Gold prices have surged to an all-time high, surpassing previous records, and crossing the $3,000 per ounce mark as investors seek safe-haven assets amid global economic uncertainty and trade tensions mainly fueled by the high tariffs of the United States of America (USA).

With the price reaching unprecedented levels, the critical question for investors is whether this is the right time to buy or if the market is overheating.

Historically, gold has been a hedge against inflation and currency devaluation, making it an attractive investment when economic instability rises.

The price of gold has been on an upward trajectory for the past two years. In 2023, gold started the year at around $1,898 per ounce and climbed steadily, with key milestones occurring during banking crises, recession fears, and escalating geopolitical conflicts.

Now, as it exceeds $3,000 per ounce, analysts are divided on whether prices will continue to rise or if a market correction is imminent.

Previous Gold Rallies

Looking at historical trends, gold prices tend to spike during times of economic distress. For instance, during the 2008 financial crisis (Great Recession), gold surged from $872 per ounce in early 2008 to over $1,571 per ounce by 2011.

Similarly, during the COVID-19 pandemic in 2020, gold reached then-record levels of over $2,000 per ounce as investors fled to safety.

However, after reaching previous peaks, gold prices have historically corrected downward once economic conditions stabilised. In 2012, for example, gold began a prolonged decline after central banks tightened policies, dropping significantly by 2015.

The current rally raises similar concerns about a potential correction.

Global inflation as a predictor of gold’s volatility

Since the early 2000s, global inflation has mostly stayed within a stable 3% to 5% range, following the turbulent inflation trends of the 1980s and 1990s. However, periods of economic crisis have disrupted this stability, leading to spikes in inflation and corresponding surges in gold prices.

For example, the 2008 financial crisis drove inflation to 6.3%, pushing gold prices from $872 in 2008 to $1,571.50 by 2011. A similar pattern emerged during the COVID-19 pandemic, with inflation rising from 3.3% in 2020 to 4.7% in 2021, keeping gold prices elevated above $1,798.60.

Gold's appeal as an inflationary hedge was strengthened by the 2022 inflation crisis, which saw inflation peak at 8.6%. By 2024, prices had risen over $2,386.20.

The future price movement of gold may be influenced by investor sentiment and economic stability, as inflation is predicted to decrease in the upcoming years, falling to 4.3% in 2025 and below 3.5% by 2029.

Considering gold's historical use as a hedge against inflation, tracking inflation patterns might be essential to forecasting its volatility.

Balancing Risk and Reward in Gold Investment: Is Now the Right Time to Buy?

Gold is still a strategic investment rather than a short-term trading asset because of its historical volatility. It is risky to purchase gold at its highest price, particularly if the world economy improves and central banks adopt stricter monetary policies. However, gold prices may sustain or prolong gain if inflation keeps rising and there is ongoing uncertainty in the world.

Purchasing gold at record highs increases the chance of suffering short-term losses in the event of a correction, according to data-driven analysis.

Nonetheless, historical evidence indicates that peak prices frequently precede corrections, necessitating the use of careful investment tactics. Before choosing to purchase gold at this all-time high, investors must consider their investment horizon, risk tolerance, and general economic trends.

While short-term speculators should exercise caution to prevent possible losses in a turbulent market, those looking for long-term security may still find value in gold.

State-of-Emergency: All Eyes on Rivers State

Three days ago, President Bola Tinubu declared a state of emergency in Rivers State under Section 305 subsection 3 of the 1999 Constitution (as amended).

As part of this measure, Governor Siminalayi Fubara, his deputy Ngozi Odu, and the entire state executive cabinet have been suspended from office for six months. In their place, the President appointed Vice Admiral Obok-ete Ibas (Rtd) as Administrator.

In a nationally televised address, President Tinubu cited escalating political deadlock, rising security threats, and critical governance failures as the reasons for this intervention.

The decision places Rivers State under federal control, raising concerns about its implications for democracy and state autonomy both within Nigeria and on the global stage.

The suspension of the governor marks a turning point in the ongoing political crisis and raises questions about Fubara’s leadership and the federal government’s approach to handling governance disputes.

A Precedent with Democratic Consequences

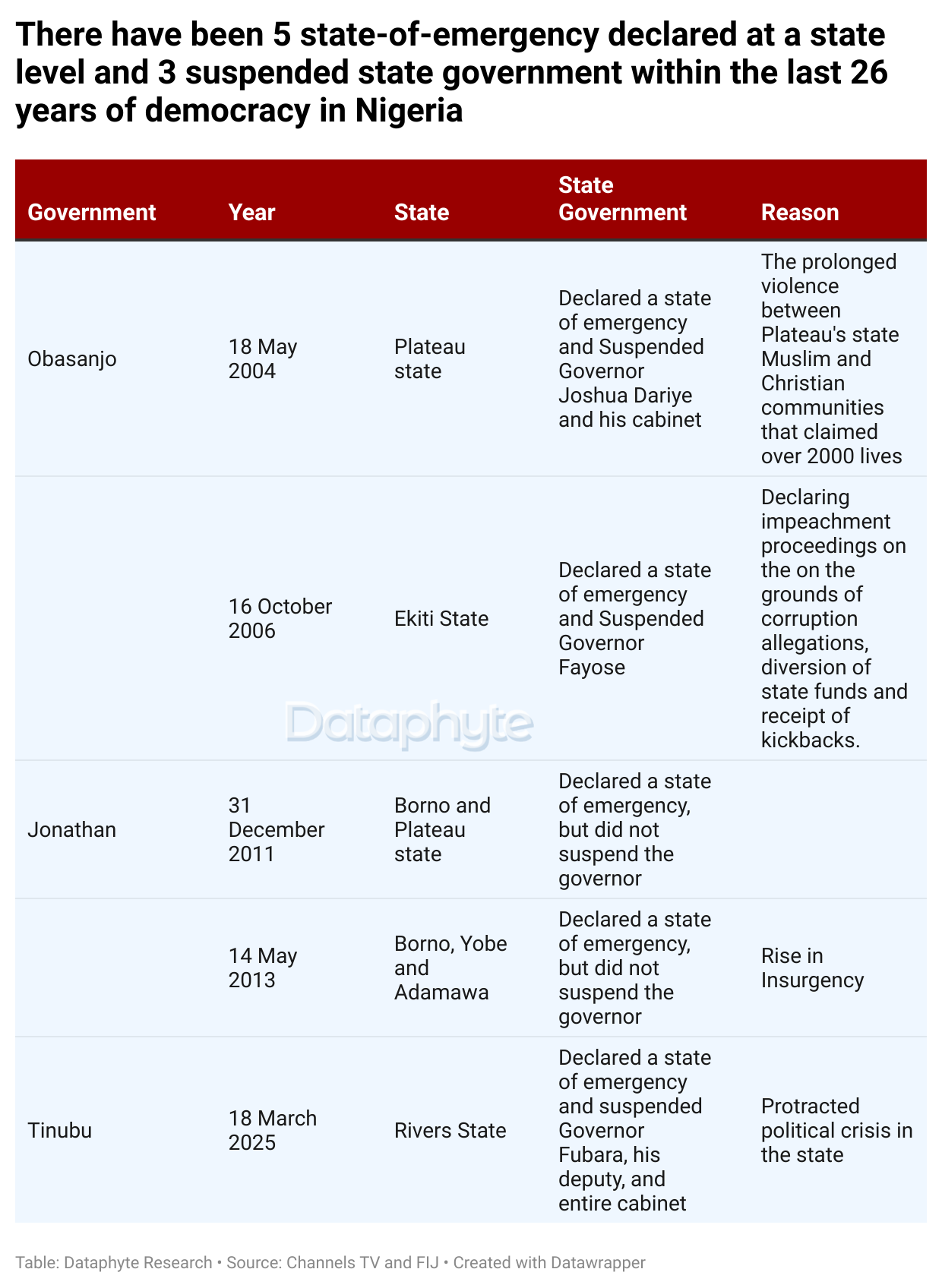

Nigeria has witnessed five state-of-emergency declarations at the state level in its 26 years of uninterrupted democracy, while, this marks the third time a sitting governor has been suspended by a presidential directive.

The declaration of states of emergency and the suspension of elected governors raise serious concerns about Nigeria's democratic resilience. While these measures might be justified as necessary to restore order, they set a troubling precedent that could undermine constitutional governance, weaken state autonomy, and erode public confidence in democratic institutions.

The Nigerian Bar Association (NBA) has strongly opposed the move, stating that “We reiterate that a declaration of emergency does not automatically dissolve or suspend elected state governments. The Constitution does not empower the President to unilaterally remove or replace elected officials—such actions amount to an unconstitutional usurpation of power and a fundamental breach of Nigeria’s federal structure.”

Frequent federal interventions in state governance suggest deeper structural issues within Nigeria’s political system, highlighting the need for institutional reforms that resolve conflicts through legal and democratic processes rather than executive overreach.

Beyond domestic concerns, international scrutiny is likely to follow, further damaging Nigeria’s democratic reputation and global standing.

Nigeria’s Democratic Standing in the Global Context

According to the 2024 Democracy Index report by the Economist Intelligence Unit (EIU), Nigeria dropped two places from its 2023 ranking, falling from 104th to 106th out of 167 countries. With a score of 4.16, Nigeria remains below the global average.

The EIU classifies Nigeria as practicing a Hybrid Democracy, a political system that blends elements of both autocratic and democratic institutions. The index measures factors such as electoral processes, governance, political participation, political culture, and civil liberties.

Notably, in the 2024 report, Nigeria received its lowest scores in "Functioning of Government" (3.57) and "Political Culture" (3.75), underscoring persistent challenges in governance and political stability.

At the continental level, Nigeria’s score surpassed the Sub-Saharan Africa average by only 0.16 points. The region's average stands at 4.00 across the 44 countries measured in the index.

Mauritius leads the region with a score of 8.23, ranking 20th globally, while the Central African Republic recorded the lowest score of 1.18, ranking 164th.

While Nigeria ranks 20th out of 44 countries in the Sub-Saharan Africa region and 106th out of 167 countries globally, placing it at a middle-tier position within the continent but significantly lagging behind on the global scale.

Security Reality

President Tinubu in his address cited escalating political deadlock, rising security threats, and critical governance failures as the reasons for this intervention.

A key factor influencing the President’s decision was the Supreme Court’s February 2025 ruling, which stated that there was “no government in Rivers State.” This judgment stemmed from the legal battle between the Rivers State government and 27 lawmakers who defected from the People’s Democratic Party (PDP) to the All Progressives Congress (APC).

However, analysis shows that despite the political crisis, Rivers State has recorded significant improvements in security, economic performance, and governance under Governor Fubara.

Within the last 14 months of the Fubara administration, violent incidents in Rivers State declined by 55%, suggesting notable improvements in security and stability.

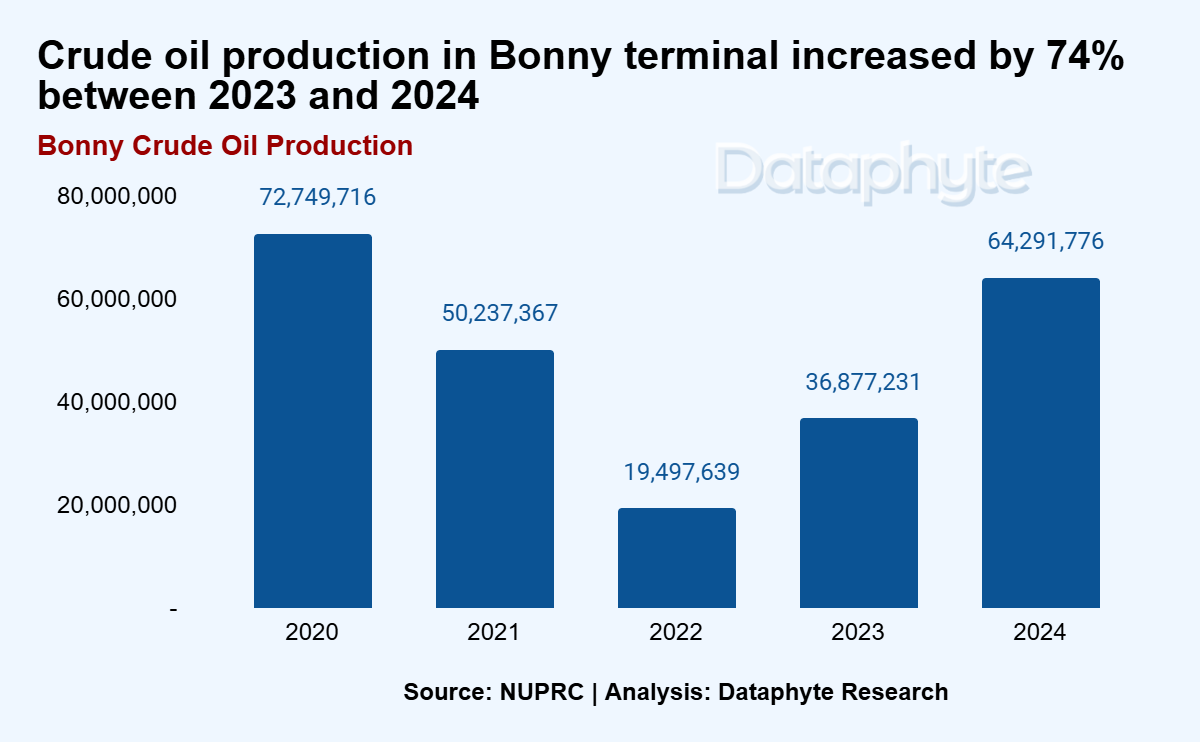

Another concern of the federal government was pipeline vandalism, particularly the fire on the Trans Niger Pipeline, which transports crude oil to the Bonny export terminal by militants raised significant concerns and otherwise questioned the improving security conditions in Rivers State.

President Tinubu criticised the state government for failing to prevent these incidents, arguing that they threaten the lives of the people and the oil pipelines.

The Bonny Terminal, located in Rivers State, is one of Nigeria’s key hubs for crude oil production and export and over the last seven months, Nigeria’s average daily crude oil production has increased, exceeding the OPEC+ quota of approximately 1.5 million barrels per day (mbpd).

Enhanced security measures in oil-producing regions like Rivers State caused this increase in crude oil production.

This shows the wider effects of Rivers State's instability. In addition to endangering the state's security achievements, any increase in violence, especially attacks on vital infrastructure like oil pipelines, also puts Nigeria's ability to meet its oil output limit in jeopardy.

Disruptions in Rivers, one of Nigeria's major oil-producing regions, could have significant economic and geopolitical repercussions because oil revenue continues to be a vital component of the country's economy.

Generally, Nigeria's democratic standing faces scrutiny amidst the call for legal and institutional reforms to ensure that political crises such as this are addressed through a democratic process rather than executive intervention.

Thanks for reading this edition of Marina and Maitama. It was written by Adijat Kareem and Lucy Okonkwo, and edited by Adijat Kareem.

Do you work at a Civil Society Organisation? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey:

Do you work for any government agency? Share your insights on Digital Public Infrastructure (DPI) and e-governance platforms in Nigeria. Take our 5-minute survey: