The Federal Government of Nigeria has approved a ₦758 billion bond to clear outstanding liabilities under the Contributory Pension Scheme (CPS). As part of this initiative, ₦107 billion has been allocated to provide a living wage for retired low-income pensioners.

While this initiative aims to offer financial relief, questions remain about its sufficiency in addressing long-term economic security for retirees.

According to reports, “this is the first time the Federal Government is committing funds to the Pension Protection Fund, a statutory provision designed to augment pensions for low-income earners.”

In the Pension Reform Act (PRA) of 2014, the Contributory Pension Scheme (CPS) governs post-retirement pension payments in Nigeria.

The CPS, managed by the National Pension Commission (PenCom), operates on a system where both employers and employees contribute a minimum of 18% of an employee’s salary into a Retirement Savings Account (RSA) to secure their pension upon retirement.

An employee can take a lump sum payment out of their RSA when they retire, as long as there is enough money left over to cover planned withdrawals or annuities that cover at least 50% of their monthly income before retirement.

However, the new system that will soon be implemented aims to give retired low-income individuals financial security and relief by paying them a living salary, regardless of the amount that they may have in their pension accounts.

According to an African Journal of Social Work Research, life after retirement in Nigeria has become cloaked in misery, financial struggle, and poverty. It was shown that retirees struggle to meet their socioeconomic responsibilities due to the small pension and payment delays, which eventually have an impact on their welfare, especially for those with low incomes.

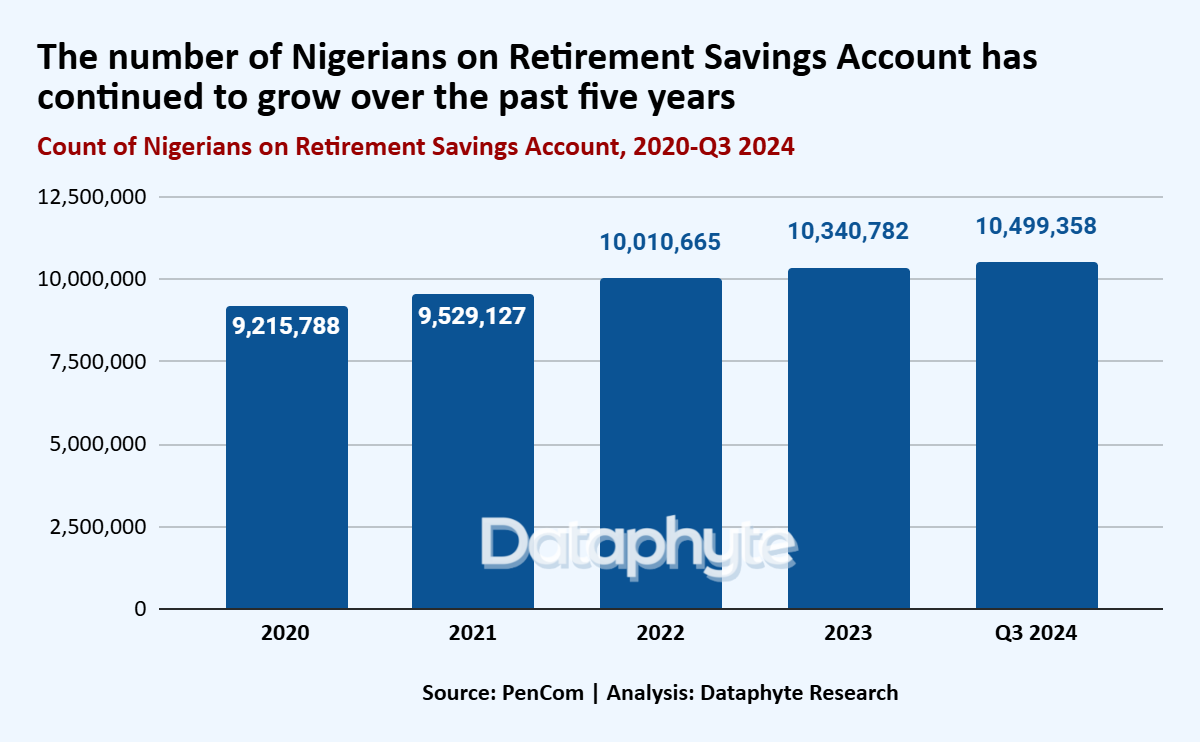

Over the past five years, there has been a steady increase in the number of Nigerians enrolled in the Retirement Savings Account. The number increased from 10.3 million in 2023 to 10.5 million by the third quarter of 2024, indicating an increased adoption of the pension system.

The proposed living wage should provide retirees with shelter, food, and other necessities, preventing poverty.

How much is living wage expected to be in Nigeria?

According to the World Bank, the average monthly income required for a low middle-income worker in a country like Nigeria to meet basic living expenses is ₦320,518, given the country’s current economic condition. However, the officially implemented minimum wage remains at ₦70,000.

In 2024, Dataphyte analysed and moderated what could be considered an ideal minimum wage and a living wage for low-income earners. The report determined that accounting for year-on-year inflation from 2019 to 2024, the real minimum living wage should be ₦105,862.

With this analysis in mind, low-income retired pensioners may expect a ₦105,862 living wage. However, this falls significantly short of the ₦320,518 monthly income recommended by the World Bank for individuals in lower middle-income countries like Nigeria, leaving a ₦214,656 gap for a truly sustainable livelihood.

If the goal, as stated by PenCom’s Director General, Omolola Oloworaran, is to “provide financial relief for low-income pensioners who may not have accumulated enough savings to sustain themselves in retirement,” this initiative risks being inadequate.

Given the rising cost of living, aging-related expenses, and economic instability, will there be regular pension adjustments tied to inflation to prevent retirees’ purchasing power from eroding? Without such measures, this intervention may offer only temporary relief rather than alleviating or preventing the retired income earners from falling into poverty.

Thanks for reading this edition of Pocket Science. It was written by Salako Emmanuel and edited by Adijat Kareem.

Do you work at a Civil Society Organisation? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey:

Do you work for any government agency? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey: