Oil and Gas: NNPC Looks Outwards

The Nigerian National Petroleum Corporation (NNPC) Limited announced the beginning of the export of Liquefied Natural Gas (LNG) into the Asian market - Japan and China.

Globally, China and Japan are the highest importers of LNG with an average of over 75 million tonnes per year.

This strategic move by the NNPC will increase Nigeria’s exports. Also, it will increase its share in the global energy market, and encourage the development and investment in gas production.

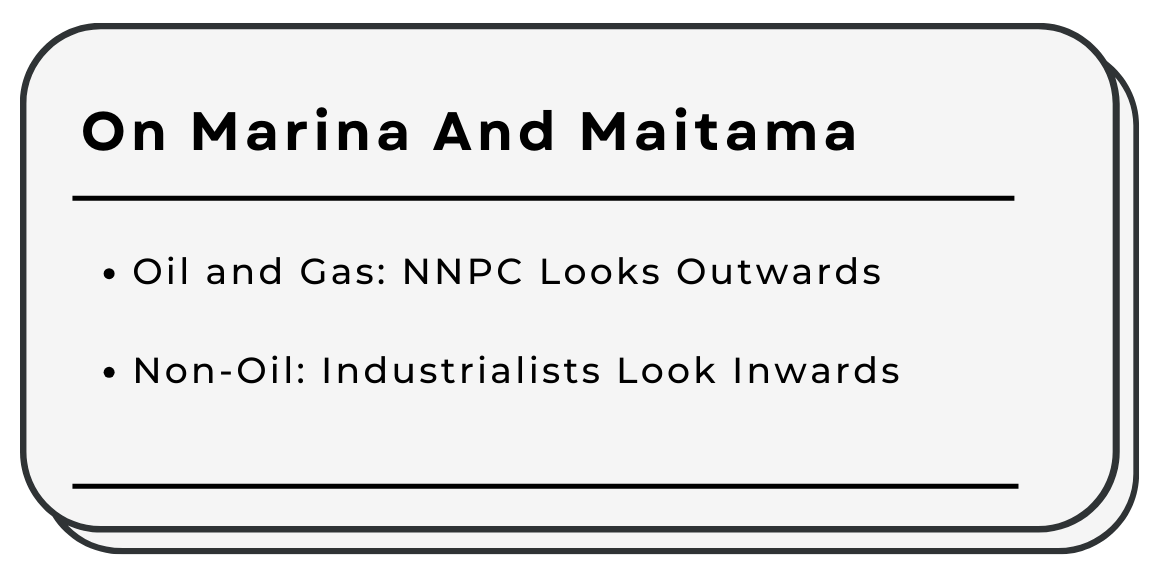

In the last 3 years, the volume of natural gas exports has been on a steady decline, a 37% dip between 2021 and 2023.

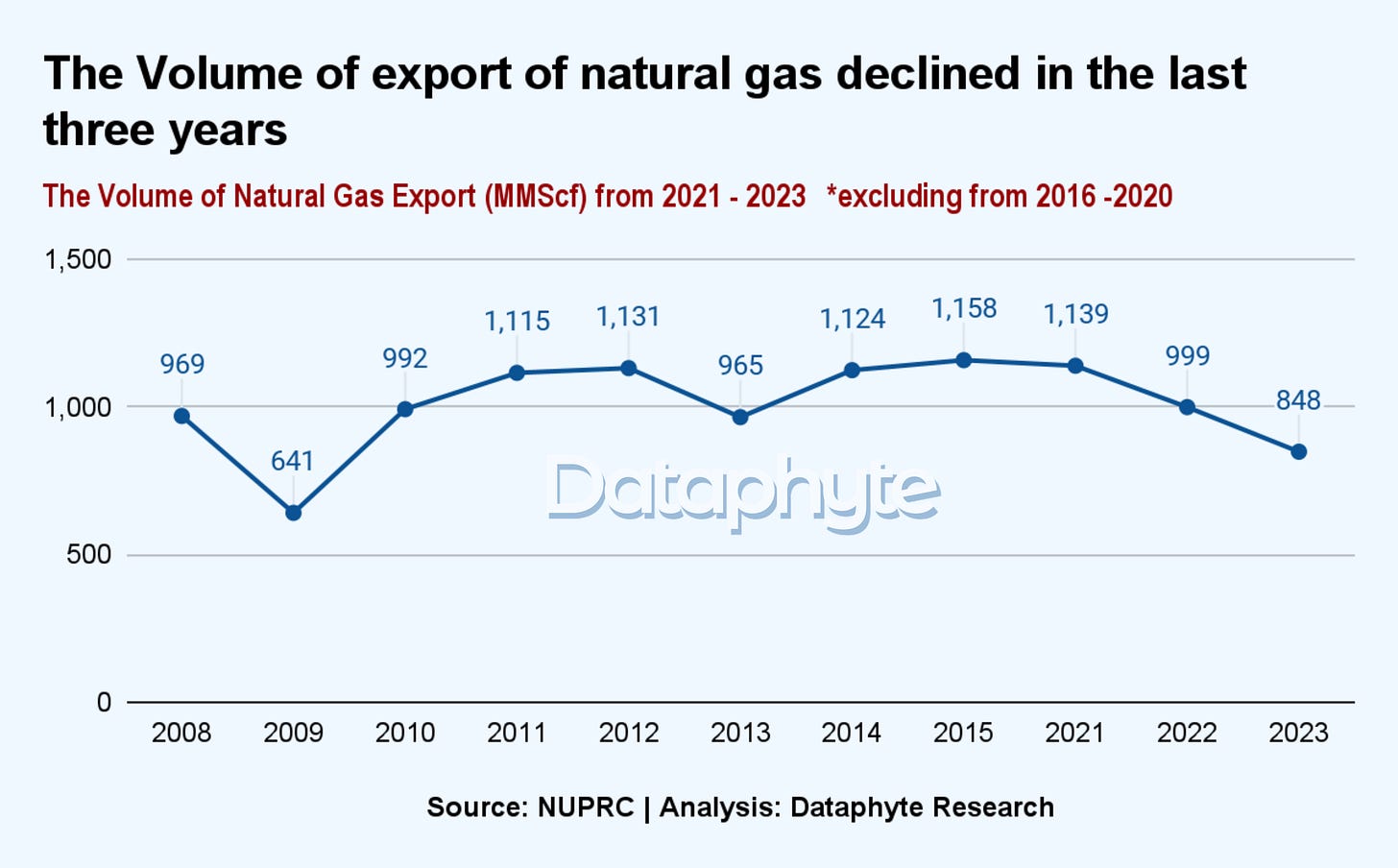

This decline in exports might have resulted from the decline in the production of natural gas, especially within the last three years.

Gas production declined the most in 2009, but recovered quickly in 2010. However, in the past 4 years, the decline has been steady, the longest streak of declines in production in the last 13 years.

Within the last 4 years, natural gas production declined by 22% between 2015 and 2023.

