Men and Women Savings Culture

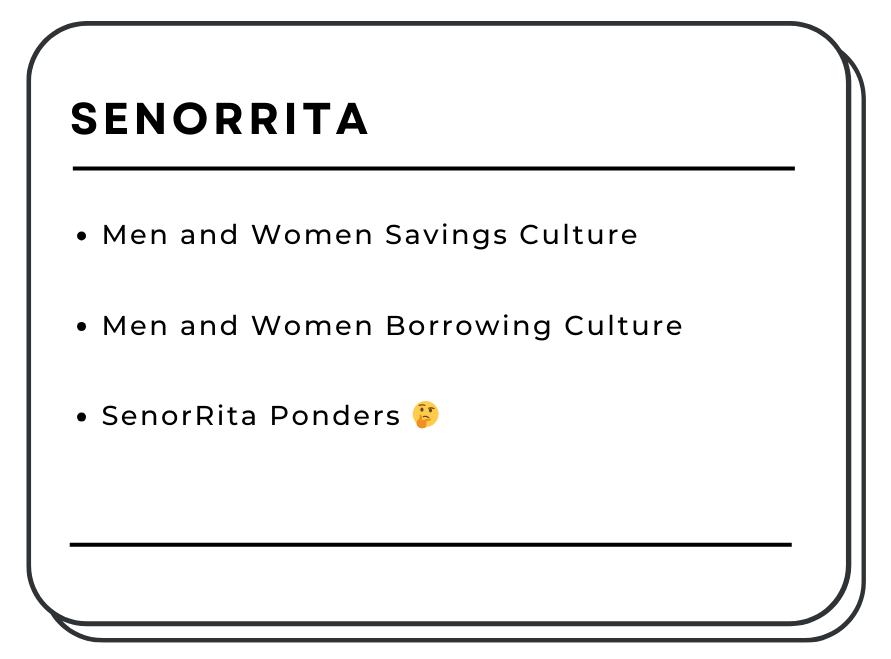

Nigerian men have more financial accounts than women.

The World Bank Data shows that there is a significant gender gap when it comes to owning financial accounts in Nigeria.

A study says that Financial accounts provide a systematic way of organising and managing financial information, which helps in assessing the economic health, performance and position of an entity.

In Nigeria, 55.45% of Nigerian men have financial accounts compared to 34.96% of women.

But why do women hold back than men in owning formal bank accounts?

According to the IMF, women entrepreneurs often do not even attempt to apply for loans in the credit market due to factors like low financial literacy, risk aversion, and fear of failure.

Men Prefer Formal savings

While men own financial accounts, they tend to save more money in their bank accounts. They save their money in their bank accounts more than women.

A study shows savings are generally made by putting aside cash in a savings account in a bank, and this amount can be used in emergencies or to attain a short-term goal. Saving money helps to build wealth and also have funds to face an economic crisis.

The 2021 World Bank data shows that 57.36% of Nigerian men saved more money in their accounts than 53.64% of women.

Men and Women Borrowing Culture

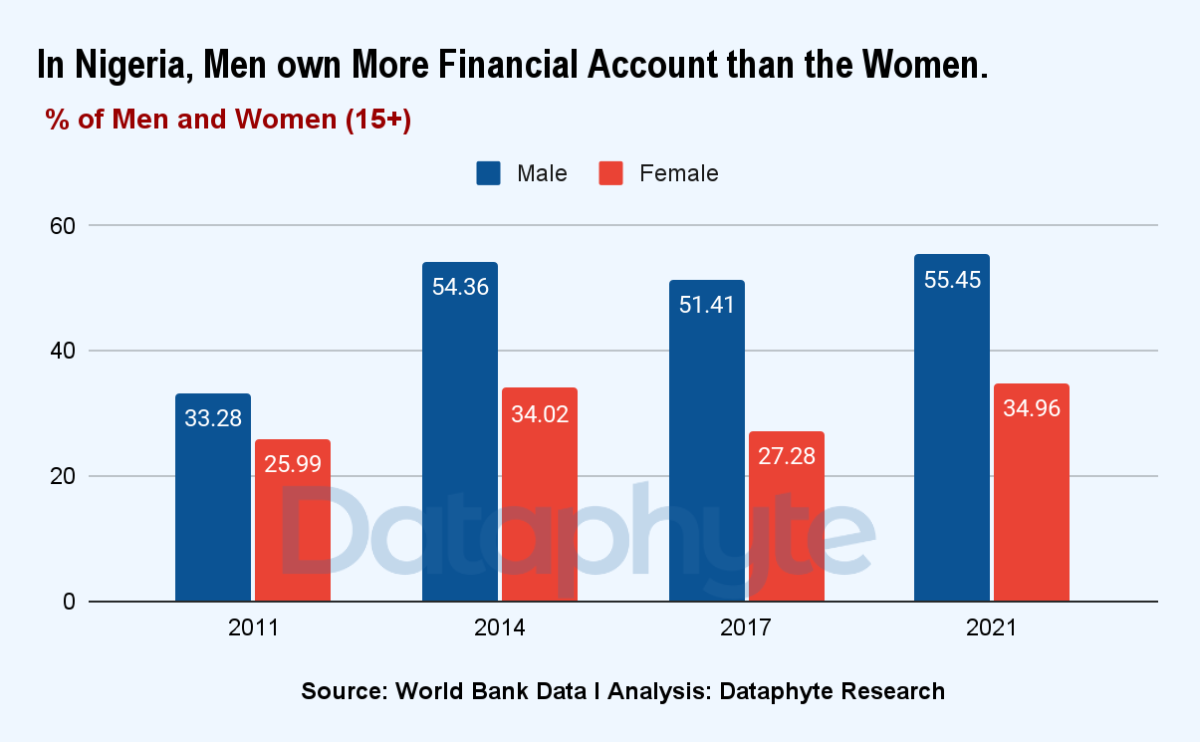

Nigerian men borrow more funds from formal financial institutions than women.

