Indorama’s 3rd

Indorama Eleme Fertilizer & Chemicals Limited (IFL), one of Nigeria’s major fertiliser producers, is set to build its third urea fertiliser production line and a new shipping terminal, thanks to the African Development Bank (AfDB).

The Bank recently signed a $75 million loan agreement to boost Indorama’s fertiliser export.

The loan is part of a $1.25 billion facility arranged by the International Finance Corporation in partnership with other financial institutions and commercial banks.

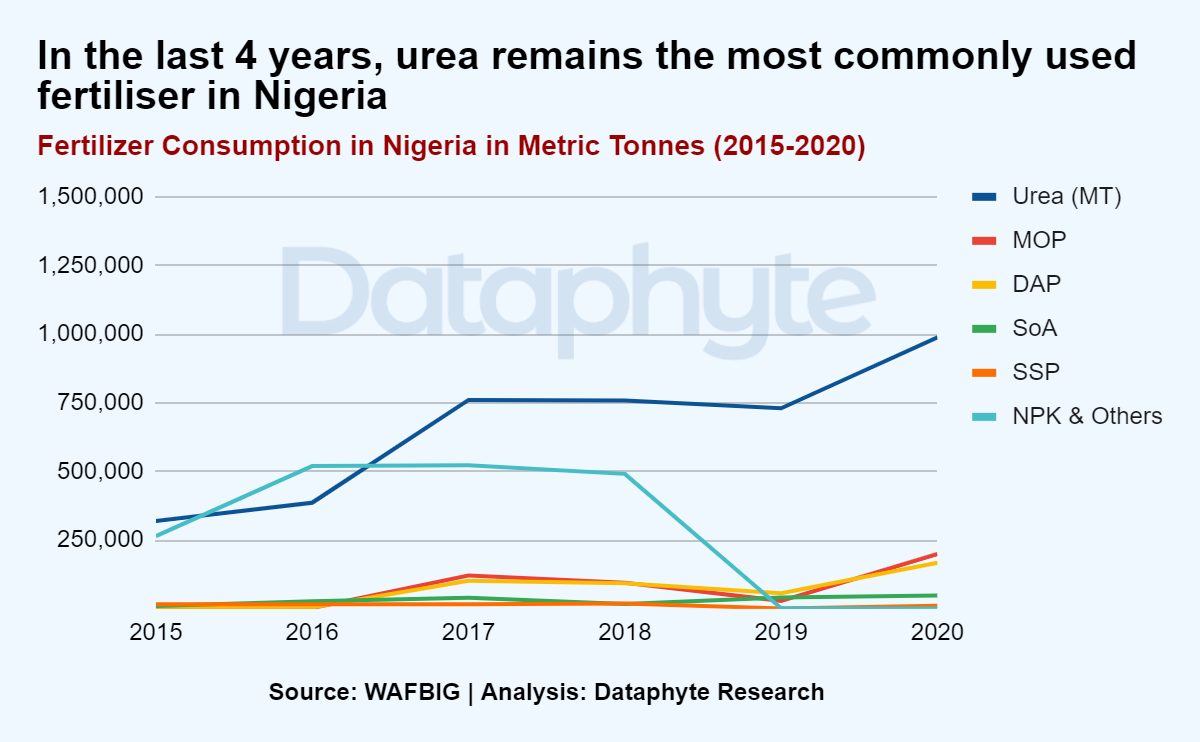

In 2020, urea accounted for 70% of the total fertiliser used. Between 2015 and 2020, total urea fertiliser used in Nigeria increased by 209% from 319,656 metric tonnes in 2015 to 988,343 metric tons in 2020.

This suggests that there is a big market for Urea-based fertiliser in Nigeria.

The main fertiliser types in Nigeria are urea and phosphate compound fertilisers. In addition, there is NPK compound fertiliser and blend fertiliser.

The new production line is expected to have an annual capacity of 1.4 million metric tons of urea. Together with the company’s two operational urea fertiliser lines, this can potentially boost Nigeria’s domestic fertiliser market.

Fertilisers are substances or mixtures applied to soil or plants to supply essential nutrients that aid their growth and development. They are produced from different sources, such as nitrogen, phosphorus, and potassium.

Urea, a nitrogen-containing organic compound, is a vital source of nitrogen for plants and is widely used in agriculture as a fertiliser.

Given the existing market of urea-based fertiliser in Nigeria, Indorama's proposed urea fertiliser plant appears to be a strategic investment to meet the country's growing agricultural demands.

Urea’s 3rd

Urea is Nigeria’s third largest export after natural gas and petroleum oil.

It remained a significant part of Nigeria's export trade between Q1 and Q2 2023.

Similarly, urea accounts for 62% of the global demand for nitrogen-rich fertilisers. This suggests that urea is a viable product with the potential to boost a nation’s economy.

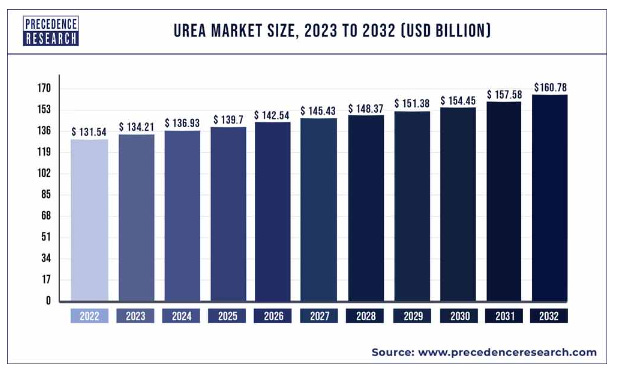

According to data from Precedence Research, the global market value of urea was $131.54 billion in 2022. Market analysis indicates that by 2032, its value is expected to rise to $160.78 billion, reflecting an annual growth rate of 2.03%.

This market trend presents an opportunity for Nigeria to leverage the current expansion in its urea production plants to penetrate the global urea market by adding value to its urea exports and maximising economic growth.

The Dollar’s 5th

Nigeria has recorded 5th drop in the Dollar rate in the last 2 weeks in the parallel market and like appreciation of the Naira against the dollar in the official market

This has elicited mixed feelings, of hope and doubt, from Nigerians who wonder if the naira will yet appreciate to pre-deregulation levels.

The Central Bank of Nigeria (CBN) announced the unification of all segments of the foreign exchange market, floating the naira against other foreign currencies on June 14, 2023

The sharp decline in the last two weeks brought the naira to dollar exchange rate in the official market from N1,538 at the close of trade on March 1 to N1260 on April 3.

Similarly, the naira-to-dollar rate at the parallel market declined from 1600 to N1,270 during the same period.

The process removed the CBN's direct intervention from the forex market, leaving the naira to be determined by market forces. Since then, the naira's value has depreciated against the dollar and other currencies.

However, the dollar's recent fall in the FX market in the last two weeks has led to several speculations regarding the effectiveness of the floating exchange rate.

There are also concerns regarding Nigeria's ability to maintain the drop in the value of the dollar in the FX market without substantial effort to boost local production and exports, which could reduce the dollar's demand considerably.

Meanwhile, the Association of Bureau de Change Operators of Nigeria (ABCON) attributed the naira’s appreciation and recovery to recent policy changes implemented by the Central Bank of Nigeria (CBN), including interest rate hikes and the clearance of $7 billion in forex backlog forward commitments.

Thanks for reading this edition of Marina and Maitama.

This edition was written by Funmilayo Babatunde, who just discovered while writing this story that fertiliser is not another liquid that was sprayed on plants. It was edited by Oluseyi Olufemi who hopes the Naira can return to its prederegulation levels.