canada, the tariffs will primarily affect the automobile and auto parts industries, while Mexico faces restrictions on energy exports to the U.S., the world's largest economy. The tariffs, which were implemented on Monday, February 4, 2024, have faced criticism from countries that rely on foreign trade with the affected countries. Nigeria, for instance, has decades of economic ties with both China and the U.S. and could be vulnerable to this trade war if the tariffs remain in place.

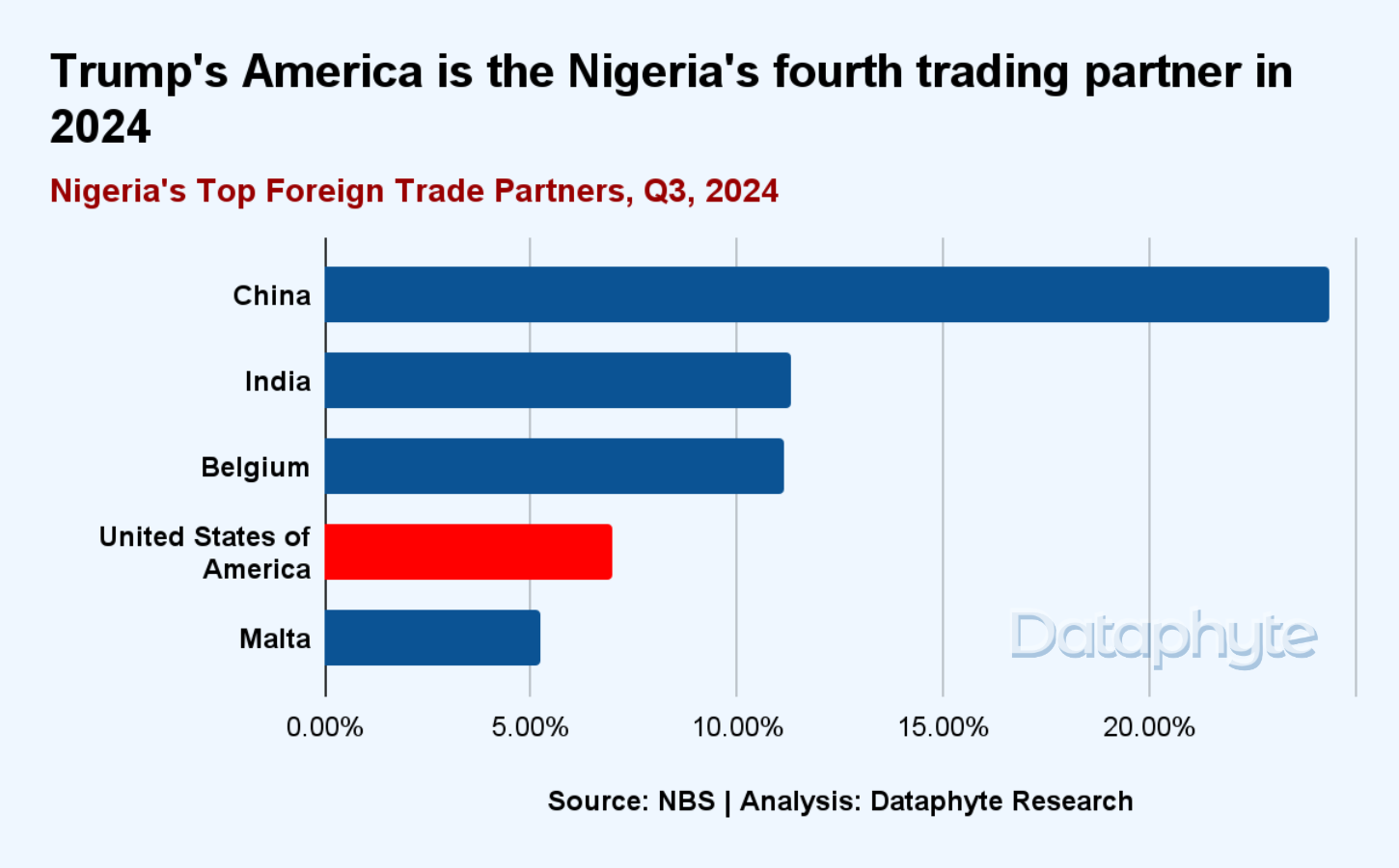

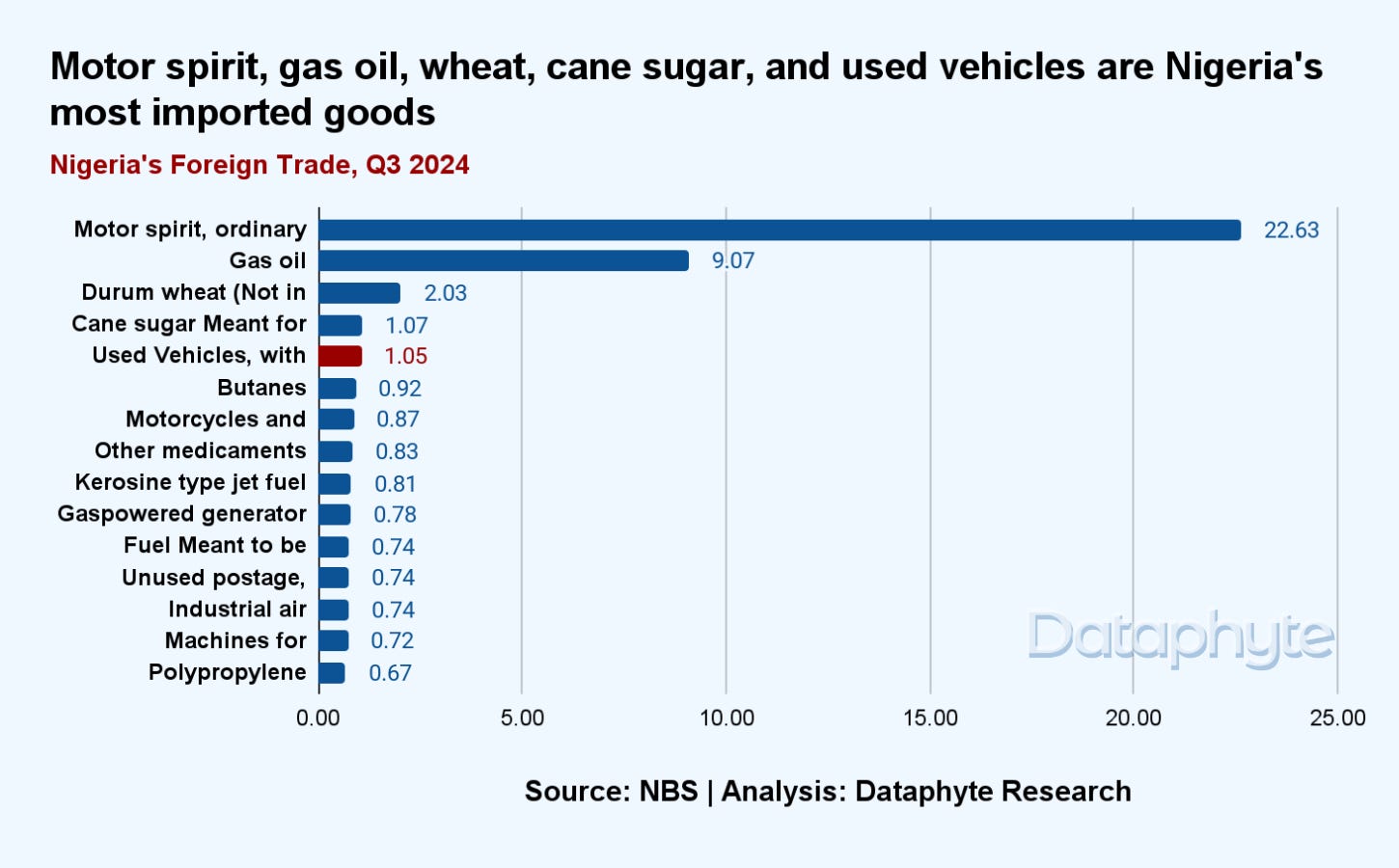

In 2024, the U.S. was Nigeria’s fourth largest trading partner after China, India, and Belgium respectively. Most of the goods Nigeria imported from the U.S. in that same year included machinery, vehicles, mineral fuels, and cereals. However, how will these tariffs affect these goods coming from the U.S. to Nigeria?

To put it this way, if the U.S. puts tariffs on goods from Canada and Mexico, what will be the cost effects when companies in those countries have to pay more money to sell their products to the U.S., and the U.S. sells those goods back to Nigeria?

This is the area Nigeria needs to look into considering the fact that most imported Nigerian goods are shipped from either the U.S. or China, and Nigerians will have to face the ripple effects of cost increase.

