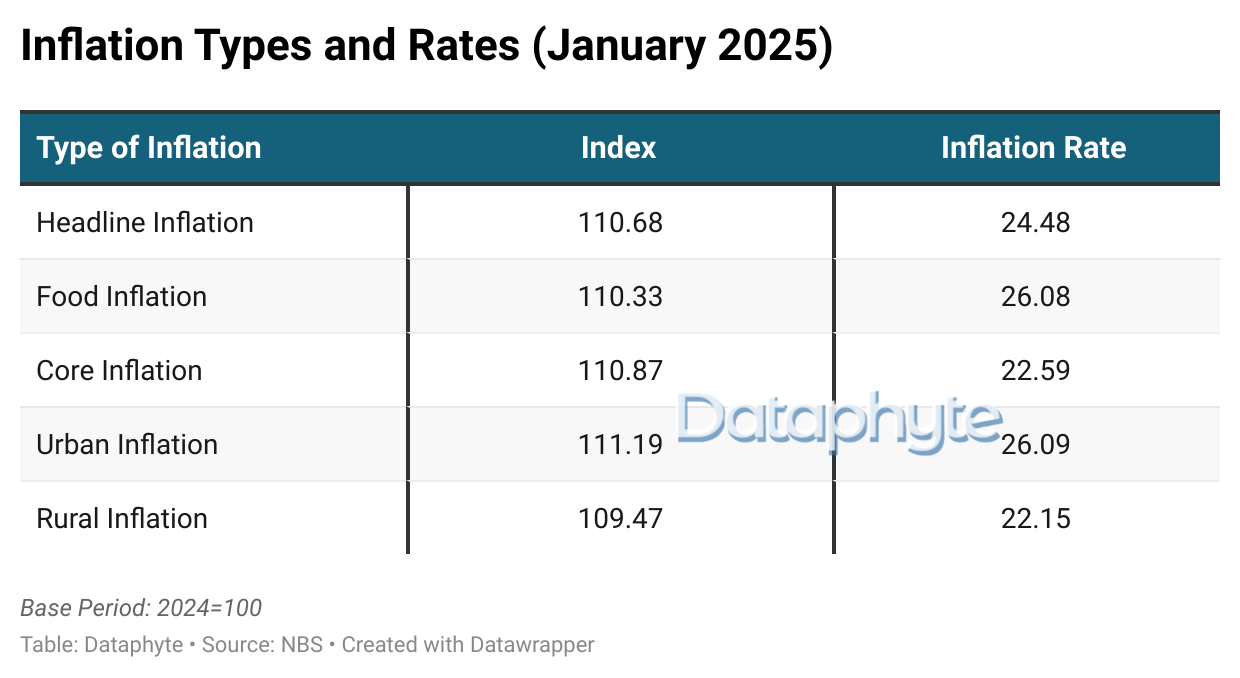

Nigeria’s Consumer Price Index (CPI) also known as headline inflation dropped year-on-year to 24.48% in January 2025, down from 34.80% in December 2024. The decline in headline inflation was due to the adoption of a new base year, 2024 and a revised basket of goods and services.

CPI rebasing is a routine statistical adjustment that enhances the accuracy of inflation measurement. However, it does not, in itself, serve as a solution to inflationary pressures. Instead, it updates the methodology for tracking price changes and ensures that inflation calculations align with current economic realities.

According to experts, the rebasing of the CPI will be significant for monetary and policy decisions by the Central Bank of Nigeria (CBN), particularly changes to interest rates, affecting financial instruments including bonds and fixed-income securities.

Nevertheless, the interest rate in Nigeria has remained at 27.50%, defying the notion that the CBN will probably raise it.

As the inflation rate dropped precipitously to 24.48%, the Central Bank of Nigeria's (CBN) Monetary Policy Committee (MPC) decided to keep the benchmark interest rate at 27.50% during the 20th of February policy meeting.

The monetary authority also decided to keep the asymmetric corridor at +500bps/-100bps at the conclusion of the two-day meeting. Additionally, it maintained at 50.0% for deposit money banks and 16.0% for merchant banks is the Cash Reserves Ratio (CRR).

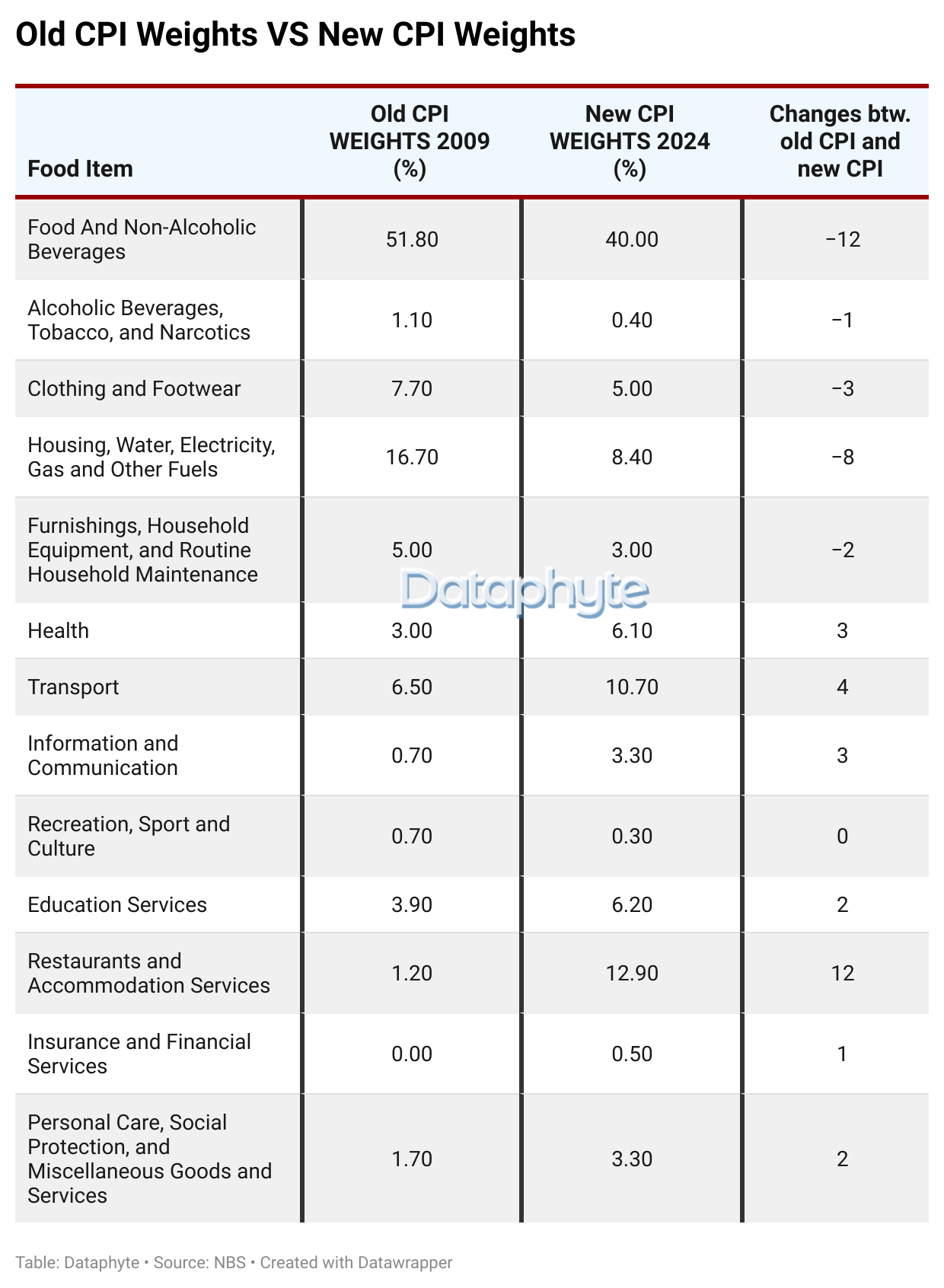

A recalibrated inflation rate resulted from Nigeria's 2009 CPI rebase, which updated the base year from 2009 to 2024, updating the basket of goods and services to reflect shifting consumption patterns.

The January 2025 CPI post-rebasing indicates persistent inflation, particularly in the food, transportation, and consumer services industries. Since food accounts for 40% of the basket, it continues to be the main driver of Nigeria's inflation.

The inflation rate is lower mostly due to the recent restructuring of the inflation basket, which effectively reduced the impact of food, non-alcoholic beverages, housing, electricity, gas, and other fuels on inflation by 72.29 per cent.

The new inflation reality

While the rebasing of Nigeria’s CPI improves statistical accuracy and provides a more current reflection of economic conditions, it is not a direct solution to inflation.

Rebasing guarantees that the CPI basket appropriately reflects Nigerians' current expenditures. It also increases the accuracy of data. Older base years can skew inflation calculations by over- or underrepresenting price increases in less important commodities.

By utilising recent data, rebasing increases the accuracy of economic research and policy decisions.

To keep economic indicators in line with the state of the economy, several nations routinely rebase their CPI, usually every five to 10 years.

Experts, however, believe that the Central Bank of Nigeria's Monetary Policy Committee should take into account lowering the Monetary Policy Rate (benchmark interest rates) in order for the latest inflation figures to indicate an actual slowdown in pricing levels.

Nigeria’s Cocoa Production Gets a Boost

Johnvents Group, a Nigerian agribusiness company, has secured a $40.5 million investment from British International Investment (BII) to increase the cocoa production of its Ile Oluji cocoa processing facility from 13,000 to 30,000 metric tonnes per year. This is reinforcing the UK’s commitment to strengthening Nigeria’s agricultural sector.

This funding is designed to foster growth and innovation while expanding economic opportunities for farmers, particularly in Nigeria’s vital cocoa industry. It aims to enhance the export of premium cocoa, strengthening the country’s position in the global market.

The British deputy high commissioner in Lagos stated, “The UK is proud to back first-class sustainable investment that is creating jobs and mutually beneficial partnerships across Nigeria. Through this landmark agreement between the UK’s development finance institution, British International Investment, and Johnvents Group, we look forward to further growth in Nigeria’s cocoa industry and increased export markets.”

This highlights that with the right investment, the cocoa industry in Nigeria has potential for growth, increase the country's export value and help diversify the economy away from oil dependence.

