Global Crude Oil Price Fall: Can Nigeria Stay Afloat?

+Nigeria’s Naira-for-Crude Initiative Fuels Local Oil Refinery Growth

Global Crude Oil Price Fall: Can Nigeria Stay Afloat?

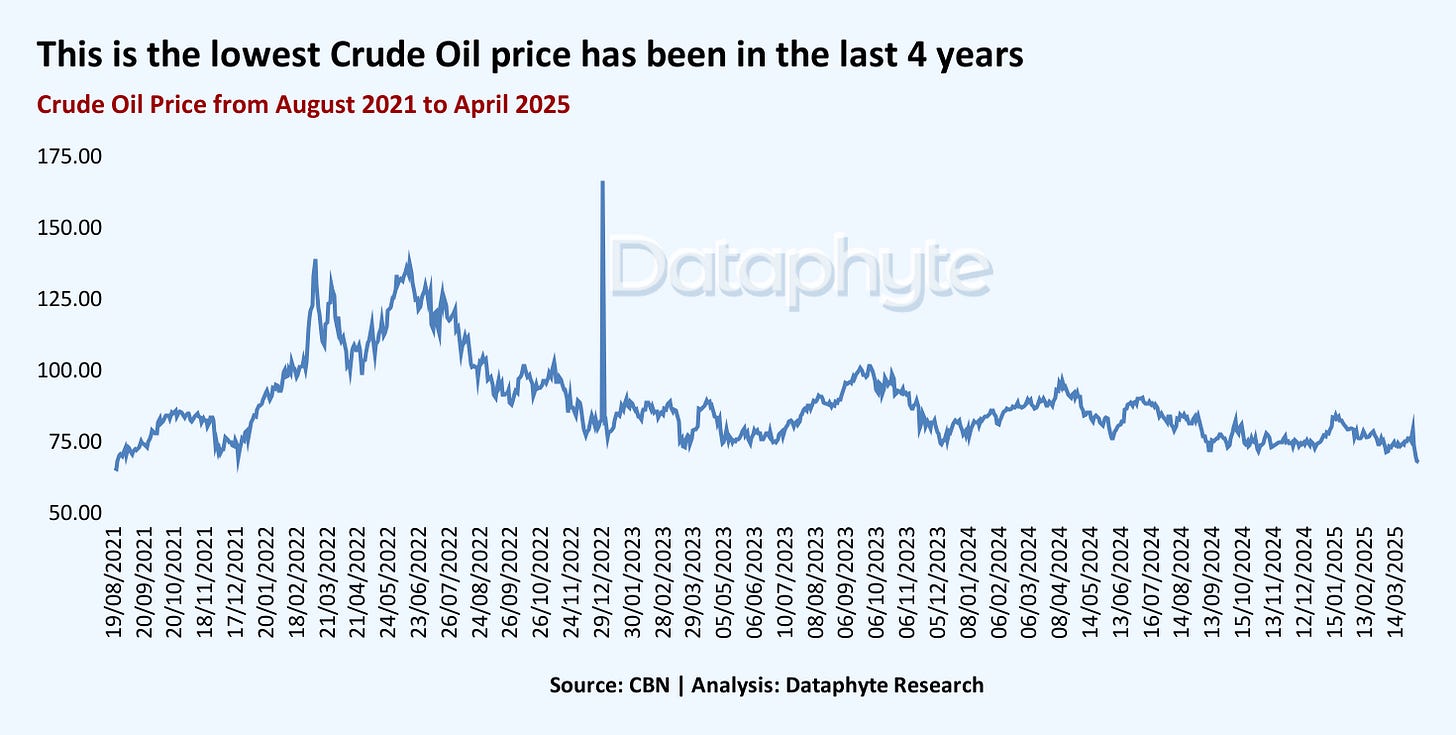

Crude oil prices have dropped to their lowest level since August 2021, with Brent crude oil trading at $63.90 per barrel. This is the first time it has fallen below the $70 threshold in nearly four years.

This is a 17% decline over the past three months, with a 13% drop recorded within six days after President Donald Trump announced new trade tariffs on April 3.

The market’s swift reaction reflects growing concerns over escalating trade tensions, weakening global demand, and the risk of a looming global recession.

Analysts link the price slide to a mix of geopolitical factors and market fundamentals. Key among them are the newly imposed U.S. trade tariffs, heightened fears of a global economic slowdown, and increasing production from organisations of Petroleum Exporting Countries (OPEC+) members all of which are amplifying market volatility.

For Nigeria, this downward trend signals more than just global market jitters. It strikes at the core of the country's fiscal stability. According to the 2025–2027 Medium Term Expenditure Framework and Fiscal Strategy Paper (MTEF-FSP), the 2025 budget is predicated on an average crude oil price of $75 per barrel.

With current prices trailing at around $63, this creates a $12 gap, raising concerns about the feasibility of meeting revenue targets for the 2025 N54.99 trillion budget.

This would also intensify pressure on the Naira and could trigger a new wave of inflation, further worsening Nigeria’s already fragile economic landscape.

Over the past three months, crude oil prices have experienced a notable decline of 17%, marking a sharp reversal in momentum. The year opened with prices at $77.04, but persistent market pressures have steadily driven them downward.

This latest decline is similar to the 2021 oil price crash, when the rapid global spread of COVID-19 caused major demand disruptions and destabilised markets. Crude oil prices fell rapidly and for a prolonged time as a result of a breakdown in OPEC+ negotiations over output quotas, which also increased market uncertainty.

For Nigeria, the 2025 budget’s heavy reliance on optimistic oil price projections presents a fiscal risk. A sustained drop in crude oil prices could jeopardize revenue targets, strain public spending, and deepen existing economic vulnerabilities.

In contrast to 2025–2027 MTEF shortfall of $12 from the $75 per barrel benchmark, Nigeria outperformed its Oil GDP projections in 2024 by 39%, primarily due to higher-than-anticipated crude prices. While the budget assumed an average oil price of $78 per barrel, the market delivered $83, exceeding expectations by $5.04.

This revenue windfall occurred despite a production shortfall of 0.44 million barrels per day (mbpd), highlighting how favorable pricing helped offset volume-related losses.

Such a gap may have ripple effects even on the non-oil sector, disrupting overall revenue flows and threatening broader macroeconomic stability.

According to the 2024 National Bureau of Statistics (NBS) Foreign Trade Report, oil remains central to government revenue generation and is the primary source of foreign exchange, accounting for 71.4% of the country’s total export earnings.

Also, a decline in oil prices might lead to reduced foreign exchange earnings and reserves. This might place heightened pressure on the Naira, potentially resulting in currency depreciation and rising inflation.

An analysis by the CBN shows that “negative oil shocks have been followed by declining foreign exchange inflows and reserve accumulation, subsequently leading to exchange rate instability and rising inflationary pressures.”

A weaker Naira raises the cost of imported goods and raw materials, squeezing businesses across manufacturing, trade, and services. This often leads to higher inflation, reduced consumer purchasing power, and a decline in private sector growth.

This indicates how a sustained decline in oil prices could trigger a chain reaction disrupting investment, eroding fiscal buffers, and stifling growth across Nigeria’s wider economy.

Nigeria’s Naira-for-Crude Initiative Fuels Local Oil Refinery Growth

The Federal Government has reaffirmed its commitment to the Naira-for-crude initiative with local refineries, overriding an earlier decision by the Nigerian National Petroleum Company Limited (NNPCL) under former Group Chief Executive Officer Mele Kyari, whose tenure ended in March to revert to a dollar-denominated crude supply framework.

According to the Minister of Finance, Wale Edun, “the crude and refined product sales in Naira initiative is not a temporary or time-bound intervention but a key policy directive designed to support sustainable local refining, bolster energy security, and reduce reliance on foreign exchange in the domestic petroleum market.”

The Naira-for-crude initiative, launched in October 2024, was designed to support domestic oil refining, particularly with the commencement of operations at the 650,000-barrel-per-day Dangote Refinery. The policy aims to facilitate market-driven petrol pricing, stabilise foreign exchange rates, and stimulate private-sector investment to drive economic growth and job creation.

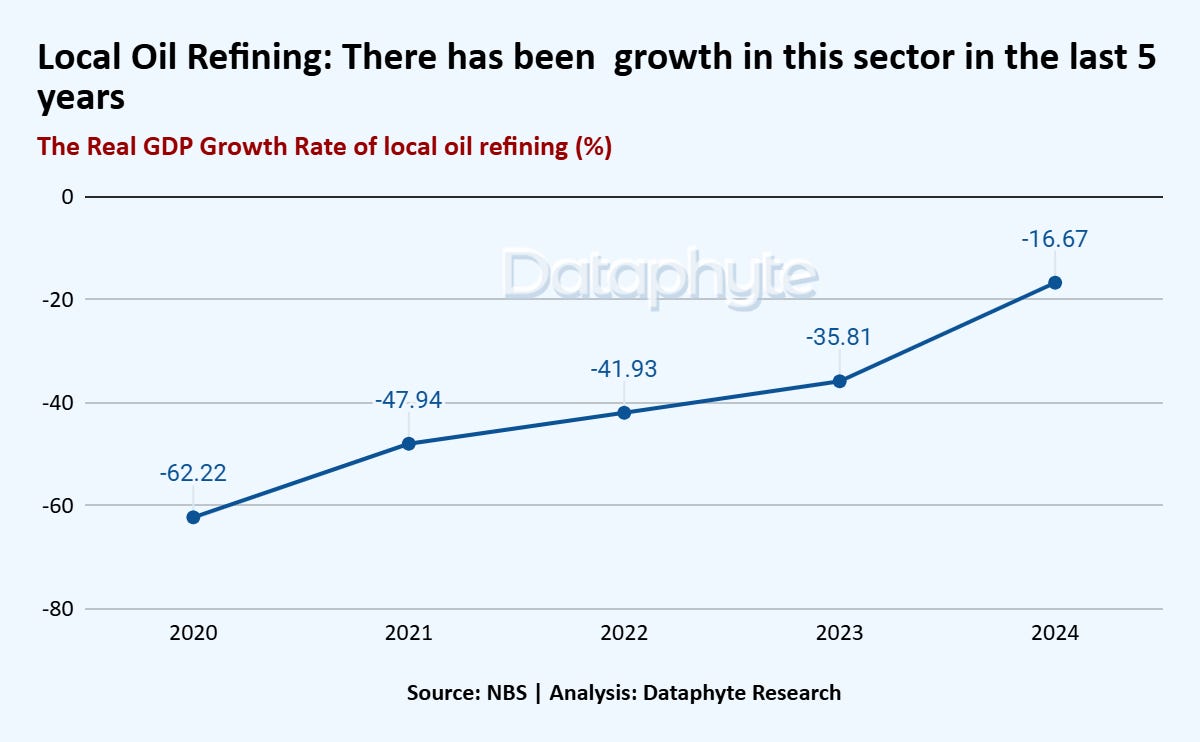

Since the implementation of the Naira-for-crude initiative six months ago, the local oil refining sector achieved a significant milestone in Q4 2024, the quarter marking the initiative’s inception by recording a real GDP growth rate of 9.59%. This marks the first time in five years that the sector has made a positive contribution to the national economy, highlighting a strong turnaround in performance and underscoring the early impact of policies aimed at boosting domestic refining capacity

Over the past five years, the sector has rebounded by 42%, rising from a steep contraction of -62.22% in 2020 to -16.67% in 2024. Although the sector's overall growth remains in a negative trend, this sharp recovery reflects renewed investor confidence and a resurgence in domestic refining activity.

Despite recording modest gains over the past five years, Nigeria’s local oil refining sector remains one of the smallest contributors to the country’s Gross Domestic Product (GDP). In 2024, it ranked as the third-lowest contributor to real GDP growth, highlighting its limited influence on the broader economy.

The current policy holds the potential to fully harness the refining sector not only to boost GDP, but also to reduce reliance on imported fuels and strengthen Nigeria’s foreign exchange reserves.

Within just six months of implementing the Naira for Crude policy, many of its key objectives have already been achieved.

Over the past year, local refinery output has risen significantly, contributing to a notable decline in the importation of refined petroleum products. According to a report released by the Central Bank of Nigeria (CBN), petroleum imports dropped by 23.2% in 2024. This decline in imports reflects the growing capacity and operational efficiency of domestic refineries, signalling progress toward self-sufficiency in fuel production.

In tandem, Nigeria’s Net Foreign Exchange Reserves (NFER) surged by 479% between 2023 and 2024, reaching their highest level in three years. This growth indicates reduced pressure on the foreign exchange market largely driven by the significant fall in oil importation.

The past year has also witnessed the establishment of more local refineries, signalling rising investor confidence and increased private sector participation in the industry.

As local production of refined oil continues to expand under supportive policies like the Naira-for-Crude initiative, the refining sector is poised to play a vital role in easing pressure on the Naira and enhancing overall macroeconomic stability.

Thanks for reading this edition of Marina and Maitama. It was written by Lucy Okonkwo and edited by Adijat Kareem.

If you've read this far, now take 2 seconds to share: