Petrol: Scarce and Subsidised

Fuel scarcity resurfaces in different parts of Nigeria amidst reports of the return of fuel subsidy. Filling stations sell subsidised (and unsubsidised) petrol at regulated prices. But most of the filling stations hoard their stock or sell negligible quantities daily.

On the streets, petrol is readily available, just outside the filling stations, at unregulated prices.

Filling stations in Wuse, Apo, the Central Business District and Lugbe areas of the city sell petrol to buyers at prices ranging between N655 and N700. Only retail outlets of the NNPC sell at N617, Premium Times reported.

The President of the Independent Petroleum Marketers Association of Nigeria (IPMAN), attributes the cause of fuel scarcity to the failure of NNPCL to supply to the marketers and the poor distribution pattern of petrol.

On the other hand, the Vice President, Downstream, at Nigerian National Petroleum Company Ltd (NNPCL), Adedapo Segun, in a press conference at the NNPC Towers in Abuja on the 22nd of August, 2024, blamed the scarcity of petrol on a mix of logistics failure and unfavourable weather.

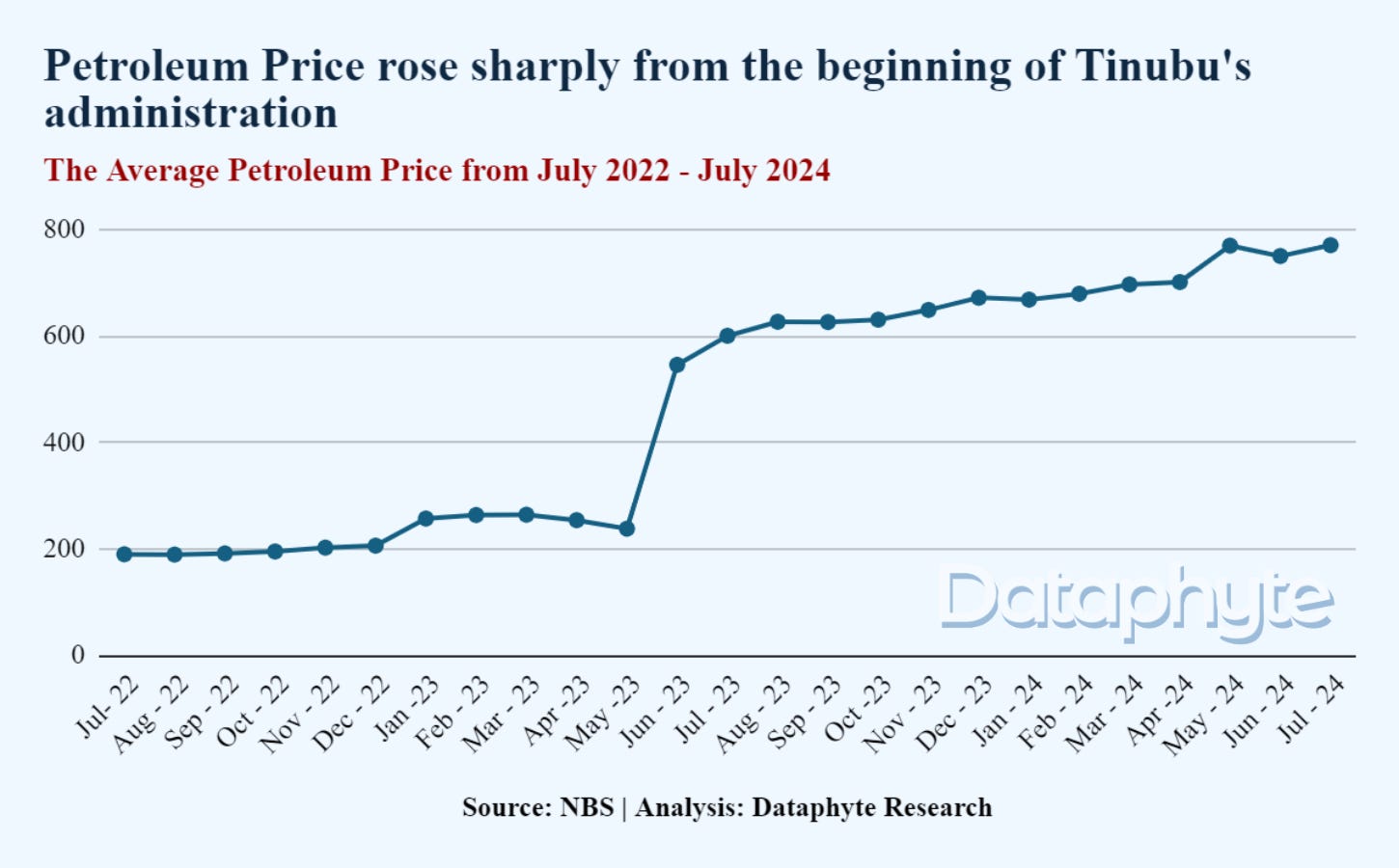

According to NBS Premium Motor Spirit (PMS) Price Watch, the average petrol price in Nigeria for July, 2024 is N770.54. This is a 28.35% increase from the price in July 2023, which was N600.35.

Nigeria is reliant on imported refined petroleum products, which are sold to the public at subsidised prices.

The state oil corporation, NNPCL is the sole importer of refined petroleum products into Nigeria. NNPCL and independent marketers, including Nigerian businesses and subsidiaries of international companies, handle its distribution.

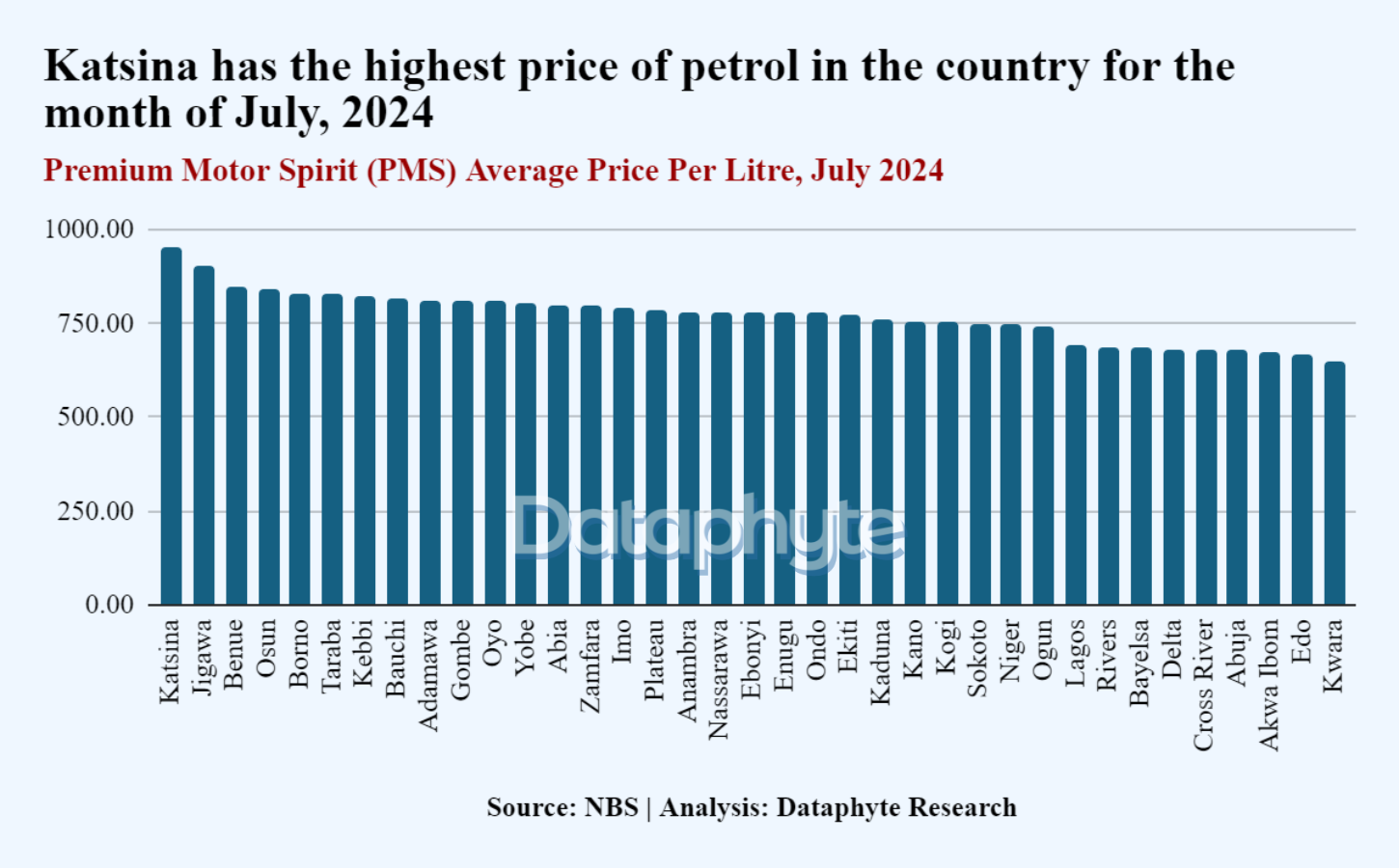

The gap between the supply and distribution has given room for exploitation by many marketers, causing scarcity and variations in prices across the different states of the country.

In July, Katsina State had the highest average petrol price at N950 while Kwara state had the lowest average petrol price at N650.

Crude oil production increased in the last three years in Nigeria and refined petrol remains the country’s highest imports till date. With a share of 20.84% of all imports.

According to the Chairman of the Independent Petroleum Marketers Association of Nigeria (IPMAN), Ore Depot, Engr Shina Amoo, his colleagues are forced to buy the product from depots that sell to them at a premium price instead of the subsidised price obtained from the NNPC.

“Go around, if you see 50 petrol stations, and you take a random sample, you will discover that only between three to eight would be selling products. And these products we are selling, we are getting them at premium prices. Virtually all the depots we buy from sell to us at prices they want to sell from the neighbourhood of between ₦750 to ₦850,” says Engr Shina Amoo, the Chairman of IPMAN, Ore Depot.

The President, Petroleum and Natural Gas Senior Association of Nigeria, Mr Festus Osifo, attributed the insufficient supply and scarcity to outdated and insufficient distribution channels coupled with bad roads and floods.

Furthermore, Engr. Amoo advised that If corruption were eliminated from the downstream system, product prices would inevitably decrease.

Wheat: BUA Seeks Significance

BUA Foods Plc has signed an agreement with IMAS, a Turkish milling equipment manufacturer, to construct four new wheat milling factories with a combined capacity to mill up to 3,200 tonnes per day.

This move will increase production capacity, employment, and food security in the country. It will also increase its market share in the flour milling industry.

The Director of Marketing and Communications, Adewunmi Desalu, stated, “this partnership with IMAS is a testament to our dedication to improving food security in Nigeria. These new factories will significantly boost our capacity to continue to produce high-quality flour products while helping to create additional job opportunities across the country.

“This investment is a step towards our target of increasing our share of the Nigerian flour market.”