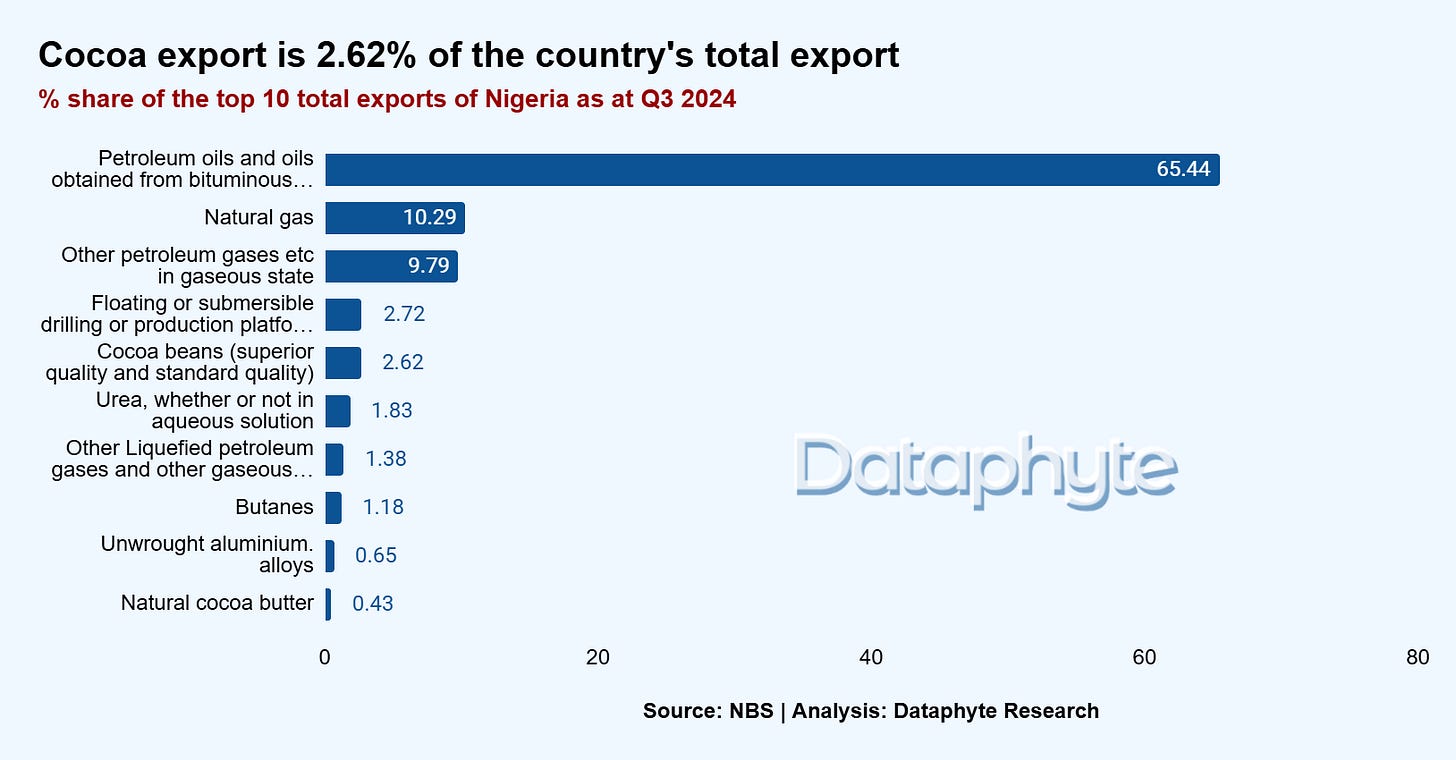

The NBS report on foreign trade showed that cocoa is Nigeria’s biggest agricultural export and the 5th highest export of the country in Q3 2024, making cocoa one of Nigeria’s main cash crops.

Currently, cocoa exports contribute 2.62% to Nigeria’s total exports in Q3 2024, generating a significant value of ₦538 billion. As one of the country’s top agricultural exports, cocoa plays a crucial role in Nigeria’s economy and global trade presence.

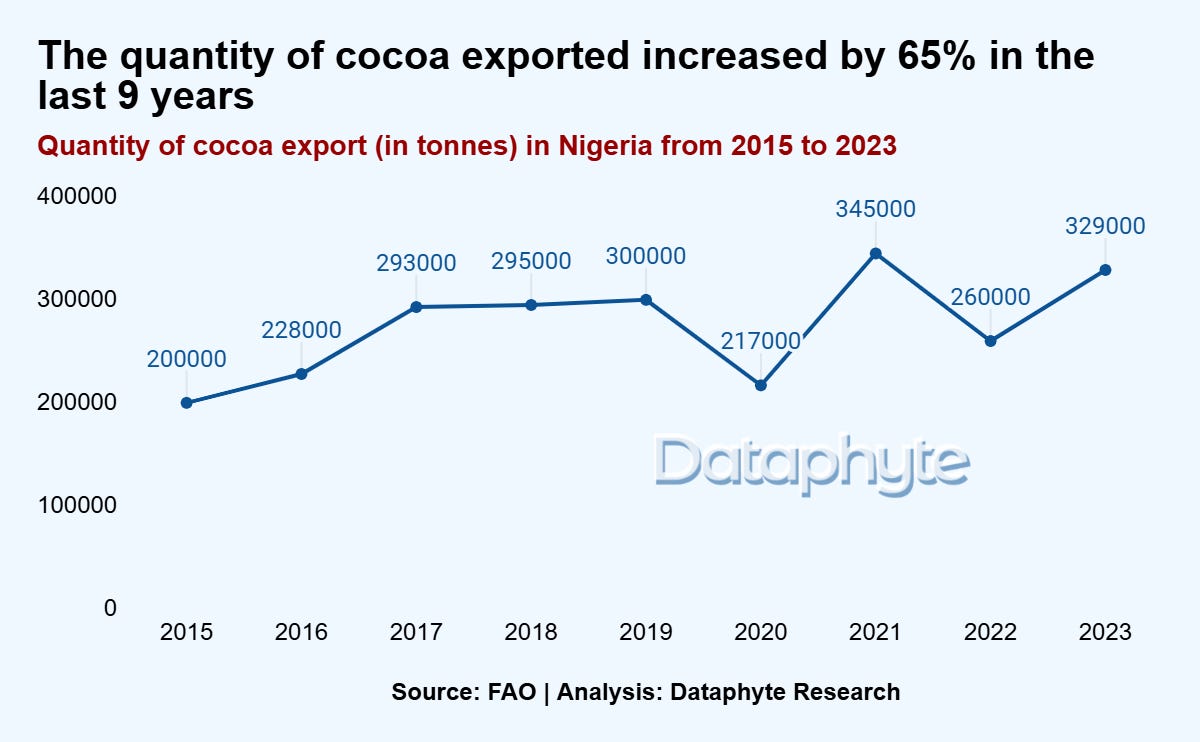

Over the past nine years, Nigeria’s cocoa exports have grown from 200,000 tonnes in 2015 to over 329,000 tonnes in 2023. This is a 65% increase in the overall percentage growth in export volume.

