ICYMI: Food outflow: Pressure on Food Prices

+Food Inflow: Pressure on Farmers’ Profits

As we approach the festive season, the increasing cost of food continues to be of concern to many Nigerians as food inflation has risen to 39.16% in October from 37.77% in September 2024, according to the NBS report on inflation.

The Federal Government of Nigeria proposed to begin a 150-day duty free import window for the import of maize, rice paddy, wheat and cowpeas (beans) in July 2024. The move is meant to curb rising food prices and increase the supply of these staples.

However, officials have not yet implemented the duty-free import since its announcement in July.

The government expected this policy to increase the supply and decrease the price of these staple products in the market, as the prices of most of these staple products have increased by over 100% within one year.

Also, the porosity of the Nigerian borders could lead to increased undocumented outflow of agric produce through the Nigeria border states, and this might cancel out the aim of the policy.

The prices of food have increased by 8% points within a year. It rose from 31.52% in October 2023 to 39.16% in October 2024. The situation is worse in border states.

Yet, it could lead to market complications in the agriculture value chain - the drop in prices may discourage local production of these staples and reduce employment in crop production.

So, for those who missed this in its first publication, here is the analysis on the food crisis: The burden of the 150-day duty free import policy.

Food Outflow: Pressure on Food Prices

The 150-day duty-free import of staples assumes increased significance in its potential to counterbalance the undocumented outflow of foods through Nigeria’s land borders.

