Nigeria’s money supply has been on the increase despite the Monetary Policy Committee's (MPC) interest rate hikes in the last 12 months. Money supply has increased by 65% on a year-on-year basis while the interest rate has increased by 45% between September 2023 and September 2024, according to data from the Central Bank of Nigeria (CBN).

The Governor of the Central Bank, Mr Yemi Cardoso at the last MPC meeting in September observed that as the Federal Accounts Allocation Committee (FAAC) is allocated, money supply increases.

He said, “Members have observed a strong correlation between FAAC releases and liquidity levels in the banking system as well as its impacts on the exchange rates. The committee therefore agreed to increase monitoring of future releases with a view to addressing its effects on price development.”

According to Econlib, an increase in money supply is supposed to lead to a decrease in interest rate, which will spur on investments and productivity in the economy.

This combination has not spurred investment as anticipated. Instead, private-sector credit has grown only 19% in the last year, indicating that higher rates might be discouraging borrowing and investment despite the larger money supply.

Also, this situation reflects the CBN’s challenge in using monetary instruments to control inflation and stabilise the Naira in the short term.

CBN data shows that the Money Supply (M2) in the economy increased to ₦108.9 trillion in September 2024, from ₦66.2 trillion in September 2023.

However, the 65% year on year increase in the money supply is not the highest within the year. The year-on-year increase in money supply was the highest in May 2024, where it stood at 78%. At that time, money supply increased from ₦55.6 trillion in May 2023 to ₦99 trillion in May 2024.

In retrospect, this trend is not unique to Tinubu's administration. A similar pattern was observed under former President Yar’Adua, who also experienced rising interest rates alongside an expanding money supply in his first 16 months in office.

During Yar’Adua’s term, the money supply grew by 77% in his first 16 months, with interest rates increasing from 8% to 9.75% over a similar period.

Within the last 10 months, the CBN under Mr Cardoso has increased the interest rate 5 times from 18.75% to 27.25% to reduce the inflation and mop up cash in the economy to help stabilise the Naira.

The data suggests that the interest rate hikes alone have not been able to curb the money supply and inflation rate effectively because while the interest rate increased, the inflation rate and money supply also increased.

A key factor influencing the increase in money supply appears to be the monthly FAAC disbursements as observed by the members of the MPC.

As CBN Governor Mr. Yemi Cardoso noted in the September MPC meeting, FAAC allocations correlate strongly with increased liquidity levels in the banking system, which subsequently affects exchange rates.

An analysis of the data showed that there is a weak correlation of 10% between FAAC allocation and money supply in the last 12 months. This suggests that the changes in FAAC allocations have little to no impact on the money supply in the short term.

However, data from June 2022 to August 2024 showed a strong correlation between FAAC allocation and money supply in the medium term, lending credence to the statement by Mr. Cardoso.

In the medium term, FAAC allocation has a strong correlation of 65% to money supply.

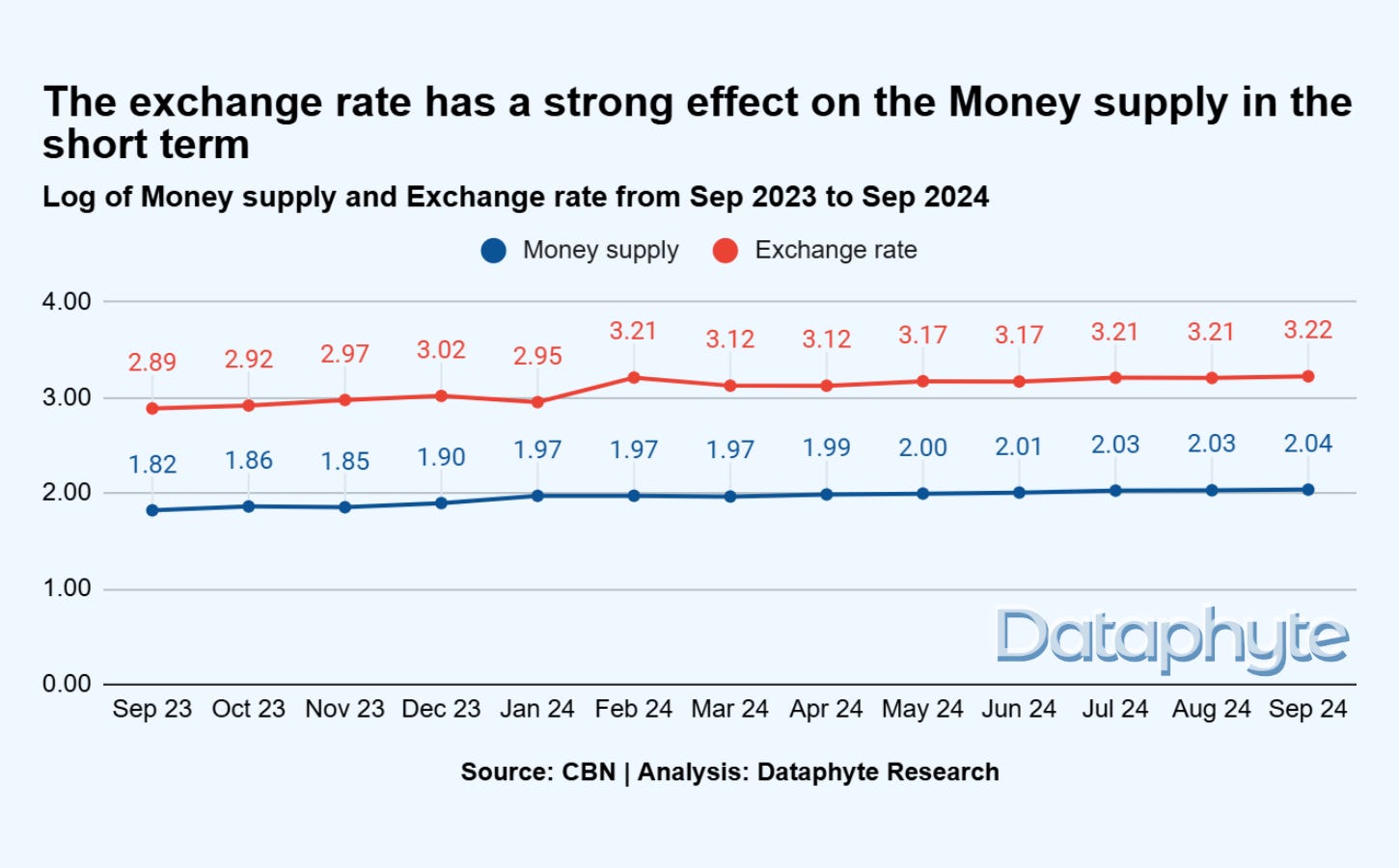

In the short term, however, the release of FAAC allocation has been linked to the increases in the exchange rate. The exchange rate is a key factor driving the increase in the money supply and adding inflationary pressures to the economy.

The correlation between exchange rate and money supply in the short term is 89%. This indicates that there is a strong link between the increase in money supply and exchange rate. Changes in the exchange rate will lead to an equal change in the money supply.

The introduction of the floating currency in June 2023, has led to the devaluation of the Naira in the last 16 months.

As the value of the Naira weakened, the money supply increased. The Naira has devalued by over 82% between January and September 2024. It moved from ₦896 in January 2024 to ₦ 1668 in September 2024.

The volatility in the exchange rate, coupled with increased interest rates has reduced both domestic and foreign investments.

The foreign direct investment in the country is the lowest it has been in the last 11 years. The FDI declined by 65% on a year on year basis, falling from US$86.02 million in Q2 2023 to US$29.83 million in Q2 2024.

Furthermore, a record-high interest rate of 27.25% has not slowed the growth in money supply or eased inflationary pressures but has restricted private business borrowing, resulting in only a 19% increase in credit to the private sector. This has dampened investment and hindered business growth domestically.

Meanwhile, government credit has surged by 90%, potentially crowding out private sector loans and fueling higher government spending, which may further drive up inflation.

The current situation underscores the difficulty of using monetary policy tools alone to achieve economic stability in an environment that has poor productivity and is highly dependent on imports, significantly impacting the money supply.

Without increased productivity and much better government spending, the CBN’s interest rate hikes may have limited impact on controlling inflation and stabilising the Naira.

Nigeria’s Telco Troubles

Nigeria’s active mobile subscriber base fell by 29% between January and September 2024, according to a report by the Nigerian Communications Commission (NCC).

Also, the report showed that Globacom, one of the 4 major telecommunication providers in Nigeria, lost 42.7 million subscribers within the last 9 months. The total number of its subscribers fell from 61.9 million subscribers in January 2024 to 19.2 million subscribers in September 2024.

This data showed Globacom lost the largest number of subscribers among all the telecommunication providers within this time period.

The NCC attributed the decline in active mobile subscribers to “the removal of Subscriber Identification Modules (SIMs) that are not linked to verifiable National Identification Numbers (NIN) and the rectification of a major discrepancy by a Mobile Network Operator.”

The decline in the number of active subscribers by Nigeria’s telecommunication providers, especially for Globacom, reflects the effect of the regulatory move to ensure data accuracy and compliance with the SIM-NIN policy rather than user dissatisfaction. Additionally, discrepancies in data submissions, as noted by the NCC, may indicate a need for improved data management and reporting protocols among operators in Nigeria.

The NCC data showed the total number of subscribers reduced by 63.5 million within the last 9 months. It fell from 218.4 million in March to 154.9 million in September 2024.

The SIM-NIN linkage exercise, which mandates the linkage of all active SIM cards to verified NINs, began in 2020. The exercise was mandated by the former Minister of Communications and Digital Economy, Prof. Isa Ali Ibrahim (Pantami) to strengthen national security through accurate identification of mobile users.

The breakdown of the numbers of subscribers among the 4 major telecommunication providers showed MTN had the lowest decline in subscribers. It had a percentage decline in subscribers of 2.1%. The number of its subscribers fell from 79.8 million in January 2024 to 78.1 million in September 2024.

The most affected telecommunication provider was 9Mobile. It had the highest percentage loss of 74% within the last 9 months. Its number of active subscribers fell from 13.8 million to 3.6 million between January and September 2024.

Although 9Mobile had the highest percentage decline in subscribers, Globacom lost the largest number of mobile subscribers within this time period.

This large loss by Globacom is likely linked to the “rectification of a major discrepancy” by the NCC which suggests that the decline might not be due to user dissatisfaction or market competition but a regulatory move to ensure data accuracy and compliance.

It also shows that the Globacom network had the lowest compliance rate to data verification and authentication through the SIM-NIN exercise.

However, the National Association of Telecommunications Subscribers (NATCOMS), Adeolu Ogunbanjo highlighted the difficulty experienced by many subscribers in linking their NIN to their SIM such as slow speeds and congestion on the NIMC portal. He noted that these technical challenges have prevented many subscribers from following through with the process.

This indicates the need for the improvement of data collection and management systems in Nigeria to ensure more efficient collection and data accuracy.

On a positive note for Globacom, the statistics on the number of users that ported or moved from other service providers’ networks to Globacom increased by 253%. It has been on a steady increase in the last 9 months. It increased from 187 user requests in January to 661 user requests in September 2024.

This could imply that some users still prefer the services of Globacom to other networks.

Thank you for reading this edition of Marina and Maitama. It was written by Lucy Okonkwo and edited by Joachim MacEbong.