MTN Explains Downtime

A significant service outage on Wednesday prevented 87 million MTN Nigeria subscribers from making calls or connecting to the internet. According to a corporate statement, the four-hour interruption was caused by multiple fibre cuts.

MTN has 87,038,768 subscribers as of December 2023, according to data from the Nigerian Communications Commission (NCC), representing 38.79% of the total market share, the largest in the country by any licenced Mobile Network Operator (MNO).

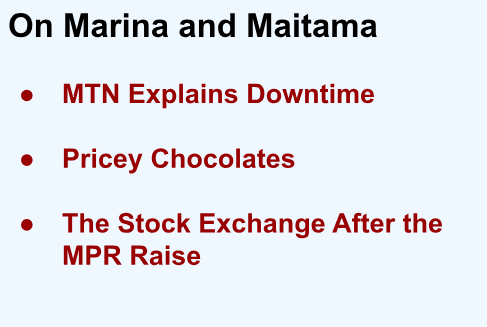

According to Downdetector, disruptions in MTN’s network operating conditions was above the normal threshold between 1 pm and 9 pm on February 28. This further explains that events and alerts generated during this period were unusual.

The survey from DownDetector also shows that 43% of MTN users complained of “No Signal” alerts, 35% complained of “No mobile internet” and 21% experienced “total blackout.”

This power outage encouraged speculations that Telcos had barred all subscribers who were not linked to their National Identification Numbers (NIN). The NCC gave a directive to Telcos for this to take effect with February 28, 2024 as the deadline.

MTN responded to this on Wednesday night, describing the network problem as a "major service outage caused by multiple fibre cuts, affecting voice and data services."

"A fibre optic cable cut refers to a complete or partial severing of the thin glass fibres that make up a fibre optic cable. These cables transmit data over long distances using light pulses." a report by TechCabal clarified.

Road construction and vandalism are key causes of fibre cuts in places like Lagos.

Airtel and 9mobile subscribers also reported network outages at noon on the same day. However, the telco companies did not admit the outage or provide an explanation for the supposed outage.

Pricey Chocolates

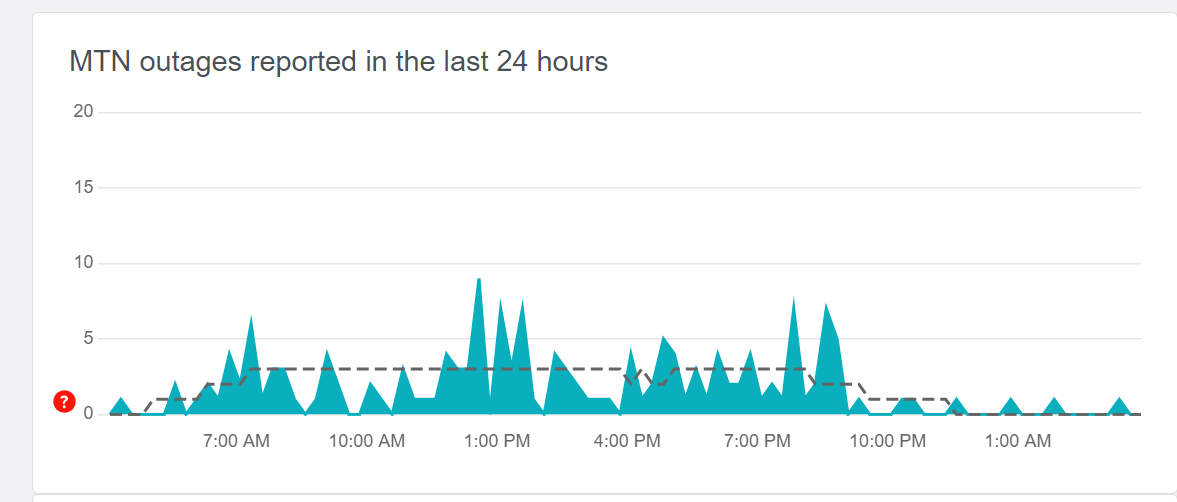

The price of a unit of chocolate in Nigeria has increased in the past six years. This is partly due to the fall in cocoa production in the country.