More dependent than independent

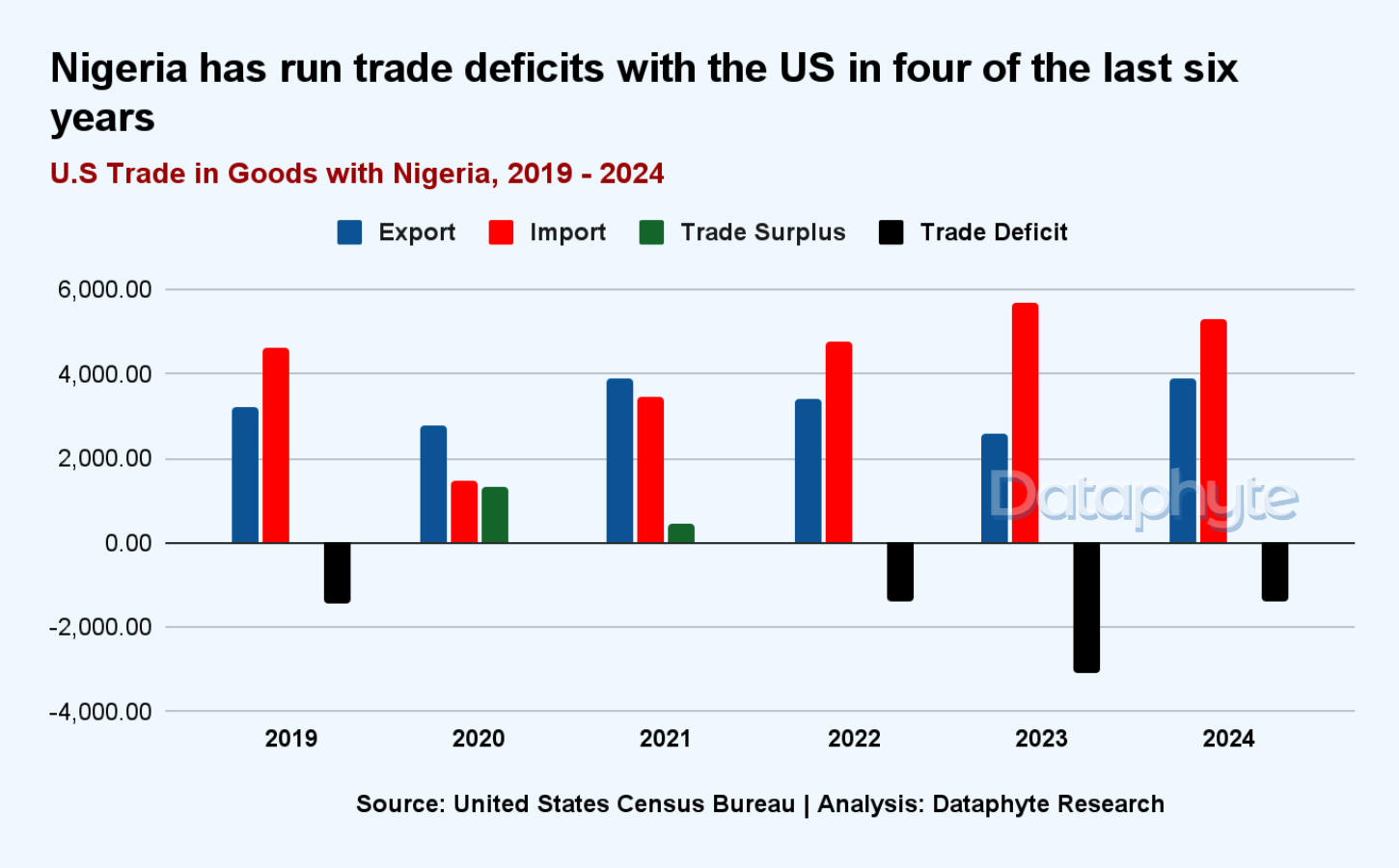

Nigeria’s trade relationship with the U.S. is shifting, but not in its favor. Data from the U.S. Census Bureau reveals a persistent trade deficit in 2022, 2023, and 2024, thanks to Nigeria’s reliance on the U.S. for imports. Take for example, Nigeria imported $3.24 billion worth of goods, with cars being the top imports valued at $580 million from the U.S in 2022.

Coupled to this effect is the fact that Nigeria’s naira has depreciated in value against the U.S. dollar, making imports more expensive. Only in 2024, the naira lost 82% of its value.

More pain than gain

Nigerians face more pain than gain from global trade wars and the effects of these tariffs are felt at home. This is not the first experience of trade war between the U.S and the other countries, imposing tariffs on each other’s imports. In 2018, during Trump's first administration, the U.S. raised tariffs on Chinese imports from 10% to 25% which subsequently affected about $200 billion worth of goods a year. According to Trump at the time, the tariffs were intended to pressure China into negotiating better trade terms. However, the consequences as reported were more of a disadvantage than an advantage.

What it means for Nigerians

Let’s take a car dealer for example. If the U.S. imposes tariffs on key trade partners like Canada and Mexico, the cost of vehicle production in those countries may increase. Since Nigeria imports a significant number of vehicles from the U.S., higher production costs could translate into higher prices for imported cars. This means that if cars are more expensive to buy abroad, Nigerians will buy them more expensively in Nigeria from the car dealers.

This could also compound the tariffs and levies paid on imported goods from Nigeria’s ports. In October 2024, the cost of clearing rose by 110.3 percent. Prior to naira devaluation, the cost increased from ₦770.88 to ₦1,621.259 per dollar in that same month.

However, to bypass these costs, the only options available are for Nigerians to buy cars from other markets like Europe or Asia. But more profitable is for Nigerians to invest more in buying Nigeria’s manufactured products such as locally assembled vehicles. Interestingly, Nigeria’s demand for imported vehicles such as used cars has been on decline for the last three quarters as reported here. This is likely the result of reduced purchasing power as inflation has risen, and with it, the cost of clearing cars.

A new era

Even though the implementation of the proposed tariffs on Canada and Mexico has been halted for the time being, it is clear that we are in a new phase of global trade relations, driven by the second coming of Donald Trump, which elevates perceived national interest over the existing trade relationships that have brought prosperity to much of the world over the last several decades. While countries look at ways to mitigate the effects of this protectionism, in the short and perhaps medium term it is consumers in many countries who will feel the pinch.

Thanks for reading this edition of Pocket Science. It was written by Salako Emmanuel and edited by Joachim MacEbong.

If you've read this far, now take 2 seconds to share: