The 2024 national budget, initially regarded as having the lowest debt risk in the last 4 years, is now the budget with the third-highest debt risk.

The shift in this position came as a result of the supplementary budget presented by president Tinubu in July 2024 to encompass the new minimum wage and additional capital expenditures.

In the 2024 national budget, the total projected revenue remained unchanged at ₦19.6 trillion. However, total expenditure rose significantly from ₦28.7 trillion to ₦35 trillion following the addition of the supplementary budget.

The fiscal deficit projected for 2024 amounted to over ₦15 trillion compared to the ₦13 trillion deficit recorded in 2023.

This widened gap between revenue and expenditure or increased fiscal deficit may necessitate additional borrowing by the government to finance the shortfall.

Consequently, this expansionary fiscal stance heightens debt risk and raises concerns about fiscal sustainability.

The debt risk, measured by the revenue-to-spending ratio, increased after adding the supplementary budget to the 2024 original budget. The ratio dropped from 68% to 56%, showing that the additional budget added spending but no extra revenue.

Consequently, this positions Tinubu's projected budget as having the highest debt risk among past presidents in their first 2 years in office, particularly when compared to those of the last 14 years.

In Tinubu's two years in office, his administration has enacted two supplementary budgets, for 2023 and 2024, both of which increased the total fiscal expenditure beyond the initial allocations in the original budgets.

Data from the Budget Office of the Federation shows that Nigeria has implemented only three supplementary budgets in the past 14 years. The first was introduced in 2021 under former President Buhari, adding ₦0.98 trillion to the fiscal plan, while the last two was in 2023 and 2024 under President Tinubu, which increased the budget by ₦2.2 trillion and ₦6.2 trillion respectively.

Public debts grew the highest in 2023 and 2024, whereas 2021 saw comparatively minimal growth. This suggests that supplementary budgets alone may not lead to public debt increase.

The similarity between the periods of 2023 and 2024, during which public debt increased, lies in the impact of monetary policy. Specifically, the adoption of a floating exchange rate system led to a depreciation of the Naira, resulting in a higher volume of domestic currency required for capital purchases denominated in U.S. dollars. This policy shift likely influenced the cost of debt servicing and the overall fiscal balance.

The expansion of the Naira supply in the economy has contributed to upward pressure on the inflation rate.

Over the past two years, inflation has experienced a consistent upward trajectory, peaking at levels not seen in 25 years. As of October 2024, the inflation rate reached 33.88%. This indicates significant erosion of purchasing power and highlights monetary and price stability challenges.

The rising inflation rate has the potential to spill over into other macroeconomic variables, exacerbating vulnerabilities within the economy. This could heighten susceptibility to both external shocks, such as changes in global commodity prices or exchange rate volatility, and internal shocks, such as fiscal imbalances or declining consumer confidence. These dynamics may undermine economic stability and growth prospects.

