On Cardoso’s One Year in Office

In September 2024, Mr. Yemi Cardoso marked his first year as Governor of the Central Bank of Nigeria (CBN), a tenure already distinguished for its tightening monetary policy aimed at stabilising the Naira and transforming Nigeria's economic landscape.

The Governor of the Central Bank plays a critical role in maintaining macroeconomic stability by steering monetary policy to regulate inflation, ensure liquidity, and safeguard the value of the national currency.

The data on his first year in office shows that his monetary policies might not have been able to deliver on macroeconomic stability. Key economic indicators show persistent challenges in areas such as inflation control, currency stability, and employment level, suggesting that his policy interventions are yet to have their intended impact.

One of the major monetary policy instruments deployed by Mr Cardoso within his first year in office is the interest rate hikes to combat inflation and stabilise the Naira.

In an effort to curb inflation and stabilise the Naira through increased interest rates, other economic variables—such as employment, private sector investment, productivity, and foreign investment—have experienced adverse effects.

Under Cardoso's administration, the Central Bank raised the interest rate five times, bringing it to a 25-year high. The rate increased from 18.75% in September 2023 to 27.25% by September 2024.

According to the World Economic Forum, the increase in interest rates shouldl lead to a decrease in the inflation rate.

“Interest rate hikes act to slow spending and encourage saving. This motivates companies to increase prices at a slower rate, or lower prices, to stimulate demand.”

However, despite recent rate increases, inflation in Nigeria has surged to its highest level in 25 years, indicating that the expected inflation-curbing effects of higher rates have not yet materialised.

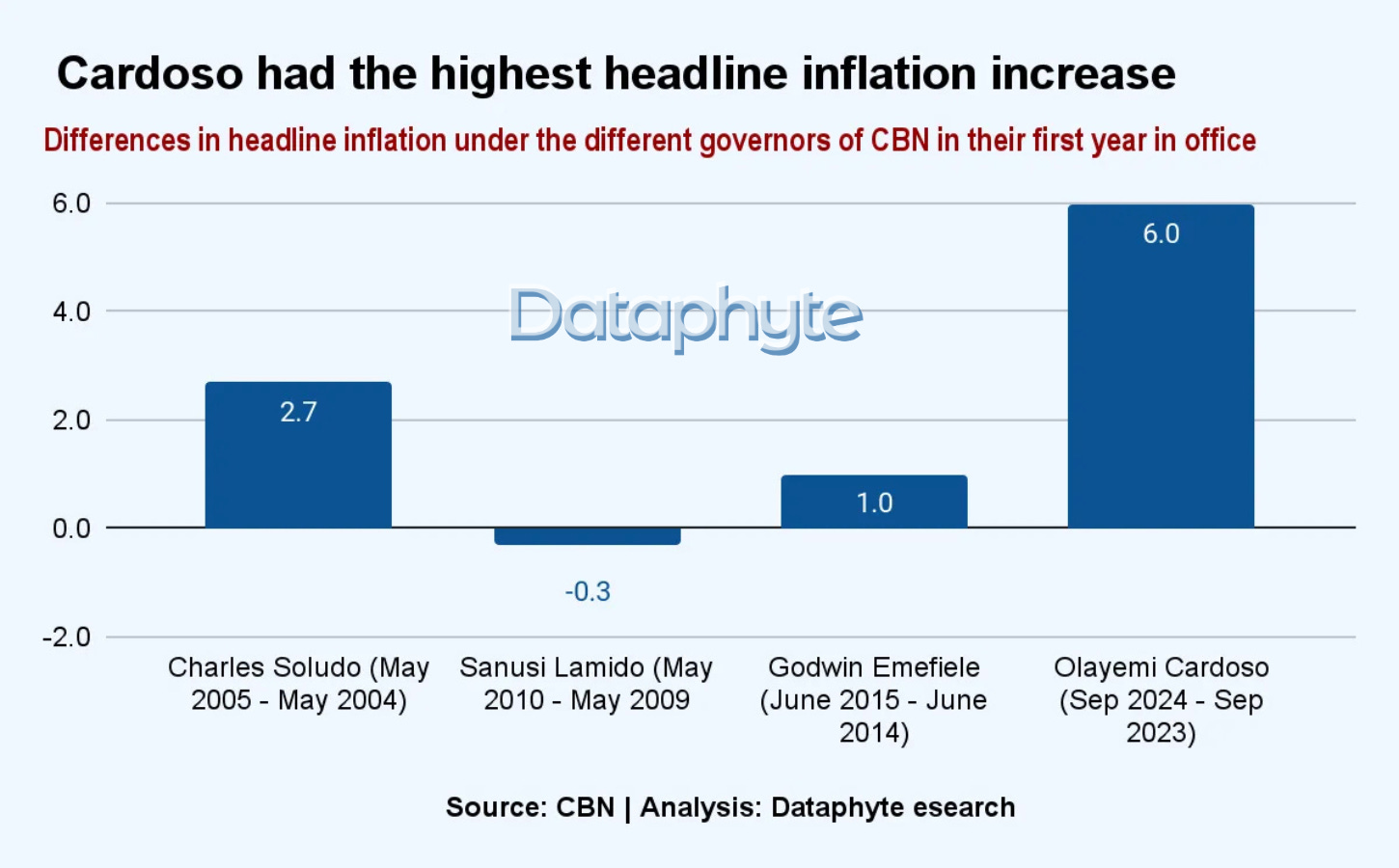

An analysis of CBN governors' effectiveness in controlling headline inflation shows that Mr. Cardoso experienced the highest inflation rate increase within his first year in office.

According to the CBN data, Sanusi Lamido recorded the lowest inflation rate during his first year in office while simultaneously reducing the interest rate from 8% in May 2009 to 6% by May 2010.

The increase in the headline inflation rate under Cardoso's tenure has been attributed to the continued depreciation of the national currency, a consequence of the floating currency monetary policy.

The floating currency was put in place to eliminate arbitrage and align the foreign exchange rate in the parallel market and official market by making the market forces determine the value of the Naira.

Within this time period, the Naira has been volatile and has devalued by over 82%. The Naira became the third most devalued currency in Africa.

The devaluation and volatility of the Naira have led to a contraction in both foreign and domestic investment, as fluctuating exchange rates heighten uncertainty and reduce investor confidence.

For foreign investors, the depreciation of the Naira has increased their exchange rate risk and diminished potential returns when converted back to stable currencies, making Nigeria a less attractive investment destination.

Domestically, businesses face rising import costs and reduced purchasing power, which hinder expansion and capital investment.

The CBN’s Purchasing Managers’ Index (PMI) showed that private sector business activities have been in contraction over the past year, with only a slight improvement observed between August and September 2024.

The contraction of business activities coupled with a declining purchasing power and increasing operational costs have led to the shutdown of businesses within the last one year.

A Dataphyte report showed that over 11 multinational businesses have closed down within the last one year and few others are struggling to stay afloat due to increased operational costs from the unstable exchange rate.

This has further compounded the increase in unemployment rate in the country. The unemployment rate increased from 5% in Q3 2023 to 5.3% in Q1 2024.

Consequently, the country’s economic growth measured in real GDP has declined by 0.27 percentage points between Q4 2023 and Q2 2024. It declined from 3.46% in Q4 2023 to 3.19% in Q2 2024.

Overall, in one year, Mr Cardoso’s policies have not been able to curb inflation nor stabilise the Naira, putting a strain on the country’s business environment, thereby impeding economic growth and development

While interest rate hikes are traditionally aimed at reducing inflation by tempering demand, the ongoing instability in Nigeria's economic environment suggests that additional policy measures—potentially including structural reforms and coordinated fiscal policies—may be necessary to achieve sustainable macroeconomic stability.

