The Middle Class’ Missing Comforts

A peek into the pockets of the middle class in Nigeria reveals old comforts are slipping out of their financial reach.

Essential needs like housing and healthcare or luxury goods like new cars and travel for vacations, are becoming unattainable for those caught in this economic downturn.

About 4 million of Nigeria’s middle class were reported by the World Bank to have slipped into poverty in H1 2023, and 7.1 million more were at risk of becoming poorer. This was revealed in the World Bank’s Nigeria Development Update.

An earlier survey commissioned by the African Development Bank estimated the middle class at about 23% of the population.

According to the OECD, the daily income of most middle-class individuals in emerging countries is typically between $10 and $100. This means earning between 450,000 and 4.5 million monthly, going by current official exchange rates.

The working class among the middle class find it harder to get a pay rise even in the face of obvious price hikes, including those working in unionised environments.

What can one do?

Healthcare

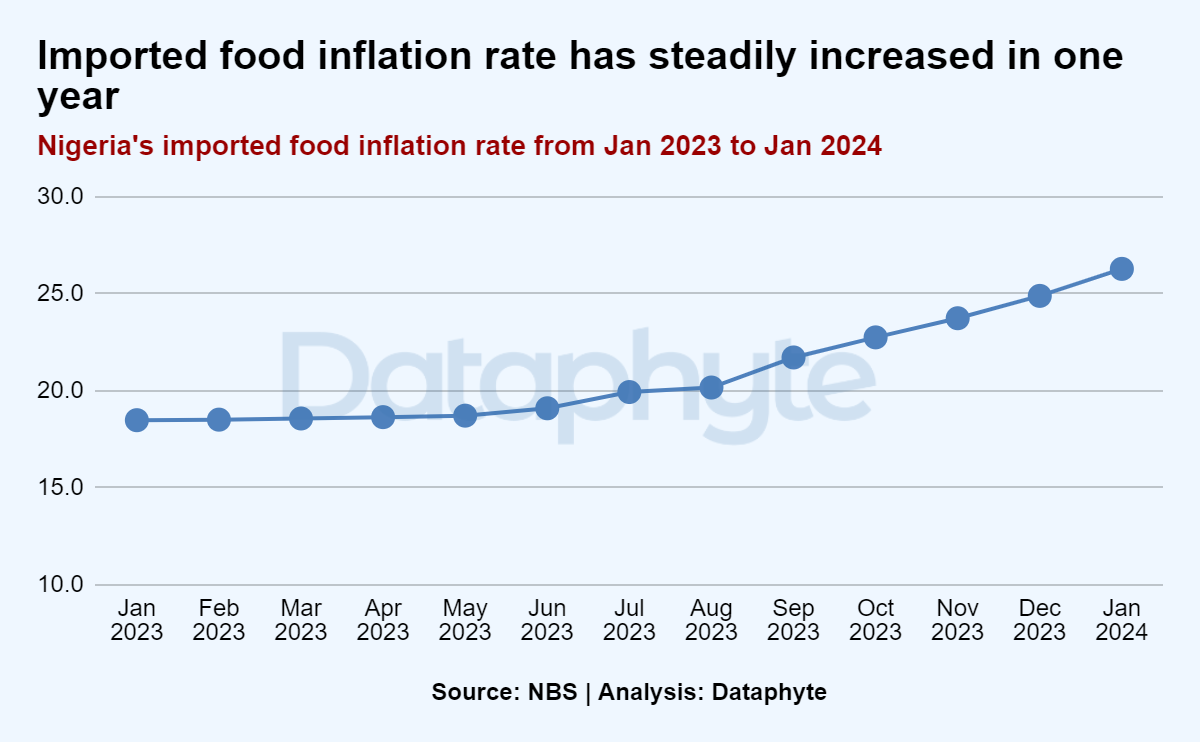

Nigeria's health inflation rate has consistently increased over the analysed period, reflecting a concerning trend. Starting at 18.6% in January 2023, the inflation on health products and services had reached 24.6% by January 2024.

This indicates that the cost of healthcare services and related commodities has been rising faster each month in the last 12 months.

Rising healthcare expenses, encompassing prescription drugs, medical services, and insurance premiums, may pressure middle-class budgets and restrict their access to high-quality healthcare.

A persistent rise in health inflation may have severe consequences for people and families, including increased costs for prescription drugs, medical procedures, and general healthcare.

This could make it more difficult for the general public, especially the poor and working class to maintain their well-being and obtain necessary healthcare.

On the government side, for the Nigerian populace to have access to affordable healthcare, it may be essential to address the reasons driving up the rate of health inflation, such as rising expenditure for health personnel, equipment, and supplies.

Furthermore, legislators might need to investigate ways to lessen the effects on the populace and preserve a balance between the cost and quality of healthcare.

And if the government prevaricates on this, the people can still do something.

To reduce skyrocketing out-of-pocket expenditures on healthcare, people can take health insurance premiums.

Above all, maintaining a healthy lifestyle and work-life balance can help reduce the added health insurance premiums charged to people with pre-existing health conditions.

New cars

As of July 2023, the devaluation of the naira and the increase in currency rates for clearing imports caused new automobile prices to skyrocket, according to recent market research by Modor intelligence.

This devaluation had an approximate 15% influence on new car pricing.

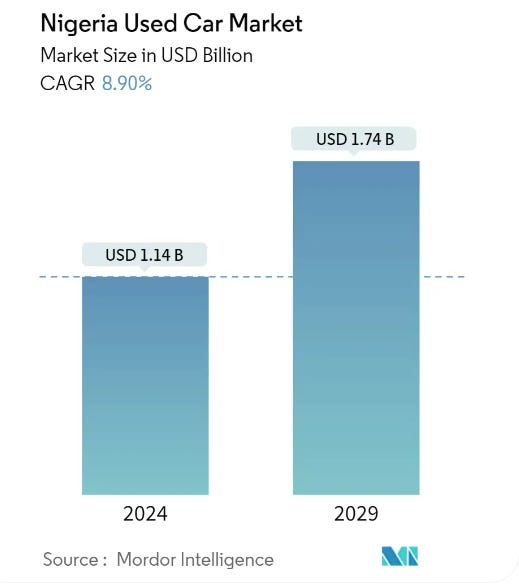

The Modor Intelligence forecast on the market size of cars indicates that the current value of the used car (also known as Tokunbo car) market in Nigeria, standing at USD 1.14 billion, is expected to exceed USD 1.74 billion by 2029, showing a Compound Annual Growth Rate (CAGR) of 8.9%.

This growth is partly influenced by the increase in Tokunbo car prices, which grew by nearly 100% following the steep rise in the exchange rate.

Besides the cost of imports, the Nigeria Customs Service (NCS) decided in June 2023 to raise the import duty on vehicles from 39.45% to 39.62%.

The move aimed to reduce reliance on imported cars and boost the domestic manufacturing sector.

The Mordor Intelligence report also indicates that used sedan vehicles remain the favoured choice among consumers seeking to buy used cars in the Nigerian market.

This preference is attributed to the lower prices of sedans compared to their counterparts, such as sports utility vehicles (SUVs) and multi-purpose vehicles (MPVs).

Notable used sedan models that have gained popularity in Nigeria include the Toyota Corolla, Toyota Camry, and Honda Accord, among others, as of June 2023.

As inflation and currency devaluation continue to surge, accessing sedan models of cars may become more challenging for the middle class looking to upgrade their vehicles in the future.

Like the options for healthcare, the middle class, who can scarcely afford to purchase new cars may think of taking premium car insurance to fully secure their current vehicles from the risk of theft or damage through accident.

There is also the need to maintain the old cars well to reduce the risks of damage and the necessity of replacement with a new costly one.

Vacations

Cost and affordability are the paramount factors Nigerians consider when planning international trips, the TGM Global Travel Report 2023 reveals. This is alongside considerations for local culture, history, experiences, and leisure time.

The challenging economic landscape, including a devalued naira, and costlier flight tickets complicates the possibility of summer vacations for many middle-class and poor people in Nigeria. This is besides the usual travel restrictions and stringent visa requirements.

Economic difficulties may thwart middle-class dreams of future vacations. Typically occurring from June to September, summer vacations involve leisure travel for individuals, couples, and families, with international trips often driven by shopping, recreation, and religious ceremonies.

A cost-saving alternative to vacations abroad is exploring domestic vacations in Nigeria. This is potentially more economical than international travel or by playing a little economics of opportunity cost of foregoing vacations altogether.

Cereal’s the Real Deal

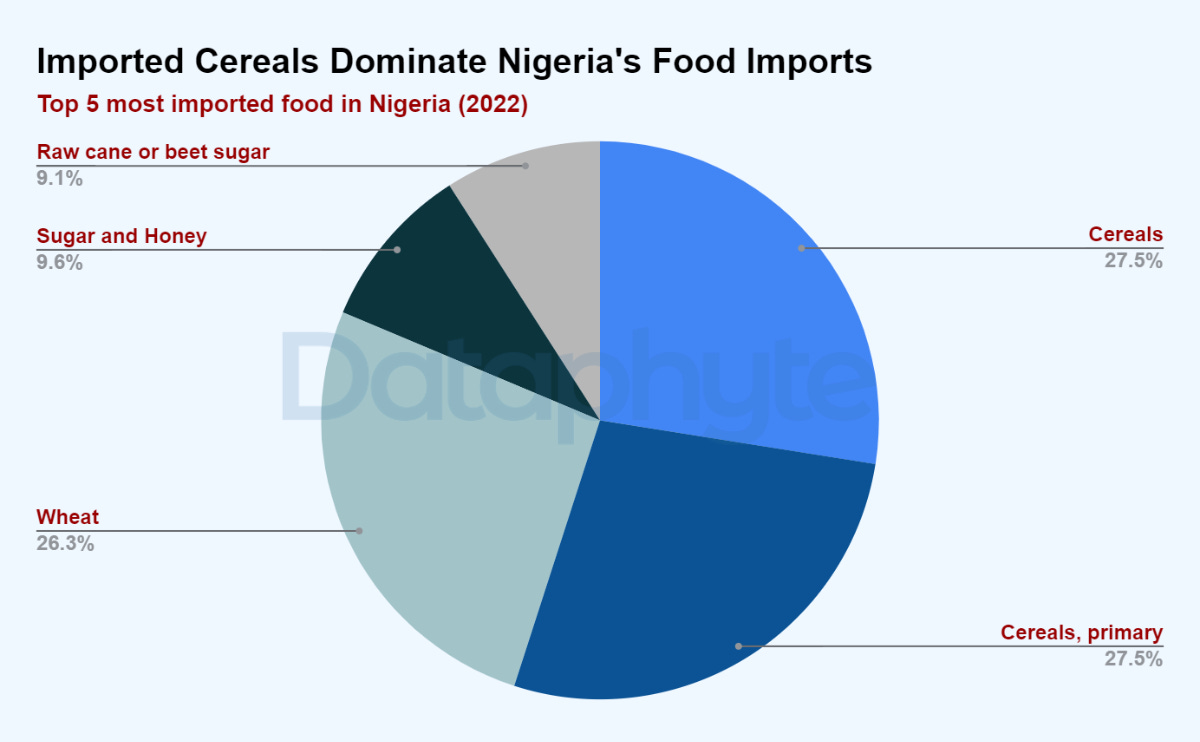

Nigeria’s top imported food indicates grains are key in every Nigerian’s diet with cereal being Nigeria’s most imported product in 2022.

Cereal crops are crops cultivated for their edible grains or seeds. They include rice, wheat, rye, oats, barley, millet, and maize.

The importation of cereals is a sign of consumer preferences, but it also raises concerns about possible effects on domestic agriculture.

The high level of importation may indicate that either Nigerians are not buying local cereal producers' goods or that Nigeria does not produce enough cereal for domestic consumption.

Data from the Food and Agriculture Organisation (FAO) reveals that cereals were the most imported food item, racking up a total quantity of 5,132,433 tonnes in 2022, with primary cereals coming second.

Wheat imports came in third, while sugar and honey imports, especially raw cane or beet sugar came in fourth and fifth respectively giving us a peek into Nigerians' sweet side.

Cereals are a nutritional powerhouse, in addition to being essential. Enriched with vital vitamins, minerals, and dietary fibre, cereals meet the nutritional requirements of a wide range of people and provide a substantial contribution to overall nutrition.

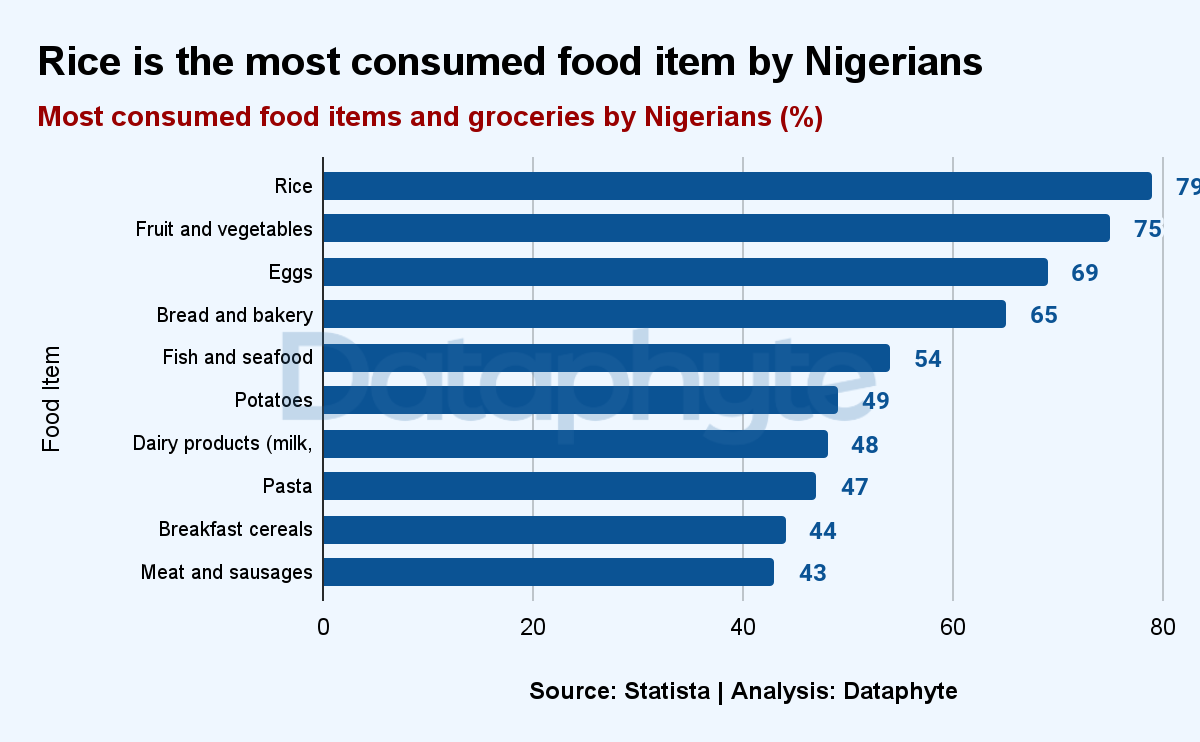

This is evident, as rice, one of the main cereal crops is the most consumed food by Nigerians according to a Statista consumer insight survey.

When asked what they regularly consume for groceries, Nigerian shoppers most frequently responded with "rice" and "fruit and vegetables."

According to the West Africa Regional Supply and Market Outlook, Agro-climatic problems, insecurity, and growing production costs are expected to cause a significant reduction in the production of some major cereal crops in Nigeria and other West African countries by 2024.

Cereal prices are also likely to be higher than the five-year average in the majority of the region's markets because of anticipated decreases in output, high worldwide pricing, unrest along trade routes, and expensive transportation.

This implies that Nigerians either can't eat as much of their favourite food as they would like to or have to pay more for it.

On the personal level, with such surplus demand for cereals, growing some by oneself could reduce household dependence on other sowers.

And on the patriotic level, growing some maize, wheat or millet could reduce Nigeria’s import bill significantly.

Hope you enjoyed this edition of Pocket Science. It was composed by Khadijat Kareem.