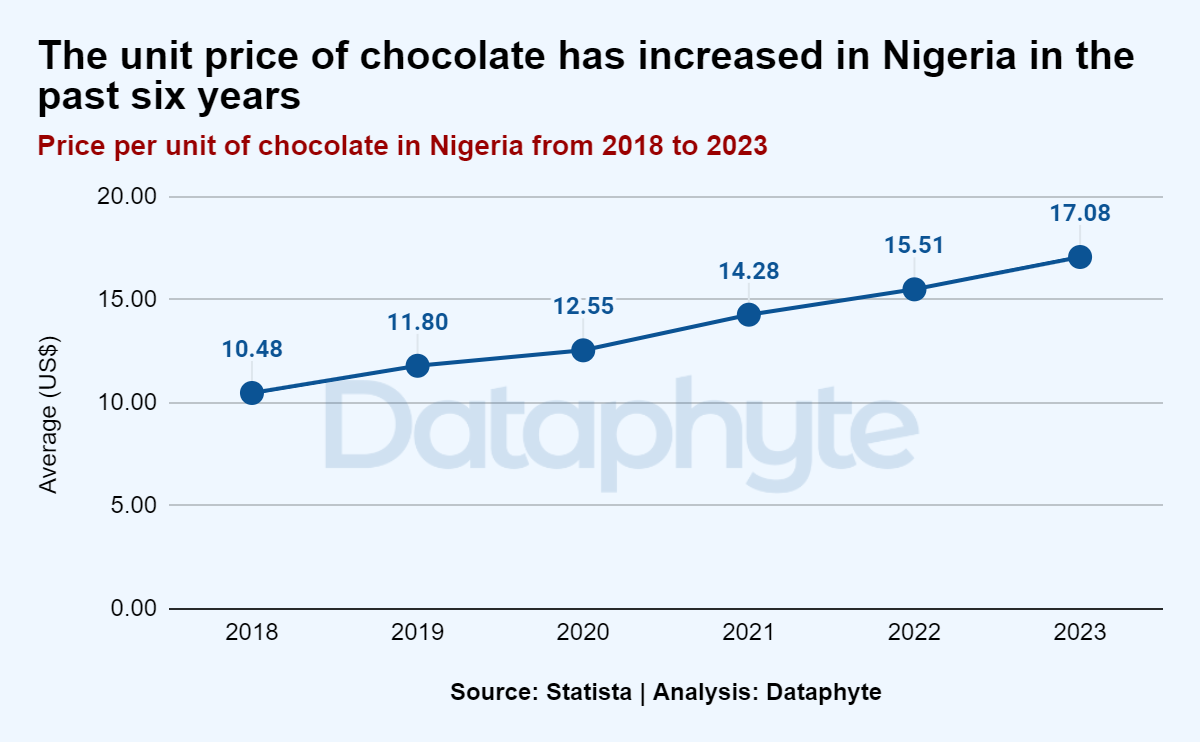

Also, cocoa prices globally have skyrocketed due to low supply from major cocoa-producing countries like Nigeria, Ghana, and Ivory Coast, Nairametrics reported.

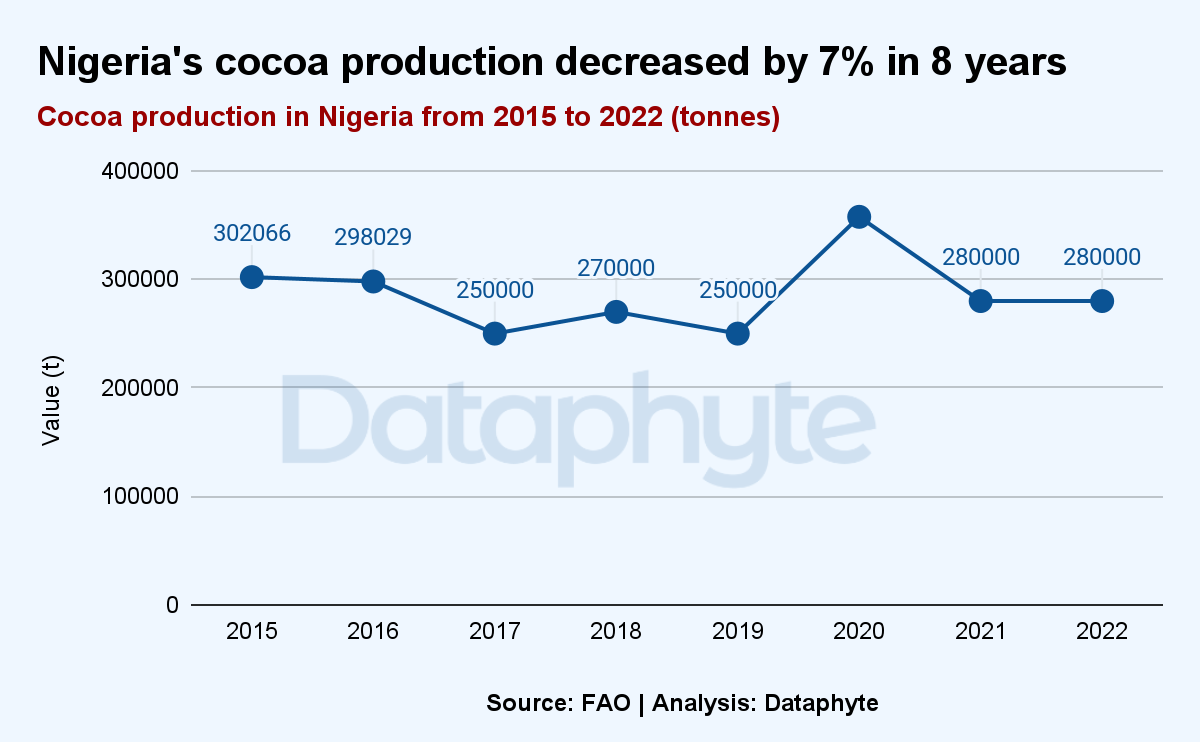

As the world grapples with the price of cocoa, Nigeria’s output and value for output have decreased over the last 8 years, from $302,066 in 2015 to $28,000 in 2022.

Cocoa's global price is normally decided using the London Cocoa Futures contract.

The price per unit of chocolate in Nigeria increased from $10.48 in 2018 to $17.08 in 2023.

Since January 2015, worldwide cocoa prices have changed, beginning at $2,946.82 per tonne, and the most current price of $4,452.60 in January 2024 which is the highest amount cocoa has ever been sold for, according to a review of the International Cocoa Organization (ICCO) cocoa price data.

Since 2015, the total production of cocoa in Nigeria remained below 300,000 tonnes, except for 2020 where it increased to 357,608.24 tonnes.

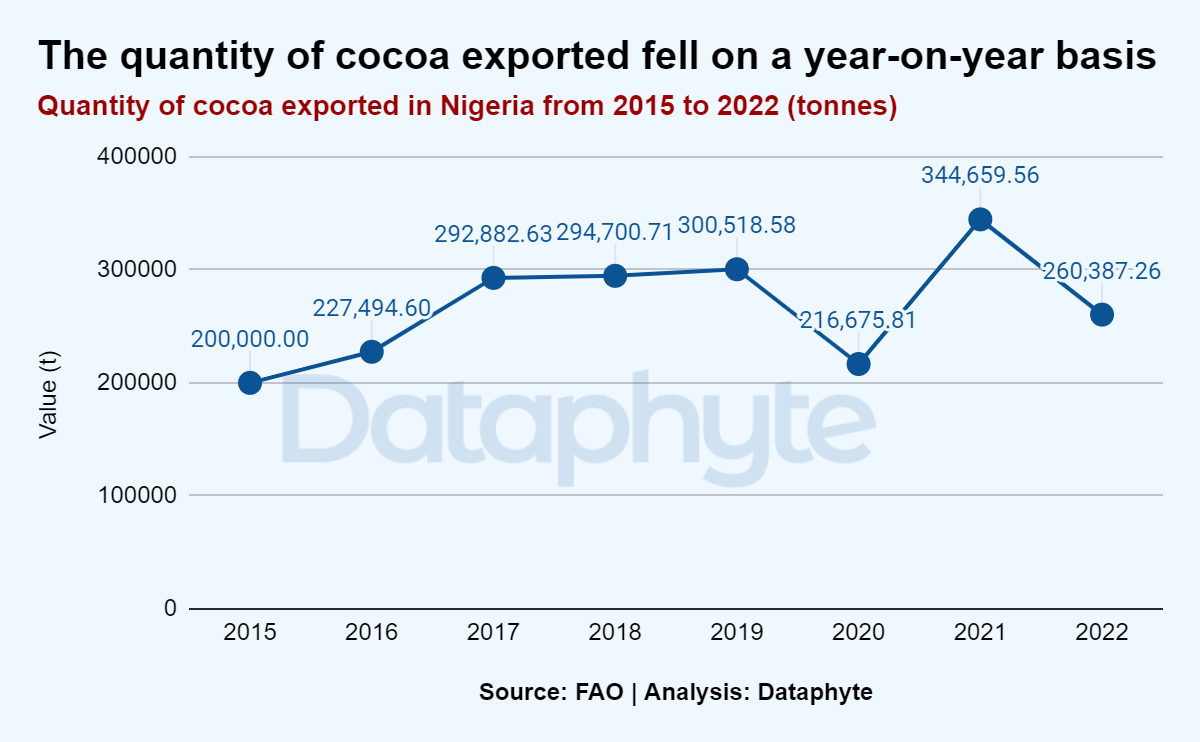

Similar to the total production of cocoa in Nigeria, the quantity of cocoa exported did not exceed 300,000 tonnes except in 2019 and 2021 where it exported 300,518 and 344,659 tonnes respectively.

Over an eight-year period, Nigeria's cocoa export value has shown a shifting tendency. The amount increased steadily starting at $460 million in 2015 and peaked at $790.7 million in 2021.

But there was a brief drop to $510.8 million in 2020. 2022 was the next year with a drop of $528.4 million.

West African countries, notably Côte d'Ivoire, Ghana, Nigeria, and Cameroon, account for 70% of the global cocoa supply.

Nigeria, the world's fifth largest cocoa producer, contributes more than 5% to global supply. Nigeria's cocoa harvest is likely to fall below 300,000 tonnes this year due to ageing plants and pest infestations, which reduce yields.

Nigeria exports more than 60% of its cocoa to Europe, with 8% going to the United States and Canada.

Climate change is causing old and diseased plants, lower crop yields, and the spread of diseases, all of which are problems for the cocoa industry.

Experts predict that despite these obstacles, the global market for chocolate and cocoa will expand from $48 billion in 2022 to over $68 billion by 2029.

The Stock Exchange After the MPR Raise

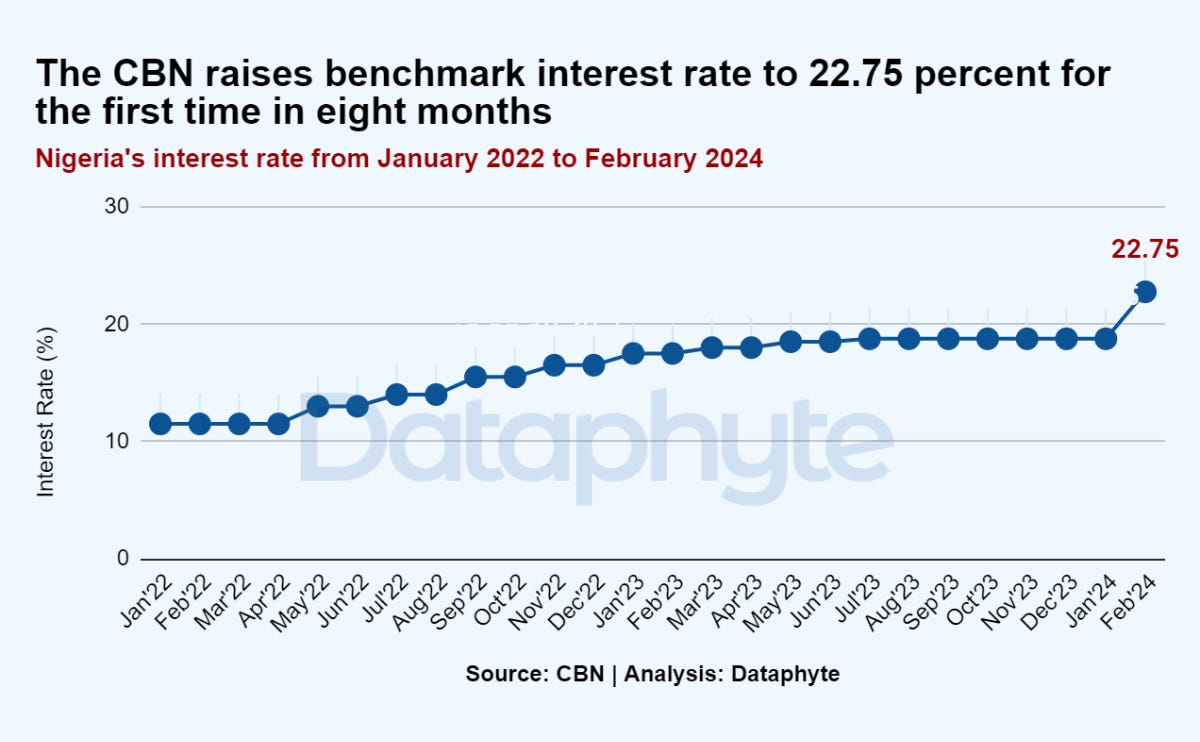

The Central Bank of Nigeria (CBN) raised the benchmark monetary policy rate from 18.75% to 22.75%.

At the end of the Monetary Policy Committee (MPC) meeting on Tuesday, February 27, 2024, CBN Governor Yemi Cardoso reiterated that the decision was based on the existing inflationary and exchange rate pressures and forecast inflation

The CBN’s announcement and its anticipation coincided with a decrease in the all-share index of the Nigerian stock exchange market.

Nigeria's stock market fell by 1.38 per cent, or N773 billion after the Monetary Policy Committee (MPC) raised the Monetary Policy Rate (MPR) by 400 basis points (bps) to 22.75 per cent after its two-day bimonthly meeting.

The benchmark for interest rate increased to 22.75 per cent for the first time in eight months and is the greatest rate hike in absolute terms in around 17 years.

Mr Cardoso also stated that the cash reserve ratio, or the commercial bank deposits held by the central bank, will be raised from 32.5 per cent to 45 per cent to control inflation by increasing the money supply.

At the close of trading on Tuesday, the Nigerian Exchange Limited (NGX) All-Share Index (ASI) fell from 101,995.21 points the day before to 100,582.89 points. Also, Market Capitalization fell from N55.810 trillion to N55.037 trillion.

The market's year-to-date (YTD) return was lower at 34.52 per cent.

Interest rate changes affect the economy and the stock market, impacting the borrowing costs for individuals and enterprises.

The impact of the Monetary Policy Rate takes longer to reflect on the general economy, but the stock market's response is often faster.

However, in the long run, it affects everyone because an increase in the MPR leads to potential increases in banks’ discount rates. This may result in lower future discounted valuations and, overall, lower the company's value.

Thanks for Reading this edition of Marina and Maitama. See you next week!

This edition of Marina and Maitama was composed by Khadijat Kareem.