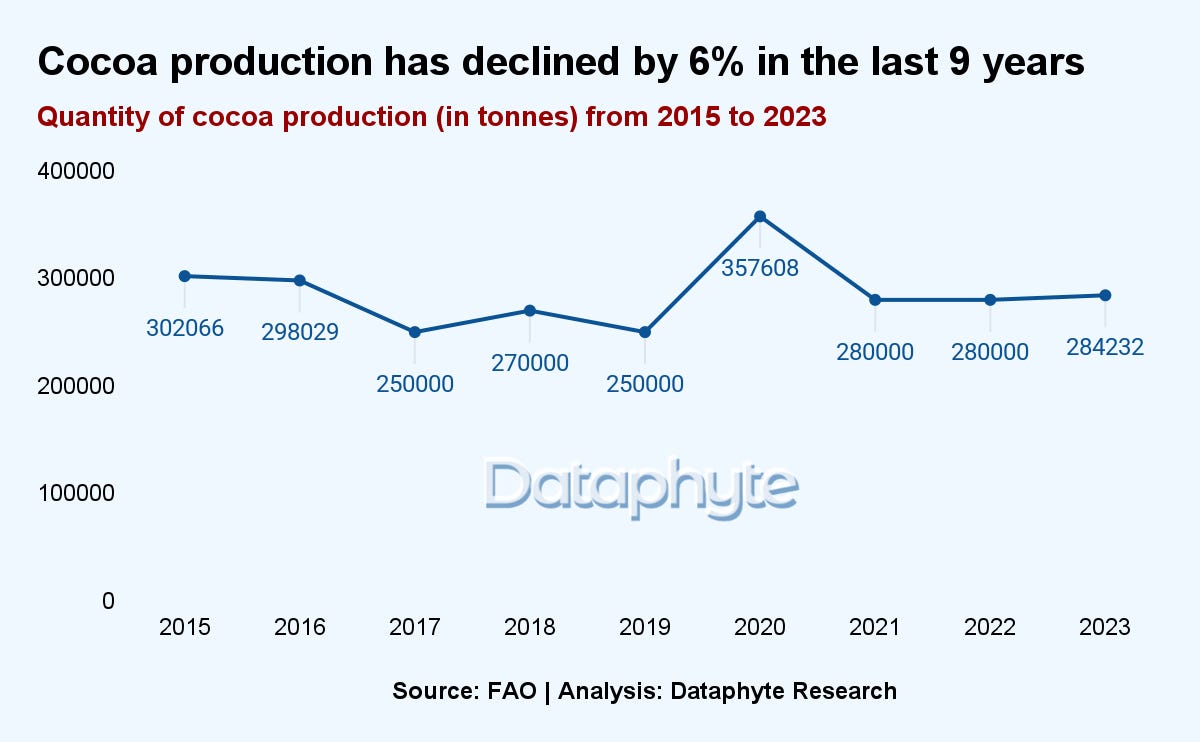

While cocoa exports have grown over the past nine years, cocoa production has declined. Between 2015 and 2023, cocoa production declined by 6%, dropping from over 302,000 tonnes to approximately 284,000 tonnes.

The decline in cocoa production growth has been attributed to an increasing number of aging plants, widespread disease outbreaks, and persistent pest infestations.

