Trade Wars: 14% Tariff Implication for Nigeria

+ What Nigeria’s Growing FX Reserves Mean for the Economy

Trade Wars: 14% Tariff Implication for Nigeria

Nigeria is currently subject to a 14% trade tariff on its exports to the United States, introduced under the U.S. government's Liberation Day Reciprocal Trade Tariffs. The policy, championed by President Donald Trump and launched under the slogan "Make America Wealthy Again" (#MAWA) is designed to bolster the U.S. economy through protectionist measures.

In Trump's words, the U.S. would implement “reciprocal tariffs” on all countries at approximately half the rate they charge the United States. Nigeria, which imposes a 27% tariff on U.S. imports, has consequently been levied a 14% tariff in return.

The tariff is part of a sweeping global policy affecting 189 countries, with rates varying widely. Saint Pierre Miquelon and Lesotho bear the highest tariff rate of 50%, while 122 countries received the lowest rate of 10%. Nigeria falls squarely in the middle subject to a moderate yet economically significant 14% rate.

The United States accounts for 7.1% of Nigeria’s total exports, comprising key goods such as oil, agricultural products, and manufactured items. As Nigeria’s 7th largest trading partner, the U.S. plays a significant role in the country’s external trade.

However, the broader concern lies in the potential ripple effects on Nigeria’s economy, particularly from global inflation triggered by rising costs of goods and services due to international tariff hikes by the US.

Over the past five years, Nigeria's exports to the U.S. have steadily grown, rising by 4 percentage points from 3.1% in 2020 to 7.1% in 2024.

While Nigeria's exports to the U.S. have been on the rise, imports from the U.S. have steadily declined over the same period. This shift has led to a growing trade surplus in Nigeria's favour, particularly over the past three years. The increasing export volume, coupled with reduced reliance on U.S. imports, signals a changing trade dynamic that strengthens Nigeria’s economic positioning.

The United States as a trade partner

In 2024, the U.S. ranked as Nigeria’s seventh-largest trading partner by trade balance, with a surplus of N1.4 trillion in Nigeria’s favour. While the U.S. remains a key economic ally, it lags behind top partners such as Spain, France, and the Netherlands.

This positioning reflects Nigeria’s continued efforts to diversify its trade relationships and expand access to other global and regional markets.

Nigeria’s Trade Outlook Under New U.S. Tariffs

Although Nigeria’s exports to the United States have steadily increased over the past five years, Dataphyte’s analysis reveals U.S. total trade accounts for 0.52% of Nigeria’s total nominal GDP. This indicates that the newly imposed 14% U.S. tariff on Nigerian exports may not substantially impact Nigeria’s overall economy.

However, the real concern lies in sector-specific effects. The 14% tariff could increase the cost of Nigerian goods entering the U.S. market, potentially reducing their competitiveness and dampening demand. This decline in demand may lead to lower export revenues, particularly in sectors like agriculture, oil, and semi-manufactured goods.

However, one of the broader and more significant implications of these tariffs is the potential to trigger global inflation. As production and trade costs rise globally, countries like Nigeria heavily import-dependent may face heightened exposure.

Rising prices for raw materials and finished goods could push up production costs, shrinking profit margins, and escalate consumer prices, straining households and businesses alike.

For instance, if Nigeria exports cocoa to the United States for $100, a 14% tariff increases the price to $114. This additional cost may reduce demand for Nigerian cocoa in the U.S. market.

If the imported cocoa is processed into chocolate in the U.S. and originally sold domestically for $10, the production cost might rise to $15 due to the higher price of cocoa.

When this U.S.-made chocolate is exported to Nigeria, it faces a 27% tariff. This further raises the price to over $19.05, making it significantly more expensive for Nigerian consumers.

This chain reaction of rising costs illustrates how tariff policies can have compounding effects across international supply chains, ultimately affecting market demand and affordability.

Nigeria-U.S. Trade Composition

According to Q4 2024, Foreign Trade Statistics from the National Bureau of Statistics (NBS), Nigeria's key exports to the U.S. included crude oil, agricultural products, and semi-manufactured goods.

In contrast, imports from the U.S. primarily consisted of refined petroleum products and used vehicle parts.

Given this trade dynamic, the cost implications of tariffs may reflect across Nigeria’s industrial sectors, especially those reliant on imported components or raw materials.

In the long term, Nigeria may need to reassess its trade strategy, explore new economic partnerships, and strengthen regional and global alliances to counterbalance the effects of U.S. trade policies. Diversifying export markets and fostering local production capacity will also maintain economic resilience and reduce dependency on any single trade partner.

What Nigeria’s Growing FX Reserves Mean for the Economy

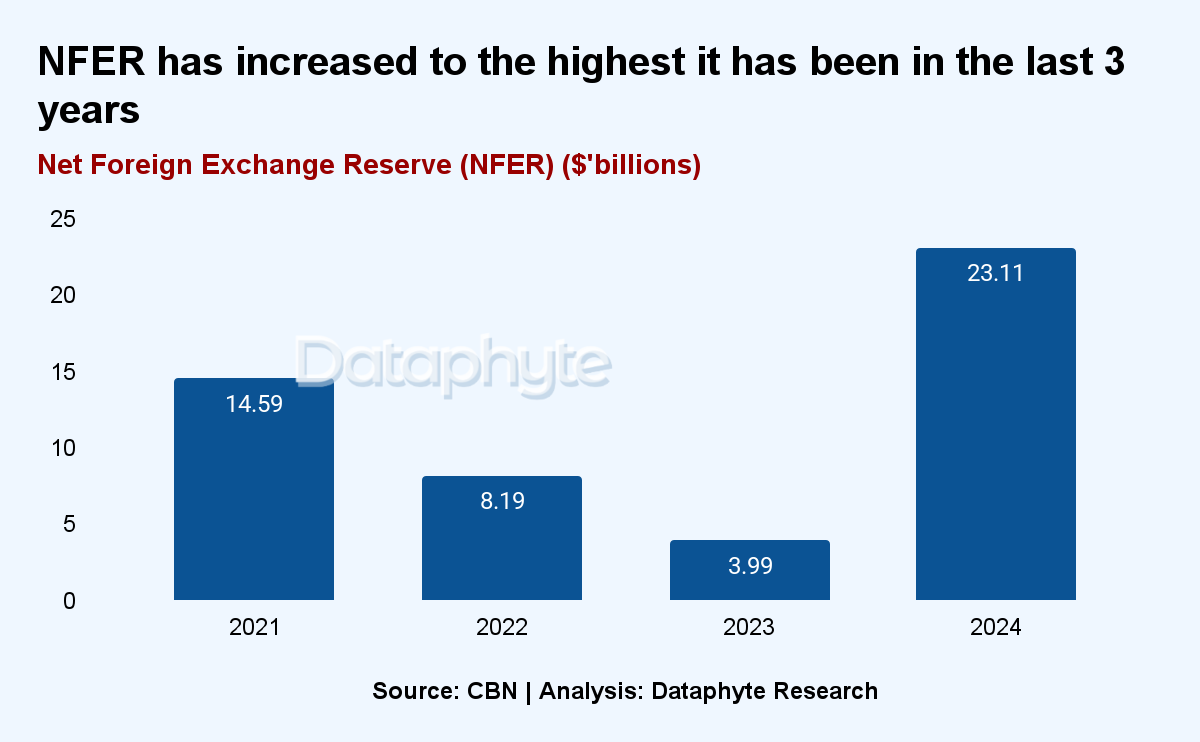

The Central Bank of Nigeria (CBN) has reported an increase in its net foreign exchange reserve (NFER) by over 58% in the last four years. It increased from $14.59 billion in 2021 to $23.11 billion in 2024, the highest in the last three years.

According to the CBN, “the increase reflects a combination of strategic measures undertaken by the CBN, including a deliberate and substantial reduction in short-term foreign exchange liabilities – notably swaps and forward obligations.

The strengthening was also spurred by policy actions to rebuild confidence in the FX market and increase reserve buffers, along with recent improved foreign exchange inflows – particularly from non-oil sources.”

A stronger reserve position is expected to support exchange rate stability, which plays a critical role in curbing inflation. This development could also boost investor confidence and create a more conducive environment for export growth, especially in enhancing non-oil foreign exchange earnings.

Notably, the CBN’s February Inflation Expectation Survey Report identified exchange rate fluctuations as the second most significant driver of inflation, after energy costs.

The report suggests that many businesses believe that stabilizing the exchange rate could lead to more predictable prices for goods and services, ultimately contributing to broader economic stability.

Source: CBN

Before the recent rebasing of the Consumer Price Index (CPI) by the National Bureau of Statistics (NBS), data revealed a strong 88% correlation between Nigeria’s inflation rate and the exchange rate.

This high correlation implies the significant influence that exchange rate fluctuations, particularly the depreciation of the Naira have on inflation.

In simple terms, as the exchange rate increases, the cost of imports rises, leading to higher prices for goods and services across the economy.

This strong linkage highlights the critical importance of exchange rate stability in managing inflation and sustaining overall economic stability.

Nigeria’s heavy reliance on imports makes exchange rate stability critical to maintaining overall market and economic stability. A stable exchange rate helps reduce market disruptions, supports price stability, and promotes sustained economic growth.

A strong foreign exchange reserve position empowers the Central Bank of Nigeria (CBN) to intervene effectively in the foreign exchange market when needed.

Such interventions help curb excessive volatility in the naira, preventing sharp currency depreciation that could otherwise raise import costs, and fuel inflation, and create uncertainty for businesses.

Stable exchange rates also provide the predictability firms need to make long-term investment decisions, manage operational costs more effectively, and forecast financial outcomes with greater confidence. This strategic clarity is vital for fostering private sector growth, improving productivity, and driving overall economic expansion.

In addition, a robust reserve position boosts investor confidence—both local and international—by signalling that Nigeria has sufficient external buffers to meet short-term obligations. This assurance can attract foreign direct investment (FDI) and portfolio inflows, further strengthening the economy.

Ultimately, improving Nigeria’s foreign exchange reserves is not just about building financial buffers. It’s about laying the foundation for macroeconomic stability that enables sustainable development.

As businesses gain the confidence to invest and expand within a more predictable environment, the ripple effects will be felt across various sectors from manufacturing to agriculture, particularly by enhancing non-oil export performance and diversifying Nigeria’s foreign exchange earnings.

Thanks for reading this edition of Marina and Maitama. It was written by Lucy Okonkwo and edited by Adijat Kareem.

You've read this far, now take 2 seconds to share: