Power to purchase: Nigeria’s IJGBs and the Holiday Season

+How to Leverage the IJGB Benefit

In the 2024 holiday season, I Just Got Back (IJGB) individuals can accomplish more with their foreign exchange in Nigeria than ever before, thanks to a combination of Purchasing Power Parity (PPP) for private consumption and the exchange rate.

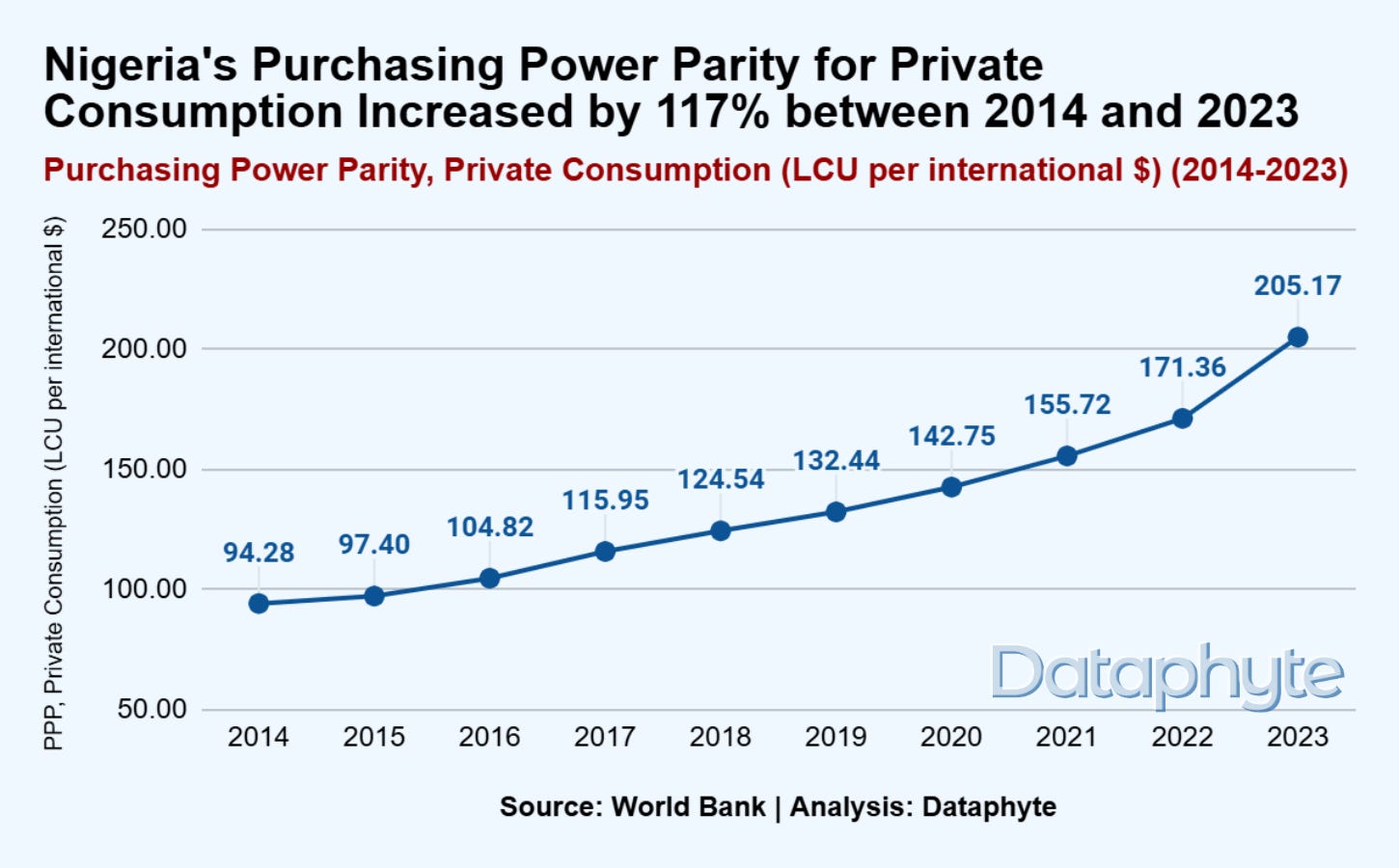

The PPP for private consumption increased from ₦94 per international dollar in 2014 to ₦205 in 2023.

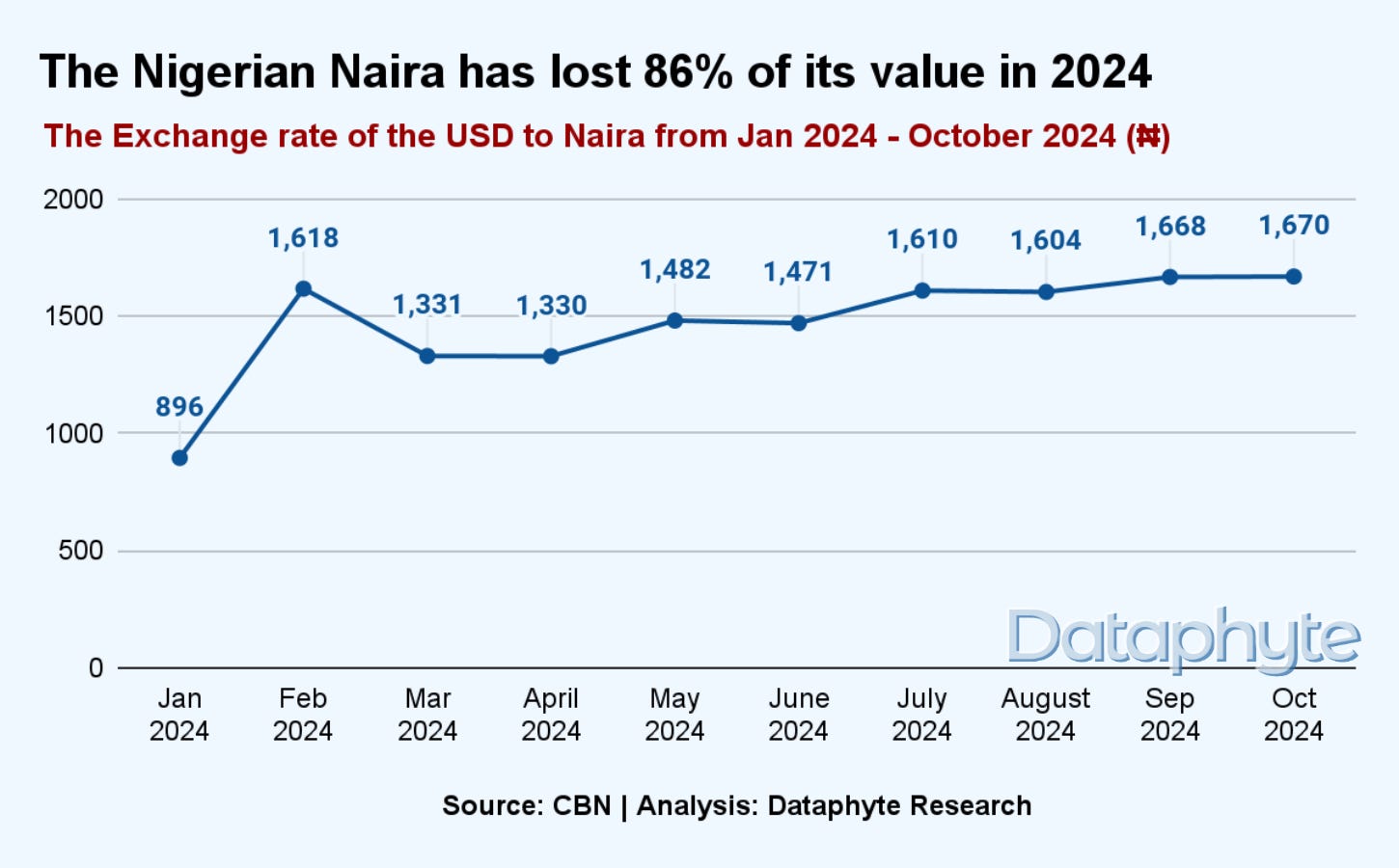

Additionally, Nigeria’s exchange rate is at an all-time high, marking the highest level recorded.

