Businesses and investors in Nigeria are contending with an unstable stock market as international market fluctuations continue to impact the value of domestic assets.

Since mid-2024, Nigeria's stock exchange has experienced increased volatility, primarily driven by US inflationary pressures and measures to curb the inflation that have affected emerging economies like Nigeria.

Domestic economic difficulties and concerns about global inflation, particularly from the United States, lie at the heart of this market instability. These issues are further exacerbated by inflationary pressures, a shortage of foreign currency, and the depreciation of Nigeria’s naira.

The Nigerian Exchange Group (NGX) reports that the All-Share Index has experienced gains and losses between August and October 2024.

The Nigerian stock market is not alone in facing this volatility. Global stock markets have also taken a hit, with Japan’s Nikkei 225 falling by 12.40% in a single day on 5th of August, 2024, the largest drop since 1987. Major indexes in Europe opened lower, recording losses between 1.7% and 2.8%, while US NASDAQ 100 futures saw a 5% decline.

Concerns over a potential US recession and disappointing July payroll data were the main causes of this market downturn. Additionally, the unwinding of Japanese yen positions has sent waves of volatility across global markets.

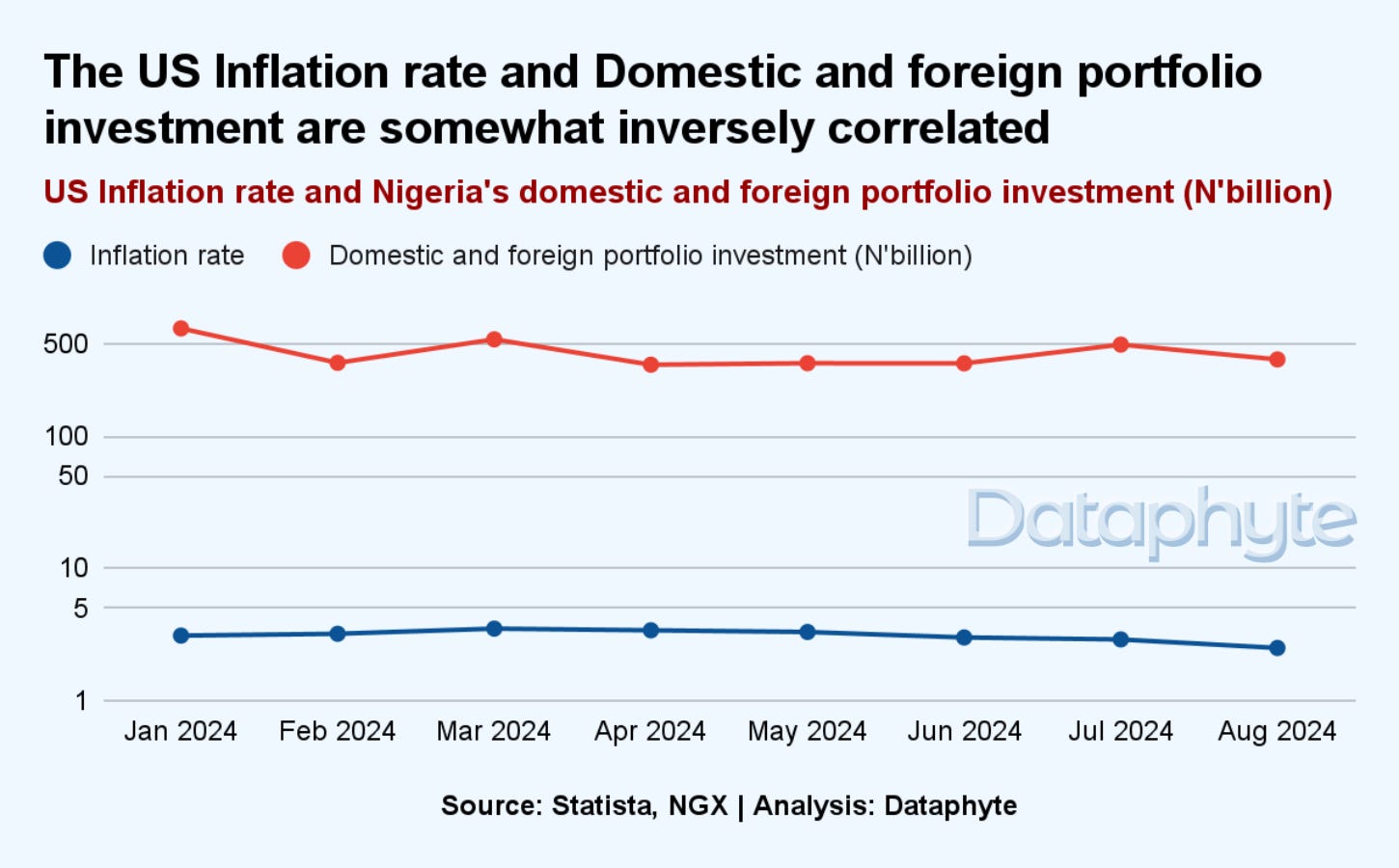

Data suggests a correlation between rising US inflation and decreased portfolio investment in Nigeria. This likely stems from capital flight as investors shift funds away from Nigeria, given the heightened tensions in global markets influenced by the US, the world's largest economy.

Rising U.S. inflation contributes to increased volatility in Nigeria’s stock market through capital outflows, currency depreciation, commodity price fluctuations, and reduced foreign investment.

US inflation not only drives up interest rates but also encourages capital flight as investors seek safer, higher-yielding assets abroad, which reduces liquidity in Nigerian markets.

