PMI Up: Private business sees modest expansion

Nigeria's private business sector entered its second month of expansion in September, with the Purchasing Managers' Index (PMI) increasing from 50.2 in August to 50.5 in September, according to the Central Bank of Nigeria’s (CBN) business survey.

The over 50 index point in the PMI suggests that the economy is growing, but at a slower and steady pace. This can be a positive sign of stability, especially as the business environment is recently recovering from contraction.

Also, it might imply that private businesses have adjusted their operations to the changing macroeconomic environment to encourage expansion.

On a year-on-year basis, the PMI has increased by 11% or 5 points. It increased from 45.5 points in September 2023 to 50.5 points in September 2024.

The private business environment experienced a period of contraction from July 2023 to July 2024. The last recorded expansion occurred in June 2023, prior to the renewed expansion observed in August and September 2024.

“An index above 50.0 points indicates an expansion in business activities, while below 50.0 points indicates a contraction in business activities. An index of 50.0 indicates a no-change situation,” as stated by CBN.

Although still in contraction, the industry sector showed modest growth between August and September 2024, with the PMI rising from 49.5 in August to 50.7 in September, signalling a shift towards expansion.

This growth was primarily driven by increased production (output), supported by a rise in new orders (demand) within the sector. Industrial production reached 50.7, its highest level since April 2024, when it stood at 51.4. New orders for products rose to 49.9, the highest in the past 16 months, reflecting strengthening demand.

Employment levels in the sector, while still contracting, improved from 47.5 in August to 48.2 in September, as businesses increased staffing to meet the higher production and demand levels.

The sector's growth was driven by the increased output of key industries, such as chemical and pharmaceutical products, cement, fabricated metal products, non-metallic mineral products, plastics and rubber products, printing and related support activities, furniture, textiles, apparel, leather and footwear, as well as electricity, gas, steam, air conditioning supply, and construction.

The service sector maintained its expansionary momentum in September 2024, marking the fourth consecutive month of growth since May. The sector's PMI rose from 50.7 in August to 51.0 in September, indicating continued expansion.

The growth in the service sector was primarily driven by a surge in new orders, which reached their highest level in 16 months. New orders for services increased from 47.1 in June 2023 to 52.2 in September 2024, reflecting strong demand.

However, the rate of growth in business activities slowed, with the index declining slightly from 51.3 in August to 50.9 in September. The key sub-sectors were information and communication, Finance and insurance, management of companies, real estate, rental and leasing, wholesale trade, motion pictures, cinema, sound recording and music production, arts, entertainment and recreation and educational services.

Despite this deceleration in business activities, the service sector saw a modest improvement in employment levels, rising from 49.2 in August to 49.5 in September 2024, signalling a reduction in the pace of job contraction.

The agricultural sector sustained its expansion, with the PMI rising from 50.5 in August to 51.4 in September. However, growth in general farming activities (output) slowed, declining from 51.3 to 50.5, despite an increase in demand for agricultural products.

There was a moderate increase in employment level within the sector. It rose from 48.8 in August to 49.1 in September.

The recent expansions show that there are improving conditions for businesses, including higher production, new orders, and increased employment. This implies that companies are seeing more demand and are adjusting production and inventories accordingly.

This expansion could be sustained, as inflation rates have declined over the past two months. Headline inflation fell from 34.19% in June to 33.14% in July and 32.15% in August.

The impact of lower inflation was evident in the reduced average prices of inputs and outputs in both the service and agricultural sectors between August and September. However, the industrial sector experienced a contrasting trend, with average input and output prices increasing over the same period.