E-Commerce: Jumia’s Revenue Decreased by 13%

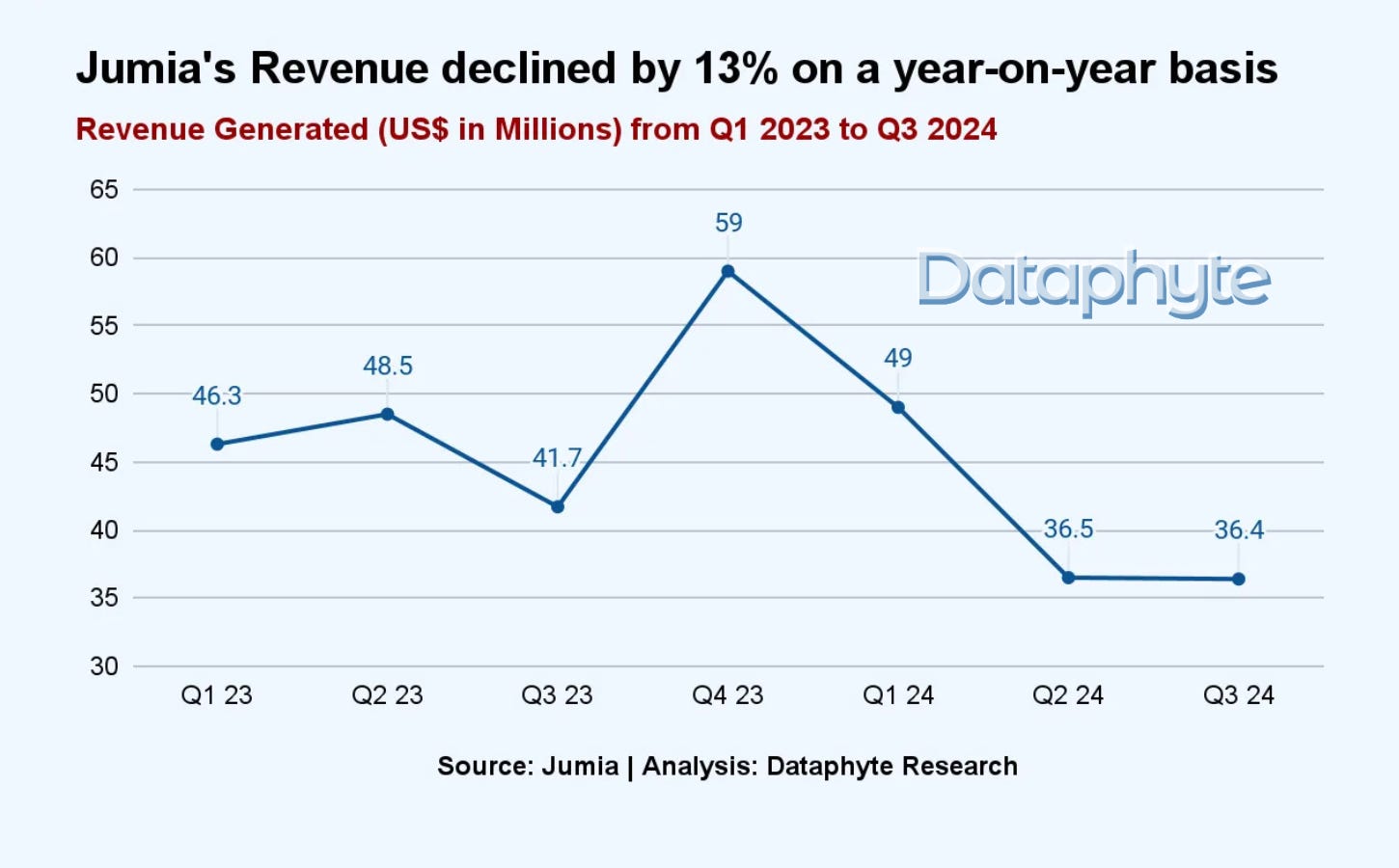

Jumia, one of the leading e-commerce platforms in Africa, recorded a decrease of 13% in revenue on a year-on-year basis, while, the Gross Merchandise Volume (GMV) decreased by 1% on a year-on- year basis, according to the Quarterly statement of accounts released by Jumia.

The revenue decreased from US$41.7 million in Q3 2023 to US$36.4 million in Q3 2024. Also, the GMV decreased from US$164.1 million to US$162.9 million within the same time period.

This downward trend in both revenue and GMV highlights several economic challenges that could be affecting the operations of the e-commerce sector in Nigeria, such as reduced consumer purchasing power, currency volatility, and infrastructural barriers.

According to the market analysis conducted by Mordor Intelligence, the e-commerce market in Nigeria is estimated to be worth US$8.54 billion in 2024 and is projected to reach US$14.92 billion by 2029, growing at a Compound Annual Growth Rate (CAGR) of 11.82%.

Also, data from Statista shows online sales now make up 6% of the total retail sales in the country. It is one of the highest online retail sales in Africa.

One reason stated by Jumia for their current GMV decline is the currency devaluation.

Over the past year, 18 out of 54 African countries have seen their currencies devalue significantly. Among these, Nigeria ranks third in terms of currency devaluation, following Zimbabwe and Ethiopia, where currency devaluation is the highest on the continent.

Jumia operates across 11 countries: Algeria, Egypt, Morocco, Ghana, Ivory Coast, Kenya, Nigeria, Senegal, Tunisia, Uganda, and South Africa.

Among Jumia’s African markets, only Ghana, Nigeria, and Egypt have experienced currency devaluation during the year. The remaining countries in Jumia’s network, particularly Kenya, have seen their currencies appreciate. Kenya notably recorded the highest currency appreciation in Africa this year.

Currently, Jumia holds the largest market share in Nigeria's e-commerce sector, with over 2.3 million users as of 2023. The latest report indicates a 1% increase in its customer base and 4% increase in orders. The orders increased from 5.7 million in September 2023 to 5.9 million orders in September 2024.

The company is currently listed on the New York Stock Exchange, with a market capitalisation of $489.9 million. Year to date, the stock has delivered a 13.31% yield, rising from an opening price of $3.45 at the start of the year to its current level of $4.36.

In October 2024, Jumia announced its decision to cease operations in South Africa and Tunisia by year end 2024.

According to the press report by Jumia, “In the longer term, these changes to Jumia's geographic footprint are expected to enhance operational efficiency and resource allocation, enabling the Company to focus on markets with stronger growth trajectories. The Company believes this strategic realignment will support its path toward sustainable growth.”

Thank you for reading this edition of Marina and Maitama. It was written by Lucy Okonkwo and edited by Joachim MacEbong.