In today’s volatile financial environment, identifying what constitutes a good or bad investment is crucial for achieving significant profits or avoiding substantial losses.

Nigeria’s fluctuating market conditions, inflationary pressures, and currency instability make it essential to assess which assets have performed well over time and which have not.

Dos and Don'ts of Investing

Investing in Nigeria’s stock market can be rewarding when approached with a sound strategy and discipline. Thoroughly researching companies, diversifying your portfolio across industries, and staying informed about both domestic and global economic trends are key to making informed investment decisions.

Long-term investments generally offer more stability, allowing investors to ride out market fluctuations. Regularly monitoring your investments and staying updated with market news also helps you stay aware of opportunities and risks.

However, it’s important to avoid impulsive investing without a plan, chasing quick profits, and relying on market rumours. Ignoring transaction fees or company fundamentals can lead to lower returns.

Concentrating all your investments in one stock or panic selling during market downturns are other risky behaviours to avoid.

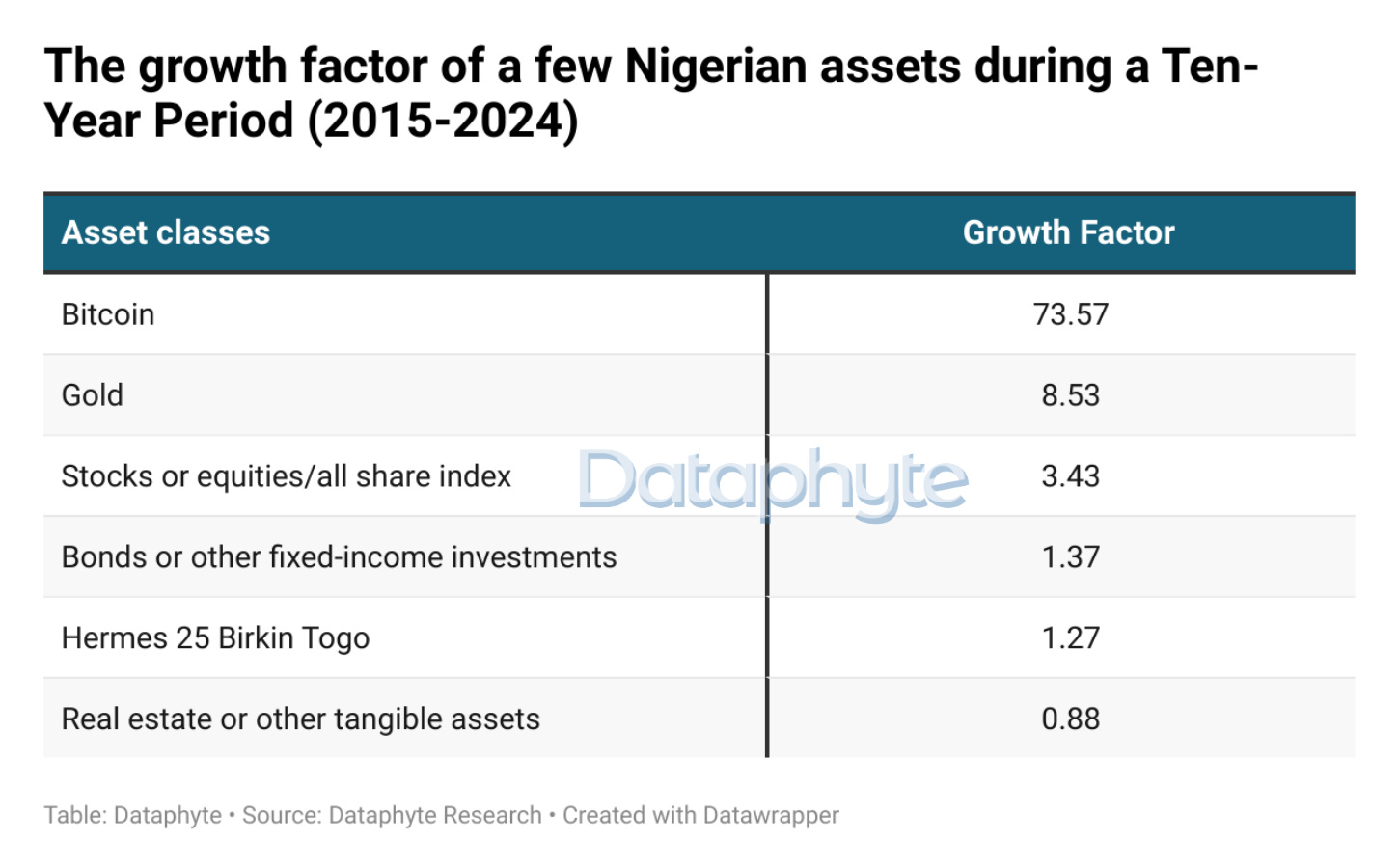

Diversification across asset classes is essential in light of the current economic difficulties. Bonds or real estate are safer investments that grow more slowly than high-growth assets like Bitcoin, but they also carry a higher risk.

As a result, investors might want to balance their portfolios with some of these assets to avoid excessive risk.

The growth values of various asset classes show a distinct difference between traditional, stable investments like bonds and real estate and high-risk, high-reward investments like Bitcoin.

Due to the ability to protect against inflation and currency depreciation, assets like gold and Bitcoin are more appealing in Nigeria, where these factors have a substantial impact on investor behaviour.

However, even though their returns have been modest, traditional assets like stocks, bonds, and real estate are still attractive options for investors looking for stability.

Thanks for reading this edition of Pocket Science. It was written by Adijat Kareem and edited by Joachim MacEbong.