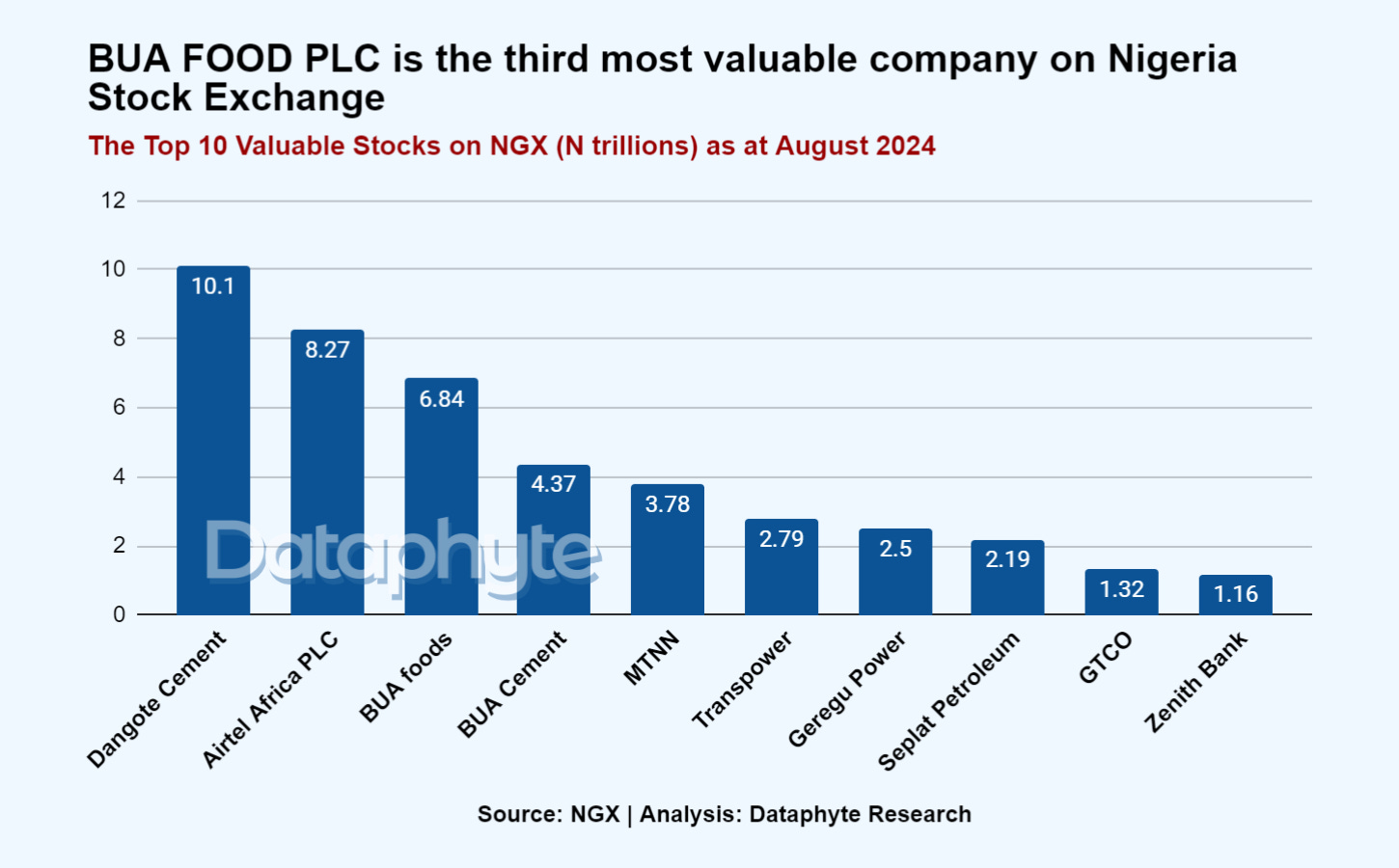

BUA food Plc is the 3rd most valuable company on the Nigeria Stock Market, with a valuation of over N6.84 trillion, which is about 12.4% of the entire Nigeria Stock Exchange equities market.

The company gained 96% in its Year-to-date performance with the open stock price at the beginning of the year at N 193.40 and is currently at N379.90.

