Is Nigeria's Falling Non-Performing Loans a Sign of Tightening Credit or Bank Stability?

+Tips on how to get loans

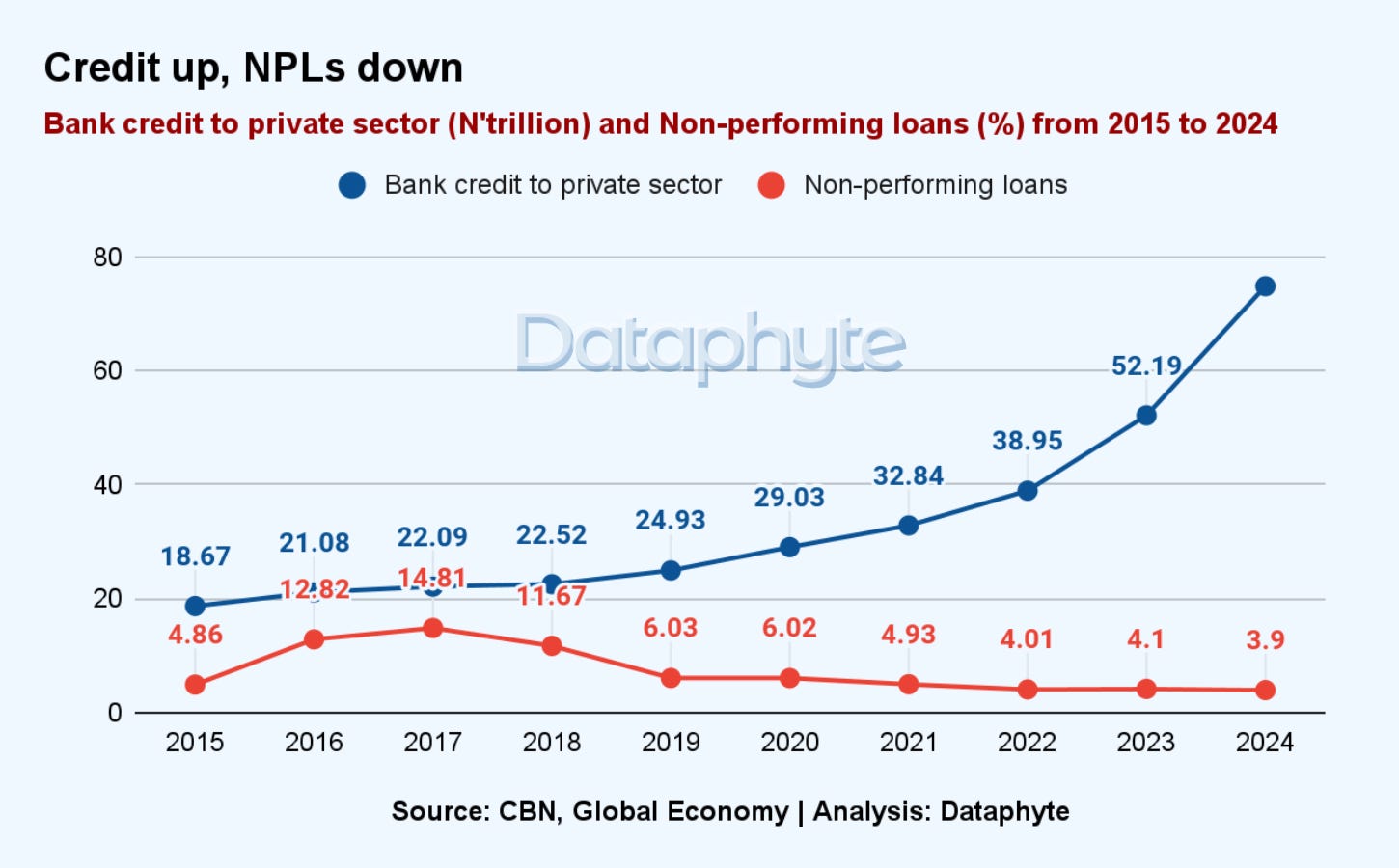

Non-performing loans (NPLs) in Nigerian banks, as a percentage of total loans, have been on the decline. A falling NPL ratio signals an overall improvement in the health of Nigeria's banking sector.

