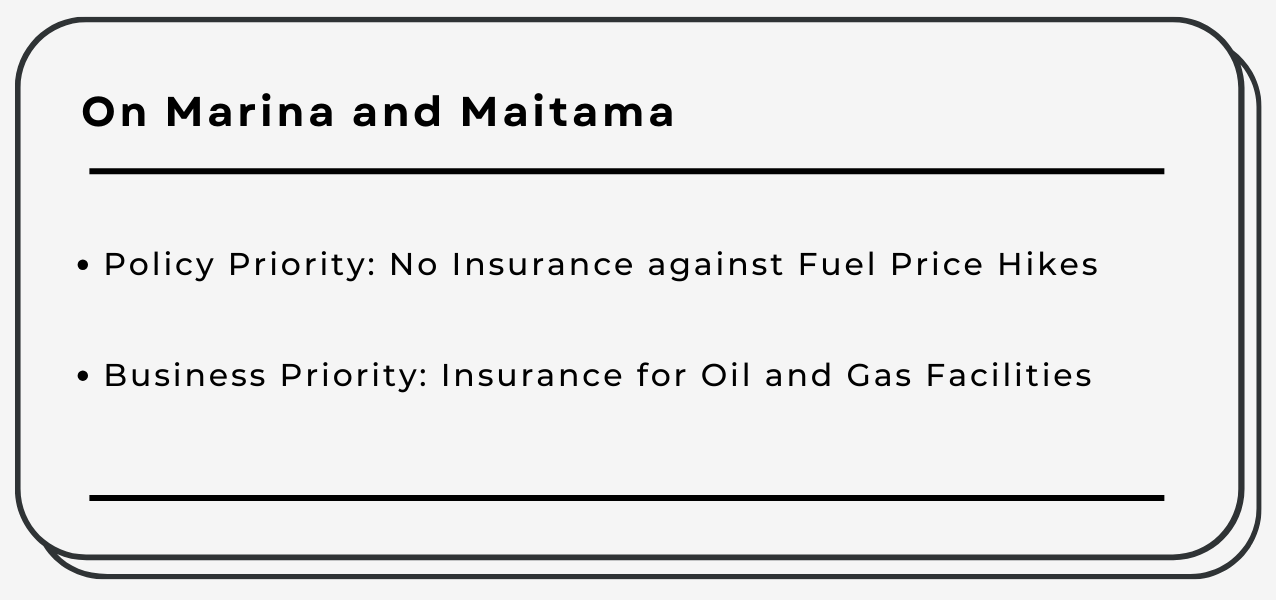

Policy Priority: No Insurance against Fuel Price Hikes

+Business Priority: Insurance for Oil and Gas Facilities

Policy Priority: No Insurance against Fuel Price Hikes

President Bola Tinubu doubled down on the latest hike in petrol prices, insisting he needs to take hard decisions to move the country forward.

“For example, you might have been hearing from home in the last few days about fuel prices. But can we help it?” he said.

Fuel price has increased in Nigeria to its all-time highest, from the N617 official price in June 2023 to N855 in September 2024.

The recent hike comes at a sensitive moment for an economy already grappling with rising inflation and a depreciating currency against the dollar, leading to increased cost pressures on businesses.

The Director General of the Manufacturers Association of Nigeria (MAN), Mr Segun Ajayi Kadiri, disclosed that the increase in fuel price might hamper the productivity of Small and Medium Enterprises (SMEs) because of higher operational costs, which will lead to a rise in prices of goods and services in the market.

“Small and Medium-Sized enterprises, which often operate on thin margins, could be particularly hard-hit. The increased costs could force some to scale down operations or even shut down if they are unable to pass on the additional costs to consumers,” he said.

The average fuel price has surged by 237%, an increase of N601 per litre over the N255 it sold for eighteen months ago, and two months before the President announced the removal of the fuel subsidy in June 2023.

The June 2023 fuel price increase impacted small business activities, especially those relying on fuel for power and transport, increasing their operational costs.

The CBN Purchasing Managers Index (PMI) showed that business activities contracted within that period.

Business activities in Nigeria experienced a long spell of contraction from July 2023 to July 2024. In February 2024, business activities were the lowest, with an output index of 37.2 and a PMI of 39.2.

“An index above 50.0 points indicates an expansion in business activities while below 50.0 points shows a contraction in business activities. An index of 50.0 indicates a no-change situation,” according to CBN.

The PMI decreased from 54.6 in May 2023 to 50.2 in August 2024.

Although the PMI for August 2024, which stood at 50.2, indicates growth in business activities, the shock of the most recent fuel price increase may slow down this expansion or reverse it in the coming months of the year.

Within the last 16 months, at least 11 major multinational companies have shut down, citing increased operational costs as one of the major reasons for their closure.

The Chairman of the Lagos state chapter of the Nigerian Association of Small Scale Industrialists, Gertrude Akhimien stated that at least 30% of the over 24 million registered SMEs have shut down within the last 15 months because of operational costs.

As seen in June 2023, the surge in fuel prices directly inflated transportation, logistics, and production expenses, resulting in an upward pressure on overall prices within the economy.

The inflation rate increased from 22.22% in April 2023 to 33.40% in July 2024, a 50% increase in the last 16 months.

According to the NBS report on transportation fares, between April 2023 and July 2024, transportation costs increased across all forms of transport.

Bus journeys within the city increased by 46%, bus journeys interstate increased by 78%, airfare increased by 32%, motorcycle transport fares increased by 5%, and waterway transport fares increased by 36%.

Ajayi-Kadir projected that the manufacturing sector is likely to face adverse effects, with businesses potentially needing to adjust their pricing strategies. A decline in consumer demand could further reduce revenue and profit margins.

“One is naturally worried about the impact this price increase will have on the already lacklustre performance of the manufacturing sector.

“In particular, there is no doubt that it will add to production inputs and logistics costs. These will lead to higher prices and dwindling disposable income of the average Nigerian,” he argued.

Business Priority: Insurance for Oil and Gas Facilities

Insurance on oil and gas facilities ranked highest among other policy subscriptions, contributing to the 60% growth in the Insurance industry estimated by the NBS for Q1 and Q2 2024.

Besides high gross incomes from insured oil and gas facilities, the growth in the insurance industry suggests greater customer confidence in insurance stocks, better regulatory measures and innovative developments within the industry.

The insurance industry's real growth percentage increased from 8.34% in Q1 2024 to 13.30% in Q2 2024. This is higher than the growth recorded in Q1 and Q2 of 2023.

According to the National Insurance Commission (NAICOM), the gross premium income of the insurance industry stood at N1,003.2 billion in Q4 2023.

The financial data for the insurance sector indicates that non-life insurance businesses reported total assets valued at N1,943.6 billion, while the life insurance segment recorded assets of approximately N1,392.8 billion.

Life Insurance includes group life, individual life and annuity while non-life insurance includes oil and gas, fire, motor, general accident, marine and aviation, and miscellaneous policies.

Nigeria has 70 recognised insurance companies spanning 6 categories - micro-insurance, general and family takaful, reinsurance, general, composite, and life insurance, data from NAICOM shows.

The top 10 insurance companies by market capitalisation are either General or Composite Insurance companies.

“The insurance industry in the first quarter appears stable, profitable and robust. Moreover, in cognisance of the ongoing initiatives including Sector-Wide digitization, Risk-Based Supervision and other market deepening measures the outlook could be adjudged positive,” the NAICOM Gross Premium publication noted.

Thank you for reading this edition of Marina and Maitama. It was written by Lucy Okonkwo and edited by Oluseyi Olufemi.