This difference means that when a dollar is exchanged, it can buy significantly more in Nigeria than the equivalent amount of Naira would purchase in the United States.

The term “I Just Got Back” (IJGB) refers to people who have been living abroad and have recently returned to Nigeria, a phenomenon that is especially common during the festive season.

PPP for private consumption is an economic theory that uses a "basket of goods" approach to compare currencies across countries. PPP demonstrates how far a unit of currency can go to satisfy domestic versus foreign consumers' needs, making it a useful measure of a currency's practical value.

The exchange rate is the value of a nation's currency in comparison to the currency of another nation or economic zone.

Over the past decade, Nigeria's PPP has increased from ₦94 per international dollar in 2014 to ₦205 in 2023, representing a 117% rise.

This ranking implies that Nigerians enjoy relatively strong domestic purchasing power, as fewer Naira are needed to purchase a basket of goods that would cost $1 in the U.S. compared to most other nations.

Nigeria currently places 25th in PPP for private consumption globally, at ₦205.17 to the U.S. dollar.

One U.S. dollar can buy significantly more in Nigeria than in 125 other countries.

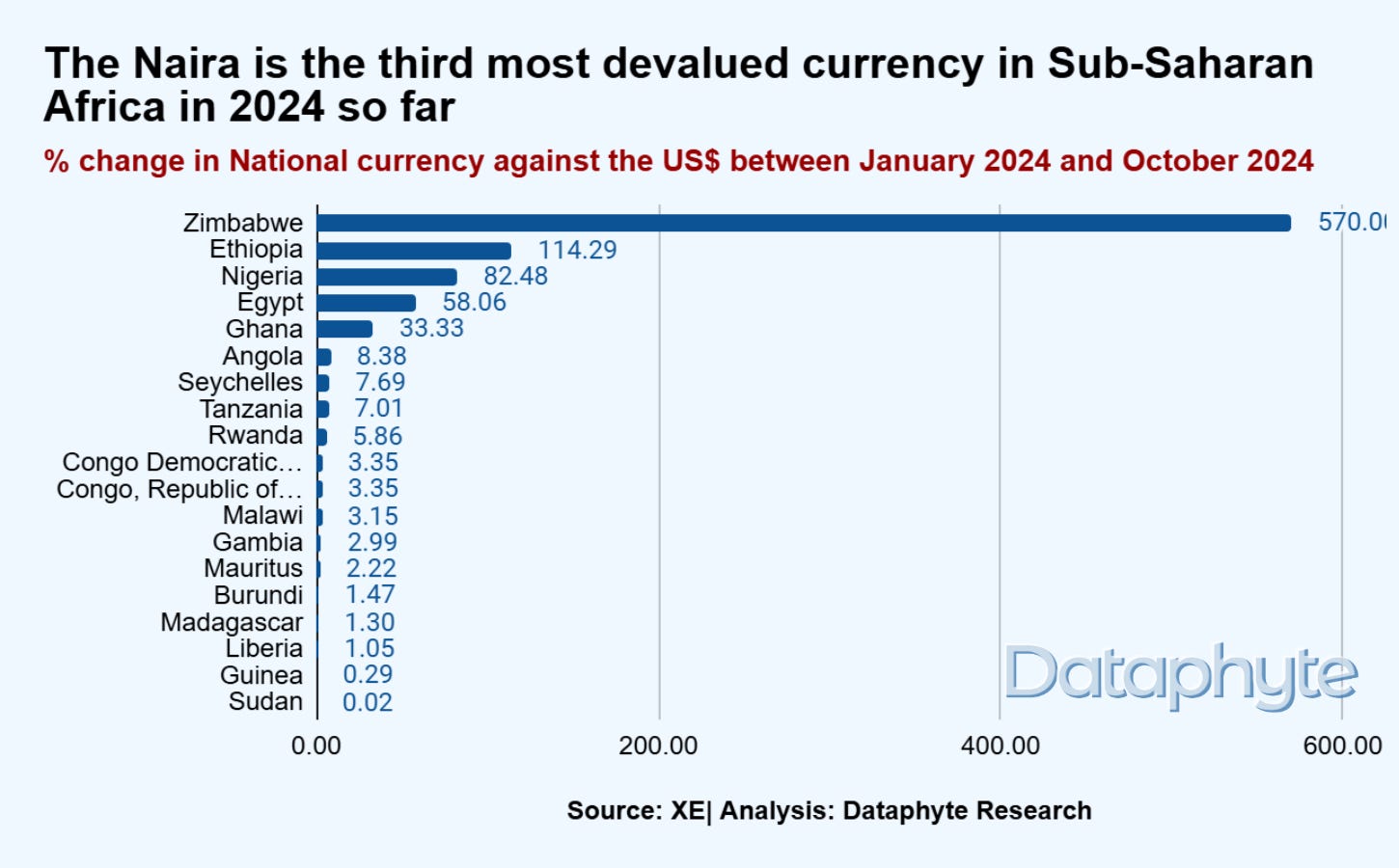

In the same vein, within one year, Nigeria’s exchange rate has moved from ₦896 in January to ₦1,670 in October, losing about 86% of its value in 2024.

However, this does not reflect the Naira’s strength in the global market. Internationally, the Naira is one of Africa’s weaker currencies, which becomes evident when Nigerians exchange their currency abroad, as it buys far less in foreign markets.

A lower PPP for individual consumption is generally advantageous, while a higher PPP is considered less favourable due to the PPP’s inverse nature.

Thus, Nigeria’s PPP ranking reflects strength in local terms for domestic consumption, while the Naira’s weakness in global terms limits its purchasing power internationally.

Put simply, when foreign currencies, especially the U.S. dollar are converted to Naira, the resulting amount in Naira is substantially larger than the original amount in dollars, reflecting a difference in currency strength.

This increased purchasing power for foreigners in Nigeria shows that although the Naira may be weak on the global exchange market, it can still provide access to more goods and services domestically.

How to Leverage the IJGB Benefit

With the IJGBs return to Nigeria with increased spending power, thanks to favourable exchange rates and Nigeria's relatively high purchasing power parity (PPP). Here’s how both IJGBs and local beneficiaries can make the most of these advantages:

For Local Businesses:

The best advice for local businesses is to accept a variety of payment methods, such as international credit cards, online payment systems, and remittance services. This flexibility makes transactions smoother for IJGBs, allowing them to easily convert their foreign currency and encouraging repeat business. Offering these payment options not only increases convenience for customers but also allows business owners to tap into the increased purchasing power that IJGBs bring.

For Friends and Families of IJGBs:

Now is not the time to ask for foreign chocolates or gadgets! Instead, consider asking your returning loved ones to buy gifts locally in Nigeria. With the current exchange rate, they’ll be able to purchase far more in Naira than they could with the same amount of dollars abroad, helping you get more value for your money.

For IJGBs:

The best way to maximise your spending power is by purchasing locally-produced goods and services. By doing so, you not only support the Nigerian economy but also make the most of the favourable exchange rate, getting more value for every dollar. Investing in local businesses, from fashion to food, will allow you to enjoy high-quality products at competitive prices while contributing to the growth of your home country.

Thanks for reading this edition of Pocket Science. It was written by Adijat Kareem and edited by Joachim MacEbong.