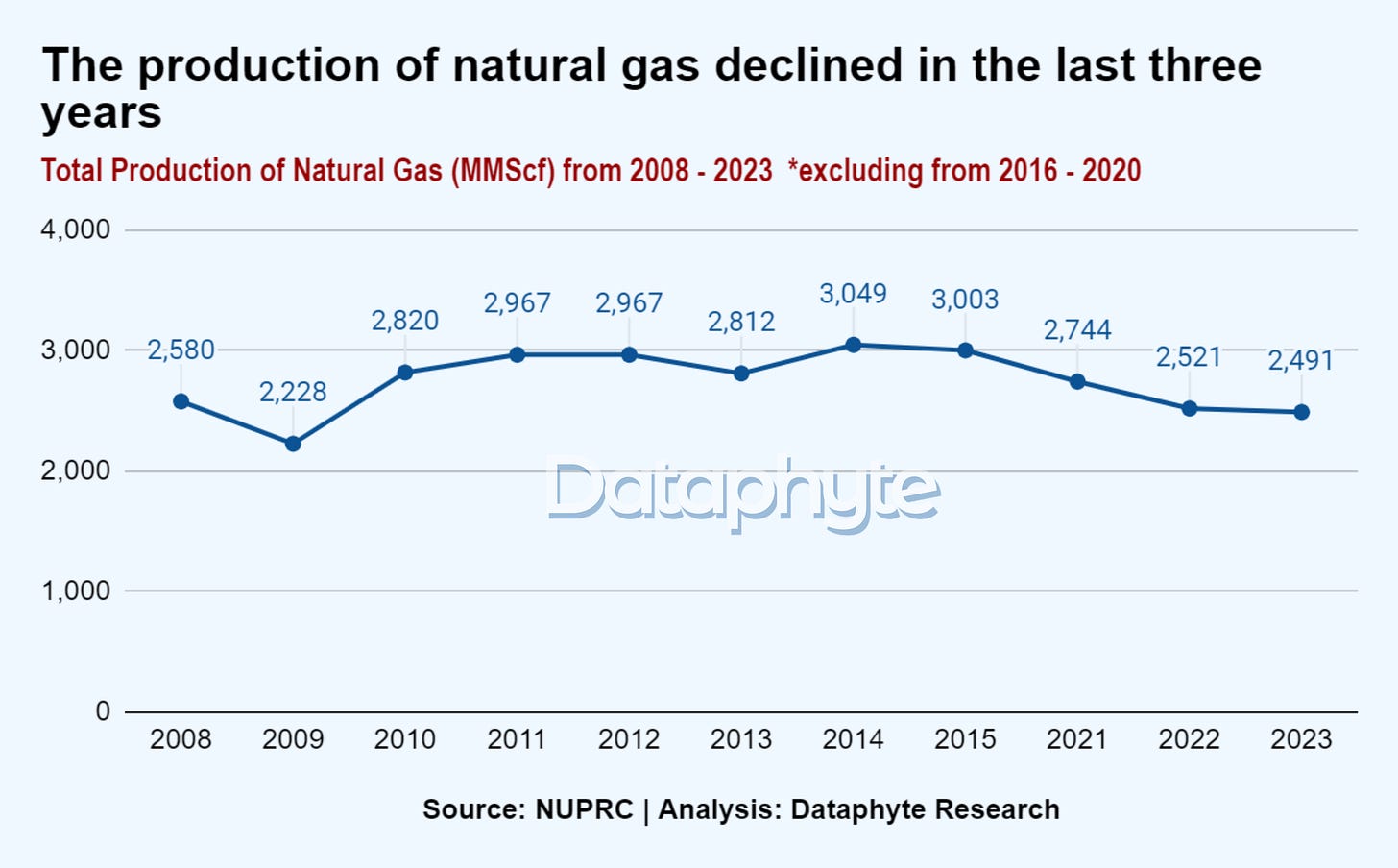

Despite this decline in volume of exports and production, Nigeria remains the country with the 9th largest Natural Gas reserve in the world.

According to a PWC report, Nigeria’s gas reserve is 900 times more than its oil reserve, yet it is the most underutilised of both resources.

In the latest NBS foreign trade report, natural gas remains the second largest export of Nigeria. It is 8.75% of the total share of exports with a value of N1,677 billion in Q1 2024.

The decline in production has not deterred the increase in domestic consumption of gas. Domestic consumption rose to its highest in 2023 to a volume of 666 million mscf compared to 232 million mscf in 2008.

NNPC Ltd in collaboration with NNPC Shipping Ltd shipped the natural gas cargoes to Japan and China on a Delivery Ex-ship (DES) basis.

A DES is “an international commercial term that requires the seller to deliver the products/goods at a specific port. The seller takes responsibility for the shipping and insurance for the products/goods until it reaches its designated location.”

The Chief Corporate Communication Officer NNPC Ltd, Olufemi Soneye, stated, “In line with its strategic vision to be a dynamic and reliable global energy supplier of choice, the Nigerian National Petroleum Company Limited (NNPC Ltd) has commenced shipment of Liquefied Natural Gas (LNG) cargoes to Japan and China on Delivered Ex-Ship (DES) basis.”

Although this is a welcomed development, the underwhelming performance in the production of natural gas in Nigeria, especially in the last 4 years, should be a source of concern if Nigeria wants to increase its export quota of natural gas going forward.