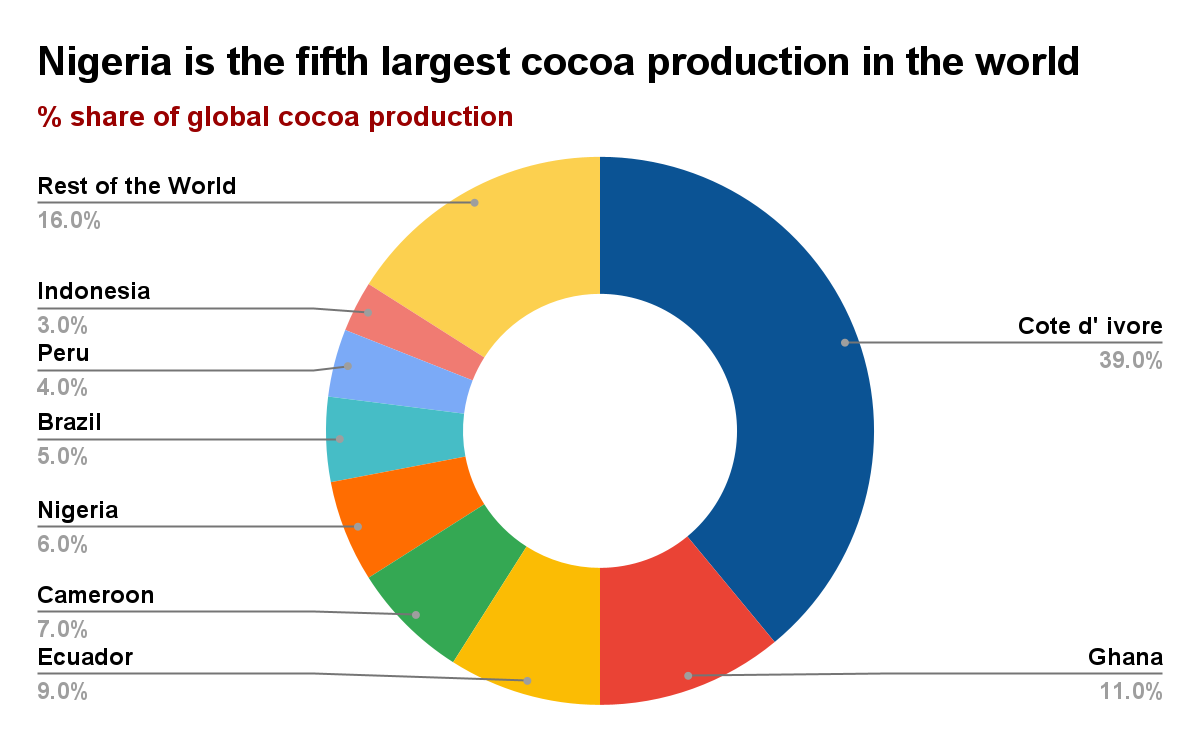

Despite the decline in the country’s cocoa production, Nigeria remains the world’s fifth-largest cocoa producer, contributing 6% to the global supply. It ranks behind Côte d'Ivoire, Ghana, Ecuador, and Cameroon, which collectively dominate the market, accounting for 66% of total global cocoa production.

Source: Swiss Platform for Sustainable Cocoa | Analysis: Dataphyte

The Nigerian cocoa industry has significant potential to contribute to economic diversification, especially given the rising global demand and prices. The increase in cocoa prices to $8,246 per tonne by the end of 2024 is a strong indicator of profitability. However, for Nigeria, the price was even higher due to currency devaluation, which makes exports more competitive but also raises the cost of imports for inputs like fertilizers and equipment.

The chief executive officer of Starlink, Adeyemi Adeniji stated that, “the cocoa market, in terms of volume, is just about 250,000 tons, but in terms of value, it is about $6 billion or more, depending on the international market price. Today, the price of cocoa has risen to $10,000 per tonne. This means Nigeria’s cocoa exports could generate $25 billion, underscoring the potential of the sector.”

In line with the potential of this industry, the investment by the BII would boost the profitability of the industry, and ensure that Nigeria gains more global competitiveness in the export of cocoa.

Benson Adenuga, Coverage Director and Head of Nigeria Office at BII, said: “We are delighted to partner with Johnvents Group to address critical barriers to the growth of Nigeria’s cocoa industry. Not only will this benefit local farmers, but also improve Nigeria’s trade balance and global competitiveness through increased exports”.

If Nigeria can address issues like low productivity, aging farms, poor infrastructure, and access to financing, the cocoa sector could become a major foreign exchange earner, reducing reliance on oil revenues.

Thanks for reading this edition of Marina and Maitama. It was written by Adijat Kareem and Lucy Okonkwo, and edited by Joachim MacEbong.

Do you work at a Civil Society Organisation? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey:

Do you work for any government agency? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey:

But I guess the SG said you should not compare the new CPI with the previous one? I hope you correct this.