Nigeria’s rural-urban inflation divide

+Lessons for urban folks to learn from rural residents

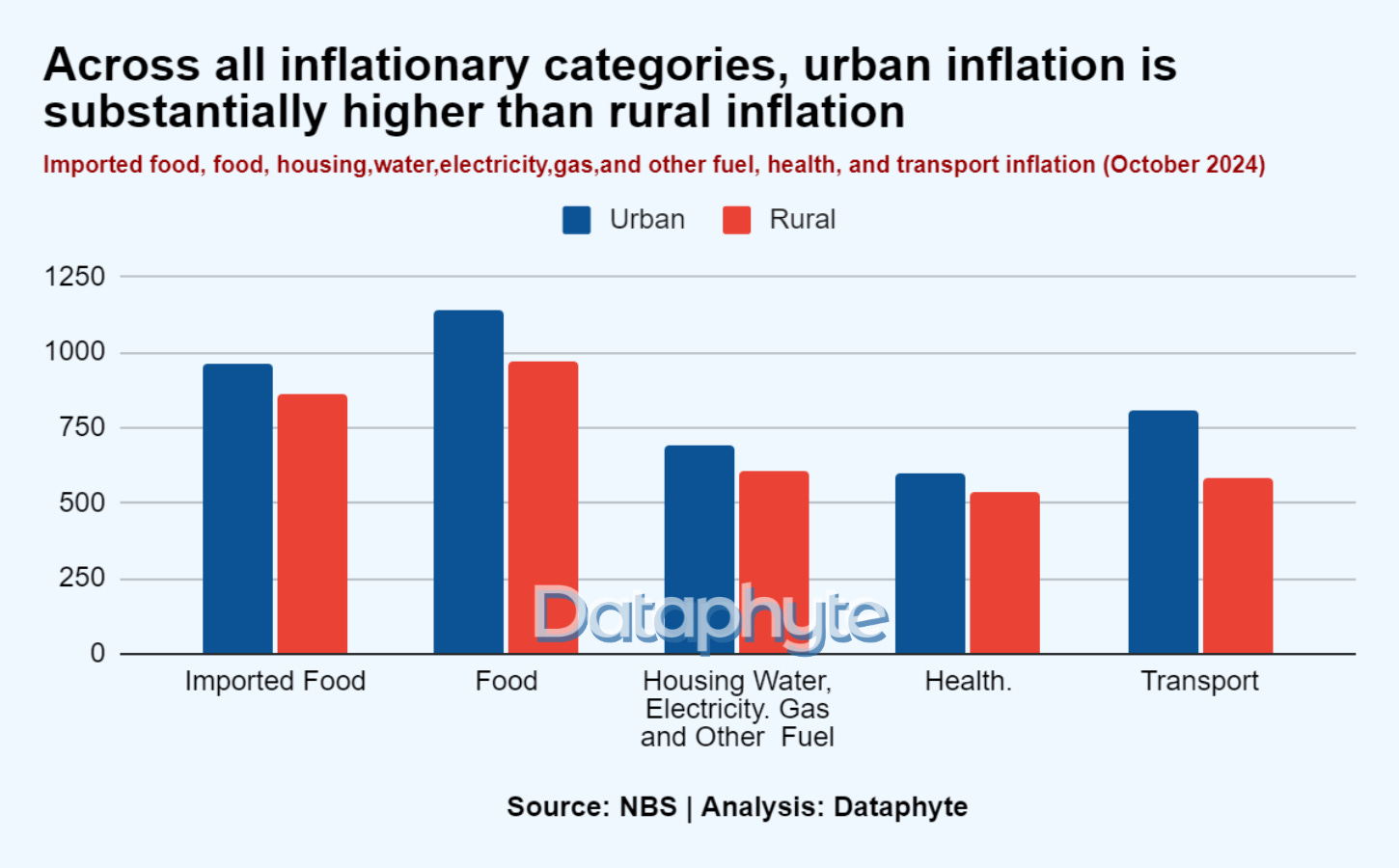

Nigeria’s urban inflation is higher than rural inflation. According to the latest National Bureau of Statistics (NBS) inflation report, urban inflation was higher than rural inflation in October 2024, continuing a trend observed over the past 22 months.

This difference is a typical occurrence, driven by increased exposure to cost drivers such as rent, food, imported food, transportation and health expenses. Urban inflation consistently surpasses rural inflation due to these factors.

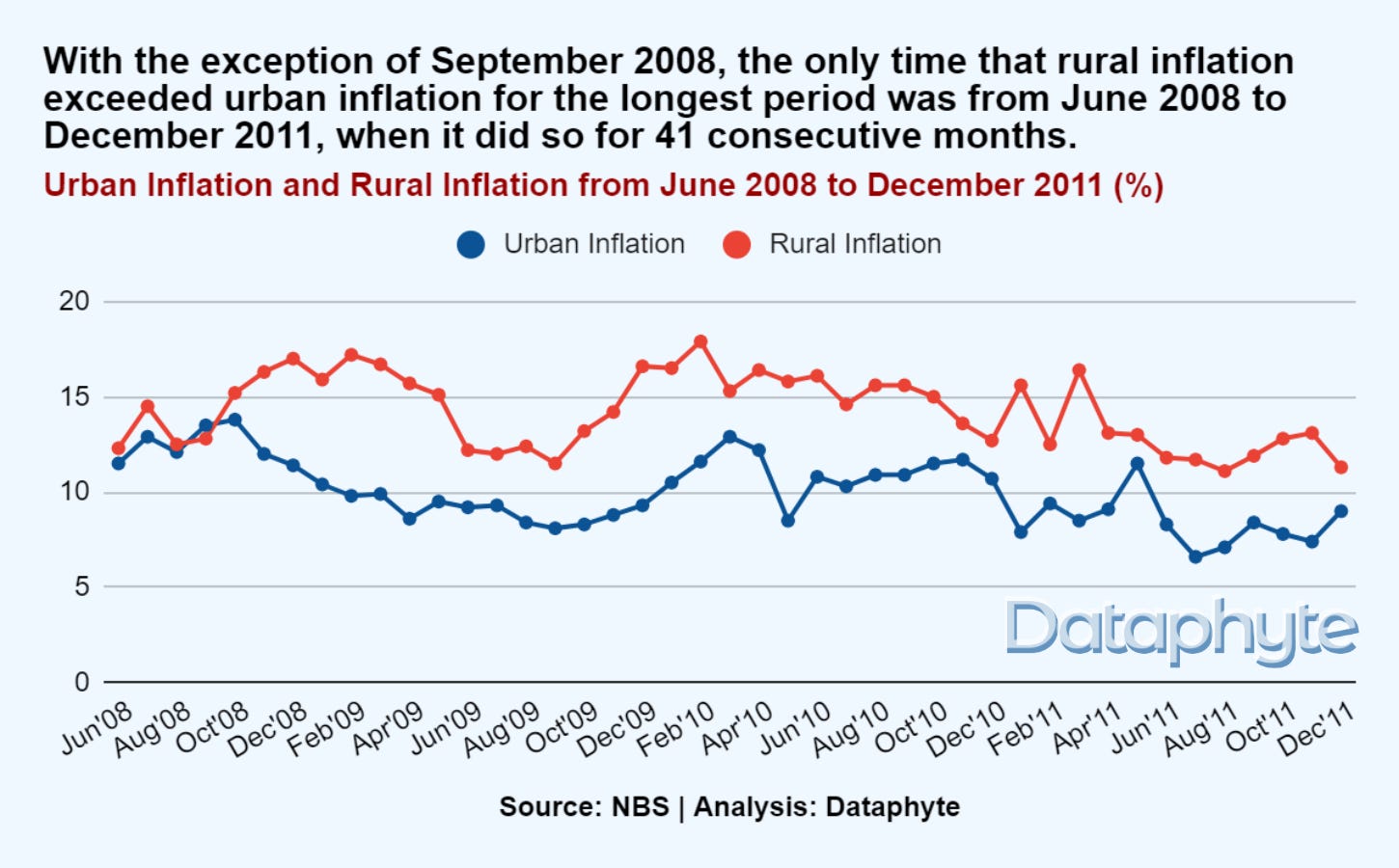

Although it is typical for urban inflation to be higher than rural inflation, Nigeria has had some exceptions where rural inflation was higher than urban inflation.

The period from June 2008 to December 2011 stands out in Nigeria’s inflation history, with rural inflation consistently surpassing urban inflation for 41 consecutive months.

This change might have been due to inefficient supply chains, poor rural infrastructure, and growing prices for agricultural inputs like fertilizer and seeds.

The gap between urban and rural inflation stems from structural differences in economic activities, consumption patterns, and integration with global markets.

Urban areas rely heavily on formal markets and imported goods, making them more prone to global economic shocks, exchange rate pressures, and infrastructural challenges.

In contrast, rural inflation is majorly shaped by local agricultural production and minimal interaction with global supply chains.

Urban inflation can be explained through the interplay of demand-pull, cost-push, and structural inflation dynamics. Cost-push issues like ineffective transportation systems and rising fuel prices make it more expensive to get commodities to cities, which drives up prices.

Rapid urbanisation also raises demand for housing, which is consistent with demand-pull inflation, since a shortage of available housing raises rents and property values.

Due to exchange rate changes and tariffs which raise costs and are passed on to consumers, urban economies that rely largely on imported commodities are vulnerable to imported inflation.

Also, a breakdown of responses by settlement types reveals that urban dwellers consistently perceive inflation as being higher than rural settlers. According to the Central Bank of Nigeria (CBN) inflation perception survey of October 2024, urban residents report a stronger awareness of inflationary pressures.

This perception is influenced by increased reliance on cash-based transactions in official markets, real-time pricing visibility for urban services including utilities, housing, and transit, and increased exposure to the media, which raises awareness of financial trends.

Lessons for urban folks to learn from rural residents

Even while there may not always be a significant difference in inflation rates between urban and rural locations, urban residents can nevertheless learn a number of important lessons from the resilience and economic activity of rural inhabitants.

Due to the characteristics of the rural economy and way of life, rural inflation is relatively constant, whereas urban inflation frequently faces more notable swings.

Self-sufficiency is one of the most important lessons. Due to their heavy reliance on agricultural output, rural communities are less affected by price rises for staple foods.

Many households cultivate their own food as a result of this agricultural dependence, which promotes a more sustainable way of life by lowering their reliance on volatile external markets.

The cost of living is frequently lower in rural locations than in metropolitan ones, where housing and necessities are more expensive. Last but not least, rural economies are typically better prepared to adjust to external economic disturbances and seasonal variations.

Due to their familiarity with agricultural cycles, rural inhabitants have evolved coping strategies to deal with lean seasons, such as food preservation and relying on support systems within their communities.