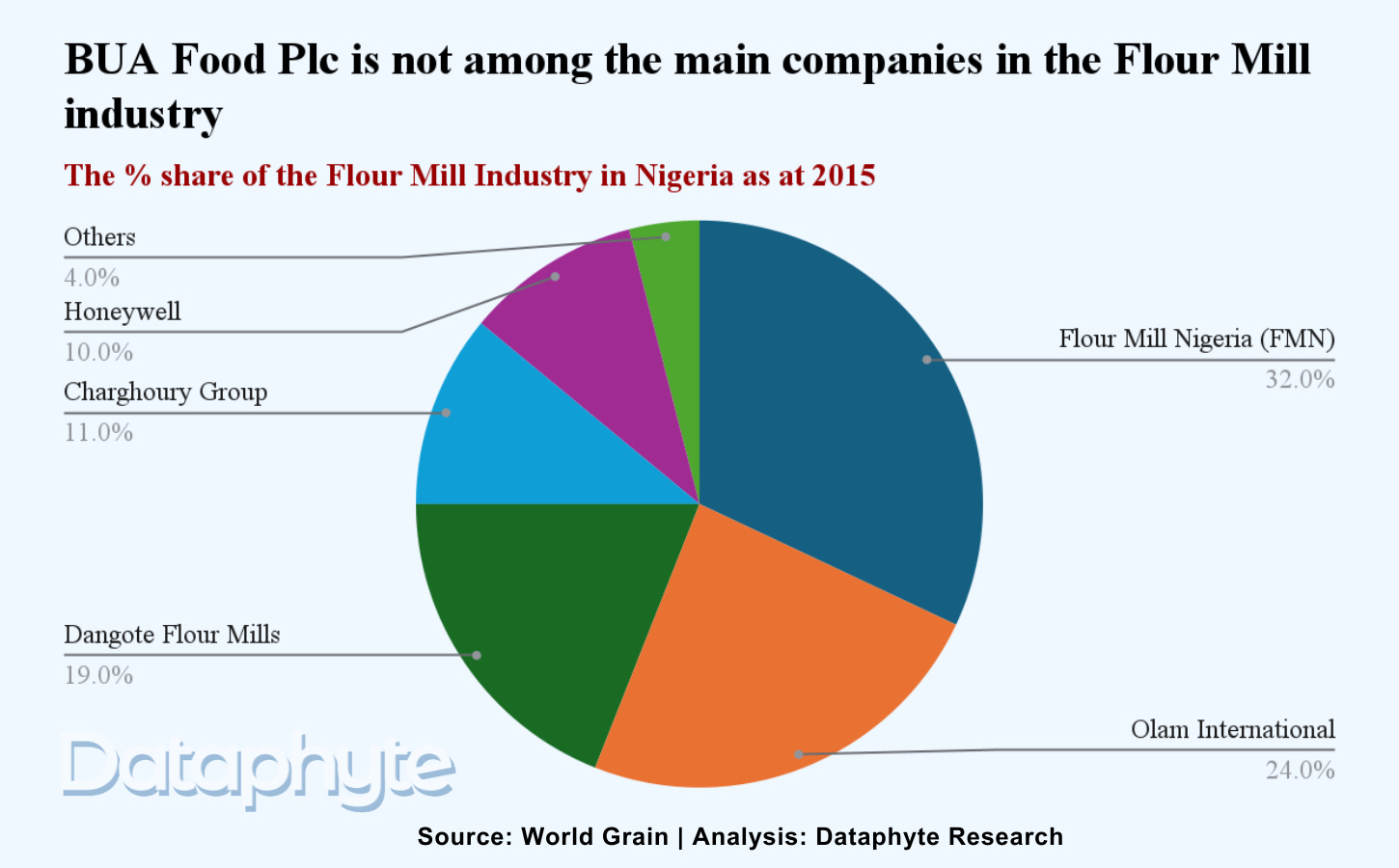

Despite it being one of the top 3 most valuable companies in the NGX, it has very little share in the flour milling industry.

The creation of these new wheat milling factories might encourage the increased production of wheat and bring down the prices of food products associated with wheat within the country.

BUA Foods Plc is a leading company in the food and fast-moving consumer goods sector, specialising in the processing, manufacturing, and distribution of food products and packaged goods. The company's operations are organised into five divisions: Sugar, Flour, Pasta, Rice, and Edible Oils.

Thank you for reading this week’s Marina and Maitama. It was written by Lucy Okonkwo and edited by Oluseyi Olufemi