FDI Down: Foreign Direct Investment continues to decline

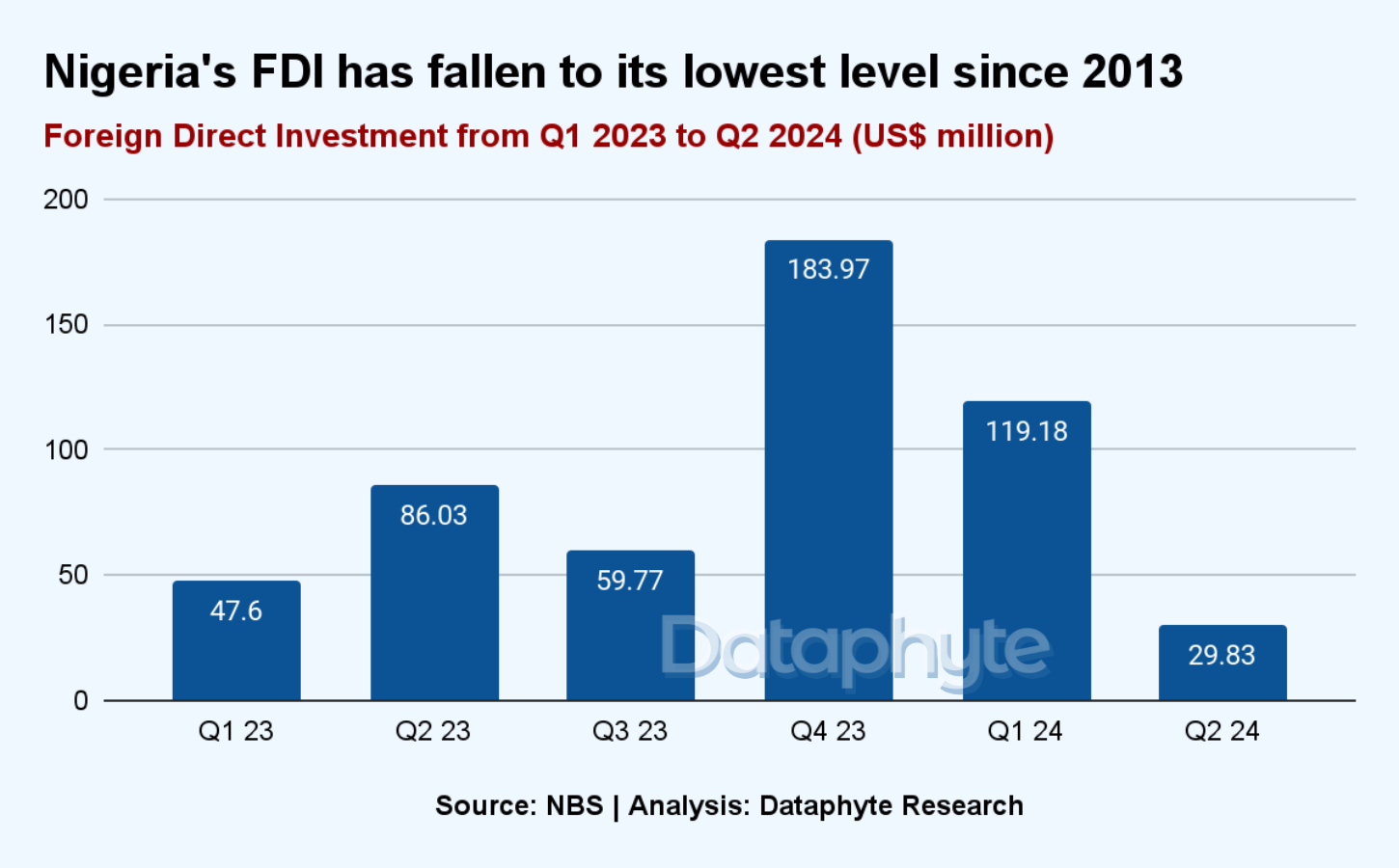

Nigeria’s Foreign Direct Investment (FDI) inflows for Q2 2024 is the lowest it has been in the last 11 years. The FDI flow into the country in Q2 2024 totalled US$29.83 million, according to the Capital Importation data released by NBS.

The sharp decline in FDI raises significant concerns about the country's economic attractiveness to international investors, which may be due to the volatility of its regulatory policies, currency fluctuations and overall ease of doing business.

The FDI declined by 65% on a year-on-year basis, falling from US$86.02 million in Q2 2023 and on a quarter-on-quarter basis by 75%, falling from US$119.2 million in Q1 2024.

This weak performance highlights Nigeria's ongoing struggle to restore investor confidence in its economy

In Q2 2024, FDI inflows amounted to just $29.83 million, contributing a mere 1.15% of the total capital import of $2.6 billion, according to data from the National Bureau of Statistics (NBS).

Notably, nearly all FDI inflows (99.9%) came from equity investments, signalling that other forms of investment are lagging.

According to the Africa Attractiveness Report 2023 by Ernst & Young, Nigeria ranked 5th in terms of attractiveness for foreign direct investment (FDI) in Africa. This ranking underscores Nigeria's position as one of the continent's major investment destinations, despite ongoing challenges.

It attracted capital investment of US$2 billion, with 49 projects creating 3,300 jobs.

Africa Attractiveness Report, 2023

Nigeria’s business environment remains challenged by persistent macroeconomic issues including high inflation, a volatile foreign exchange market, and rising public debt, all of which significantly dampen the country's investment appeal.

Within 2 years, at least 11 multinational companies have exited or divested their assets in the country as high inflation has increased operational costs for businesses, while fluctuations in the naira have created uncertainty for foreign investors, reducing profits and increasing currency risk.

The CEO of the Centre for the Promotion of Private Enterprise, Dr Muda Yusuf observed that Nigeria's challenging macroeconomic environment largely attributes to the decline in Foreign Direct Investment (FDI).

He identified key issues such as foreign exchange (FX) instability, where the weakened naira makes it difficult for foreign companies to repatriate profits, reducing the attractiveness of the country as an investment destination. This FX volatility, combined with inflation and other structural challenges, has discouraged long-term foreign investment.

Addressing these issues, along with fostering a stable investment climate, will be key to reversing the current decline and ensuring that FDI contributes to Nigeria's economic growth.