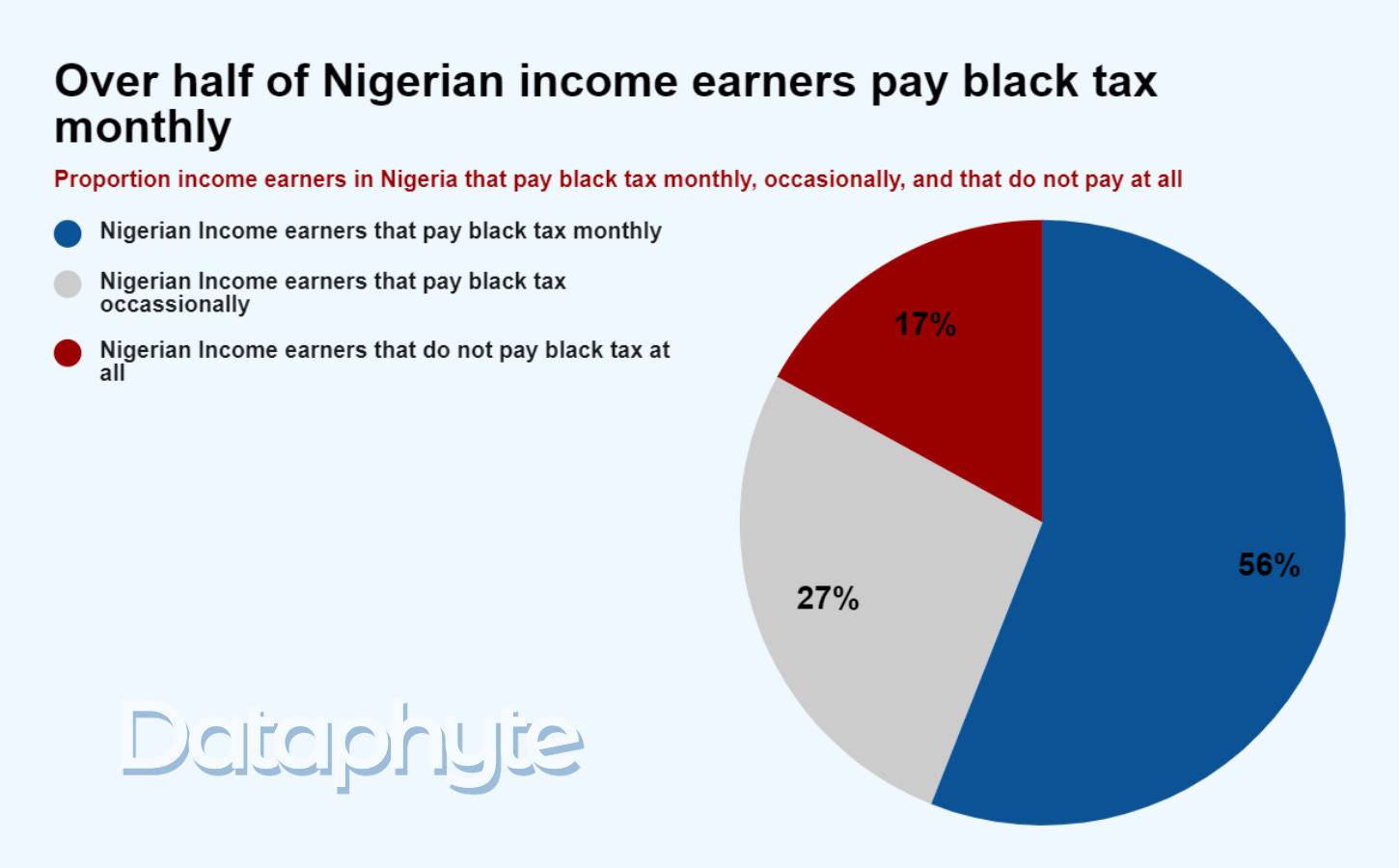

Over 4 in 5 Nigerians earning an income pay black tax, according to the 2023 Piggyvest Savings Report of 2023.

Of the 83% of Nigerians income earners who pay black tax, 56% pay it monthly, 27% pay occasionally. Only 17% do not pay black tax at all.

The term "black tax" describes the monetary assistance or gifts that working people give to their families frequently to meet necessities including daily living costs, healthcare, education and so on.

Black Tax: Social Burden

Black tax reduces the ability of the working class to save, invest, and manage their finances.

The impact of paying black tax on personal finances is greater in Nigeria due to the country's economic challenges, which include high unemployment, inflation, and rising living expenses.

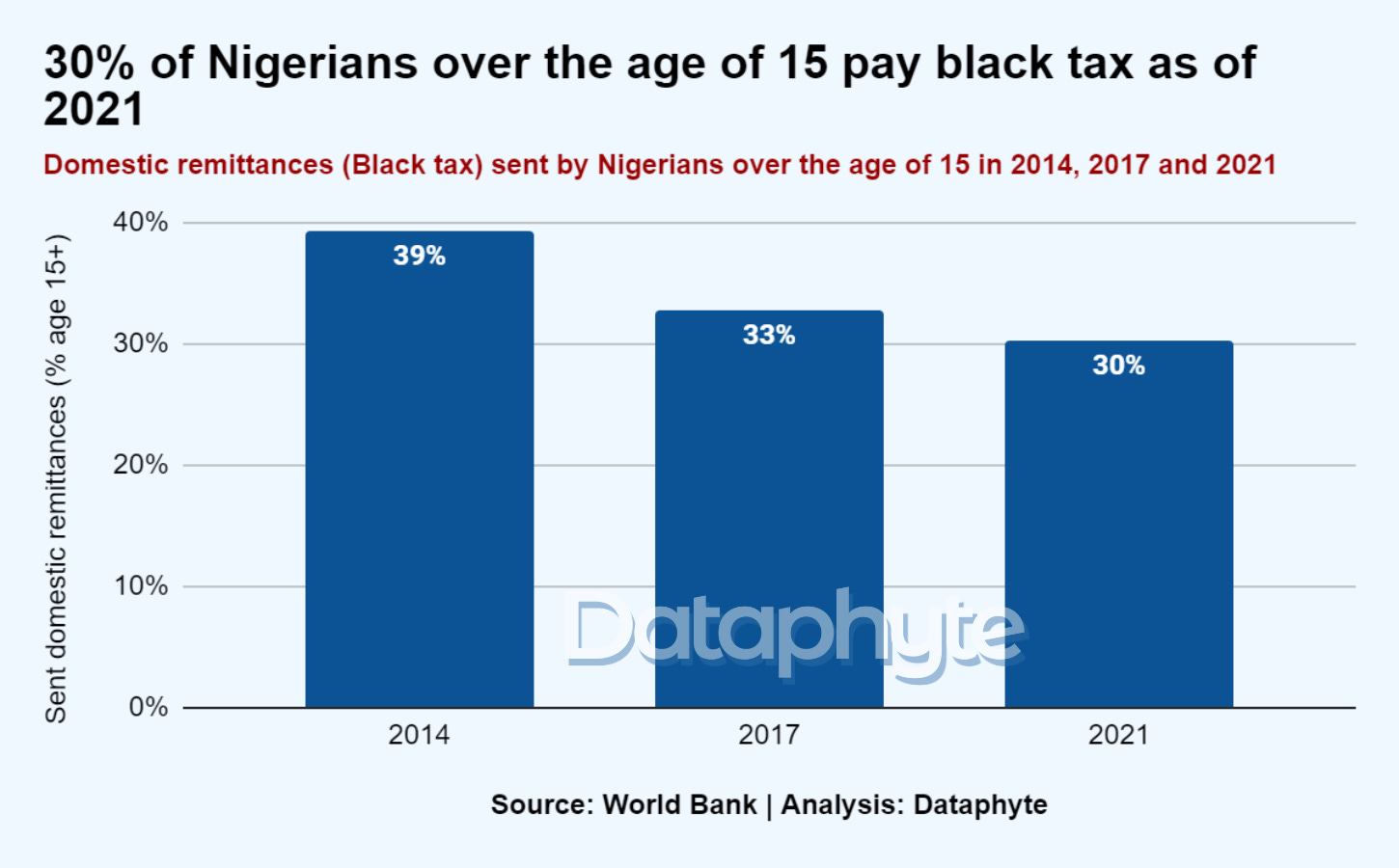

According to the World Bank, 30% of Nigerians over the age of 15 pay domestic remittances, often known as black tax as of 2021, which is 9% less than 2014.

However, presents or gifts provided to family members are not included in the World Bank’s estimation of domestic remittances. Rather, they only relate to money received via bank transfer or cash.

Although the practice of remitting black tax promotes social cohesiveness and solidarity, it can also put a heavy weight on those who are expected to provide, making it more difficult for them to meet their financial objectives and support economic progress, according to a research conducted by Development South African titled “Black Tax: Understanding the financial transfers of the emerging black middle class”

The first effect is that black tax causes financial strain on individuals. A large percentage of middle-class and young professionals' incomes is reportedly spent on providing for their extended families, which restricts their capacity to save or invest.

In light of the nation's record-high inflation rate and reduction in the real minimum wage, and a static minimum wage, the financial burden of the black tax makes these problems worse.

The static minimum wage of N30,000 calculated against the year-on-year inflation from 2019 to April 2024 shows that the real minimum wage declined yearly.

Every year, the real minimum wage falls by over N3,000.

Furthermore, young Nigerians may be discouraged from taking financial risks that are essential for economic growth and innovation, such as starting firms or funding further education, due to the obligation to support extended families.

The second effect is on the mental health of individuals. Those burdened with meeting the financial demands of their extended families often experience stress and mental health issues, impacting overall well-being and productivity.