Men with financial accounts borrow more than women from financial institutions they have an account with. These financial institutions are banks and other licensed financial institutions approved by the government.

For instance, one of the criteria for loan eligibility in financial institutions is that ‘’You must have an active account at least 6 months old with the bank’’ before being granted a loan.

Women Prefer Borrowing from the Savings Club

When women borrow money, they borrow from savings clubs more than men.

In a savings club, the holder makes regular contributions toward a predetermined goal. People with like financial needs come together under these clubs to achieve a targeted interest.

These clubs often provide incentives to encourage customers to follow through with their intended contributions.

As of 2021, the percentage of women who borrowed money from savings clubs is 6.55% compared to 4.47% of men who borrowed from the club.

Why do women borrow more from savings clubs?

According to the International Women's Development Agency, the Savings clubs lend money and help their members grow. Aside from the freedom that comes with financial independence, the clubs have also created a strong sense of community and sisterhood among the women members.

Women Borrow More for Medical Purposes

When it comes to the purpose of borrowing, women borrow more money to pay for their medical bills and other health-related issues than men.

A medical loan is a personal loan taken out for the specific purpose of financing medical treatment. It can cover various medical costs, like elective surgery and emergency procedures.

Banks, online lenders, credit unions, and healthcare providers offer these loans.

The World Bank data shows that 17.6% of Nigerian women borrow money to fund health-related issues compared to 16.76% of men, as of 2021.

Findings from STAT News show that women spend more money on services far beyond maternity and childbirth care. Radiology, laboratory, mental health, emergency care, office visits, and physical or occupational therapy were key areas where women paid more than men.

SenorRita Ponders 🤔

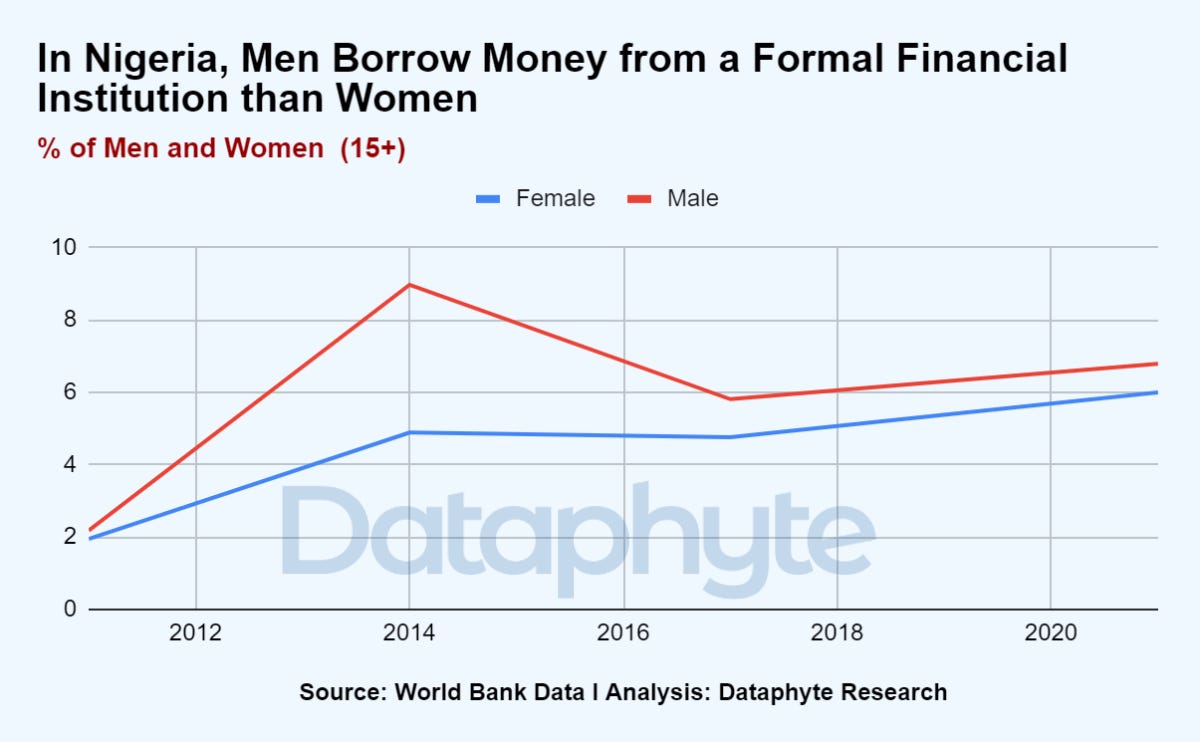

When sourcing for loans, more men borrow money from their families and friends than women.

Why?

An IMF Report indicated that borrowing money from a friend should be easier and more flexible than trying to get a bank loan. If it’s easier to get a loan from a friend or family.

Could it then be that men are more open to family and friends about their financial issues than women?

Data shows that men seek more financial assistance from their family and friends. This assistance can be through asking family and friends for a loan to sort out bills.

As of 2021, 47.8% of men in Nigeria borrow money from their family and friends, compared with 41.8% of Nigerian women.

The question remains: Why is this so?

This edition of SenorRita was written by Kafilat Taiwo, a woman who has 3 formal bank accounts and has never joined a savings club. It was edited by Oluseyi Olufemi, a man who operates 2 formal bank accounts and has been a member of a savings club twice.