For the first time since 1993, the Nigerian Ports Authority (NPA) has announced a 15% rise in port fees. The purpose of this action is to increase the competitiveness of Nigerian ports and finance infrastructure improvements.

The NPA made it clear that the extra money will go into upgrading port infrastructure, purchasing cutting-edge machinery, and enhancing overall service quality. The need to update ageing infrastructure and conform to international norms is what motivated the NPA to increase port fees.

Stakeholders are however worried about possible increases in operating costs and the wider economic ramifications of this decision, including increased inflationary pressures.

The head of the NPA, Abubakar Dantsoho emphasised that port authorities around the world rely on operating revenues to fulfil their duties.

According to Dantsoho, the international trade community uses the global index of port rating and competitiveness to determine which nations to do business with. The index is based on how well the aforementioned obligations are met.

Nigerian ports are among the least efficient in the world, according to the World Bank's 2023 Container Port Performance Index (CPPI). Only three of Nigeria's seven ports are listed in the World Bank's assessment of port performance.

The Apapa Quays, Lekki Deep Sea Port, Port Harcourt Port, and Calabar Port Complex were the Nigerian ports not included in the World Bank’s CPPI.

The ports in Nigeria were ranked among 405 ports worldwide.

Out of 405 ports evaluated, Sub-Saharan African ports score between 103rd and 354th in the world. The majority of ports in the Sub-Saharan African region performed badly due to congestion, poor infrastructure, and lengthy cargo processing times, according to the World Bank's Container Port Performance Index (CPPI) 2023.

The Problem of Ports in Nigeria

The efficacy of ports in Nigeria is plagued by inefficiencies, expensive operating expenses, and inadequate infrastructure.

According to a report by the Financial Times in 2020, due to exorbitant fees and inefficiency, importers in Nigeria pay about $4,000 per container, whereas those in nearby West African ports pay $2,500.