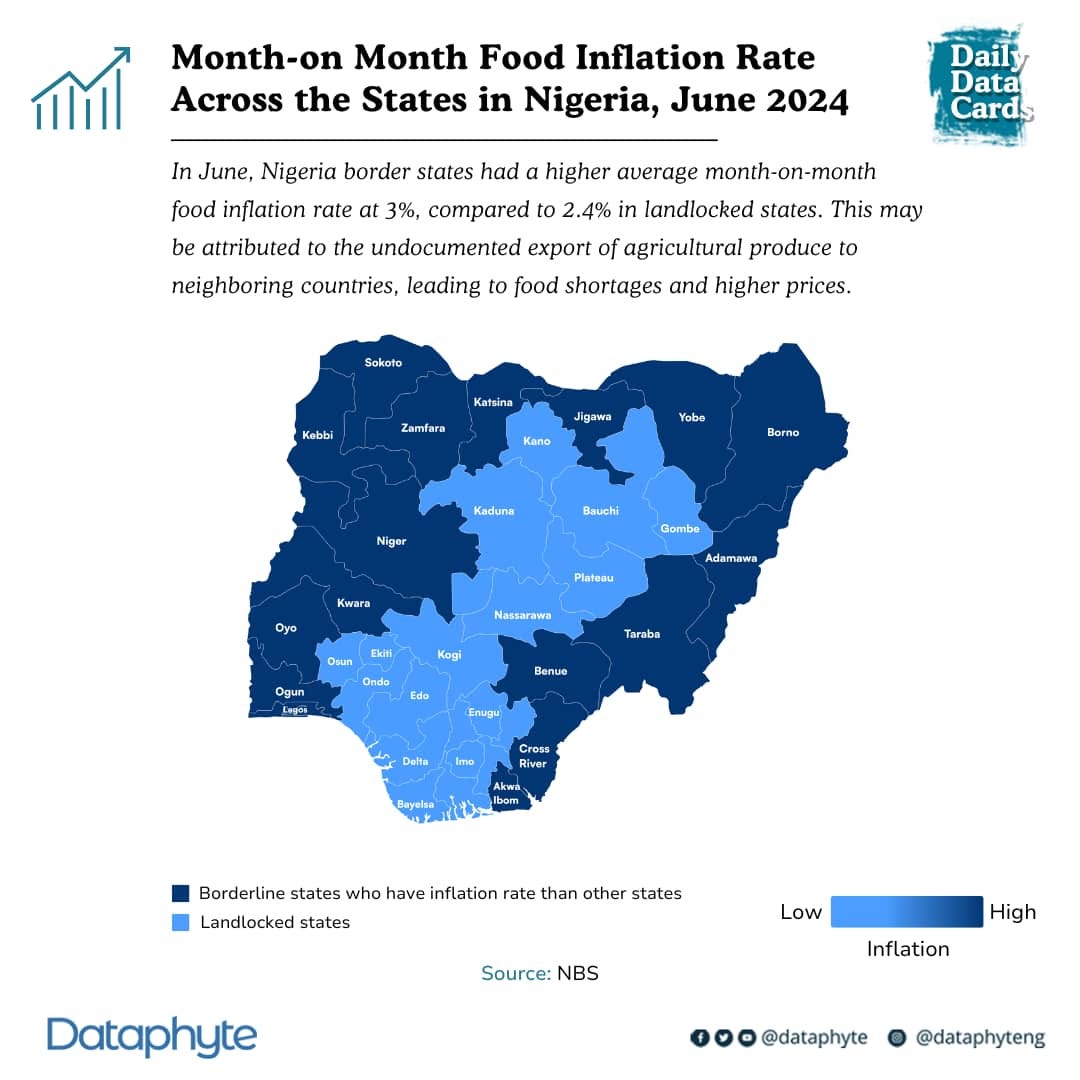

The average food inflation in Nigeria’s 17 border states is higher than that in the landlocked states, indicating reports of farmers preference to sell their produce in more valuable currencies after the Naira devalued.

The NBS data on Food Inflation already shows that almost all the 17 states in Nigeria around the border have the highest month-on-month food inflation especially in the month of June.

“In the month of June, Nigeria’s border states had a higher month-on-month food inflation rate at 3% compared to 2.4% in landlocked states,” a Dataphyte Data Card reads.

Most of these border states are classified as the food belt of the country, and the cross-border sale of food might be upending the normal food price stability in the states.

In Nigeria, staple foods such as cereals (rice, wheat, oat, and corn), legumes (lentils and beans) and tubers (potato and yam) account for about 90% of the people’s food calorie intake.

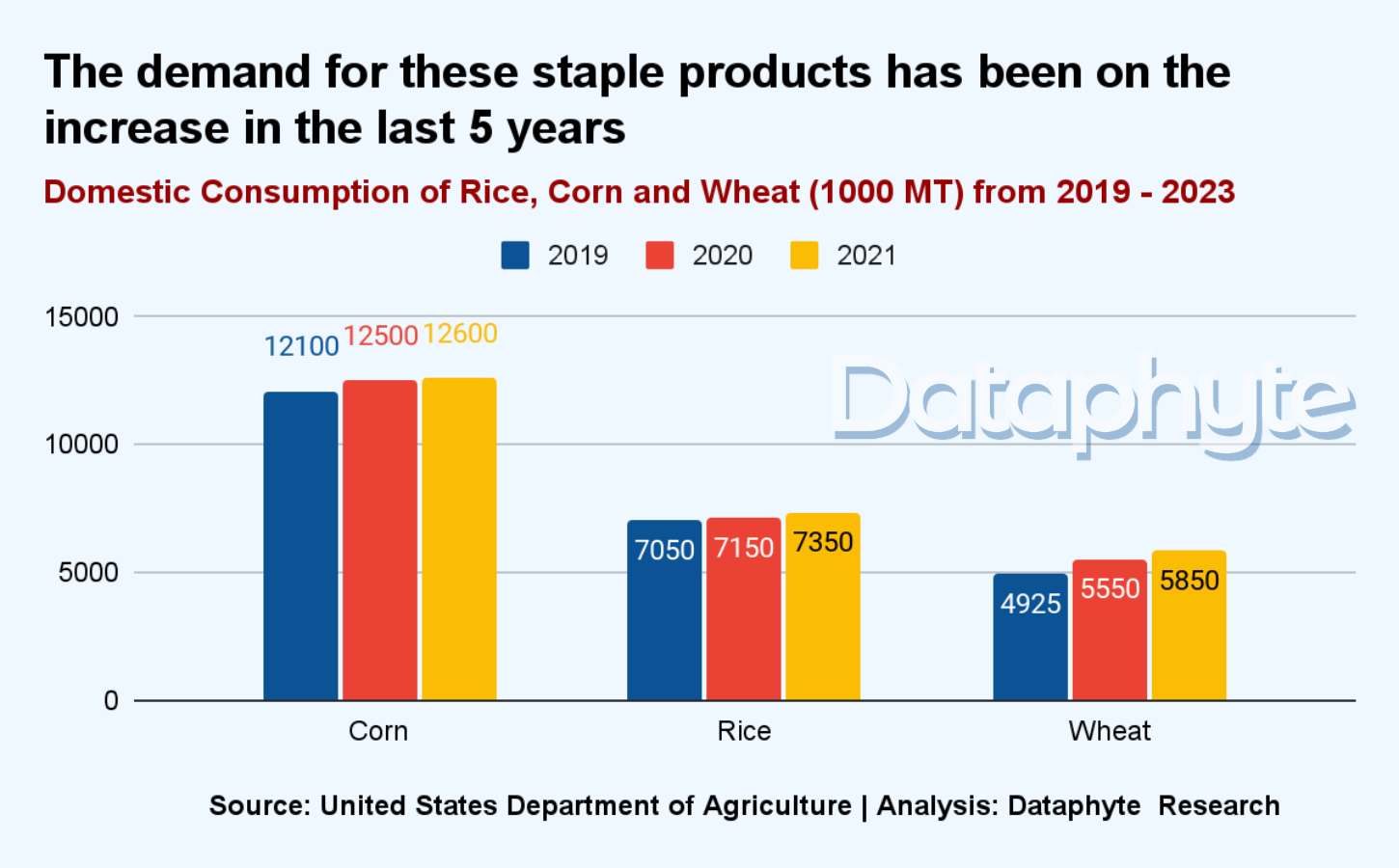

In the last 5 years, the domestic demand/consumption of staple farm produce, especially rice, wheat, and corn, has been on the increase.

The market has not been able to fully meet the country’s demand for these staple products, as domestic production, although slowly rising, is not commensurate with the country’s rapidly growing population.

Food Inflow: Pressure on Farmers’ Profits

The deficiency in supply from local sources necessitated importation of more agricultural products, especially rice and wheat.

In the last 5 years, Nigeria’s total agricultural imports have amounted to N2.6 trillion, the NBS data shows.

Wheat is not only the highest agricultural import but also the 4th highest general import into Nigeria.

Introducing the 150-day duty-free import might lead to increased supply and reduction in the prices of these products.

Yet, inducing more imports this way could also upset the country’s trade balance, besides revenue losses for the government in terms of lost tariffs and taxes imposed on imports of this nature.

It also places more pressure on the exchange rate which may further weaken the Naira, eroding the chances of the sellers to sell the produce at a significantly cheaper price in the long run.

Where the policy achieves cheaper local food prices, this may also hurt agribusinesses, as they have lower incentives to produce these food crops.

Unemployment then ensues.

Currently, agriculture is the largest employer of labour in Nigeria with 36% of the labour force in Nigeria involved in agriculture. Also,the sector contributed 25.2% to the GDP in 2023 and there has been a gradual increase in agricultural outputs over the years.

The National President of the All Farmers Association of Nigeria (AFAN), Arc. Kabir Ibrahim stated, “The gains made in internal sufficiency will certainly be lost in some of the three competencies mentioned viz; rice, maize, and wheat.

“Nigeria and Nigerians have made sizeable investments in rice production and processing such that it is going to be very painful, and if it is absolutely necessary. The wheat and maize issues if properly interrogated are easier to handle because some limited importation has always been there.”

Also, The President of African Development Bank, Dr Akinwunmi Adesina said, “Nigeria cannot rely on the importation of food to stabilize prices. Nigeria should be producing more food to stabilize food prices while creating jobs and reducing foreign exchange spending, which will further help stabilize the Naira.

“Nigeria cannot import its way out of food insecurity. Nigeria must not be turned into a food import-dependent nation.”

This policy might make food more affordable and available in the short term, but if allowed for more than 150 days, it might have negative effects on agribusinesses, the agric sector, exchange rate and government ‘s revenue in the long term.

Thank you for reading this week’s Marina and Maitama. It was written by Lucy Okonkwo and edited by Oluseyi Olufemi.