Black Tax: Social Bonding

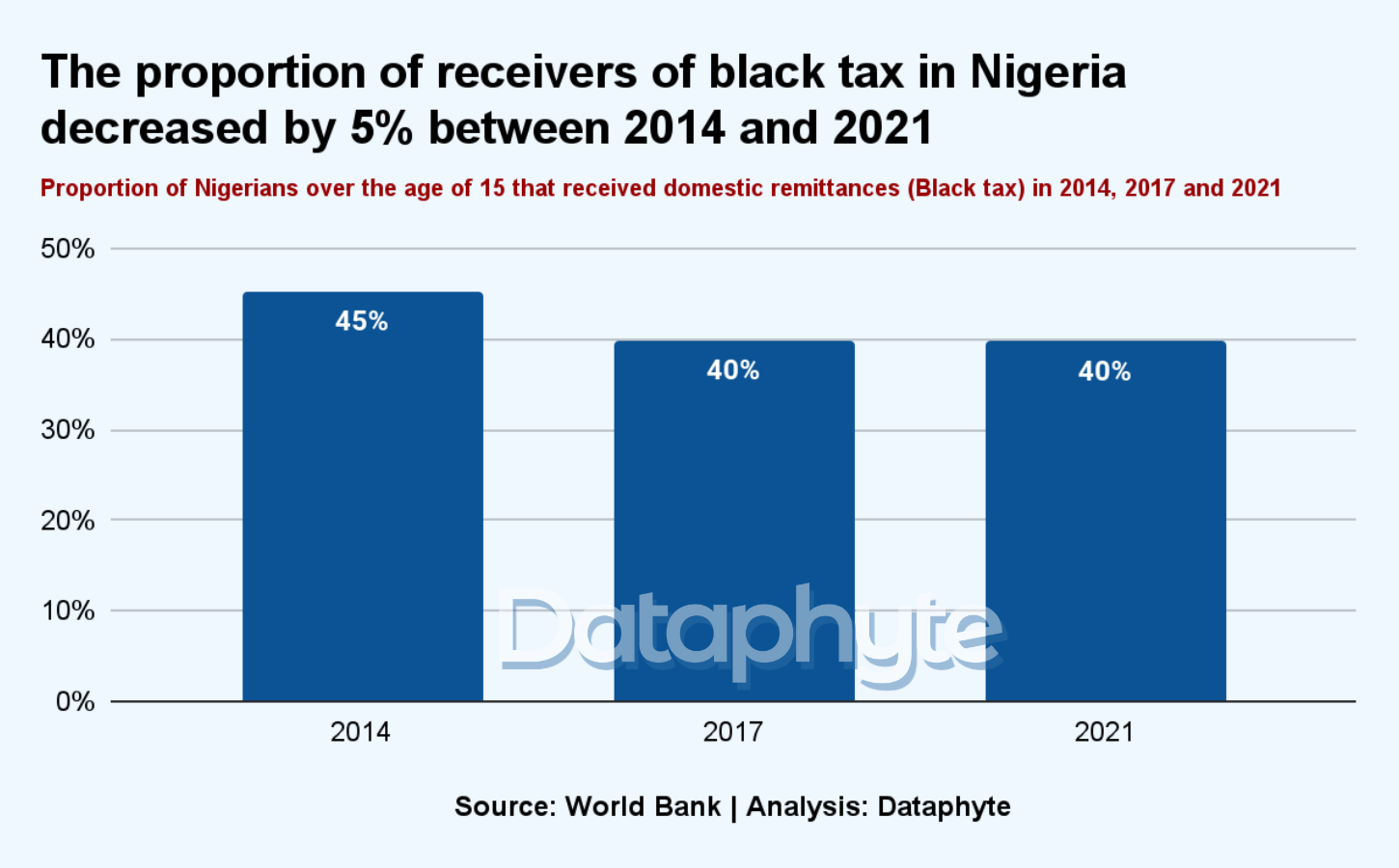

The proportion of Nigerians that receive black tax also reduced by 5% in 7 years. Indicating that less individuals in Nigeria over the age of 15 benefitted from black tax in 2021 compared to 2014.

A reduction in black tax received can lead to decreased access to essential services such as education, healthcare, and daily living expenses.

Many dependents rely on financial support from their relatives to pay school fees, settle medical bills, and fund basic necessities. Without this assistance, these critical needs may go unmet, adversely affecting their quality of life.

From the receiver’s perspective, black tax contributes to social stability by providing families with an essential safety net, though it hinders the giver’s ability to move up the economic ladder to achieve their own financial security.

To manage paying black tax, it is important to strike a balance between your financial requirements and those of your family by establishing boundaries and embracing discipline in budgeting and implementation.

Thanks for reading this edition of Pocket Science. It was written by Khadijat Kareem and edited by Oluseyi Olufemi.