Non-Oil: Industrialists Look Inwards

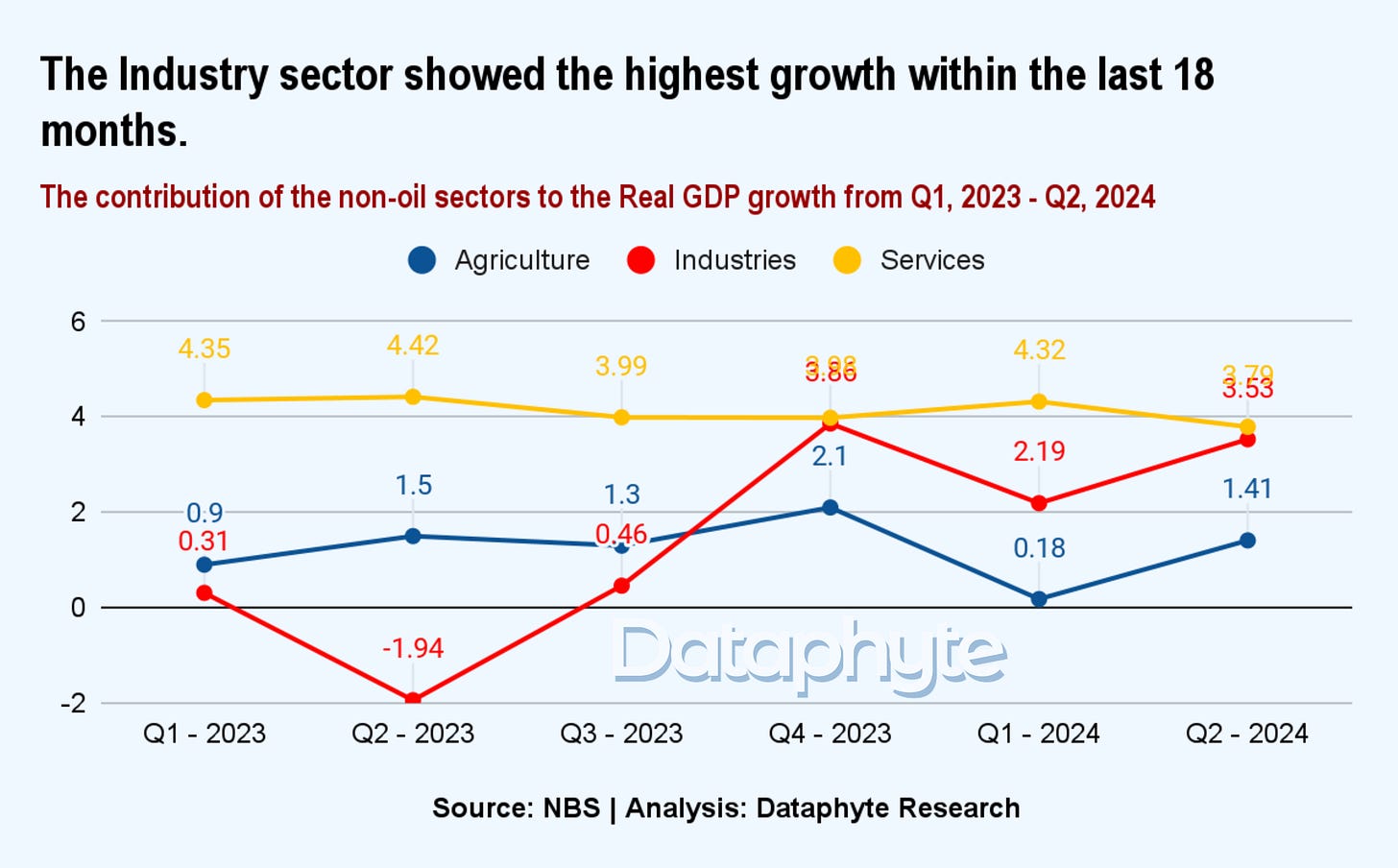

The Industries category has had the highest rise in its growth above the other 2 Non-Oil sector categories, Services and Agriculture, in the past 18 months.

This implies that there are positive developments in the business activities that make up the industry sector, which might include investments in the sector, job creation, technological progress, and innovations.

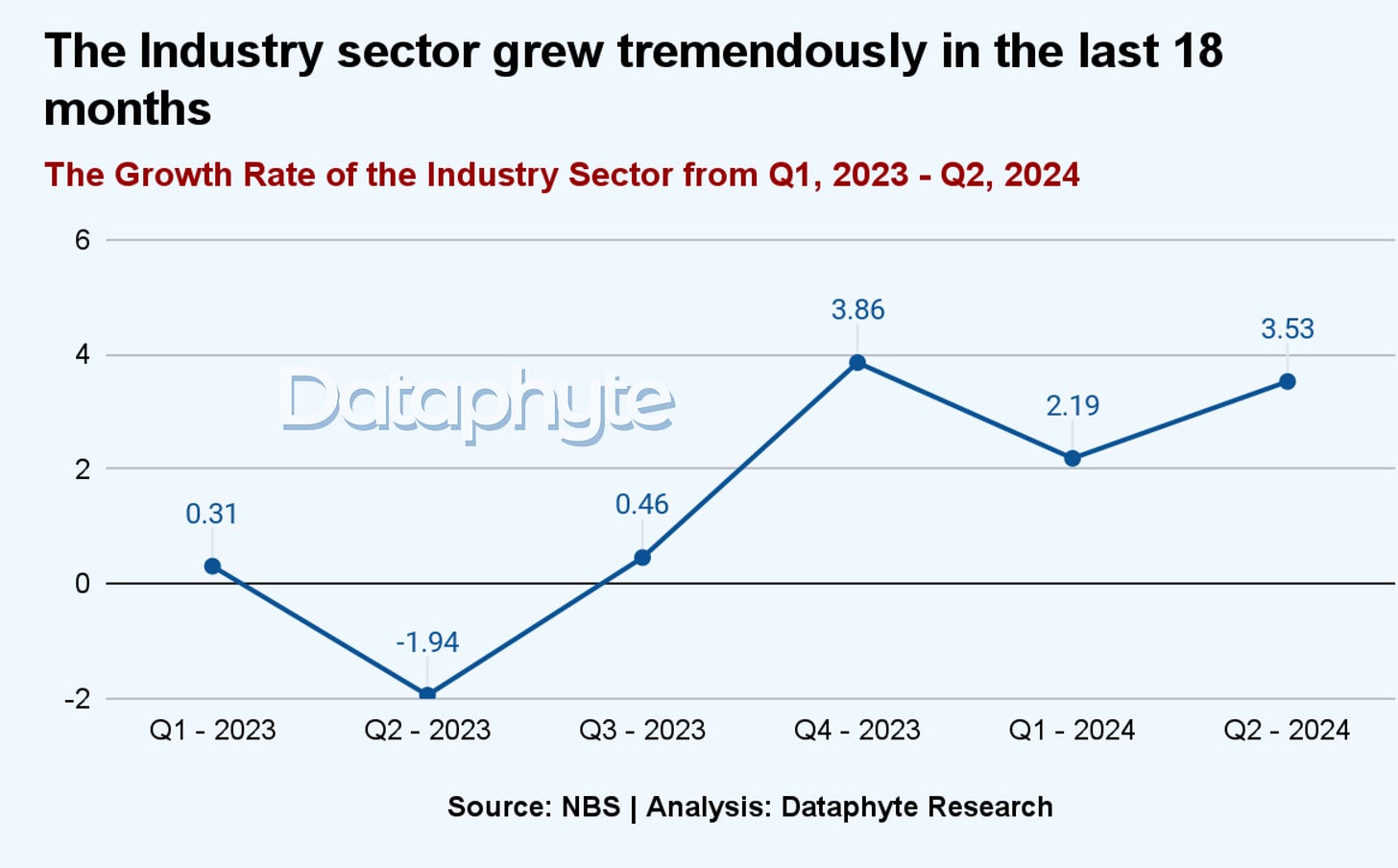

The Industries category grew by 1.34 percentage points between the 2.19% growth rate in the first quarter (Q1) and the 3.53% growth rate in the second quarter (Q2) of 2024.

Industrial output grew tremendously by 3.23 percentage points from the 0.31% growth rate in Q1 2023 to the 3.53% level by Q2 2024.

Although the service sector was the major driver of real GDP growth in Q2, it showed a decline within the last 18 months. It declined by 0.56 percentage points, dropping from 4.35% in Q1 of 2023 to 3.79% in Q2 of 2024.

Agricultural output increased by 0.51 percentage points, from a 0.9% growth level in Q1 2023 to a 1.41% level in Q2 2024, less than the 3.51% shift for Industrial output, in the same period.

