As inflation rises, the pocket feels the pinch.

This reflects the struggles of the average Nigerian, who faces a rising cost of goods and services and an increasingly high cost of living.

However, the month-on-month inflation rate for June 2024 shows a glimmer of hope. While all prices are still on the increase, the rate of increase has slowed down for some goods and services.

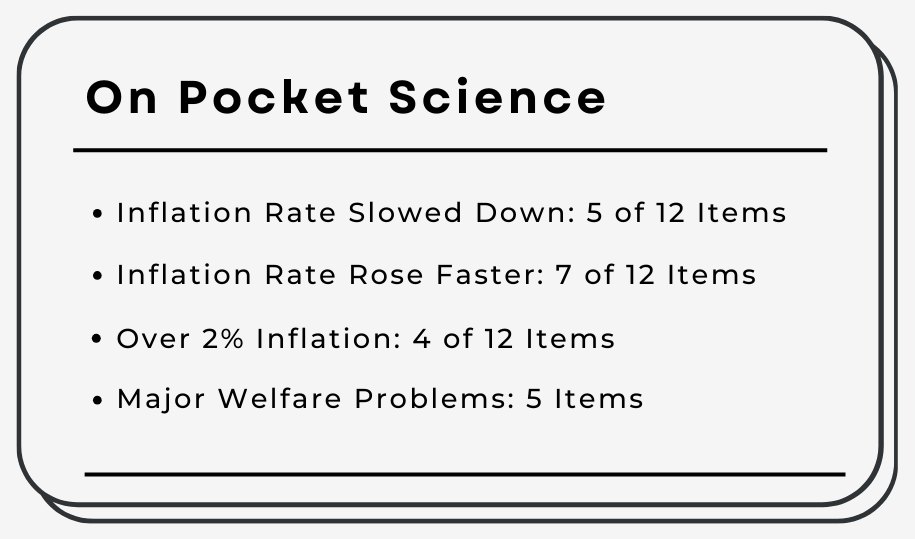

In June, the month-on-month inflation rate slowed down for 5 out of the 12 main items. These include healthcare and other miscellaneous goods.

Conversely, prices increased faster in June than May for the remaining 7 items: food and non-alcoholic beverages, housing, water and electricity, transportation, education, recreation, and restaurant and hotel services.

A sustained slowdown in the inflation rate in major services like healthcare will improve access to medical services. However, the rise in food inflation and education is detrimental to survival, welfare, and social development.

In the Consumer Price Index for June 2024, the month-on inflation rate for alcoholic beverages slowed down the most with a percentage points difference of 0.19%. This was followed by clothing and footwear, communication, and miscellaneous goods.

This does not imply that the prices of these items have decreased; it simply means that the rate at which their prices increased in June was slower compared to May.

If this trend continues, it could lead to more stable prices in these categories, making them more affordable for consumers.

Inflation Rate Rose Faster: 7 of 12 Items

The inflation rate for the remaining seven main items increased faster. Among these items are food, education, and other essential goods and services that are crucial for the survival of Nigerians.

In June, the inflation rate for restaurant and hotel services rose by 0.35 percentage points. Recreation services saw an increase of 0.28 percentage points, while food and non-alcoholic beverages went up by 0.26 percentage points.

Over 2% Inflation: 4 of 12 Items

Overall, restaurant & hotel services, food, and transport recorded the highest inflation rate in June 2024.

The rising inflation rate and the hike in prices of food and essential items in Nigeria have reduced the purchasing power of the average Nigerian, leading to a decline in public welfare.

Major Welfare Problems: 5 Items

A survey by NBS shows Nigerians considered the high cost of living the most pressing issue in 2023. Nigerians ranked crime/insecurity and unemployment as the next two urgent issues.

As a result, citizens are urging the government to halt the progress into hyperinflation, a 50% inflation rate or more, which could pose a more severe threat to their survival.

One of the citizens' reactive measures is the planned protest, scheduled for August 1, aimed at ending bad governance in Nigeria.

However, the Nigerian authorities have tried various ways to address the rising inflation that has impoverished many Nigerians.

Earlier this month, the federal government introduced a 150-day duty-free import window for food commodities. However, stakeholders have expressed concerns that this measure might undermine local food production.

Dr. Akinwumi Adesina, President of the African Development Bank Group, remarked that Nigeria’s government's decision to permit large-scale food importation poses a threat to the country's agricultural sector.

He said “Nigeria cannot rely on the importation of food to stabilize prices. Nigeria should be producing more food to stabilize food prices while creating jobs and reducing foreign exchange spending, which will further help stabilize the Naira.”

In another instance, Dataphyte reported that the federal government issued an Executive Order eliminating tariffs, excise duties, and VAT on specific pharmaceutical equipment and raw materials for two years.

The extent to which these policies address underlying economic factors and how effectively they are implemented will determine their impact on the inflation rate.

Thank you for reading this edition of Pocket Science. It was written by Funmilayo Babatunde and edited by Oluseyi Olufemi.