Pay-TV: Multichoice Nigeria loses more subscribers

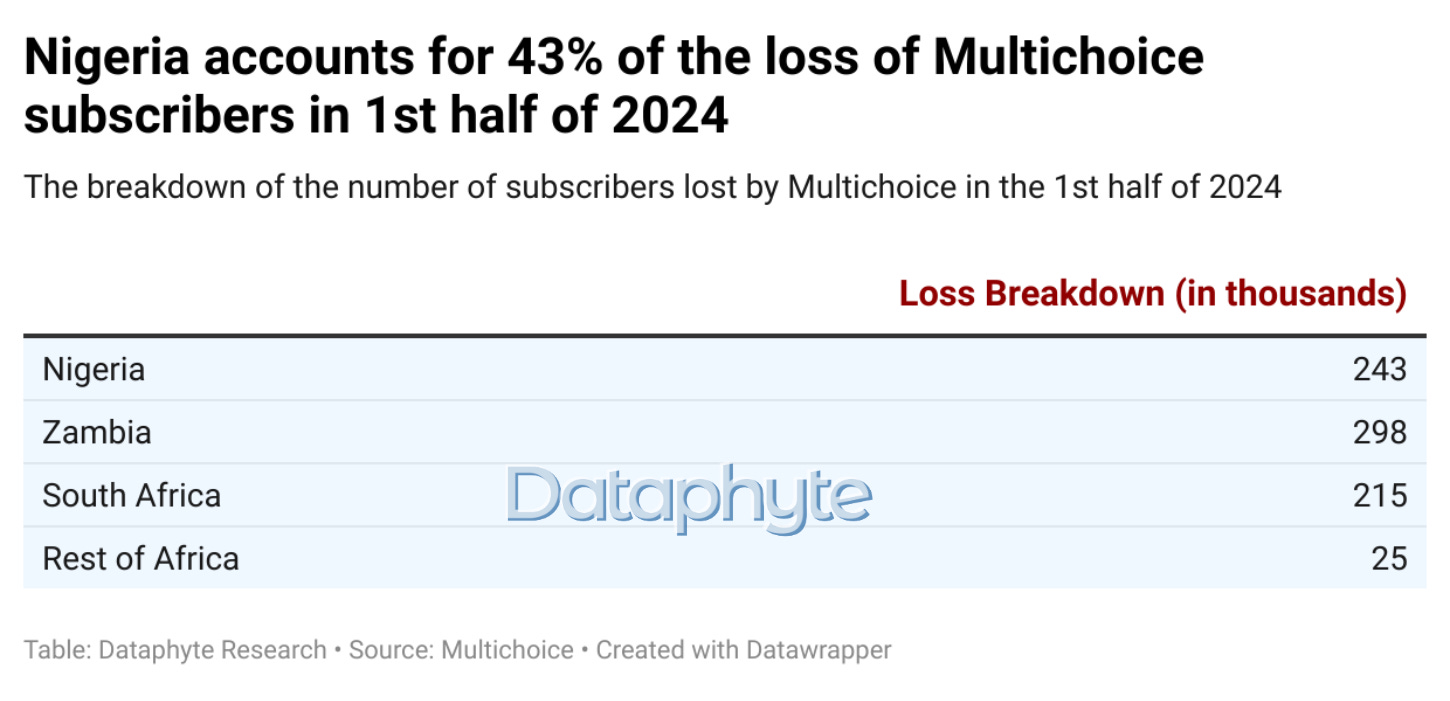

Multichoice Nigeria has announced that it has lost 243,000 subscribers in its Pay-Tv service offerings between April and September, 2024.

Across Africa (excluding South Africa), the company reported a total loss of 566,000 subscribers during the same period.

This suggests that Nigeria accounted for 43% of the regional subscription decline.

The company blamed the loss in Nigeria on the deterioration of its macroeconomic environment - increased inflation, fuel crisis and other costs.

According to the Multichoice Financial Report, “a further deterioration in the Nigerian macro and consumer environment (inflation of 30%+ driven by food, electricity, and fuel prices, compounded by fuel shortages).”

As a result of the inflation rate in the country, and the devaluation of the country’s currency, the company increased their service cost in May to mitigate against loss in operational cost.

The company increased the prices of all its Pay-TV products by over 20%.

Its DStv package was increased across all its package offerings.

Similarly, its GOtv package increased by over 20%.

The highest package, “Supa+” and cheapest package, “Smallie” was reviewed upwards as well.

The increase in cost of the packages might have also deterred customers from continuing their subscription as it has become expensive for them.

Also, this might also suggest that subscribers have found other cheaper forms of television entertainment which has led to decline of subscription of their products

Multichoice analysis of their revenue breakdown showed decoder sales dropped by 27% due to lower demand in a tough consumer market and higher selling prices aimed at reducing subsidy costs. Advertising revenues also fell by 34%, impacted by currency challenges and the difficult economic environment.

The company is the latest to suffer losses due to the impact of rising inflation on its consumers, indicating that addressing the cost of living crisis should be the primary issue on the minds of policymakers.

Thank you for reading this edition of Marina and Maitama. It was written by Lucy Okonkwo and edited by Joachim MacEbong.