Dear Esteemed Reader,

It’s a pleasure to introduce to you the next newsletter from Dataphyte’s Insight Team. We’re so inspired by your acceptance of Marina and Maitama, our Thursday Newsletter. And here’s the next: Pocket Science!

Pocket Science offers tips to individuals and families on navigating tough economic waves in the country and the Diaspora - for staying afloat during inflation or positive during economic downturns, finding opportunities in adversity or building wealth and buffer savings for seasons of austerity.

We’ll expose the invisible hands that fuel pocket crises, explore turning hobbies into profitable ventures or starting a successful side hustle, explain DIY home repairs or thrift shopping, and all the networking you need to thrive in a gruelling economic climate.

It all begins with a personal Budget!

Most Nigerians spend over 50% of their income on food, one of the highest proportions of personal income spent on food around the world.

On the one hand, this is largely due to relatively high prices of agricultural products and skyrocketing food inflation month on month and year on year.

Food consumption is inevitable. So, people can’t evade the high costs of food purchases.

Huge Food Budgets

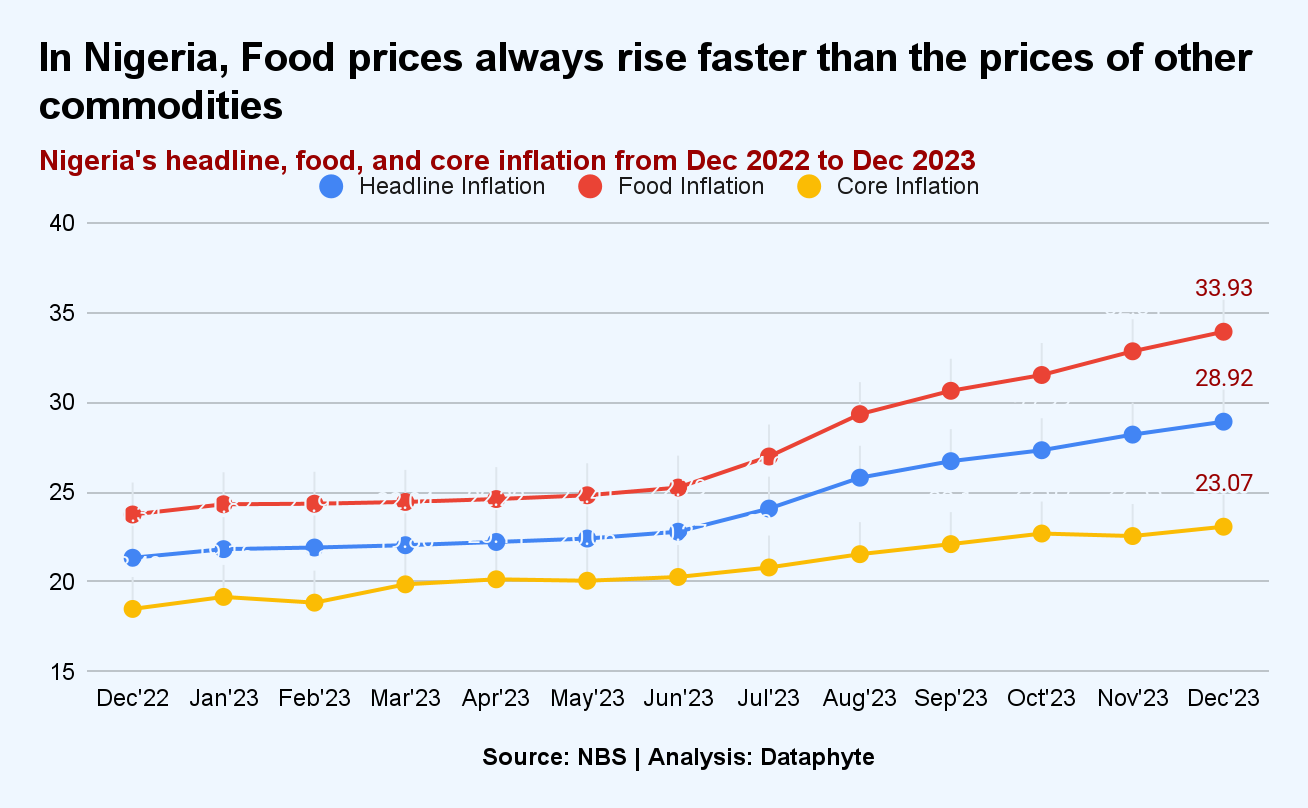

Food inflation has always been higher than other types of inflation in Nigeria due to a decades-long dearth of basic infrastructure and investments in agriculture in the country.

So, if you can survive food prices, you can survive any other expenditure.

And this is how: You are either earning an income well above the average cost of living in Nigeria, or you are not earning that much but applying some smart pocket science!

Half Full Pockets

Well, 41% of over 200 million Nigerians don’t earn that much. They live below the contrived national poverty line.

So, on the other hand, the majority’s low income makes food either unaffordable or a threat to their half-full pockets.

This shows why Nigerians need to buy smart and cut costs where possible.

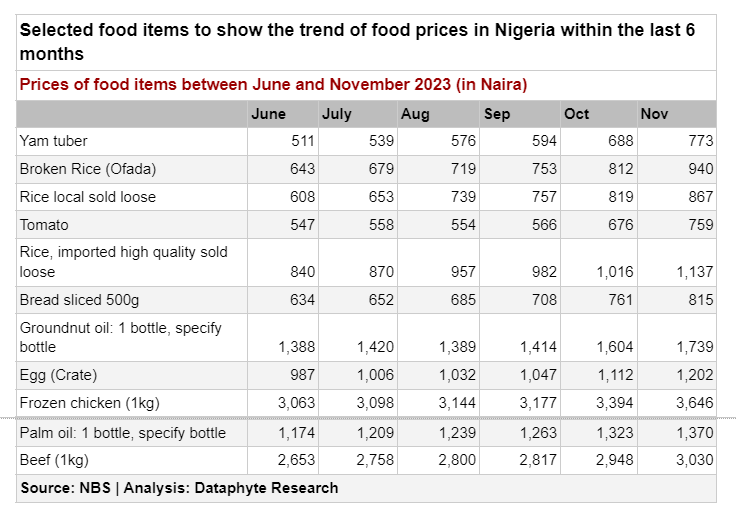

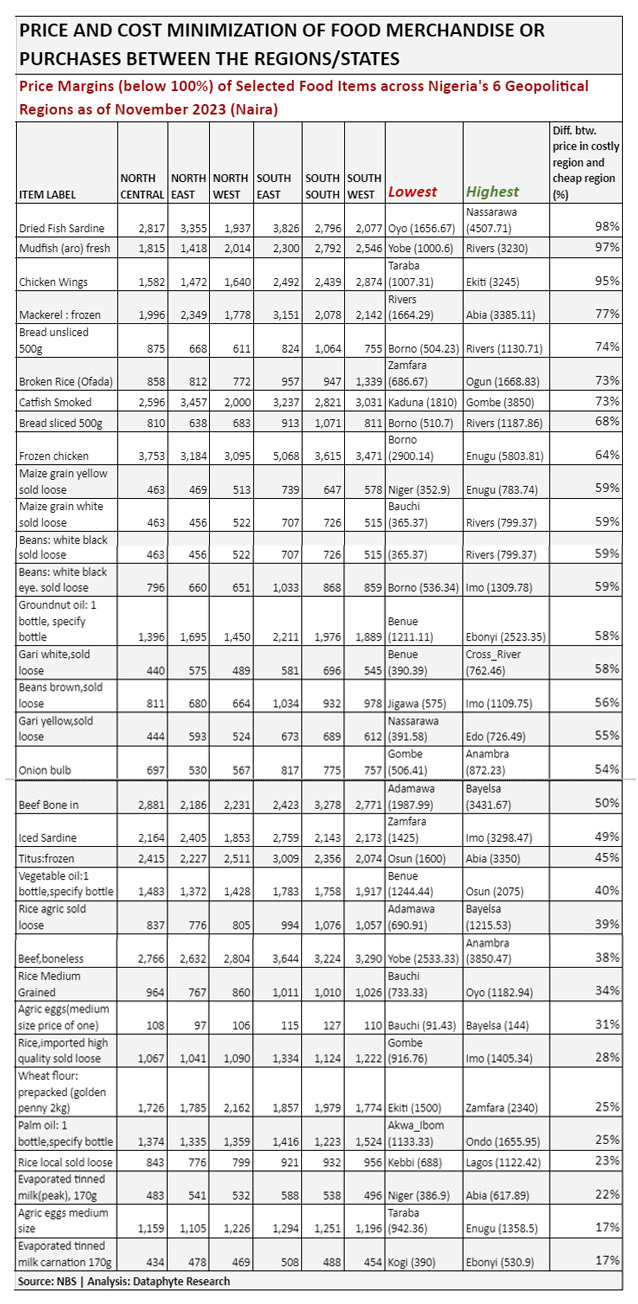

The NBS sampled prices of selected foods show that in the last year, between November 2022 and 2023, the price of some foods doubled. Others, especially carbohydrates, nearly doubled. In many parts of the country food prices increased even in greater multiples.

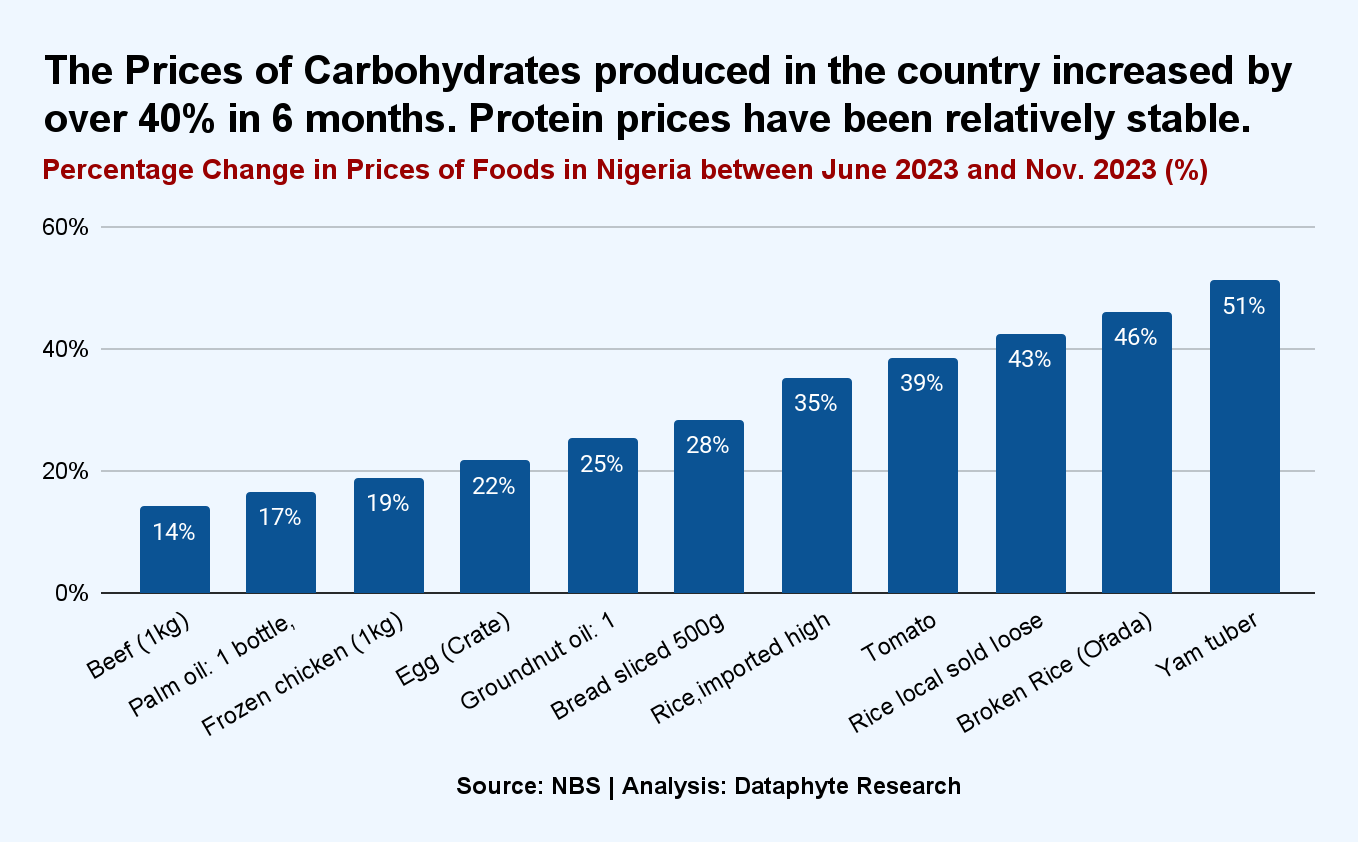

In the last 6 months of the reviewed period, the trend was the same as the annual food price increases. The prices of carbohydrates produced in the country soared faster than the majority of the proteins.

Major food items such as local rice, yam, tomato, bread, groundnut oil, egg, frozen chicken, palm oil, and beef, among others, have drastically increased in prices in the last couple of months.

Start Small with NAFDAC

Are you in Enugu State (or anywhere in the South-East region) and thinking of importing and packaging wholesome dried catfish from Jigawa (or anywhere in the North West region) for sale at your base, you don’t need to worry about the cost of going fully legit.

The National Agency for Food and Drug Administration and Control (NAFDAC) has implemented strategies to support Micro, Small and Medium Enterprises (MSMEs) in Nigeria by reducing administrative charges for the renewal of licenses for NAFDAC-regulated products for both local and foreign business owners.

According to the Director-General of the agency, Mojisola Adeyeye, the renewal of registration for locally manufactured products will now cost N44,200 with a 65 percent drop in processing fees compared to the current charges. Similarly, foreign products will be charged $450 with a 45 percent reduction in processing fees compared to current charges.

MSMEs play a major role in the country’s Gross Domestic Product (GDP), as It accounts for economic growth, by contributing to the development, job creation, and export, as well as reducing the poverty level and unemployment in the country.

As of 2022, MSMEs contributed 48% to Nigeria’s gross domestic product (GDP) and accounted for 96% of businesses and 84% of employment.

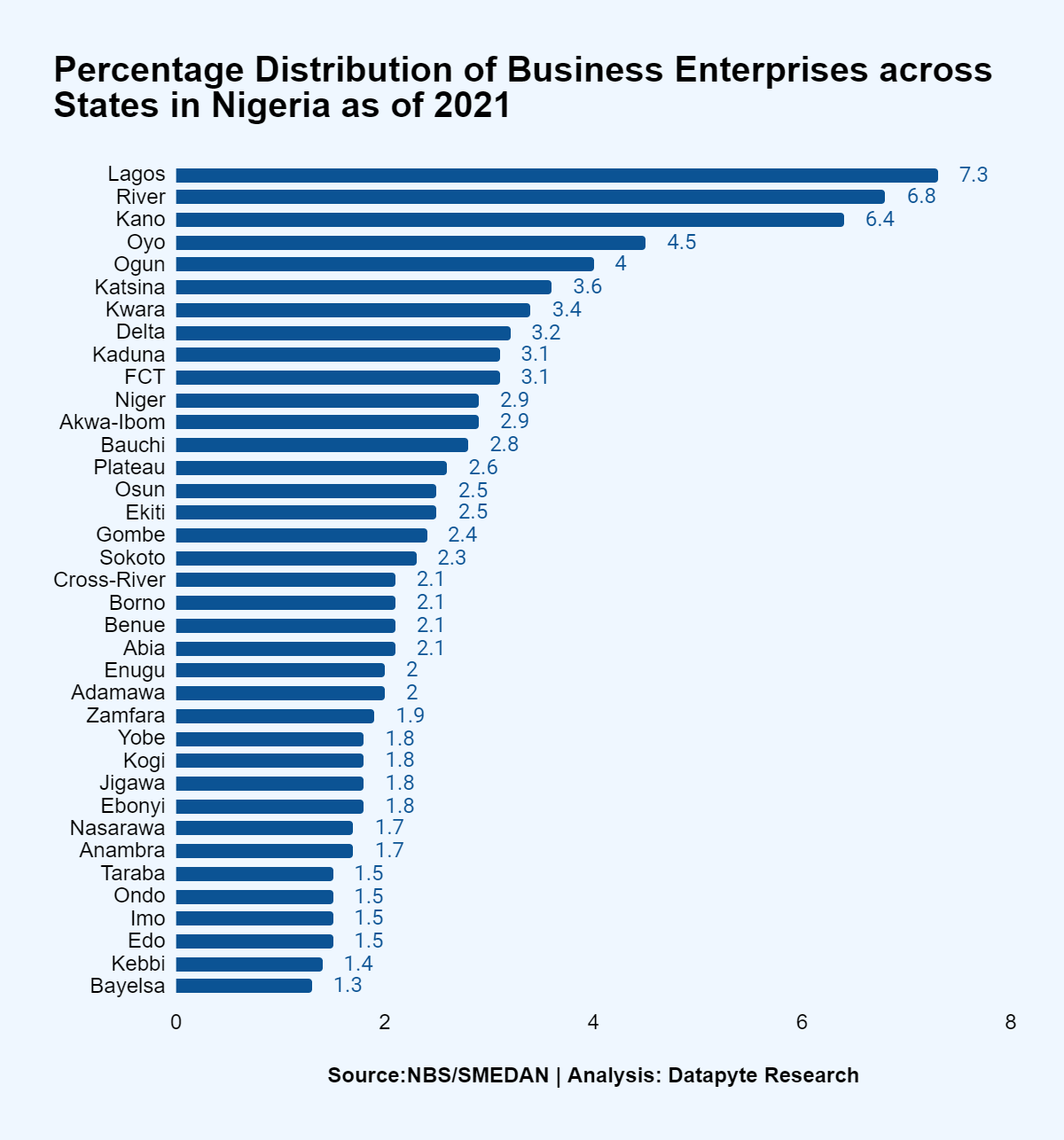

Before 2019, Nigeria had 41.5 million micro, small and medium enterprises (MSMEs), but the number decreased by 4.6% to 39.6 million, according to a survey conducted by the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) and the National Bureau of Statistics (NBS).

MSMES are concentrated in Lagos, Rivers, Kano, Oyo and Ogun States, with the 5 states accounting for 30% of the total number of MSMEs in the 36 states of the federation.

Bayelsa, Kebbi, Edo, Imo, and Ondo have the least number of MSMEs, with the 5 accounting for just 7% of all MSMEs in the country.

NAFDAC’s overture to MSMEs may encourage individuals with half-full pockets to start big businesses small small.

Start Small or Spend Less

You can leverage your presence in a particular region of the country to run a profitable ‘side hustle’ as a ‘food entrepreneur’.

And if you can’t waybill several kilos of Dried Fish Sardine from Oyo State (or any part of the South West) to your base in Nassarawa State, you could individually as a household, or as a cooperative society, drive across from Abia to Rivers State to get cheaper Frozen Mackerel there.

You could drive from Ebonyi across to Benue State to get your groundnut oil at half the price. You’ll have a better bargain, too, if you just drive from Cross River State across to Benue to get your bulk purchase of White Gaari at half the price.

In short, if one can’t reduce food prices or slow down its rate of inflation, one must buy smart, either to sell or to consume.

Our data analysis shows that food items, mostly carbohydrates and protein, are largely cheaper in the Northern regions (North East, North West and North Central) of the country compared to prices of the same food items in the South-South and South Eastern regions of the country.

The trade flow shows that farm produce is cheaper in the Northern parts of the country, leaving open room for a large market in the South-South and southeastern parts of the country.

Even if you are not living in the Northern part of the country, where these items have been identified to be cheaper, all you need to do is establish contact with traders up North. With the transport sector already made easier plus easier telecommunication, a phone negotiation call can lead to a waybill of what you want to buy.

You may just want to consider starting a side hustle leveraging these data points. While the cost of delivery of ordered goods between regions or states may be another thing to factor in, with price margins ranging between 100% and over 200% per unit of the items, and a ready market expecting, profit will still be secured.

Transport Fare: Why Commuters fare better now

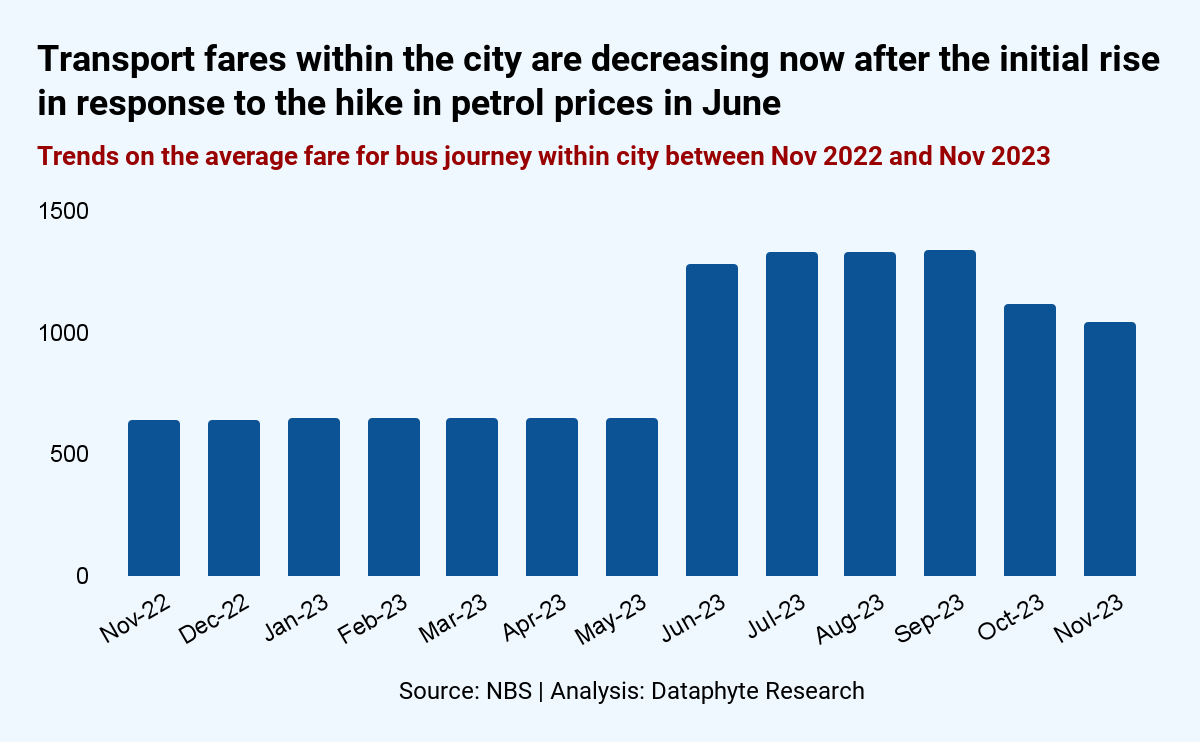

Unlike food prices, transport fares are decreasing now after the initial rise in response to the hike in petrol prices in June.

Commuters had a bitter time for four consecutive months, June through September, as they sometimes paid double the transport fares they paid in May before President Tinubu's removal of the petrol subsidy shot up transportation costs across the country.

Things appear to be getting better now, as the NBS’ transport fare report shows.

The National Bureau of Statistics (NBS) report on transport fares shows that, while road transport costs were on the decline in October and November 2023.

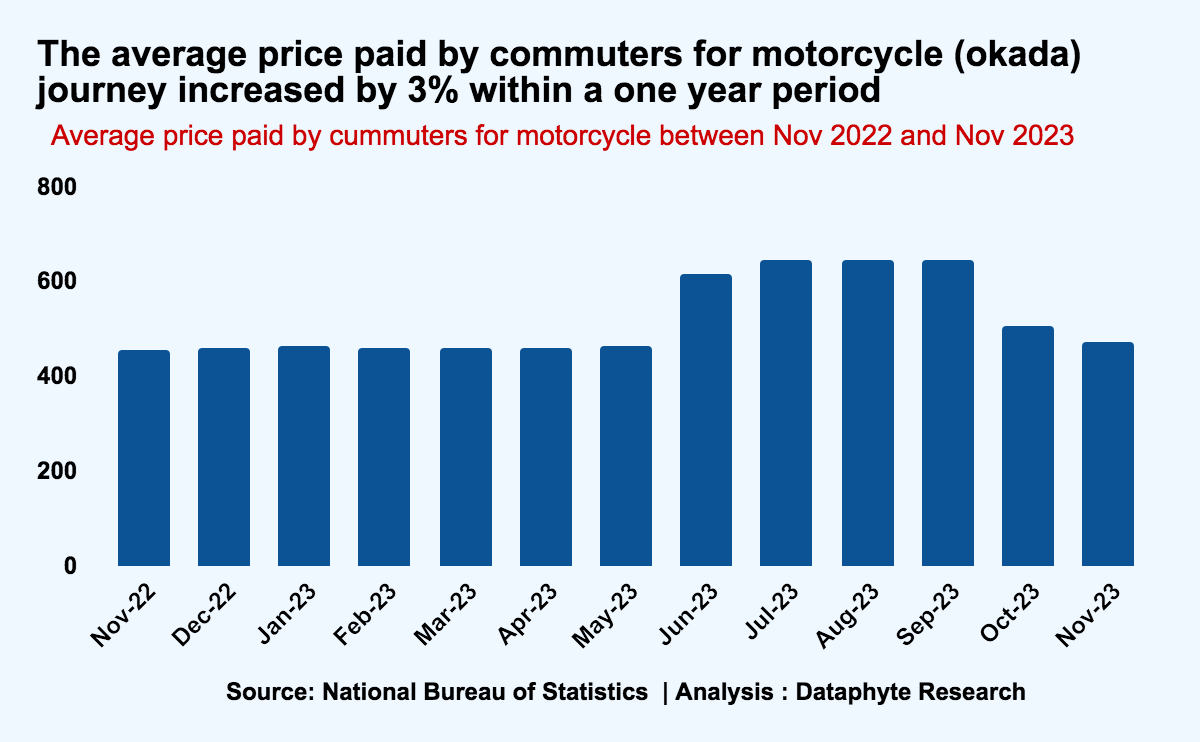

It's been the same for rides on bikes. The average price for bike rides as of November 2023 has reduced to just 1.8% above the initial prices in May before the fuel price increases.

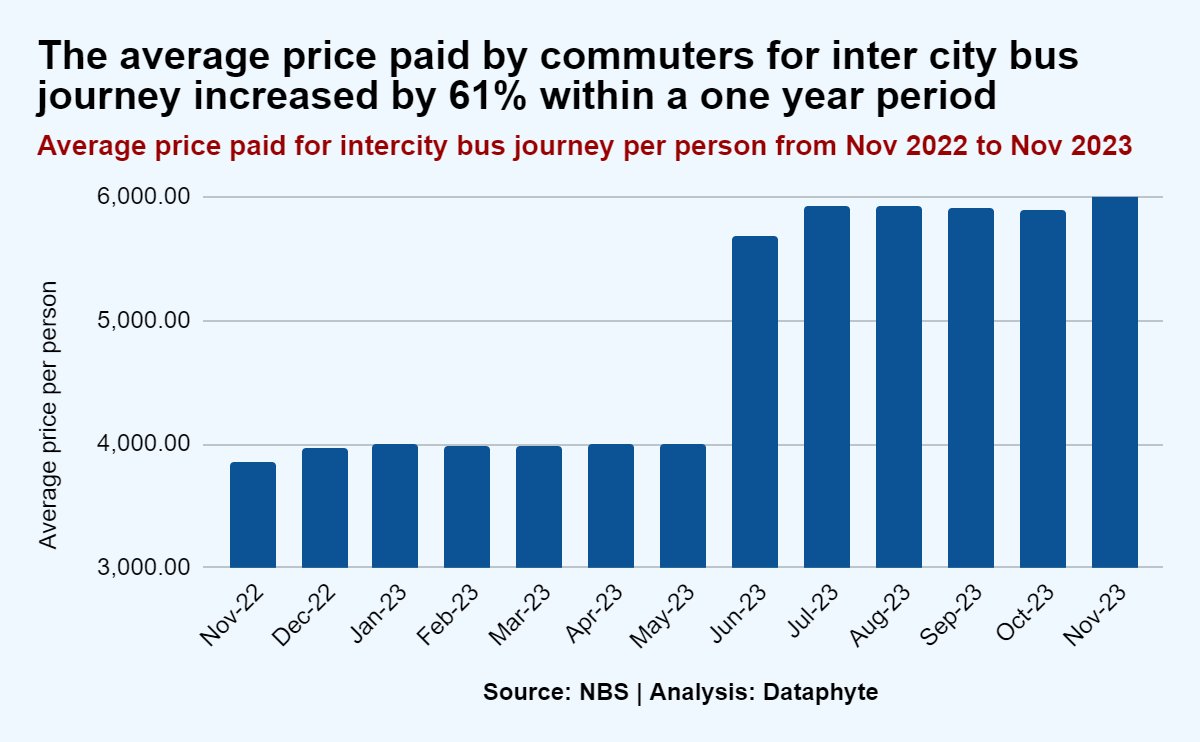

The only exception is the transport costs for intercity bus journeys.

While there were slight decreases from August through October, the transport costs soared higher in November.

We await the NBS December report to see if the general decline in transport fares will continue.

How did the people Battle the increase in Transportation Costs

No doubt people paid as much as double the amount they paid for transport before June 2023 to cover the same distance. This really hurt the pocket and household budget.

We sampled opinions on how commuters must have wrestled the transport cost down by October and November 2023.

We heard many interesting stories

Some considered other transportation options like walking instead of taking a motorbike 🥲.

Some resorted to riding bicycles 🚴

Some reduced their travels, cutting off unnecessary commutes.

Many private drivers resorted to picking up passengers at reduced costs, just enough to mitigate their fuel costs.

Many commuters resorted to patronising these private drivers instead of the commercial vehicles, which charge the market rate.

Some also queued to board the few urban mass transit buses, which charged less than the commercial vehicles.

All these and other efforts to reduce demand for transport services at the market rate could have forced down the transport prices on the supply side.

Like transport fares, food prices can begin to reduce too, if we apply some simple pocket science here and there.

Cheers to smart spending and better bargains! See you next Tuesday.

This edition of Pocket Science was composed by Kafilat Taiwo, Funmilayo Babatunde, Khadijat Kareem, and Olanrewaju Oyedeji. It was edited by Oluseyi Olufemi.