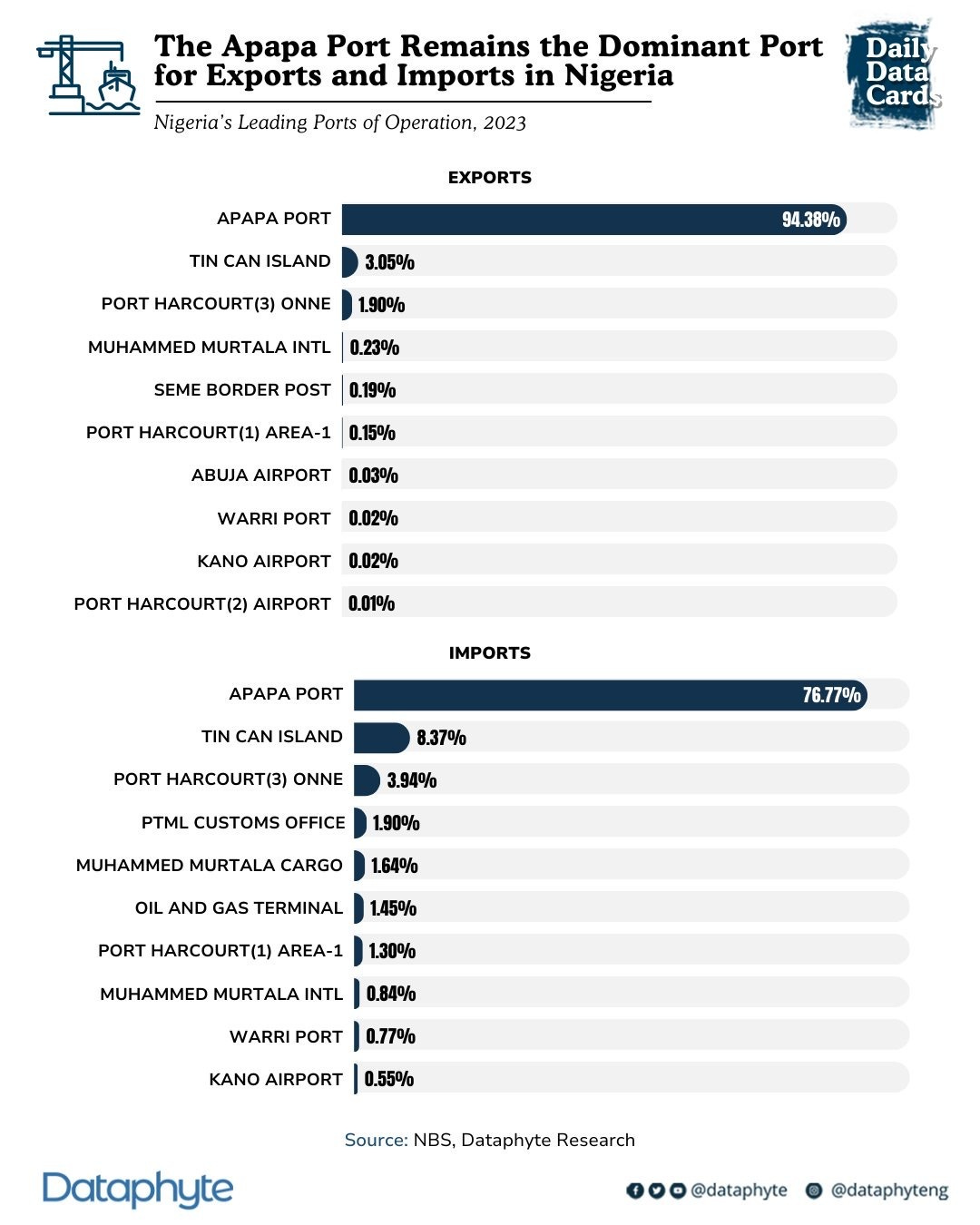

Using the Lagos port as an example, where traffic has gotten so terrible that it can now cost over $4,000 to truck a container 20 kilometres to the Nigerian mainland, nearly as much as it would cost to transport one 12,000 nautical miles from China. This is an ongoing problem at the ports of Apapa and Tin Can Island, which serve as the primary commercial gateways to the biggest economy in Africa.

According to The Guardian, to stay in business, more and more importers are moving to neighbouring West African nations, particularly Togo, Ghana, and Benin, to avoid the numerous and skyrocketing taxes levied at Nigerian ports.

These fees are levied by various government organisations, terminal operators, and shipping corporations, which have grown by about 100% In less than a month.

A report by the United Nations Trade and Development (UNCTAD) also states that 40% of inflationary pressures are caused by logistics and port-related expenses, especially for imported commodities.

A more practical example is in 2024 when rerouting, port congestion, and increased operating costs caused a spike in freight rates and by implication led to an increase in the consumer price index globally.

Thus, stakeholders' concerns about the wider economic ramifications of the NPA's decision to increase port rates, which is intended to finance necessary infrastructure improvements and improve operating efficiency, truly has the possibility of increasing inflation, production costs, and lead to reduced competitiveness.

Bank Wahala: ATM Transaction Fee Surge

The Central Bank of Nigeria (CBN) has reviewed Automated Teller Machine (ATM) transaction fees, raising the ‘Not-On-Us’ ATM withdrawals to ₦100 for each ₦20,000 withdrawn from ₦35 (after the third withdrawal within the same month).

According to the CBN circular announcing the decision, the review of the transaction fee is “in response to rising costs and the need to improve the efficiency of the ATMs in the banking industry.”

While this policy might improve the efficiency of ATM operations, it will place a higher cost on consumers and small businesses who rely more on using ATMs for cash transactions. Also, rural and underserved areas with limited ATMs may suffer more, potentially widening financial inequality.

An ATM transaction fee is a fee charged for either withdrawing or checking your balance using an ATM. You might be able to check your balance for free, but you will be charged for taking out cash.

An analysis of e-payment transactions reveals that ATM usage grew by 16% over the past 6 years. The volume of ATM transactions rose from 876 million in 2018 to 1012 million in 2023. However, despite this overall increase, there has been a gradual decline in ATM usage since 2020.

Also, the percentage share of the use of ATMs compared to other E-Payment platforms has been on a decline. In 2022, its percentage share was 7%, but declined to 3% in 2023.

A report from Inlaks Limited, an ATM provider in Nigeria, reveals that most ATMs nationwide are either out of service, out of network, or out of cash for 5 out of 7 days each week. This underscores the inefficiencies in cash dispensing by ATMs, contributing to the decline in ATM usage as an e-payment channel.

In the past 13 years, the number of ATMs in the country has increased by 15,500. It increased from 7,100 in 2010 to 22,600 in 2023.

The data also indicates that 8 banks deployed 75% of the total ATM in the country, Access Bank, First Bank, UBA, Zenith Bank, GTBank, FCMB, Polaris Bank, and Union Bank.

Despite this increased number of ATMs, the annual growth rate of ATM deployment has decreased from 4% to below 1% in the last 2 years.

According to a circular released by the CBN in 2014, maintaining ATMs is expensive and it requires economic incentives for owners to deploy and maintain these machines. Also, the wear and tear as well as servicing of the ATMs have increased significantly. This indicates that the increased ATM transaction fee will benefit the banks.

On the other hand, customers will face a significant financial burden due to the increase in ATM transaction fees. For instance, under the previous policy, withdrawing ₦80,000 in ₦20,000 increments would incur a ₦35 fee. However, under the new policy, the same ₦80,000 withdrawal (in ₦20,000 increments) will now cost ₦400—an increase of over 1,000% for every fourth transaction of ₦20,000 for Onsite ATM use. This cost will be more for offsite ATM use.

Ultimately, the inefficiencies of ATMs, coupled with the higher transaction fees, may further discourage ATM usage.

While the policy may improve ATM profitability for banks, it risks burdening customers excessively, potentially discouraging cash transactions, and increasing dependence on alternative e-payment channels. If not managed carefully, this shift could further expose gaps in financial inclusion, particularly in areas where digital banking adoption remains low.

Please do note that this policy will take effect from the 1st of March, 2025.

Thanks for reading this edition of Marina and Maitama. It was written by Adijat Kareem and Lucy Okonkwo, and edited by Joachim MacEbong.

If you've read this far, now take 2 seconds to share: