Nigerian Banks: Gaining Momentum?

+Nigeria’s Reduced Subnational Debt: Budgets, Revenue, and Fiscal Prospects

Since 2024, Nigerian banks have been undergoing structural, financial, and operational reforms led by the Central Bank of Nigeria (CBN). These reforms include banking recapitalisation, system migrations, and ATM withdrawal fee hikes, all aimed at strengthening the sector and enhancing its global competitiveness.

These changes, driven by regulatory policies, technological advancements, and evolving market dynamics, seek to improve efficiency, expand financial inclusion, and position Nigerian banks as key players in Africa’s and the global financial landscape.

However, persistent operational inefficiencies, especially frequent digital glitches raise concerns about Nigerian banks' global competitiveness, particularly within Africa. This concern is reflected in their performance in The Banker’s Top 100 African Banks ranking.

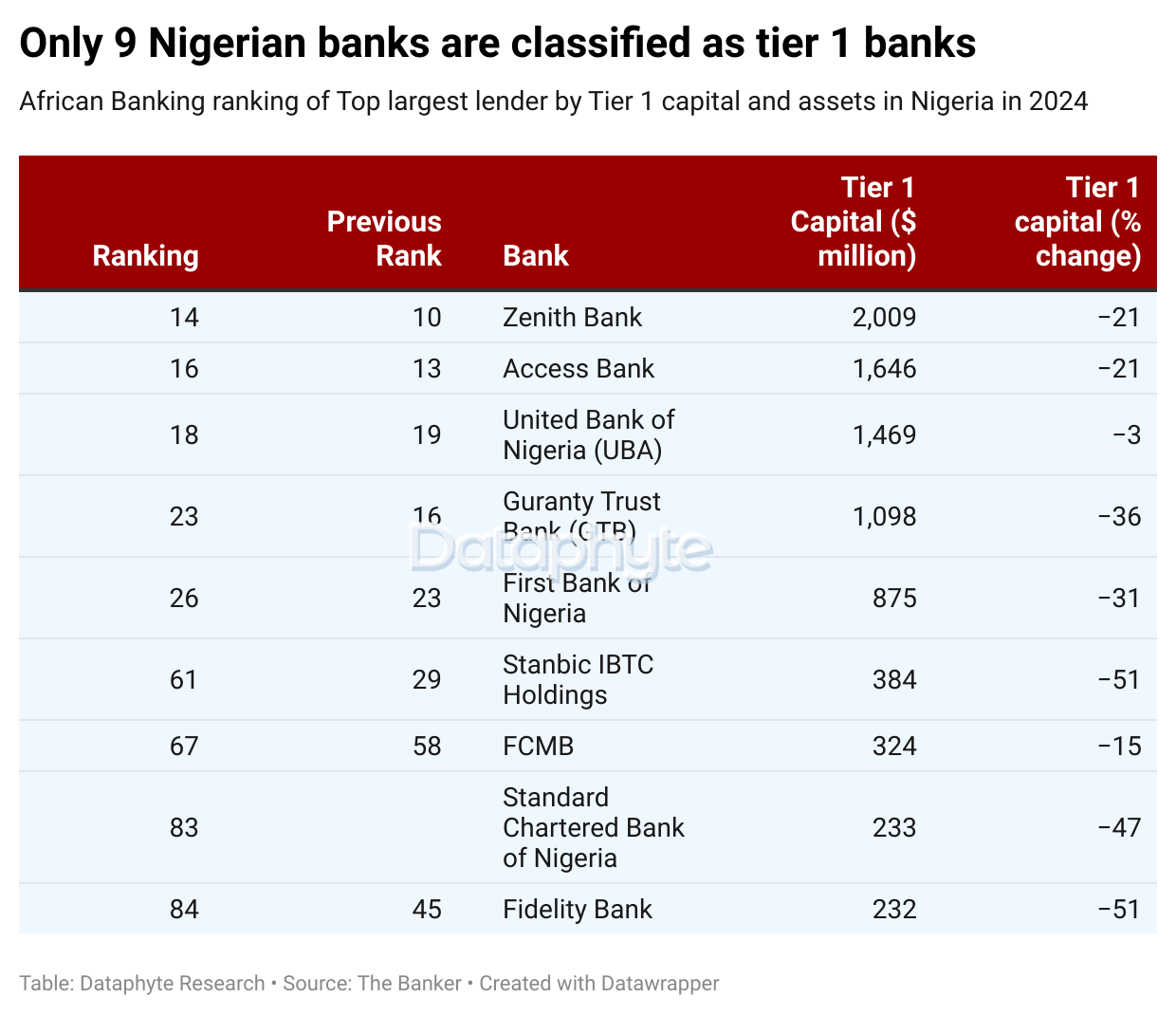

The Banker’s 2024 Top 100 African Banks report ranks only 9 out of 25 Nigerian banks among Africa’s largest lenders by Tier 1 capital and total assets, a decline from 11 banks in 2023. This implies that only 36% of Nigerian banks have enough capital to be classified as tier 1 banks in Africa.

According to the report, “following the scrapping of foreign exchange controls by President Bola Ahmed Tinubu in June 2023, the naira lost half of its value against the dollar by the end of the year, with the currency falling even further this year. As a result, eight out of nine lenders saw their Tier 1 capital positions decline by 15 per cent or more in dollar terms during the year.”

The drop in rankings and capital positions may indicate a decline in core financial reserves, potentially making Nigerian banks more vulnerable to economic shocks and external pressures.

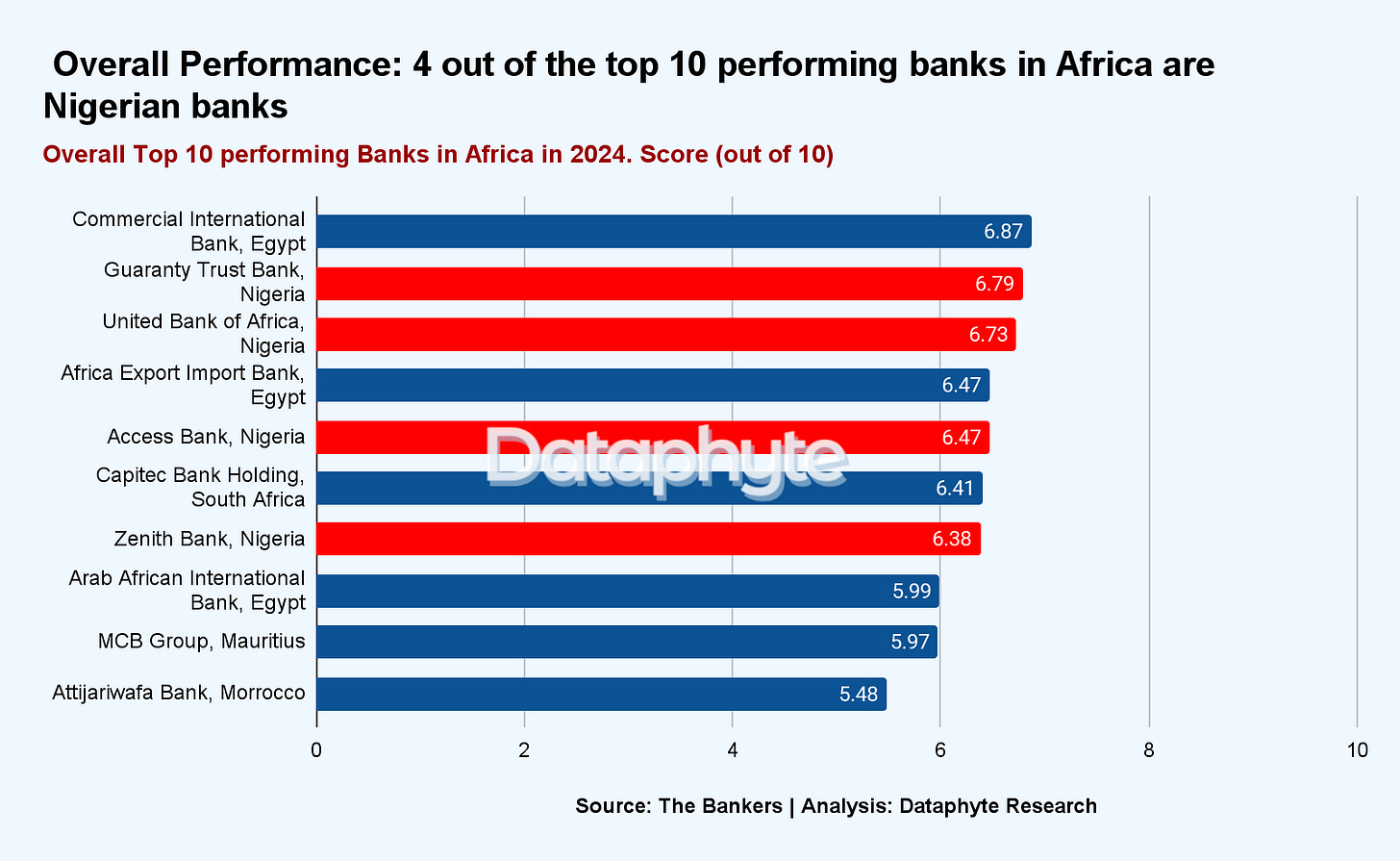

The Banker’s Top 100 African Banks ranking assesses banks from selected African countries based on key financial indicators such as growth, profitability, operational efficiency, asset quality, return on risk, financial soundness, liquidity, and leverage to determine the level of capital/assets and the overall performance of these banks.

In terms of performance, only four Nigerian banks ranked among Africa’s top 10 in 2024. Guaranty Trust Bank (GTB) led as Nigeria’s highest-ranking bank, securing 2nd place in Africa with a score of 6.79 out of 10. It was followed by United Bank for Africa (UBA) in 3rd place (6.73), Access Bank in 5th place (6.47), and Zenith Bank in 7th place (6.38).

Notably, Nigeria has the highest number of banks and the best overall performance across Africa. 4 Nigerian banks made it to the list with 3 Egyptian banks and one bank each from South Africa, Morocco, and Mauritius.

Despite a decline in rankings for some Nigerian banks based on capital and assets, the Nigeria’s banking system continues to play a significant role in shaping Africa’s financial landscape.

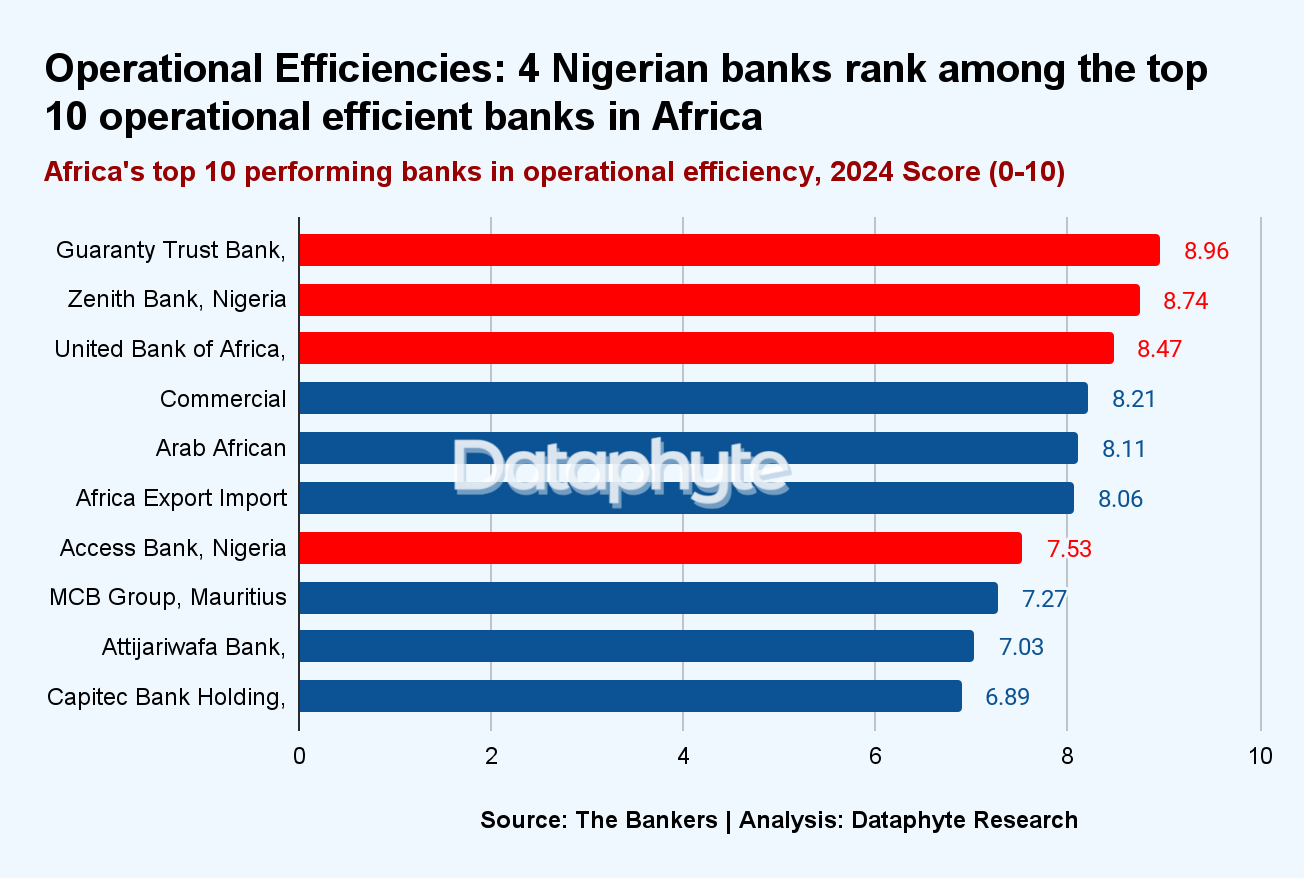

While concerns persist over operational inefficiencies, Nigerian banks have demonstrated notable progress in efficiency rankings.

In 2024, four Nigerian banks secured spots among the top 10 most operationally efficient banks in Africa, an improvement from 2023 when only two made the list.

Guaranty Trust Bank (GTB) emerged as the most efficient bank on the continent, achieving a score of 8.96 out of 10. Zenith Bank followed closely in second place with a score of 8.74, while the United Bank for Africa (UBA) ranked third with 8.47. Access Bank also maintained a strong presence, placing seventh with a score of 7.53.

Nigerian banks are effectively managing their resources, optimising costs, and maintaining high productivity levels relative to their African counterparts.

However, persistent customer complaints about digital banking failures, transaction errors, and slow service delivery indicate a disconnect between internal efficiency rankings and actual user experience.

We expect that these new policies such as the increased ATM withdrawal fees and other measures introduced by the CBN will successfully enhance the operational efficiency of commercial banks, ensuring a more stable, competitive, and customer-friendly banking sector in Nigeria.

Nigeria’s Reduced Subnational Debt: Budgets, Revenue, and Fiscal Prospects

The total sub-national debt of the 36 states and the Federal Capital Territory (FCT) stood at N4.26 trillion, in September 2024. This is a 1.3% decrease from the total subnational debt recorded in June 2024.

This decline suggests improved financial management and growing economic resilience among subnational governments, as they make efforts toward fiscal stability.

Although the reduction in debt is a positive development, there is a need to sustain this trend, through continued economic growth, disciplined budgeting, and responsible borrowing practices.

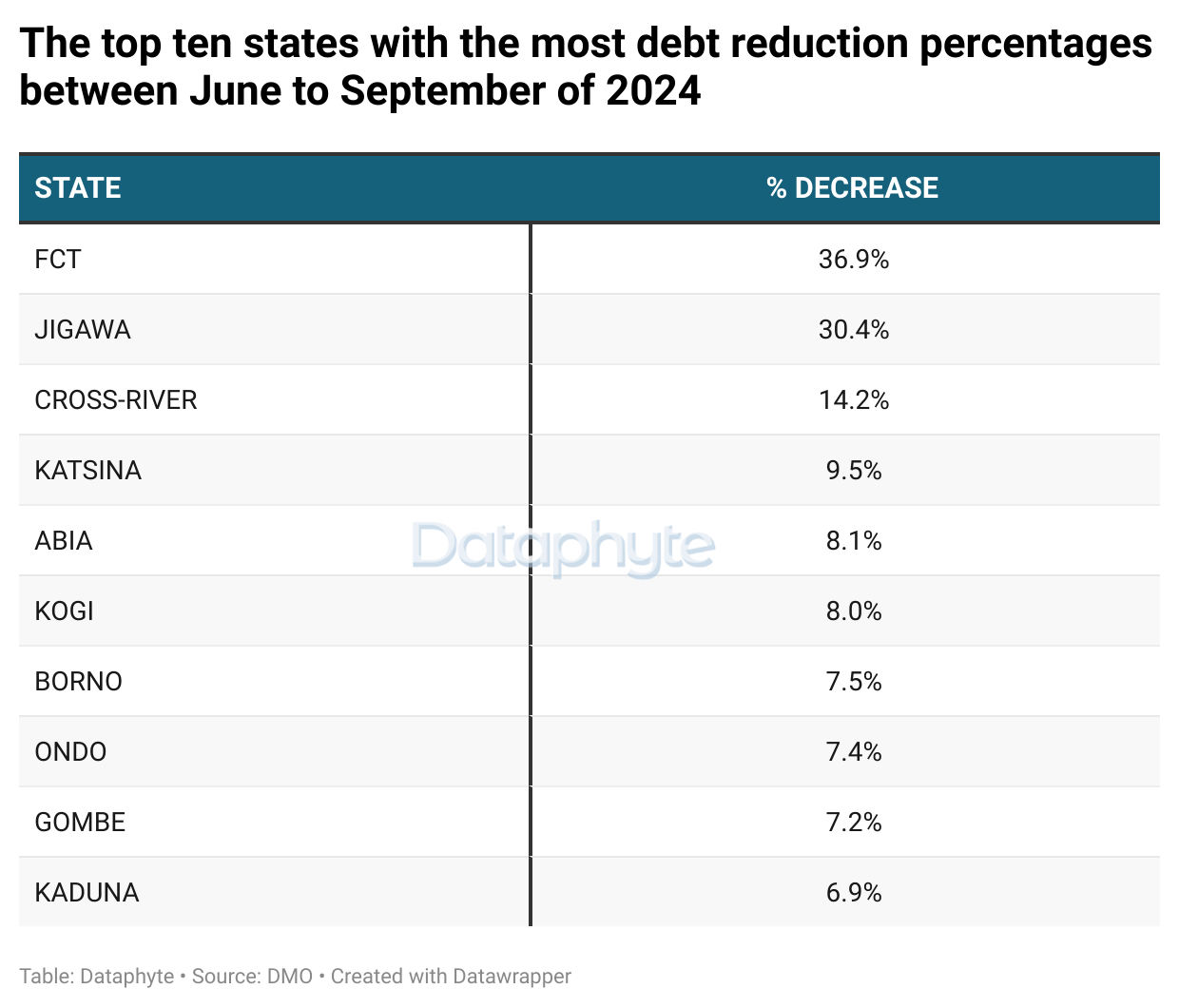

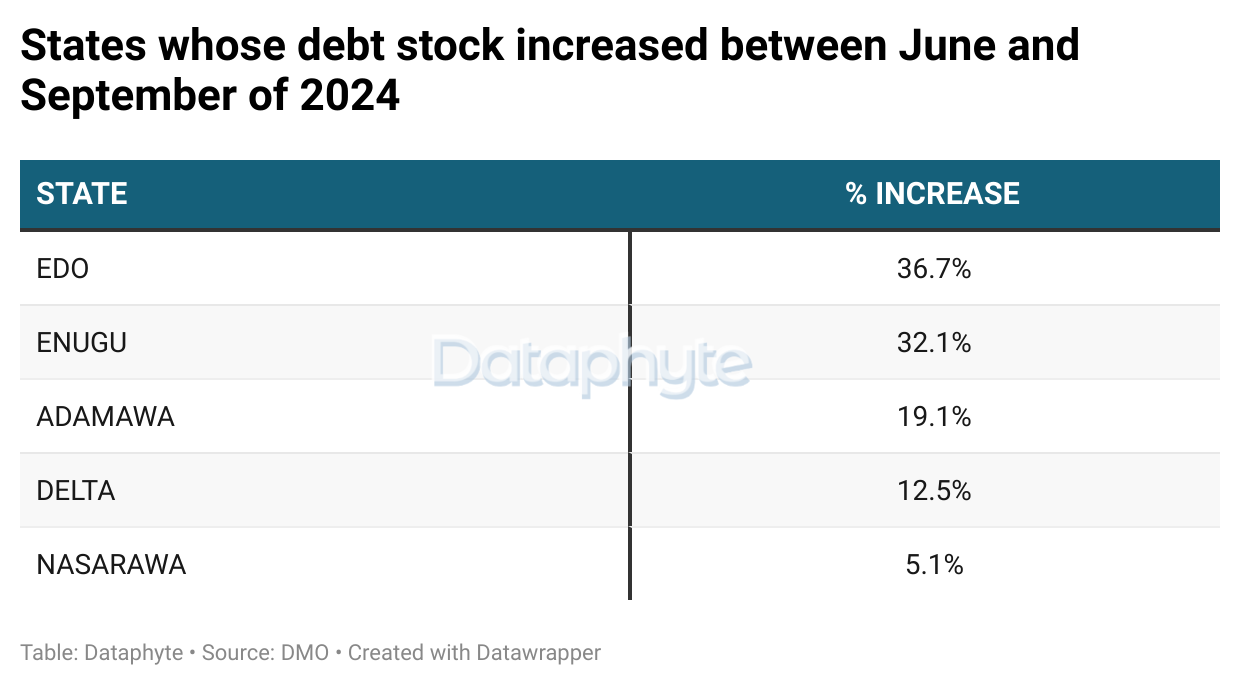

Despite the overall debt reduction, variations exist among the states. 30 states and the FCT successfully lowered their debt stock, one state maintained its debt level, and five states recorded an increase.

The FCT, Jigawa, and Cross River recorded the largest percentage decrease in sub-national debt. This could be attributed to increased internally generated revenue (IGR), better financial planning, or reduced borrowing.

On the other hand, five states saw an increase in their debt stock, with Enugu and Edo recording the highest percentage increases. This might be as a result of higher borrowing for infrastructure projects or fiscal pressures leading to increased debt reliance.

The Dynamics of Revenue and Fiscal Sustainability

State governments rely on a mix of Internally Generated Revenue (IGR) and federal allocations from the Federation Account Allocation Committee (FAAC) to fund their budgets. IGR is sourced from taxes such as Pay-As-You-Earn (PAYE), Direct Assessment, Road Tax, Stamp Duties, and various other levies.

While FAAC disbursements, which are distributed monthly, depend on factors like statutory allocations, value-added tax (VAT) revenue, the 13% derivation principle for oil-producing states, and exchange rate differentials.

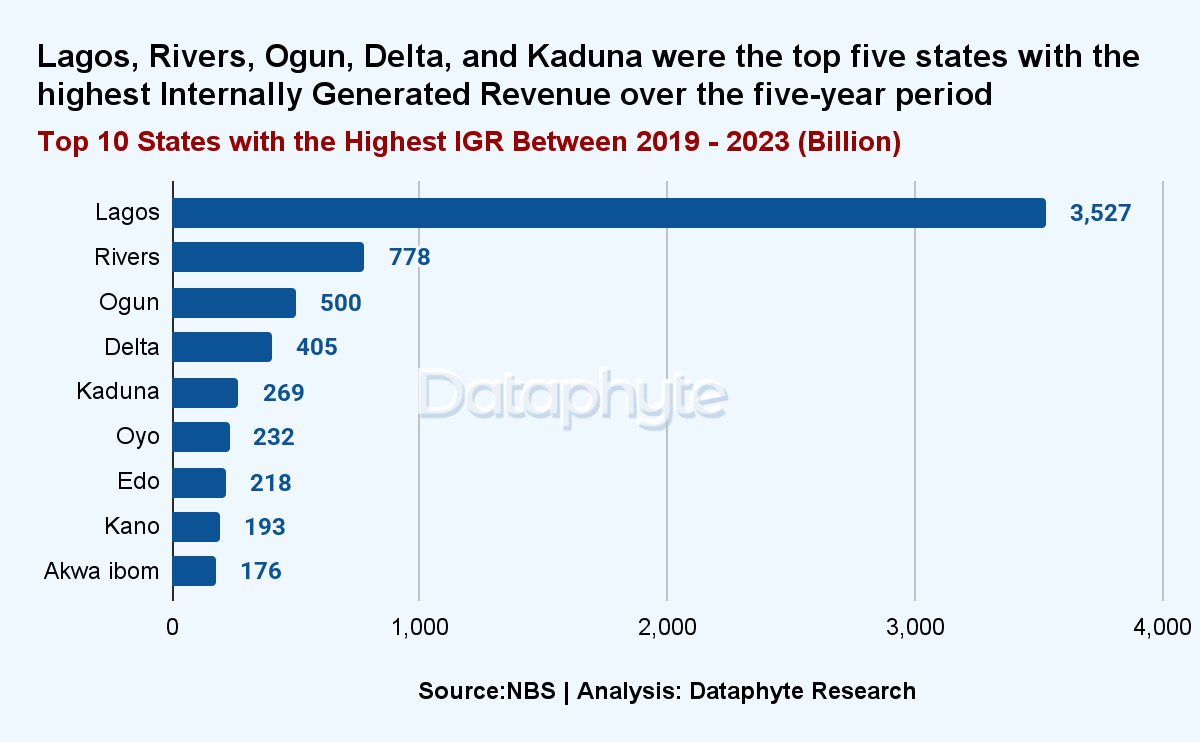

Lagos, Rivers, the FCT, Ogun, and Delta have consistently recorded the highest IGR over the past five years according to data from the National Bureau of Statistics (NBS).

An analysis on each state’s revenues compared to budget allocations revealed only 17 states can conveniently fund their budgets with the revenue generated in 2023. Among them, Rivers, Delta, Ekiti, and Ebonyi had revenue that covered more than 70% of their budgets.

However, some states, like Ogun and Kaduna, despite ranking among the highest in IGR, still struggle to meet budgetary demands, with their revenue covering only about 40% of their financial needs.

This implies that more states may rely on external or domestic loans to fund their budgets, leading to increased debt for those states.

While the recent decline in subnational debt is encouraging, the long-term financial stability of states depends on their ability to generate sufficient revenue, control borrowing, and implement sound fiscal policies.

Excessive debt can lead to loan defaults, credit rating downgrades, higher borrowing costs, and austerity measures that affect public services. In extreme cases, economic instability may erode investor confidence, trigger capital flight, and expose states to legal disputes with creditors.

To avoid these risks, state governments must strengthen revenue mobilisation, enforce fiscal discipline, and adopt sustainable borrowing strategies. Only then can Nigeria’s subnational governments achieve lasting financial stability while ensuring continued development.

Thanks for reading this edition of Marina and Maitama. It was written by Adijat Kareem and Lucy Okonkwo, and edited by Adijat Kareem.

Do you work at a Civil Society Organisation? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey:

Do you work for any government agency? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey: