Towards a Viable Aviation Industry

In recent times, the aviation industry in Nigeria has had two welcome developments: the news of the return of the Emirates Airline, which left in 2022 due to blocked funds and the beginning of the cheaper Lagos to London ticket by Air Peace, a local carrier.

In Nigeria’s aviation sector, as in other climes, international airline operations have much potential to enable economic growth.

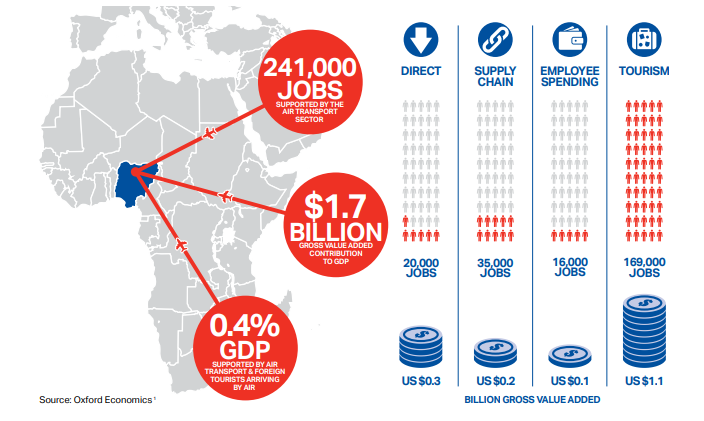

Industry insights from IATA show that travel by air in and out of Nigeria for trade and tourism has created over 241,000 jobs and generated $1.7 billion in Gross Value Added to the GDP, which makes up 0.4% of the GDP.

According to IATA, air transport "provides speedy connections between cities. These virtual bridges in the air enable the economic flow of goods, investments, people, and ideas that are the fundamental drivers of economic growth.”

The value added to the economy by the people moving to and from Nigeria can be seen in their spending and trade investments upon arrival and/or departure from the country.

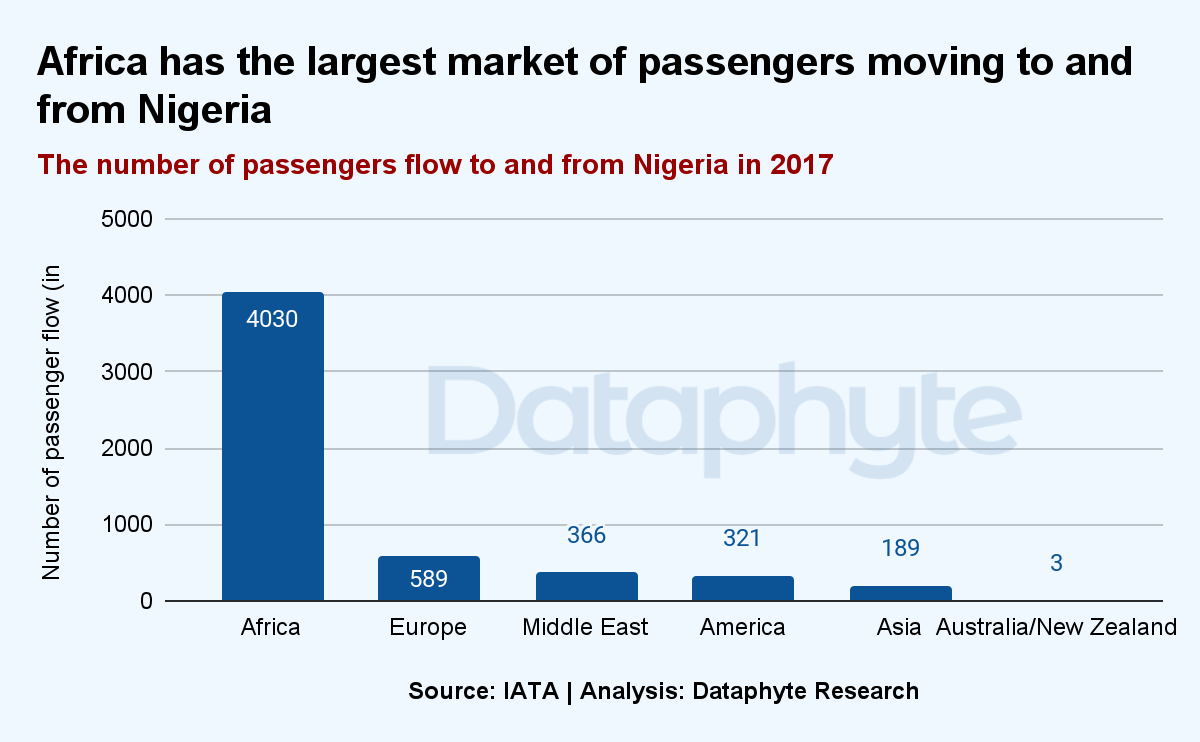

African countries are Nigeria's largest market for to-and-fro air transport for 2019 (73.3 %). It is followed by Europe (10.7 %), while Nigeria’s connection to the Middle East (6.7 %) has grown significantly in the last couple of years.

The movement of people to and from Nigeria to the Middle East increased by 20 per cent while the movement to America reduced by 50 per cent and Europe reduced by 21 per cent, reports IATA

According to the Nigeria Civil Aviation Authority, the country has 20 airports plied by 23 active domestic airlines and 22 foreign airlines.

Despite this industry's potential, it is still plagued with challenges that impede the ease of doing business within the industry.

In an interview with Allen Onyema, the CEO of Air Peace, on Arise News, there are barriers to ease of doing business in the aviation sector, such as financial instability, political interference, infrastructural deficiencies, regulatory obstacles, and high operational costs.

In the World Economic Forum Index for travel and Tourism, Nigeria scored 2.07 out of 10 and ranked 126th out of 136 countries for Ground and Port Infrastructure.

For Air Transport Infrastructure, it ranked 108 out of 136 and scored 2.01 out of 10.

Regardless of the challenges faced by the Nigerian aviation industry, foreign and local airlines have a high potential for profitability.

Much Ado about Visa Fees

Nigerian immigration has increased the visa-on-arrival fee from $90 to $170 this year. This policy affects all travellers coming into the country except US nationals, who have been exempt since March 1, 2023.

The revised fee structure on Visa on Arrival was brought to the forefront when Larry Madowo, a CNN international correspondent, posted on LinkedIn that he had paid $215 each time for a one-month single-entry visa the three times he had visited the country within the year.

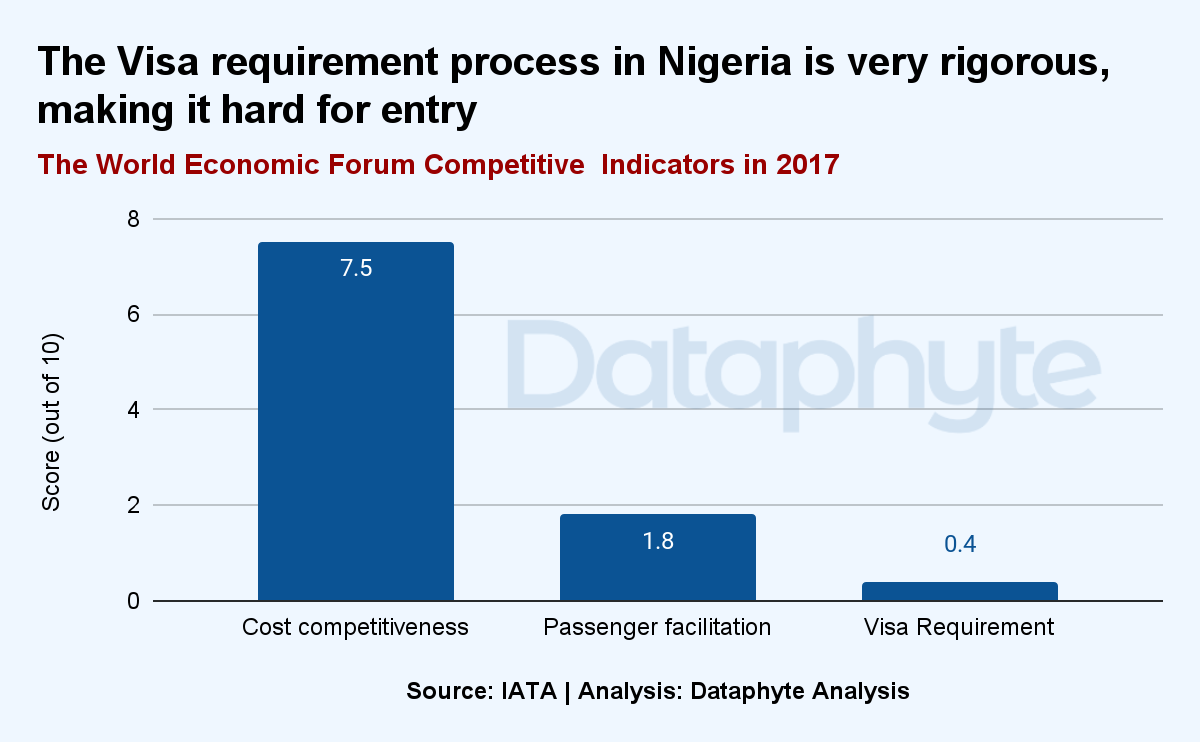

This new fee structure will hinder the ease of travel, cost competitiveness, and trade facilitation in Nigeria.

According to IATA’s Air Transport regulatory competitiveness index, Nigeria’s passenger facilitation score is 1.8 out of a score of 10, below Africa’s average of 3 out of a score of 10. Nigeria’s visa requirement score is among the world's lowest, with a score of 0.4 out of 10.

The World Economic Forum's Travel and Tourism Competitiveness Index ranked Nigeria 127th out of 136 countries, and the nation’s international openness is 124th, with a score of 1.89 out of 10.

This implies that the visa requirement process is quite rigorous, and this increase in cost will make it more stringent for tourists to enter the country.

Also, the low passenger facilitation score indicates difficulty in how people move into the country; the government facilitation process is poor, and the advanced passenger information and automatic border control system are poor.

According to Mr Madowo, “The visa itself costs $25, but Nigeria charges a $20 “processing fee” and $170 for biometrics every time. My fingerprints haven't changed since I was here 3 weeks ago, why am I paying $170 to have them taken and pose for a picture each time I visit…?”

These are some of the hassles faced by international travellers coming into the country, which is one reason for Nigeria’s low score in passenger facilitation and visa requirement indicators.

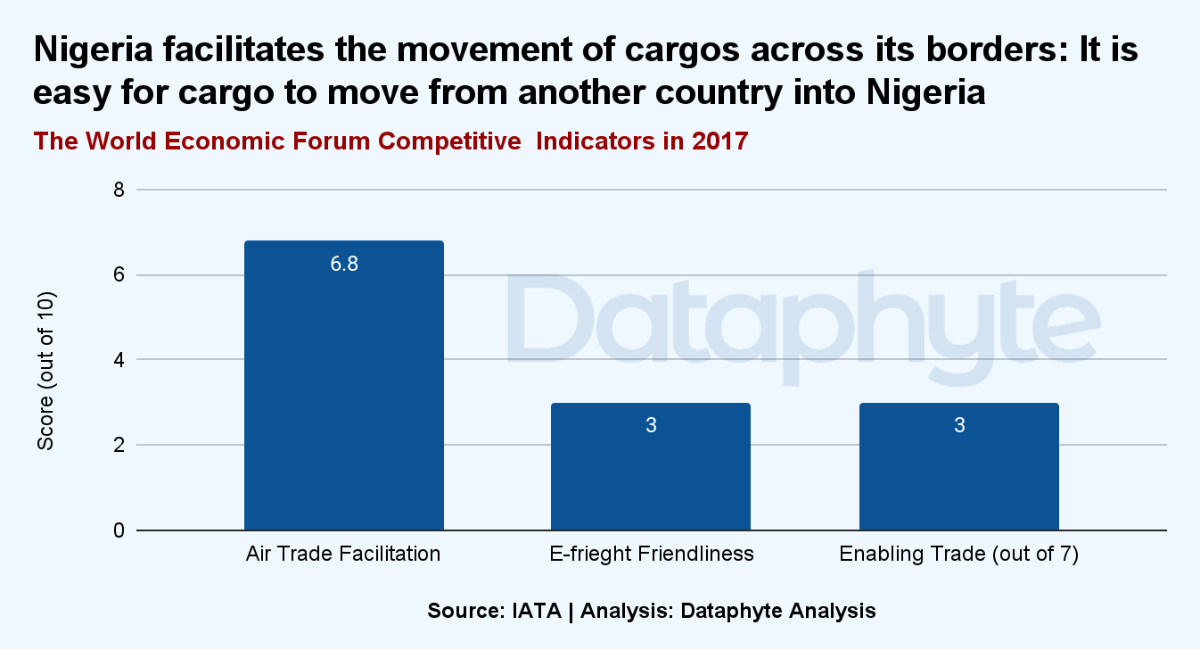

Regarding trade facilitation via air transport, Nigeria is ranked 68th out of 124 countries in the Air Trade Facilitation Index and 36th out of 136 countries in the E-freight Friendliness Index. IATA also ranks the country 127th out of 136 countries for the free flow of goods to their destination.

The Air Transport Regulatory Competitive Index, Efrieght Friendliness Index score is 3 out of 10 while the Air Trade Facilitation score is higher, 6.8 out of 10.

Nigeria has a less stringent process for cargo movement across its borders compared to the ease of travel of people.

If the policies regulating the industry are less stringent, the government can more easily facilitate people's air travel and cargo exports.

I hope you enjoyed this edition of Marina and Maitama. It was written by Lucy Okonkwo, who spent the last four years in the aviation sector. It was edited by Oluseyi Olufemi, who has lost count of the number of biometric captures he has endured.