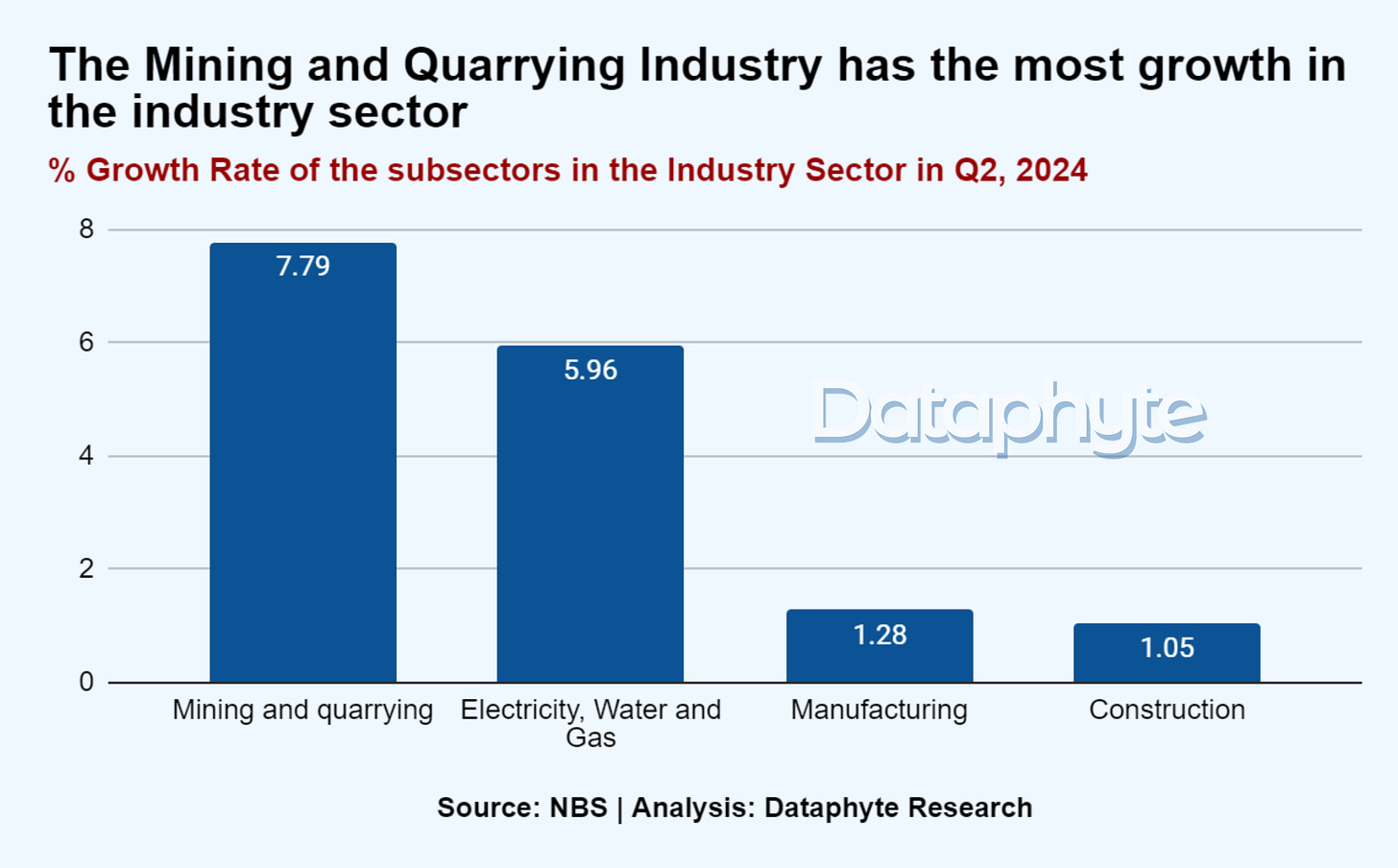

According to NBS, the industry sector comprises Mining and Quarrying, Manufacturing, Construction and Electricity, Water and Gas.

Mining and quarrying had the highest growth within the Industrial sector, while Construction recorded the lowest growth.

Despite the growth in this sector, there are challenges plaguing this sector that have led to the underperformance of some of its sub-sectors, especially manufacturing.

Within the last 19 months, the country has seen the shutdown of some large manufacturing firms due to the volatility of the exchange rate, increasing operating costs and some unfavourable market conditions.

The President of the Manufacturing Association of Nigeria (MAN), Chief Francis Meshioye suggested policies to the CBN and government to ensure that local industries thrive in the country.

“We are asking the CBN to wave many conditions for its foreign exchange policies to local manufacturers.

“Similarly, CBN can widen the window of foreign exchange to local industries while urging the Federal Government to harmonise taxes and levies at federal, state and local government levels.”

“We therefore ask the Federal government to urgently direct the Central Bank of Nigeria to drastically reduce interest rates on industrial loans. The Central Bank of Nigeria should further reduce the interest rates charged on industrial loans and other loans released as Covid-19 palliatives to 1%.”