However, when viewed alongside lending trends, this decline could indicate that lending activities have either slowed down or become more conservative. It could also mean banks may have enhanced their loan recovery strategies by restructuring delinquent loans, improving their debt recovery systems, and implementing better loan monitoring practices.

This suggests that Nigerians, particularly those in high-risk industries, may find it harder to access credit. If this trend leads to a credit crunch for businesses and individuals needing loans to expand or sustain operations, it could dampen economic growth.

NPLs refer to bank loans that are either unlikely to be repaid by the borrower or are subject to late repayment.

According to data from Global Economy and the Central Bank of Nigeria (CBN), the NPL ratio decreased from 4.86% in 2015 to 3.9% in 2024.

Nigeria experienced a sharp rise in non-performing loans between 2015 and 2017, with the percentage increasing from 4.86% to 14.81%. The economic downturn and currency depreciation following the 2016 recession were key drivers of this increase.

As the economy recovered, NPLs fell, reaching 6.02% by 2020 and 3.9% by 2024.

Notably, Nigeria ranks 14th globally in terms of NPL percentages, but its NPL ratio is lower than the global average.

The global average NPL ratio of 5.5% serves as a benchmark. Countries with NPL ratios below this average, such as Nigeria, Mauritius and Botswana, demonstrate better bank performance and lower risk exposure.

However, a reduction in NPLs does not necessarily indicate that fewer borrowers are defaulting. It might also suggest that banks and lenders are issuing fewer loans, either due to cautious lending practices or concerns about the economic environment.

Fewer loans mean fewer opportunities for defaults, contributing to a reduction in NPLs. Banks may have tightened lending standards, ensuring that loans are granted to more creditworthy borrowers, which reduces default.

According to the International Monetary Fund's (IMF) Global Financial Stability Report (April 2023), higher interest rates can discourage both banks from lending and borrowers from taking loans due to the increased cost of debt servicing. This trend was observed globally when central banks began to raise interest rates in response to stubborn inflation in 2022.

In Nigeria, the Central Bank of Nigeria (CBN) has raised interest rates 29 times since January 2022.

A Dataphyte report noted that the increase in the interest rate, also known as the Monetary Policy Rate (MPR), would affect the cost of credit, making loans more expensive for businesses and consumers. The rise in interest rates is also expected to increase yields on personal savings and bank deposits, impacting dividends for bondholders and shareholders.

Dataphyte further noted: “Businesses may be affected by the decline in credit growth as they often rely heavily on bank credit facilities for their operations and expansion plans. Limited access to credit can stifle their growth prospects and hinder job creation.”

On the other hand, improved loan management and recovery processes, such as more efficient loan monitoring and restructuring for troubled borrowers, may have helped reduce NPLs without necessarily limiting the volume of loans issued.

The data on bank credit to the private sector points to a robust banking industry, with rising credit and a decreasing percentage of NPLs. This reflects enhanced risk management, the economy's rebound after 2017, and likely regulatory interventions.

The key takeaway is that NPLs have declined while credit to the private sector has increased. This is often a sign of strength, suggesting that banks are managing credit risk effectively even as they extend more loans.

Tips on how to get loans

Nigerian banks follow a thorough evaluation process when assessing loan applications, considering factors such as income, credit history, and overall financial stability. Borrowers with a strong credit record, which reflects their reliability in making timely payments, are often eligible for higher loan limits.

Banks also review the applicant’s earnings to ensure that their income is consistent and sufficient to meet repayment obligations. In addition to personal financial criteria, broader economic conditions and legal frameworks influence lending limits.

The Central Bank of Nigeria, as the primary regulatory body, sets overarching guidelines that govern how banks approach lending.

To build a strong credit record, start by taking small loans and ensuring that both the principal and interest are repaid on time. This way, your credit record will grow, increasing your eligibility for larger loans in the future.

Thanks for reading this edition of Pocket Science. It was written by Khadijat Kareem and edited by Joachim MacEbong.